Francis Dogbe / Profile

- Information

|

10+ years

experience

|

2

products

|

39

demo versions

|

|

1

jobs

|

0

signals

|

0

subscribers

|

Friends

1777

Requests

Outgoing

Francis Dogbe

Rinor Memeti

2014.05.04

Problem is, how to find a good plan;) (p.s.: Change your profile photo buddy, you Are not a woman):D

Francis Dogbe

2014.05.04

ok i have changed it....

Francis Dogbe

Marie-MiredeVie

Comment to topic Traders Joking

Today in France, was Labor Day ... First of May, the day of thrush ... Sign of sunny days ... In April you will not discover a thread in May do what you like

Francis Dogbe

First time indicator of its kind. https://www.mql5.com/en/market/product/4129#full_description and cool price

Francis Dogbe

Added topic What Is the Difference between These two Pairs

Please i need to understand why the distance between 100 points of GBPUSD is higher than the distance of 100 points of EURAUD. Its confusing. Is there something i should be aware of...? Take a look at this snapshot

Share on social networks · 1

4

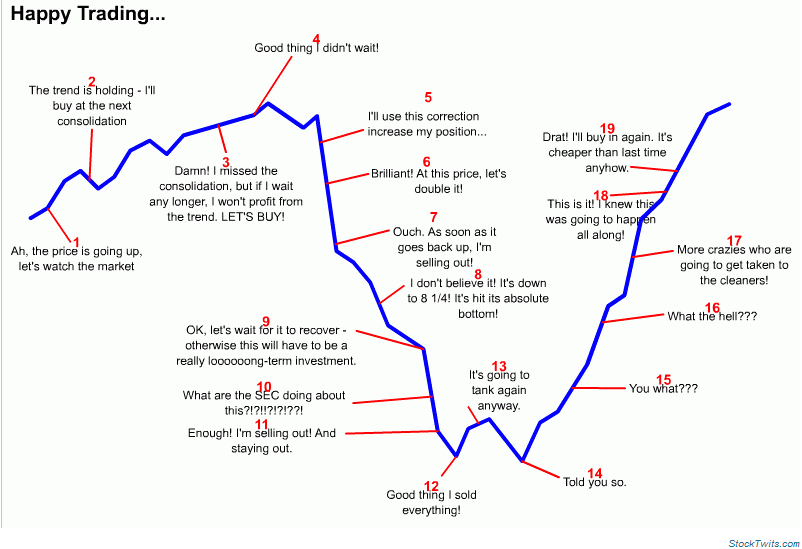

Francis Dogbe

Today market is really good. All major currencies moving well... i make 1000 points on each EURUSD and GBPUSD. ;-)

[Deleted]

2014.04.28

Good! ;-)

Francis Dogbe

shared product by seller MetaQuotes Ltd.

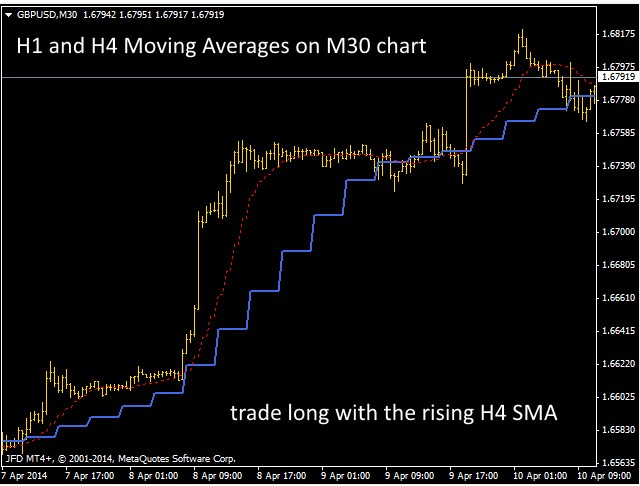

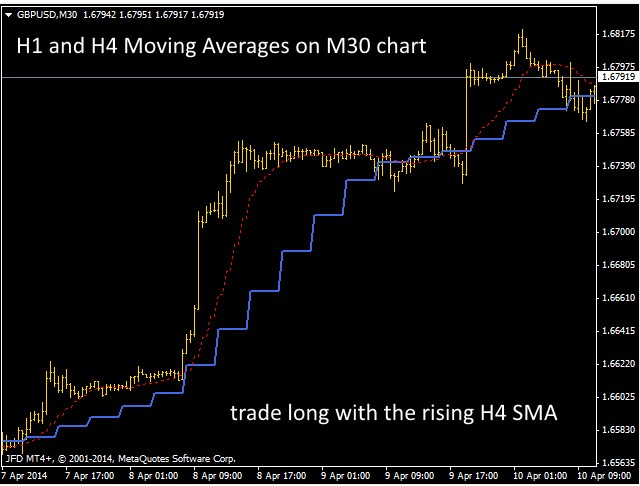

The trade strategy is based on three moving averages. To determine the trend, it uses three exponentially smoothed moving averages: FastEMA, MediumEMA and SlowEMA. Trade signals: Buy signal: FastEMA>MediumEMA>SlowEMA (upward trend). Sell signal: FastEMA<MediumEMA<SlowEMA (downward trend). Input parameters: Inp_Signal_ThreeEMA_FastPeriod = 8; Inp_Signal_ThreeEMA_MediumPeriod = 38; Inp_Signal_ThreeEMA_SlowPeriod = 48; Inp_Signal_ThreeEMA_StopLoss = 400; Inp_Signal_ThreeEMA_TakeProfit =

Francis Dogbe

Sergey Golubev

Comment to topic points == pips?

for example (in case of 5 digit broker): buy at 1,30305 and take profit at 1.30605. Profit is 30 pips, or 300 points, the other example (in case of 4 digit broker): buy at 1,30305 and take profit at

Francis Dogbe

Sergey Golubev

Comment to topic Indicators: MFCS Currency Correlation Chart

Currency Pairs Correlation in Forex Market: Cross Currency Pairs As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs

Francis Dogbe

Show all comments (4)

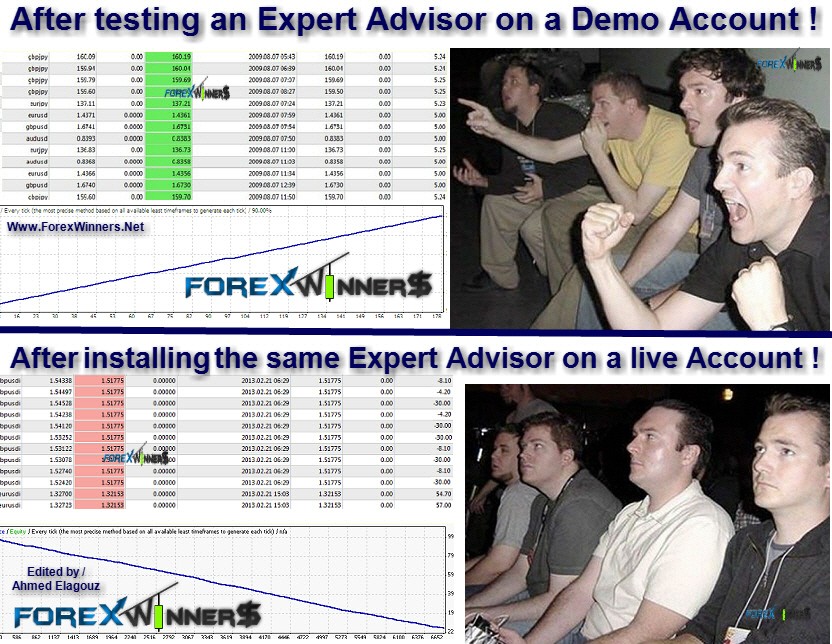

Rogerio Figurelli

2014.04.28

Can happen for all kind of accounts, since being past against the future! The secret is not jump from demo to final real account. After good demo, why not jump to a very very small real account? Note that even a small real past and a final real account future this can happen. Or worst, a nice past with final real account and a bad future final real account.

Francis Dogbe

Can someone create a forum where traders discuss day trading strategies daily....? ;-)

Francis Dogbe

Sergey Golubev

Comment to topic Something Interesting to Read May 2014

Chan: Algorithmic Trading: Winning Strategies and Their Rationale (Wiley Trading) Engaging and informative, Algorithmic Trading skillfully covers a wide array of strategies. Broadly divided into the

Francis Dogbe

Sergey Golubev

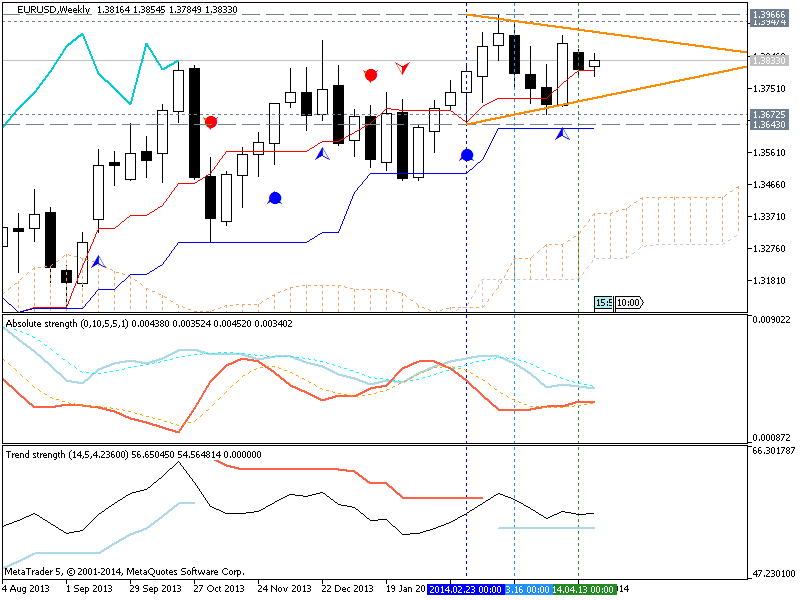

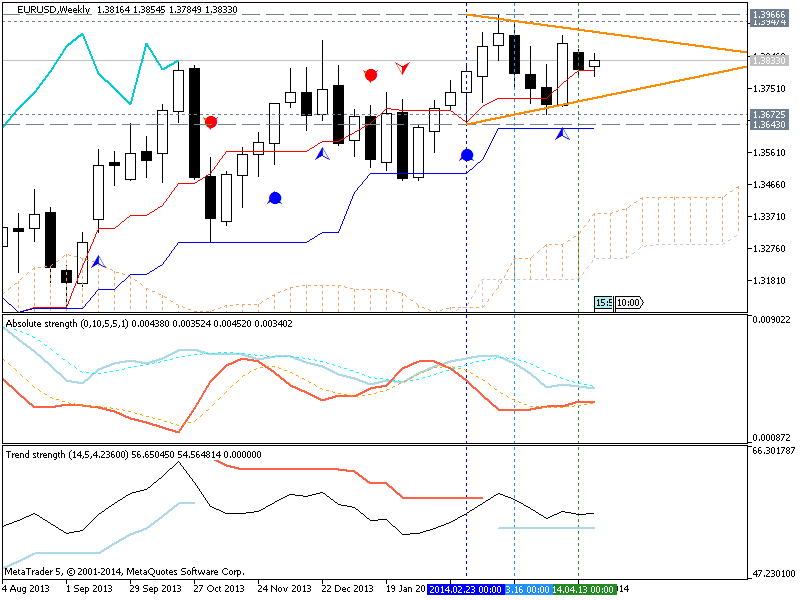

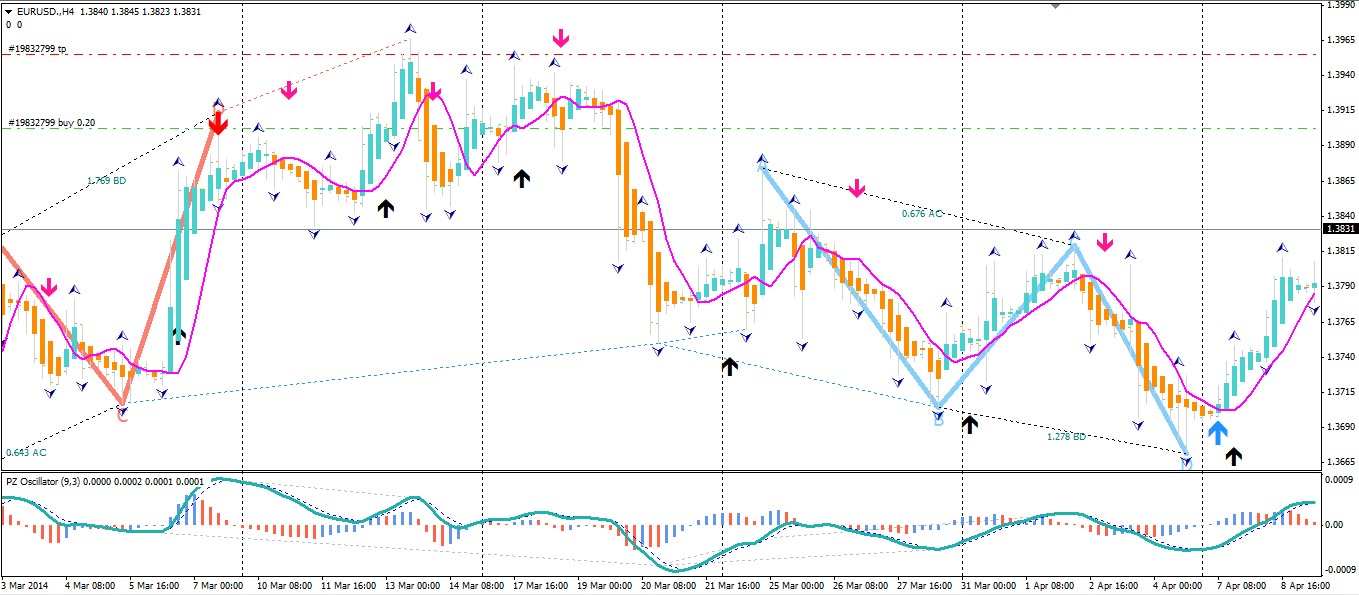

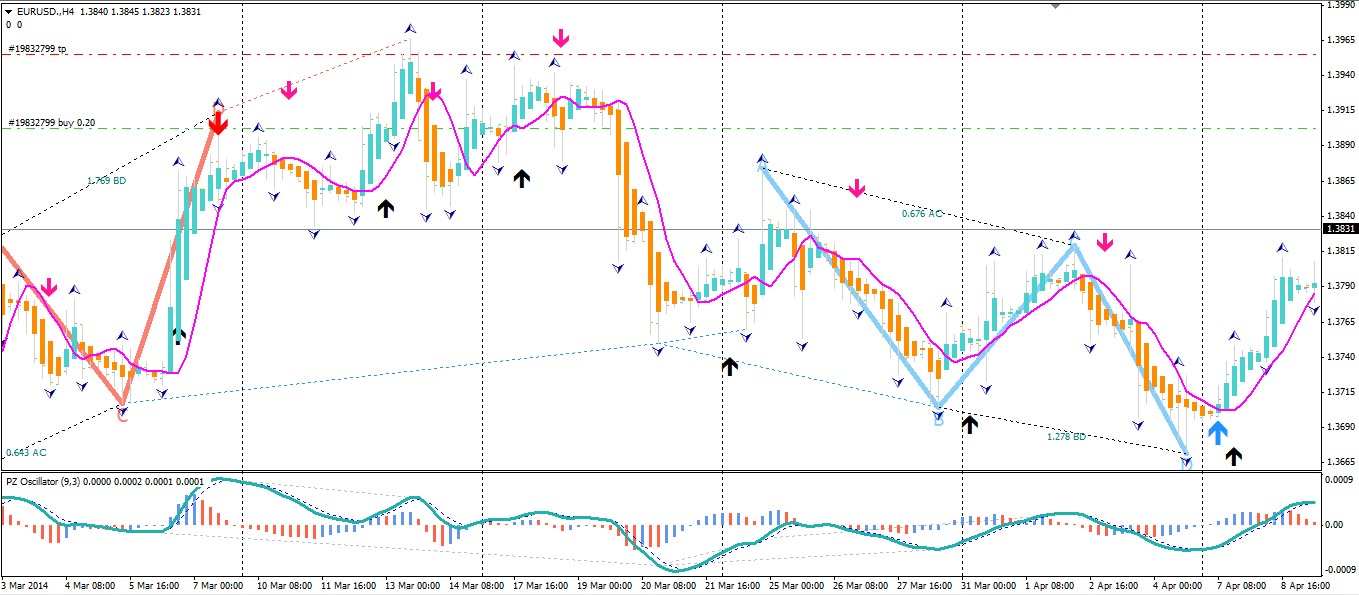

EURUSD Technical Analysis 2014, 27.04 - 04.05: Ranging

D1 price was going along Sinkou Span A line which is virtual border between primary bullish and primary bearish for D1/H4 timeframes. Chinkou Span line crossed the prifce but on horizantal way which is indicating flat within primary bullish. If D1

Francis Dogbe

Ignore the usual advice you are given, on how to make money in online FOREX trading - and do the opposite!

Francis Dogbe

EUROPE & USA.... aka EURUSD. i have learnt to believe that it is the easiest to trade which i think is true. :)

Imtiaz Ahmed

2014.04.23

yes absolutely after this its gbp-usd i trade mostly with these two and after a long time i am doing very good ...

: