You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.05 06:58

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Statement and 26 pips price movement

2016-08-05 01:30 GMT | [AUD - RBA Monetary Policy Statement]

[AUD - RBA Monetary Policy Statement] = It provides valuable insight into the bank's view of economic conditions and inflation - the key factors that will shape the future of monetary policy and influence their interest rate decisions.

==========

From the article:

"But we interpret the larger number of risks to the outlook and the RBA’s forecast that average underlying inflation would be stuck at the bottom of the 2-3% target band by the end of 2018 as a strong easing bias.

Our base case is that rates remain on hold at 1.5%, but we see a clear risk of further cuts given the RBA expects persistently low inflation and with banks passing on only half of this week’s rate cut to home loan customers. The AUD is also important given the RBA thinks it still poses a “significant source of uncertainty” around the outlook.

In our view, today’s statement reinforces this risk. With the cash rate now close to the 1% floor for the cash rate, we think the RBA would be looking more closely at unconventional options if downside risks to the outlook materialise."

==========

AUD/USD M5: 26 pips price movement by RBA Monetary Policy Statement news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.09 07:28

AUD/USD Intra-Day Fundamentals: National Australia Bank Business Confidence and 25 pips range price movement

2016-08-09 01:30 GMT | [AUD - NAB Business Confidence]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry.

==========

"Business sentiment has shown great resilience to external shocks in the July NAB Monthly Business Survey, with firms choosing to remain focussed on the positive trends within their own business. Despite the cacophony of events – including Brexit and the recent Federal election – that have posed a risk to market sentiment in the past month or so, firms are continuing to report positive levels of business confidence (albeit a little below average levels). The business confidence index eased slightly to +4 index points in July (from +5), which is modestly below the average of +6. The resilience of business confidence appears to stem largely from the fact that firms are still experiencing very elevated levels of business conditions – noting that the Survey was also conducted prior to the RBA recent decision to cut the cash rate 25bps."

==========

AUD/USD M5: 25 pips range price movement by National Australia Bank Business Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.09 09:37

AUD/USD Pivot Points Analysis - weekly ranging within yearly Central Pivot waiting for direction (adapted from the article)

W1 price is testing Central Pivot at 0.7497 to above for the second time to be reversed to the primary bullish market condition. The nearest resistance levels are 0.7675/0.7834, and if the price breaks those levels to above so the price will finally be reversed to the primary bullish market condition, alternative - the price will be on ranging within the levels waiting for direction.

Trend:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.10 09:19

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Gov Stevens Speaks and 10 pips range price movement

2016-08-10 03:05 GMT | [AUD - RBA Gov Stevens Speaks]

[AUD - NAB Business Confidence] = The speech at the Anika Foundation Luncheon in Sydney.

==========

"To conclude, over the past decade and in a very volatile world, Australia has achieved the inflation target, avoided a major economic downturn, seen remarkably little variability in real economic activity in the face of enormous shocks, experienced a fairly low average rate of unemployment, and had a stable financial system as well"

"Looking ahead, challenges remain for Australia, not least sustaining a stronger growth outlook over the longer term. More than adjustments to interest rates will be needed to secure that."

==========

AUD/USD M5: 10 pips range price movement by Reserve Bank of Australia Gov Stevens Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.12 17:17

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: U.S. Advance Retail Sales

2016-08-12 12:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From MarketWatch:

==========

AUD/USD M5: 46 pips price movement by U.S. Advance Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.15 14:20

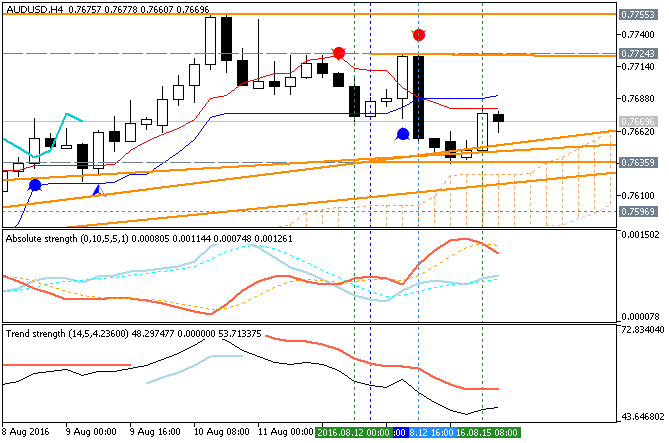

AUD/USD Intra-Day Technical Analysis: Ahead of RBA Minutes (based on the article)

H4 price is above Ichimoku cloud for the bullish ranging within 0.7724 resistance level and 0.7635 support level:

If H4 price breaks 0.7635 support level on close bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If H4 price breaks 0.7724 resistance level on close bar from below to above so the primary bullish trend will be resumed with 0.7755 level as a nearest bullish target.

If not so the price will be on bullish ranging within the levels.

VIDEO LESSON - Introduction to Australian Dollar

Like Canada, Australia's economy is a service based economy, with over 68% of GDP coming from the service sector. Although agriculture and mining account for only 4.7% of Australian GDP, they account for over 65% of the country's exports. This makes the currency highly sensitive to increases or decreases in the price of commodities, especially gold, as Australia is the world's 3rd largest exporter of gold.

While the country and currency are similar to Canada in many ways, a primary difference is the trade relationships that Australia has developed with Asia, and in particular Japan and China, which represent its two largest export markets. This gives the currency a unique exposure to Asia, which generally does not exist with the other non Asian currencies we have studied up to this point.

As Kathy Lien points out in her book Day Trading the Currency Market, the Australian economy was able to whether the Asian financial crisis relatively well, so while there is exposure there, it is also important to keep a watch on the country's historically strong domestic consumption, in times of global economic slowdowns.

The last major factor to keep in mind about the Australian Dollar, is that Australia has one of the highest interest rates in the developed world, currently at 7.25% as of this lesson. This has made the currency one of the primary beneficiaries of carry trade flows, which we learned about in my 3 part series on the carry trade, in module 3 of this course. These flows, combined with the facts that many commodities that Australia exports are at all time highs, and the Australian economy has remained relatively strong through the current crisis, has moved the AUD/USD to 25 year highs as of this lesson.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.16 08:06

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Monetary Policy Meeting Minutes and 27 pips range price movement

2016-08-16 01:30 GMT | [AUD - RBA Minutes]

[AUD - RBA Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From RTTNews article:

"Members of the Reserve Bank of Australia's monetary policy board said that additional stimulus likely would aid the prospects for the country's economic, minutes from the central bank's August 2 revealed on Tuesday. Inflation was below the target range and was expected to remain there for the foreseeable future, giving the bank the means to cut rates. Inflation was just 1 percent in the June quarter, well below the RBA's target band of 2-3 percent. "Underlying inflation was expected to remain low for a time before picking up gradually as spare capacity in labor and many product markets diminished," the minutes said. In particular, it was weakness in the housing market that convinced the board to take action. At the meeting, the board trimmed its benchmark lending rate by 25 basis points, to a fresh record low 1.50 percent from 1.75 percent following two months of no action."

"The bank last reduced its rate by 25 basis points in May, which was the first reduction in a year. The RBA noted the possibility that it may not be the only bank to provide stimulus. "Monetary policy had continued to be highly accommodative in most economies and there was a reasonable likelihood of further stimulus by a number of the major central banks," the minutes said."

==========

AUD/USD M5: 27 pips range price movement by Reserve Bank of Australia Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.17 16:16

AUD/USD Ahead of Employment Data - intra-day bearish; daily breakdown with correction (adapted from the article)

"The AUD/USD continues to decline from yesterday’s high at .7749. This move in price has been guided by a descending trendline, which is drawn below by connecting a series of swing highs over the last two trading sessions. Aussie traders should continue to monitor this line ahead of today’s employment data as an ongoing point of resistance. Expectations for AUD Employment Change (July) figures are set at 10k, and any deviation from this value may result in a significant shift in the short term pricing of the AUD/USD."

M15 price is on bearish market condition for 0.7614 support level to be testing together with ascending triangle pattern to below for the bearish trend to be continuing. If the price breaks 0.7614 support level to below on close M15 bar so the bearish breakdown will be resumed, otherwise - ranging bearish within the levels.

D1 price located above Ichimoku cloud in the bullish area of the chart. The price is started with the secondary correction on open daily bar for now with Chinkou Span line of Ichimoku indicator which is crossing the price to below for the good possible breakdown.

"The AUD/USD can currently be seen trading to new daily lows at .7615. The Grid Sight Index (GSI) is currently highlighting a short term downtrend, with the pair printing a series of lower lows in early trading. After reviewing 23,227,069 pricing points, GSI has indicated that price action has continued to decline 21 pips or more in 46% of the 13 matching historical events. Today’s primary bearish distribution is found at .7596. A move through this point would place the AUD/USD at both new weekly and daily lows."

SUMMARY : daily correction within the bullish

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.18 08:03

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 63 pips price movement

2016-08-18 01:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

==========

AUD/USD M5: 63 pips price movement by Australian Employment Change news event