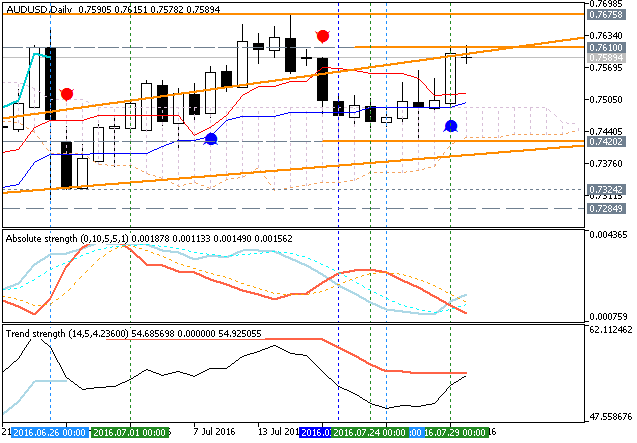

This new daily bar was opened near 0.7590 resistance with 0.7610 level: if the price breaks this 0.7610 level to above so the bullish trend will be continuing with 0.7675 target, otherwise - ranging bullish.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.02 07:18

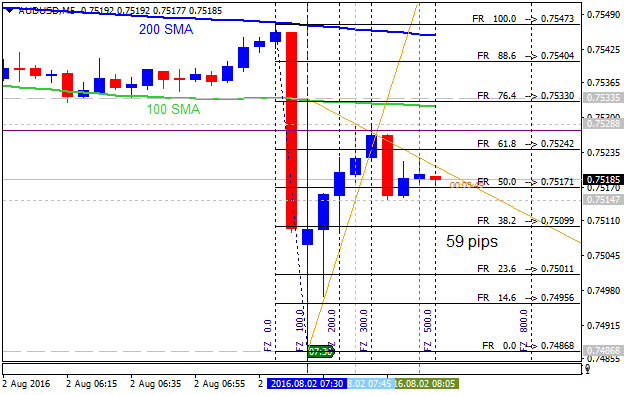

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 59 pips range price movement

2016-08-02 04:30 GMT | [AUD - RBA Cash Rate]

- past data is 1.75%

- forecast data is 1.50%

- actual data is 1.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - RBA Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From news.com.au article:

- "The Reserve Bank is rapidly running out of ammunition to stimulate the economy, cutting the official cash rate by 25 basis points to a new historic low of 1.5 per cent."

- "The central bank last moved in May with a shock Federal Budget day cut to 1.75 per cent, citing weak inflation data, after 12 months of leaving rates on hold."

- "The move is good news for borrowers but comes as yet another kick to retirees, who have had the interest earned on their savings accounts wiped out by 12 rate cuts since 2011."

- "If you had a $300,000 mortgage with an average standard variable rate of 4.93 per cent and manage to get the full discount of 0.25 per cent off your interest rate, this could pocket you almost $50 per month, or a whopping $16,325 over the life of your loan,” said Graham Cooke, insights manager at comparison website Finder.com.au."

- "However, for a saver with a 12-month term deposit at the average rate of 2.58 per cent, a 25 basis point cut would reduce their income by $750 for a $300,000 deposit and up to $1250 for a $500,000 deposit, according to Canstar."

==========

AUD/USD M5: 59 pips range price movement by RBA Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.03 15:31

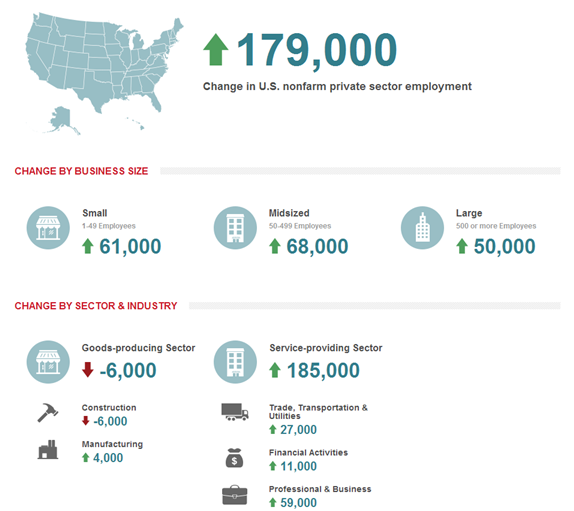

Intra-Day Fundamentals - EUR/USD, AUD/USD, NZD/USD and USD/CNH: ADP Non-Farm Employment Change

2016-08-03 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- past data is 176K

- forecast data is 171K

- actual data is 179K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

AUD/USD M5: 18 pips price movement by ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.04 07:03

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and 29 pips range price movement

2016-08-04 01:30 GMT | [AUD - Retail Sales]

- past data is 0.2%

- forecast data is 0.3%

- actual data is 0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

- The trend estimate rose 0.2% in June 2016. This follows a rise of 0.2% in May 2016 and a rise of 0.2% in April 2016.

- The seasonally adjusted estimate rose 0.1% in June 2016. This follows a rise of 0.2% in May 2016 and a rise of 0.1% in April 2016.

- In trend terms, Australian turnover rose 3.1% in June 2016 compared with June 2015.

==========

AUD/USD M5: 29 pips range price movement by Australian Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.05 06:58

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Statement and 26 pips price movement

2016-08-05 01:30 GMT | [AUD - RBA Monetary Policy Statement]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - RBA Monetary Policy Statement] = It provides valuable insight into the bank's view of economic conditions and inflation - the key factors that will shape the future of monetary policy and influence their interest rate decisions.

==========

From the article:

"But we interpret the larger number of risks to the outlook and the RBA’s forecast that average underlying inflation would be stuck at the bottom of the 2-3% target band by the end of 2018 as a strong easing bias.

Our base case is that rates remain on hold at 1.5%, but we see a clear risk of further cuts given the RBA expects persistently low inflation and with banks passing on only half of this week’s rate cut to home loan customers. The AUD is also important given the RBA thinks it still poses a “significant source of uncertainty” around the outlook.

In our view, today’s statement reinforces this risk. With the cash rate now close to the 1% floor for the cash rate, we think the RBA would be looking more closely at unconventional options if downside risks to the outlook materialise."

==========

AUD/USD M5: 26 pips price movement by RBA Monetary Policy Statement news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located above Ichimoku cloud in the bullish area of the chart: the price is on bullish breakout to be started on open D1 bar for now with the symmetric triangle pattern to be formed by the price for the direction. The price is located within the following key support/resistance levels:

Absolute Strength indicator is evaluating the trend as the primary bullish to be resumed.

If D1 price breaks 0.7420 support level on close bar so the reversal of the price movement to the primary bearish market condition will be started.If D1 price breaks 0.7590 resistance level on close bar from below to above so the primary bullish trend will be resumed with 0.7675 final bullish target.

If not so the price will be on ranging bbullish within the levels.

SUMMARY : breakout

TREND : bullish