Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.08 09:07

Weekly Outlook: 2016, October 09 - October 16 (based on the article)

German ZEW Economic Sentiment, US FOMC Meeting Minutes, UK Rate decision, US Unemployment Claims, US Crude Oil Inventories, US Consumer Sentiment and Janet Yellen’s speech; These are the main events on forex calendar.

- German ZEW Economic Sentiment: Tuesday, 9:00. Economic sentiment is expected to improve to 4.2.

- US FOMC Meeting Minutes: Wednesday, 18:00.

- UK Rate decision: Thursday, 11:00. The MPC expect a boost in growth during 2017 if the present economic momentum continues.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 252,000 this week.

- US Crude Oil Inventories: Thursday, 15:00.

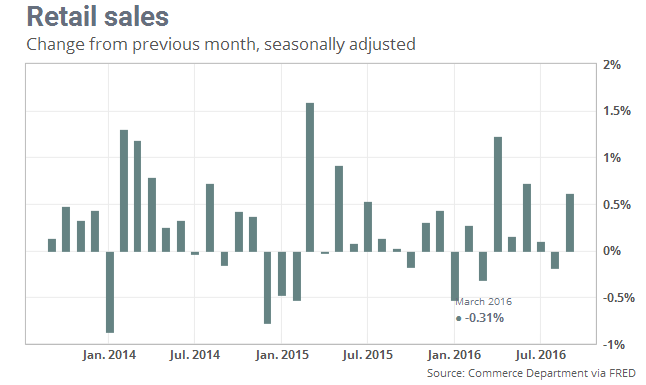

- US Retail sales: Friday, 12:30. Retail sales is expected to gain 0.6%, while core sakes are predicted to rise 0.4%.

- US Prelim UoM Consumer Sentiment: Friday, 14:00. U.S. consumer confidence is expected to climb to 92.1 this

- Janet Yellen speaks: Friday, 17:30. Federal Reserve Chair Janet Yellen will give a talk in Boston’s Annual Research Conference. She will talk about the US economic recovery and may give further clues regarding the expected rate hike timetable. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.11 14:36

Intra-Day Fundamentals - EUR/USD and USD/CAD: NFIB Small Business Index

2016-10-11 10:00 GMT | [USD - NFIB Small Business Index]

- past data is 94.4

- forecast data is 95.2

- actual data is 94.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - NFIB Small Business Index] = Level of a composite index based on surveyed small businesses.

==========

From 247 wallst article: Small Business Optimism Slips Again in September

"Clearly the stock market loves the Fed, but bloated stock values are not

real productive wealth which is created by real investment in plant,

equipment, research and infrastructure, weak in this recovery. Even

housing with low mortgage rates has not performed up to expectation

based on demographics. It has not occurred to the Fed that what meager

growth we have had has occurred in spite of government policy, not

because of it. The private sector continues to perform poorly in light

of the barriers that governments at all levels throw up in its path."

==========

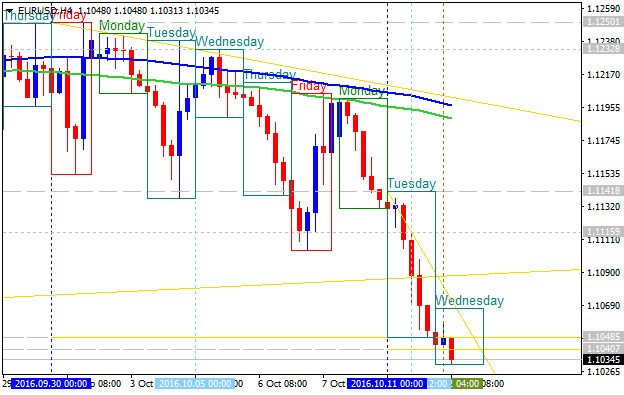

EUR/USD M5: 37 pips price movement by NFIB Small Business Index news events

==========

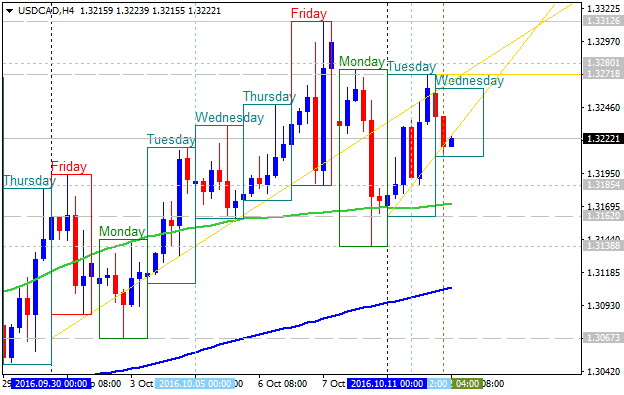

USD/CAD M5: 29 pips price movement by NFIB Small Business Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.12 07:28

Fed Dudley Speaks, Fed George Speaks , Sep FOMC Minutes - Barclays (based on the article)

2016-10-12 12:00 GMT | [USD - FOMC Member Dudley Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member Dudley Speaks] = Speech at the Fireside Chat with the Business Council of New York, in Albany.

==========

New York Fed President Dudley (FOMC voter) speaks: "Dudley speaks on the economy. Based on his recent speeches, we think he is now of the view that, from a risk-management perspective, accommodation should be removed cautiously given the lack of scope to lower rates in the event of an economic downturn."

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.12 07:41

Fed Dudley Speaks, Fed George Speaks , Sep FOMC Minutes - Barclays (based on the article)

2016-10-12 13:40 GMT | [USD - FOMC Member George Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member George Speaks] = Speech at the Federal Reserve Bank of Chicago's Annual Payments Symposium.

==========

Kansas City Fed President George (FOMC voter) speaks: "George speaks on the economic outlook. She has dissented several times this year. We expect her to maintain her call for a rate hike."

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.12 07:54

Fed Dudley Speaks, Fed George Speaks , Sep FOMC Minutes - Barclays (based on the article)

2016-10-12 18:00 GMT | [USD - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

FOMC minutes: "Given the three dissents in favor of a rate hike at the FOMC’s September meeting, we expect the minutes to reveal widening divisions within the committee over the appropriate stance of policy. On one side are those who believe a rate hike in September would have been warranted given that the economy is operating near mandate-consistent levels and mediumterm risks are rising. These concerns were expressed by regional Fed presidents Rosengren, Mester, and George in remarks leading up to, and following, the meeting. On the other side are those FOMC members, primarily within the Board, who point to a slower removal of labor market slack, via trends in participation and other variables, and a lack of evidence that inflation or financial instability are rising, as supporting a further delay in policy normalization."

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 15:27

Intra-Day Fundamentals - EUR/USD, USD/CAD and NZD/USD: U.S. Advance Retail Sales

2016-10-14 12:30 GMT | [USD - Retail Sales]

- past data is -0.2%

- forecast data is 0.7%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From MarketWatch article: U.S. retail sales snap back in September

"Sales at U.S. retail stores rebounded in September, with auto dealers

and gas stations racking up the biggest gains, in a sign consumers are

still spending fast enough to keep the economy on solid ground. Retail

sales rose 0.6% last month to snap back from a small decline in August

that was the first in five months. Economists surveyed by MarketWatch

had forecast a 0.7% increase."

==========

EUR/USD M5: 25 pips range price movement by U.S. Advance Retail Sales news events

==========

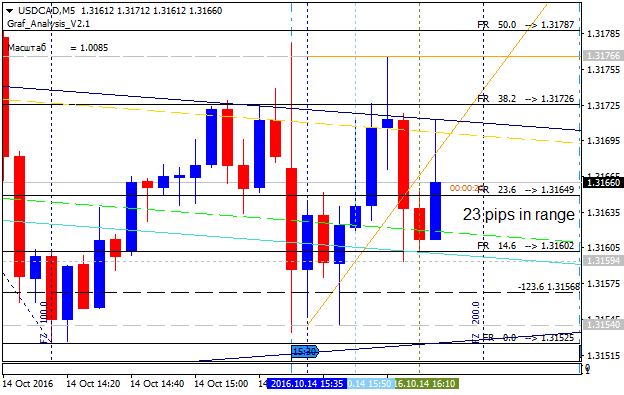

USD/CAD M5: 23 pips range price movement by U.S. Advance Retail Sales news events

==========

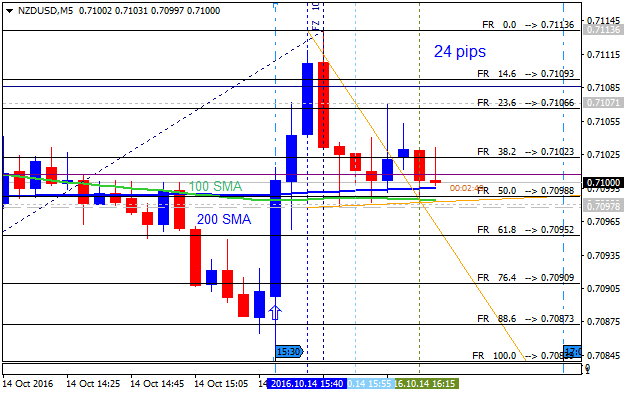

NZD/USD M5: 24 pips price movement by U.S. Advance Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.15 09:46

Weekly Outlook: 2016, October 16 - October 23 (based on the article)

- Mario Draghi speaks: Monday, 17:35. ECB President Mario Draghi will give a talk in Frankfurt. Market volatility is expected.

- UK Inflation data: Tuesday, 8:30. UK inflation is expected to climb higher to 0.9% in September.

- US Inflation data: Tuesday, 12:30. Economists forecast a 0.3% rise in CPI and a 0.2% gain in core CPI in October.

- UK Employment data: Wednesday, 8:30. The number of unemployed is expected to grow by 3,400 in September.

- US Building permits: Wednesday, 12:30. The number of permits is expected to rise to 1.17 million units this time.

- Canadian rate decision: Wednesday, 14:00.

- US Crude Oil Inventories: Wednesday, 14:30.

- Australian employment data: Thursday, 0:30. The Australian employment market is expected to gain 15,200 jobs in September and the unemployment rate is forecasted to rise to 5.7%.

- Eurozone rate decision: Thursday, 11:45.

- US Philly Fed Manufacturing Index: Thursday, 12:30. Philadelphia region manufacturing index is expected to decline to 5.2 this time.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 251,000 this week.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.15 18:26

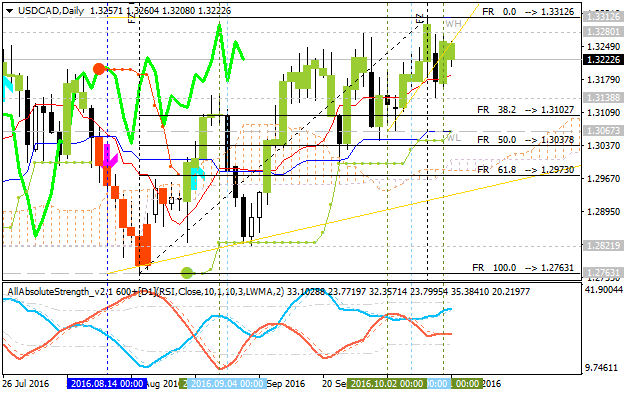

Weekly Fundamental Forecast for USD/CAD (based on the article)

USD/CAD - "The heavy economic data point this week will take place on Wednesday, which will be the October 19 Bank of Canada Policy Rate announcement and release of the Monetary Policy Report. Traders will be on watch for how the Bank of Canada is seeing stabilization in the energy sector, whether or not there is a continued pickup in the non-commodity exports to emerging economies, and how they see growth in the rest of the economy."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.17 15:00

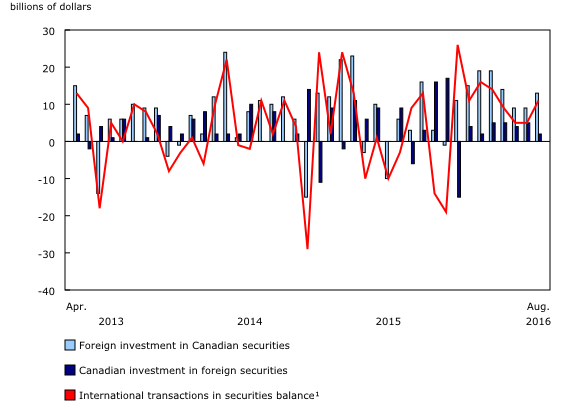

USD/CAD Intra-Day Fundamentals: Canada's International Transactions in Securities and 27 pips range price movement

2016-10-17 12:30 GMT | [CAD - Foreign Securities Purchases]

- past data is 9.10B

- forecast data is 6.24B

- actual data is 12.74B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Foreign Securities Purchases] = Total value of domestic stocks, bonds, and money-market assets purchased by foreigners during the reported month.

==========From official report:

- "Foreign investment in Canadian securities totalled $12.7 billion in August, led by acquisitions of Canadian bonds on the secondary market. At the same time, Canadian investment in foreign securities slowed to $1.6 billion. This resulted in a net inflow of funds of $11.1 billion into the Canadian economy in the month."

- "This activity marked the eight straight month of net inflow of funds in Canada's international transactions in securities. Since the beginning of the year, foreign investment in Canadian securities has exceeded Canadian investment in foreign securities by $96.9 billion."

==========

USD/CAD M5: 27 pips range price movement by Canada's International Transactions in Securities news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.19 13:39

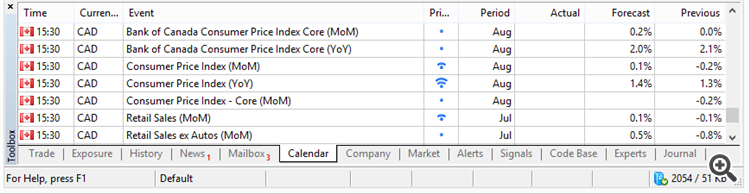

Trading News Events: Bank of Canada Interest Rate Decision (adapted from the article)

- "The Canadian dollar may show a limited reaction to the Bank of Canada’s (BoC) October interest rate decision as Governor Stephen Poloz and Co. are expected to retain the current policy, but the near-term decline in USD/CAD may largely unravel should the monetary policy report fuel bets for more easing."

- "The BoC may show a greater willingness to implement lower borrowing-costs as the ‘risks to the profile for inflation have tilted somewhat to the downside since July,’ and a reduction in the central bank’s economic projections may drag on the local currency as market participants boosts bets for additional monetary support. However, Governor Poloz and Co. may continue to advocate a wait-and-see approach as the central bank anticipates a ‘substantial rebound’ in the second-half of 2016, and the fresh comments may boost the appeal of the Canadian dollar should the committee sound upbeat this time around."

Bullish CAD Trade: BoC Advocates Wait-and-See Approach

- "Need green, five-minute candle to favor a long USD/CAD trade."

- "If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position."

- "Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit, set reasonable limit."

- "Need to see red, five-minute candle following the decision to consider a short trade on USD/CAD."

- "Implement same setup as the bullish Canadian dollar trade, just in revers."

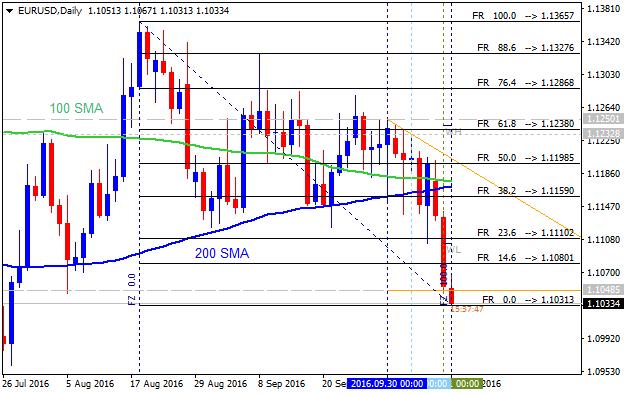

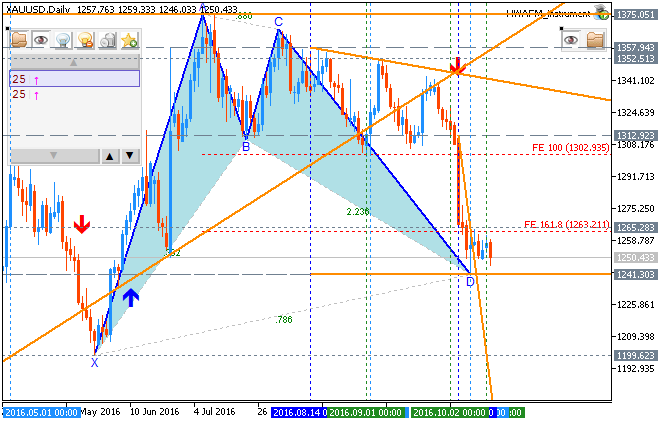

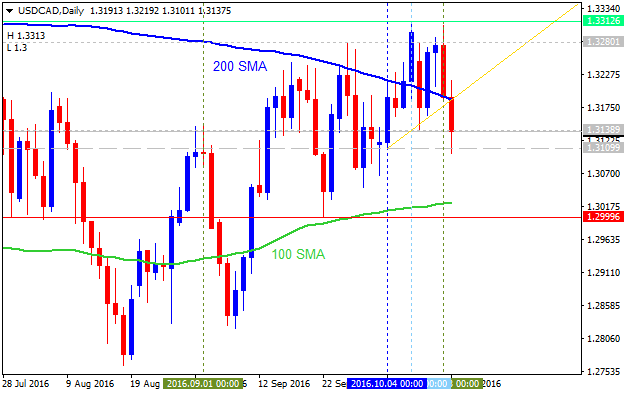

Daily

price

is located between 200-day SMA (200 SMA) and 100-day SMA (100

SMA) for the ranging market condition within the narrow support/resistance levels.

- If D1 price breaks 1.3312

resistance level to above on

close daily bar so the recversal of the price movement from the ranging bearish to tthe primary bullish market ccondition will be started.

- If price breaks 1.3054

support to below on close daily bar so the primary bearish trend will be resumed.

- If not so the price will be on bearish ranging within the levels.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

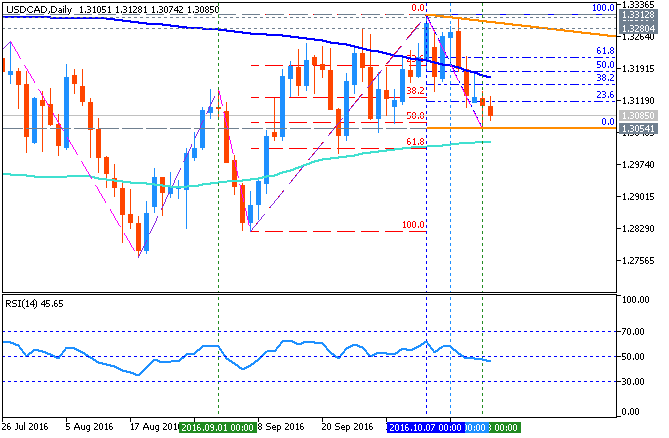

Weekly price is breaking 1.3280 resistance level to above for the reversal of the price movement from the bearish to the ranging bullish market condition to be located inside Ichimoku cloud. Ascending triangle pattern was formed by the price to be crossed to above, Absolute Strength indicator and Trend Strength indicator are estimating the bullish condition in the near future, and Chinkou Span line of Ichimoku is indicating the good breakout of the price movement with the possible bullish reversal.

If W1 price breaks 1.2763 support level on close bar so the primary bearish trend will be resumed.

If W1 price breaks 1.3280 resistance level on close bar from below to above so the reversal of the price movement to the primary bullish market condition will be started.

If not so the price will be on ranging within the levels.

SUMMARY : rally

TREND : bullish reversal