You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

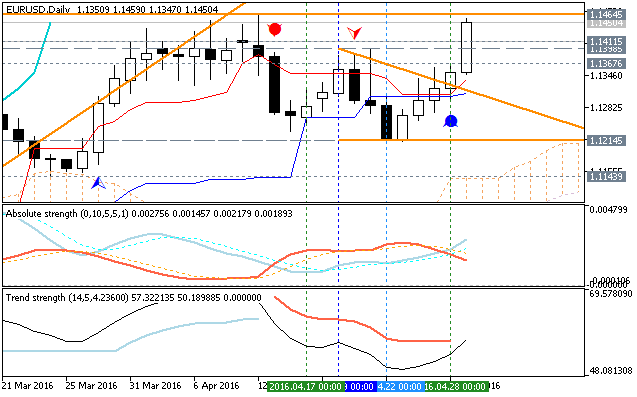

EURUSD Technical Analysis 2016, 01.05 - 08.05: daily bullish, weekly ranging bullish breakout, monthly bearish ranging within narrow levels

Daily price is on local primary bullish market condition for 1.1464 resistance level to be tested for the bullish trend to be continuing. Chinkou Span line and Absolute Strength indicator are estimating the bullish trend in the near future, and Trend Strength indicator is evaluating the future possible condition as the ranging bullish.

If D1 price will break 1.1214 support level on close bar so the reversal of the price movement from the primary bullish to the ranging bearish market condition will be started.

If D1 price will break 1.1464 resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : bullish

TREND : breakoutForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.02 07:21

EUR/USD: 1.1495 resistance level tested; AUD/USD: daily correction with symetric triangle pattern to be broken to below (based on the article)

EUR/USD

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.02 15:57

EUR/USD Intra-Day Fundamentals: USD Fed's Lockhart Remarks and 21 pips price movement

2016-05-02 12:50 GMT | [USD - Fed's Lockhart Remarks]

[USD - Fed's Lockhart Remarks] = USD Fed's Lockhart Makes Introductory Remarks in Florida.

==========

EUR/USD M5: 21 pips price movement by USD Fed's Lockhart Remarks news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.02 16:26

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speech and 33 pips price movement

2016-05-02 14:00 GMT | [EUR - ECB President Draghi Speaks]

[EUR - ECB President Draghi Speaks] = The speech at the Asian Development Bank's 49th Annual Meeting, in Frankfurt.

==========

"The global low interest rate environment is a symptom of challenges in the world economy, not its cause. If interest rates are to rise again to sustainably higher levels, it is those underlying causes that need to be addressed. This is true at a global level, and it is true in the euro area."

"In the euro area, we need expansionary macroeconomic stabilisation policy to support demand, starting of course with monetary policy. That will allow inflation to return to our objective and, in time, for policy interest rates to rise back to their long-term levels."

"But monetary policy cannot raise long-term real rates. That can only be achieved by structural reforms that elicit a structural rebalancing of saving and investment. Higher real returns on savings must come through decisive action on the supply side."

"In this context, there is also a third type of policy that would support both demand in the short-term and supply in the medium-term, and which is unique to Europe. That is committed reform of euro area governance that can remove lingering doubts about its future."

==========

EUR/USD M5: 33 pips price movement by ECB President Draghi Speech news event :

EURUSD Technical Analysis 2016, 01.05 - 08.05: daily bullish, weekly ranging bullish breakout, monthly bearish ranging within narrow levels

Daily price is on local primary bullish market condition for 1.1464 resistance level to be tested for the bullish trend to be continuing. Chinkou Span line and Absolute Strength indicator are estimating the bullish trend in the near future, and Trend Strength indicator is evaluating the future possible condition as the ranging bullish.

If D1 price will break 1.1214 support level on close bar so the reversal of the price movement from the primary bullish to the ranging bearish market condition will be started.

If D1 price will break 1.1464 resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : bullish

TREND : breakoutThe daily bar was opened at 1.1458 and the price is breaking 1.1464 resistance level to above for the primary bullish trend to be continuing. Trend Strength idnicator, Absolute Strength indicator and Chinkou Span line are estimating the trend as a bullish in the near future (for this week for example):

By the way, the new resistance level was formed by the price and we can see it on H4 chart: 1.1534 - if the price breaks this level to above so the bullish breakout will be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.04 13:36

Trading the News: ISM Non-Manufacturing (based on the article)What’s Expected:

Why Is This Event Important:

Despite the ongoing 9 to1 split within the Federal Open Market Committee, Chair Janet Yellen and Co. may come under increased pressure to further normalize monetary policy at the next quarterly meeting June especially as the U.S. economy approaches ‘full-employment.’

How To Trade This Event Risk

Bullish USD Trade: ISM Non-Manufacturing Survey Climbs to 54.8 or Higher

- Need red, five-minute candle following the print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Gauge for Service-Based Activity Disappoints- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.04 16:16

EUR/USD M5: 35 pips price movement by ISM Non-Manufacturing PMI news event :

EURUSD Technical Analysis 2016, 01.05 - 08.05: daily bullish, weekly ranging bullish breakout, monthly bearish ranging within narrow levels

Daily price is on local primary bullish market condition for 1.1464 resistance level to be tested for the bullish trend to be continuing. Chinkou Span line and Absolute Strength indicator are estimating the bullish trend in the near future, and Trend Strength indicator is evaluating the future possible condition as the ranging bullish.

If D1 price will break 1.1214 support level on close bar so the reversal of the price movement from the primary bullish to the ranging bearish market condition will be started.

If D1 price will break 1.1464 resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : bullish

TREND : breakoutNew daily support/resistance levels was formed for now:

The bearish 'reversal' level is 1.1295, and of the price breaks this level so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.06 12:01

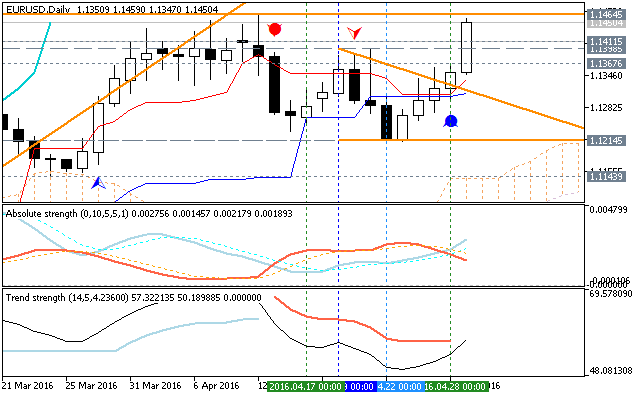

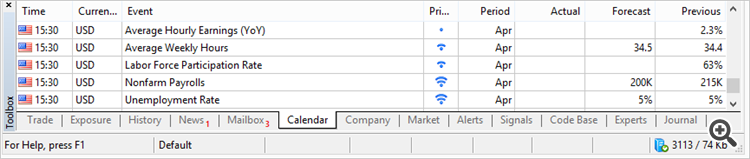

Trading the News: U.S. Non-Farm Payrolls (based on the article)

What’s Expected:

Why Is This Event Important:

With the U.S. economy approaching ‘full-employment,’ a further improvement in the labor market paired with signs of stronger wage growth may put increased pressure on the Federal Open Market Committee (FOMC) to raise the benchmark interest rate at the next quarterly meeting in June as the central bank risks falling behind the curve.

Nevertheless, waning business confidence along with the slowdown in household consumption may prompt U.S. firms to scale back on hiring, and a dismal employment report may drag on the U.S. dollar as market participants push out bets for higher borrowing-costs.

How To Trade This Event Risk

Bullish USD Trade: NFP Expands 200K+, Jobless Rate Narrows

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S Employment Report Falls Short of Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.06 15:03

EUR/USD M5: 75 pips range price movement by Non-Farm Employment Change news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.06 19:15

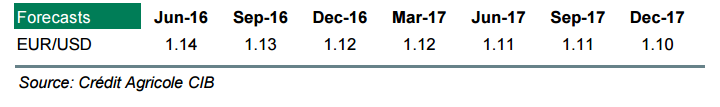

EUR: Gentle Downtrend; AUD: New Targets - Credit Agricole (based on the article)

EUR:

AUD:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.07 09:45

Forex Weekly Outlook May 9-13 (based on the article)

Graeme Wheeler’s speech, US Crude Oil Inventories, rate decision, Mark Carney’s speech, US Unemployment Claims, Retail sales, Producer Prices and consumer sentiment. These are the main events on Forex calendar.