sathish kumar / Profile

HAI, I AM TRADER. I HOPE YOU ALL DOING WELL.

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

Friends

546

Requests

Outgoing

sathish kumar

Published post WTI down to test $38.00

Crude oil prices are collapsing at the beginning of the week, finding some support around the $38.00 mark per barrel so far. WTI slumps on OPEC, USD The barrel of West Texas Intermediate is trading at shouting distance from YTD lows at $37...

sathish kumar

Published post GBP/USD supported at strong 38.2% fib level

GBP/USD has stabilized after a sell-off from the 1.51 handle to test the support base made up of the 200 SMA and 100 SMA on the 1hr time frame. The 38.2% fib at 1.5057 is also located in this cluster...

sathish kumar

Published post Fed's Bullard highlights inaccurate Fed forecasts

Fed's Bullard has been on the wires and has offered bearish comments in respect to the Fed's projections this year...

sathish kumar

Published post Getting short EUR/GBP - RBC

RBC Capital Markets explained that with the first UK rate hike not fully discounted until early-2017, the hurdle is low for this week’s MPC minutes and BoE speakers to be taken as GBP-positive...

sathish kumar

Published post Nikkei loses upward momentum

The Nikkei rebounded on Monday, adding 0.99% or 195 points to end the day at 19,698.15, on improved market sentiment following an upbeat US jobs report on Friday, which kept the yen weak against most of its major rivals...

sathish kumar

Published post AUD/USD downside pressures in commodity sell-off

AUD/USD lost its steady form on the previously robust 0.73 handle in the wake of demand for the greenback, starting in late Asia and following through as markets prepare themselves for a Fed hike this month...

sathish kumar

Published post US dollar firmer although EUR/USD upside risk remains

After the post ECB meeting, when Draghi jawboned the euro lower to end the week and cool the single currency down a bit, EUR/USD is oscillating in a 20 pip range around mixed commentary from Fed's Bullard calling out the Fed's poor judgment in respect to inflation and saying that forecasts are un...

sathish kumar

Published post USD/CAD reaches highest since 2004 as oil marks cycle lows

USD/CAD broke above the 1.3500 level and posted its highest level since June 2004 as the loonie has continued to weaken weighed by falling oil prices, as WTI hits its lowest price in 6 years below $38 a barrel...

sathish kumar

Published post Oil makes new 6-year lows

Oil prices extended losses on Monday and fell to their lowest levels in more than 6 years after the Organization of the Petroleum Exporting Countries (OPEC) failed to agree at its meeting on Friday to cut output to stabilize prices, which have fallen more than 60% since mid-2014...

sathish kumar

Published post Gold backs away from 3-week highs

Gold prices slipped on Monday, with spot down about $10.00 as the American dollar strengthened against all of its major rivals. Investors are again focusing on a possible rate hike in the US next week, retaking the short positions closed by the ends of the previous week...

sathish kumar

Published post GBP/CAD climbs to 2-month highs

The GBP/CAD cross soared on the back of oil’s slump, which resulted in the Canadian dollar plummeting against all of its major rivals and sending GBP/CAD to 2-month highs. The rally extended to 1.0375, through a major resistance level, as selling interest had contained advances around 2...

Share on social networks · 1

96

sathish kumar

Published post USD/CAD in fresh highs through 1.3500

The weakness around CAD remains unabated today, with USD/CAD in fresh cycle highs beyond the 1.3500 handle. USD/CAD above 1.35 on oil slump The pair is advancing for the third consecutive session so far, trading in levels last seen in June 2004 around 1.3510...

sathish kumar

AUD USD, “Australian Dollar vs US Dollar” 1 HOUR Wave Analysis

7 December 2015, 16:01

we can see at the H1 chart, the market is forming the zigzag in the wave (y). On the minor wave level, the pair may continue forming the ascending impulse in the wave c, which may be followed by a new descending movement of the price...

sathish kumar

Australian Dollar continues forming the wave 4, which may be taking the form of the double three. Possibly, in the future the current correction may continue...

sathish kumar

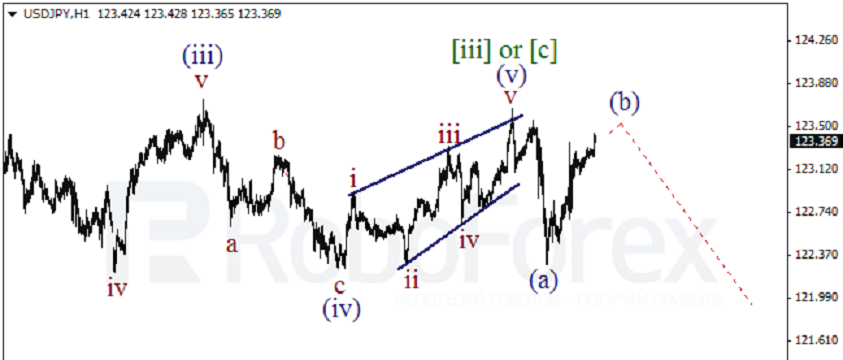

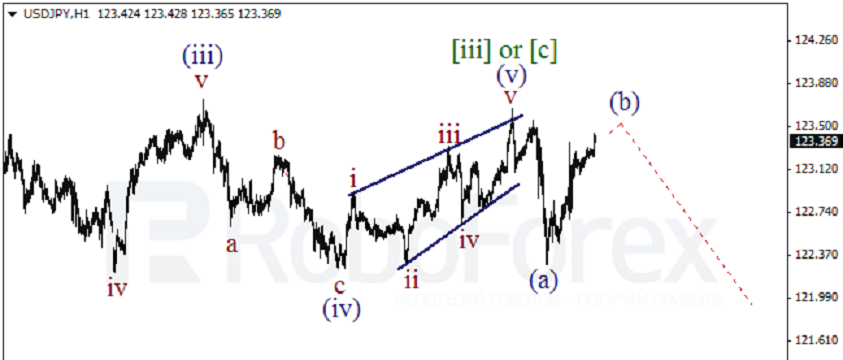

At the H1 chart, the price has finished the diagonal triangle in the wave (v), the descending wave (a), and then started forming the wave (b). On Monday, the market is expected to complete it and resume falling inside the current correction...

sathish kumar

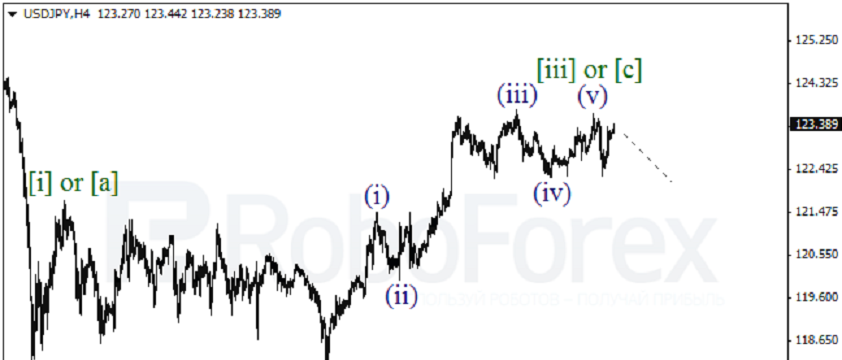

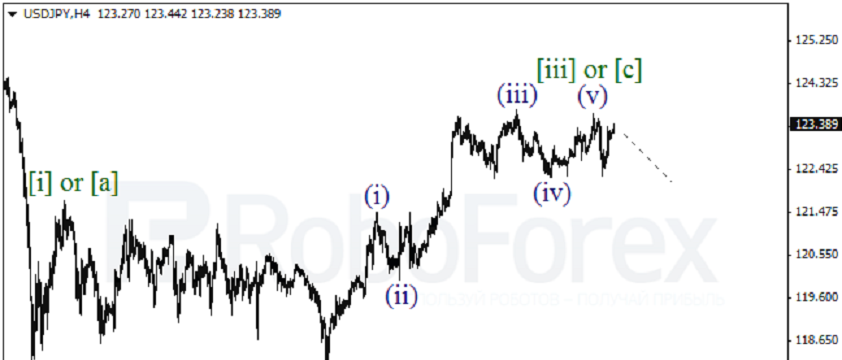

The wave (v) is quite complicated. In the future, the price may continue the fourth correctional wave of the current impulse. However, if the market breaks the maximum of the wave [i] or [a], the pair may continue forming the wave 4...

sathish kumar

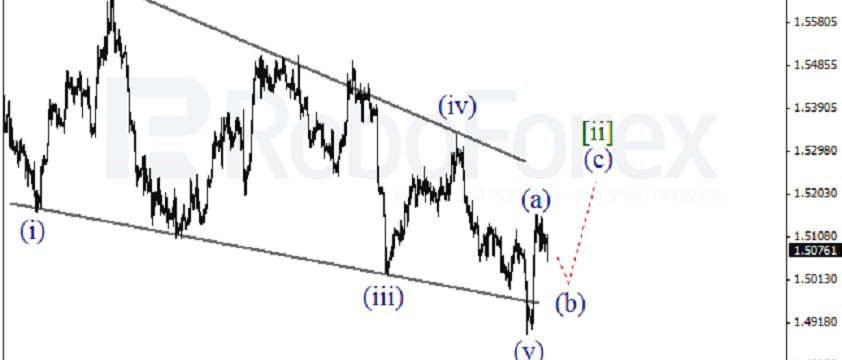

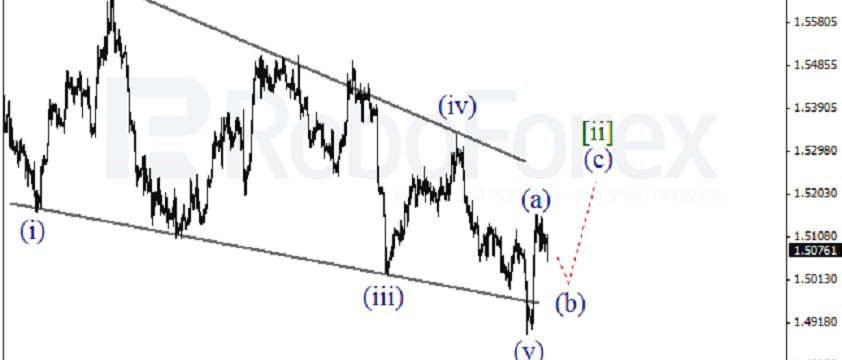

GBP USD, “Great Britain Pound vs US Dollar” Wave Analysis

7 December 2015, 14:40

After finishing the diagonal triangle, Pound has started the correction. Probably, the price has formed the ascending impulse in the wave (a). Later, after completing the local correction, the pair may resume its growth in the wave (c...

sathish kumar

on the H1 chart. After finishing the diagonal triangle in the wave [v], the pair has rebounded from its lower border and started the correction. On Monday, the market may continue forming the wave [b]...

sathish kumar

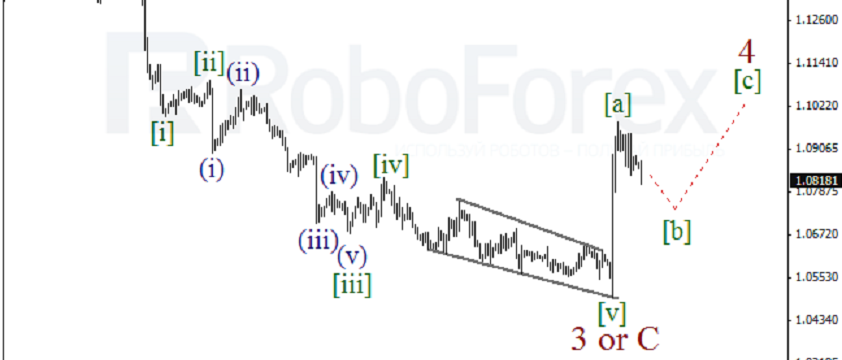

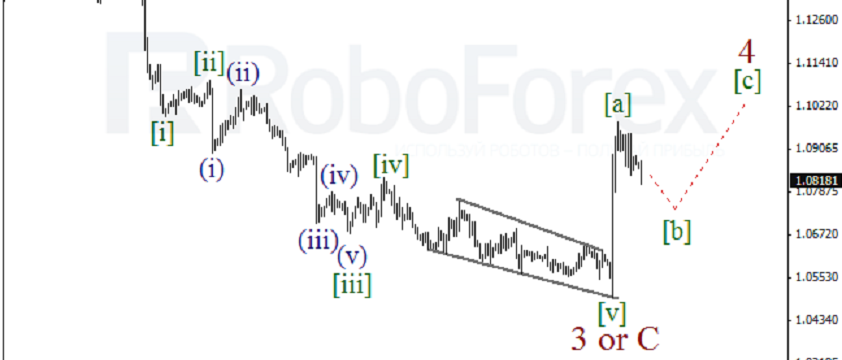

EUR USD, “Euro vs US Dollar” Eurodollar has completed the descending impulse in the wave 3 or C. In the nearest future, the pair may continue forming the correctional wave [b], which may be followed by another bullish impulse in the wave [c] of 4...

sathish kumar

XAU USD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1). Chinkou Lagging Span is above the chart, Ichimoku Cloud is moving upwards (2), and the price is above the lines...

: