You have detailed some very telling points of scam signals' modus operandi.

This is an excellent article - short and sweet. Thank you! I wish I had read this article before I subscribed to all those scammy signal providers...

I totally agree. Trading is like a sea full of sharks. I hope your warning will be listened by a lot of people before buying a signal provider.

Regards.

David.

Hi CookTim,

Thank you for your thread - its definitely got me thinking. I have recently noticed that there are some high-profit/growth signals on here for which I have downloaded the trading history.

I have can see in their trading history that they have a very high percentage of profitable trades (>90%) and extremely high profit. When one inspects their trading history it is evident that they have placed many trades of the same type, size, etc in rapid succession and closed them out again in rapid succession. Obviously one would ask the questions why it is necessary to open multiple positions of the same type rather than just open a single, larger position (?).

Something that I am struggling to understand is that even though many of the trades are "copies" of each other, the fact remains that a substantial proportion of the "unique trades" are profitable. Does this mean that the signal provider is opening many, many accounts and basically guessing trades, then gradually trimming down the list of accounts to those which made good statistics, then presenting it as a signal on here?

I thought that MQL5.com would only display the signal history for the signal during the time its been live as a broadcast signal on MQL5. So a scammer cannot develop a system offline until they have one that has a nice history, then broadcast their signal on MQL5.com with that history that was "recorded offline" (?). This means that even if the signal is repeating many trades then even though many of those trades are copies of themselves, they were broadcast legitimately (i.e. they were posted live on MQL5 without already knowing what the outcome of the trade would be), and to me this would mean that the only advantage of posting multiple copies of the same trades is to make the trade history of the signal look longer than it really is.

As an example, check out the this signal here:

https://www.mql5.com/en/signals/118879

The signal has an outrageous profitable trade percentage and pips earned vs lost. The signal is also reported as having 1047 completed trades. Inspection of the history log file shows that those trades are actually executed in batches of 3-8 trades that are of the same currency symbol, so really there are approximately maybe 150-200 unique trades. The thing is that 90% of those trades must still be profitable (because the rest are just copies) and so either the signal provider is unusually skilled at placing trades, in which case I cannot understand why they would want to sell their system for $20, or it means that they are somehow able to post results retrospectively after the outcome of the trade is known, and I dont think MQL5's platform allows someone to do that.

Id be interested to hear your thoughts. I am not claiming that they are definitely scammers, and I am not claiming that they definitely arent - their results certainly seem too good to be true but surely the MQL5 administrators would know that a signal provider is "up to something" if they have multiple accounts waiting to filter it down to the one that gives good results?

Apologies if my post doesnt make sense!

Kind regards,

Paul

It's easy to fake the statistics, especially with cent accounts. Your observations are correct! Everybody can set up a series of accounts and choose the best one to be published.

But there is one very important thing to consider when you evaluate an SP:

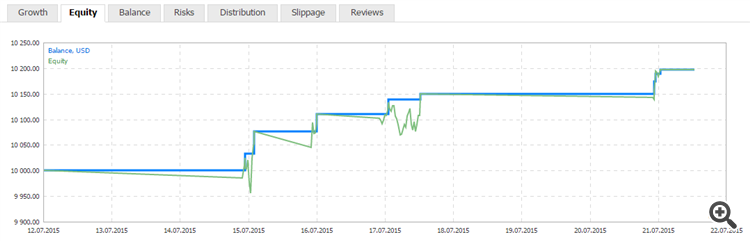

4) Difference between "Growth" tab and "Equity" tab.

I can have a seemingly excellent system (no cent account), which has 40+ weeks old.

But if I load it into MQL5, today???

There is no way to know the real (previous) statistics about the drawdown (the most important parameter in my view).

I dare you to take most of the top SP here and don't overlook these discrepancies.

Suddenly, the monthly return decreases and the drawndown increases. Almost always!

Starting from the most followed SP at the moment...

As an example, check out the this signal here:

https://www.mql5.com/en/signals/118879

This is a clear example of.

Age: 12 weeks

Equity age: 1,5 weeks (from $10k to $10,2K; real ROI = 2% out of 10 days vs nearly 35% weekly avg.)

What has happened in the other weeks where it was not possible to monitor the system?

It might also have been a 99% of drawndown.

Not given to Know!

Thanks for your reply Mirko,

Im still not sure I understand how the signal provider is able to manipulate their equity graph. How can MQL5 claim that they have been posting real trades for 12 weeks but only allow them to post 7 days of equity information?

Surely if MQL5 is logging real trades, then it will have to log both and there is no way for the SP to cheat?

As an example, suppose I have been testing a system on my real money, home account on MT4 for the past 50 weeks, and its doing really really well. If I was to create a signal today to broadcast my trades, is it not correct that MQL5 would NOT let me upload the historical trades as proof of my signal (because I could have manipulated them) and actually my signal would start reporting from "trade 1" today and I would have to effectively build up my track record on this site?

Apologies if I am being a bit slow!

Kind regards,

Paul

Surely if MQL5 is logging real trades, then it will have to log both and there is no way for the SP to cheat?

Welcome Paul.

Yep.

No manipulation of. Statistics missed due to upload occurred later.

MQL5 starts monitoring equity when have a way to monitor the system.

As an example, suppose I have been testing a system on my real money, home account on MT4 for the past 50 weeks, and its doing really really well. If I was to create a signal today to broadcast my trades, is it not correct that MQL5 would NOT let me upload the historical trades as proof of my signal (because I could have manipulated them) and actually my signal would start reporting from "trade 1" today and I would have to effectively build up my track record on this site?

But if you will use hedging-grid and/or martingale and/or (especially) 100% winrate system ... There is no way to keep track of the real drawndown outside real-time track monitoring.

Ultimately, due to lack of all the data, mql will consider only closed positions in order to establish the drawdown.

Aha, I think Im with you now!

So the key point is that only closed trades can be tracked by MQL5 and therefore only closed trades ever feature in MQL5's equity, balance, etc curves. So thats why the SPs will use cent accounts - because its very cheap to leave positions open for a long time because one can wear the losing trade for a long time.

Fortunately I now have a live tracker so I will be able to record all trades and real draw down for any signal and hopefully will separate the chaff from the wheat! Ill keep you posted with results :)

Thank you again for your help and patience Mirko!

Kind regards,

Paul

Aha, I think Im with you now!

So the key point is that only closed trades can be tracked by MQL5 and therefore only closed trades ever feature in MQL5's equity, balance, etc curves. So thats why the SPs will use cent accounts - because its very cheap to leave positions open for a long time because one can wear the losing trade for a long time.

Fortunately I now have a live tracker so I will be able to record all trades and real draw down for any signal and hopefully will separate the chaff from the wheat! Ill keep you posted with results :)

Thank you again for your help and patience Mirko!

Kind regards,

Paul

Yes.

Providing that the system is not monitored by mql.

Once uploaded even open positions (floating or not) are computed to determine the "true" drawndown.

Thus one or more positions that catch up a drawndown are recorded (even though them are recovered and closed in positive) and the relating data are (with a reasonable degree of certainty) reliable.

SP can no longer hide :)

My pleasure, Paul.

Have a nice day.

I advise that if the signal make a negative performance or no any trades in a month, subscribing fee should be returned for that month.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Advice to whomever believing in extremely high growth signal which thrive suddenly in short term. How to identify scamming signal:

1) Before signal is published, you will see multiple trades opened at similar price level, trades opened at almost the same time and closed at the same time as well. One thing I could assure you that this account is a fake one as you can make one your own by creating multiple account hedging each account and narrow down till a single account with the highest growth. The process consume time and lose some money for spreads, but what's wrong with losing so little money since money can be earned from subscribers again?

2) Scam signal provider always used cent account but the account currency is indicated in USD such as Procent server. It seems like the author has invested a huge sum of capital but the indicated 1,000USD is actually equivalent to 10USD only. Think about it.

3) Fancy description is what drive naive subscribers into thinking the author is a professional. "Many years of experience... investing this and that...a banker...or whatever...'; think about this if a professional really wanted to sell his service for 20, 30 or 40 USD? to earn you huge profit? Please be realistic...

Think twice and seriusly before subscribe, not to put your money at risk...