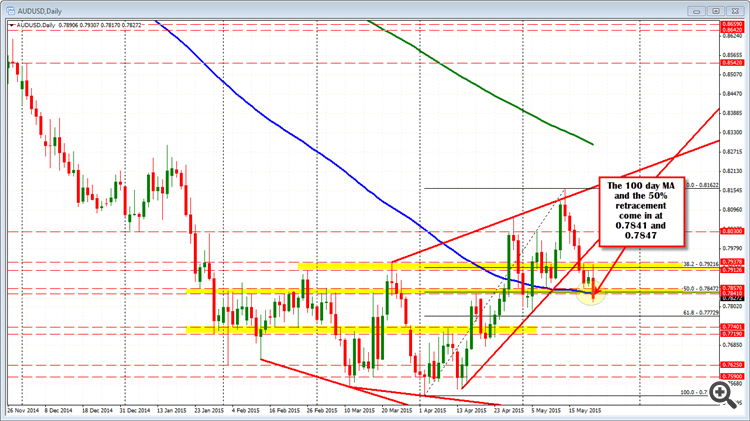

AUDUSD Technical Analysis 2015, 24.05 - 31.05: bearish reversal breakdown with 0.7532 key support and 0.8162 key resistance

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.23 12:35

Forex Weekly Outlook May 25-29 (based on forexcrunch article)

The US dollar made a comeback and the greenback was a big loser in a

week that saw trends change. And now, US Durable Goods Orders, Consumer

Confidence as well as UK, Canadian and US GDP data stand out. These are

the highlight events in Forex calendar. Here is an outlook on the main

market-movers for this week.

The Federal Reserve released minutes from its April 28-29 policy

meeting, revealing the planned rate hike will not take place in June.

Despite growing confidence in the US economic recovery, the recent data

suggest a temporary slowdown. Weaker consumer spending, slow growth and

employment data led policy makers to postpone their decision on raising

rates. Fed officials were also disappointed that falling oil prices did

not spur growth as anticipated and that the recent dollar softness muted

inflation. The Fed has reiterated it will not raise rates until it is

“reasonably confident” that prices are moving toward its 2% target. Will

the US economy rebound from its recent soft patch? In the euro-zone,

talk about front-loading QE hit the euro in particular. The common

currency reversed its previous gains. In the UK, inflation dipped below

0% and in Japan GDP came out better than expected.

- US Durable Goods Orders: Tuesday, 12:30. The U.S. manufacturing sector rebounded in March amid expansion in the transportation industry. New orders for long-lasting manufactured goods increased by 4.0%, to $240.2 billion, following a 1.4% decline in February. However, core durable goods orders, excluding the volatile transportation sector, declined 0.2% to $159.9 billion. The weak core figure followed seven months of negative readings, indicating the second quarter may not be as strong as forecast. A drop of 0.4% in orders and a gain of 0.5% in core orders is on the cards.

- US CB Consumer Confidence: Tuesday, 14:00. Consumer confidence fell unexpectedly in April to 95.2 from 101.4 in March amid weak job growth. While economists expected sentiment to rise to 102.5, sentiment plunged to the lowest level in 2015. Fuel prices continue to remain below last year’s prices contributing to growth but the soft patch in the US labor market overshadowed this positive development. 95.3 is expected now.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada kept its overnight rate unchanged at 0.75%. Governor Stephen Poloz forecast a positive outlook for the Canadian economy, despite the current weakness related to the collapse in oil prices. The central bank cut its original 1.5% growth forecast for the first quarter of 2015, to non- growth. However, Poloz insisted the economy would rebound in the second half of the year. Nonetheless, many economists believe the oil prices collapse will have a longer effect on Canadian growth.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits increased by 10,000 claims last week, reaching 274,000. Analysts expected a smaller rise to 271,000. Despite last week’s increase, the number of claims remained below 300,000 indicating the labor market continues to strengthen for the 11th week. The four-week moving average fell 5,500 last week to 266,250, reaching the lowest level since April 2000. A similar level of 272K is estimated now.

- UK GDP: Thursday, 8:30. According to the preliminary release for Q1 2015, the economy expanded by only 0.3%. The figure will likely be upgraded to 0.4% this time. It’s important to note that this growth rate is lower than seen beforehand.

- Canadian GDP: Friday, 12:30. Canada’s economy stalled in February showing no-growth, after contracting 0.2% in January. The mild improvement in the service sector was offset by contraction in goods-producing industries. Both manufacturing and energy sectors shrank in February suggesting the energy sector is not the sole cause for Canada’s economic weakness, as implied by the Central Bank. Economists believe the BOC will have to cut rates later this year to spur growth. An advance of 0.2% is on the cards now.

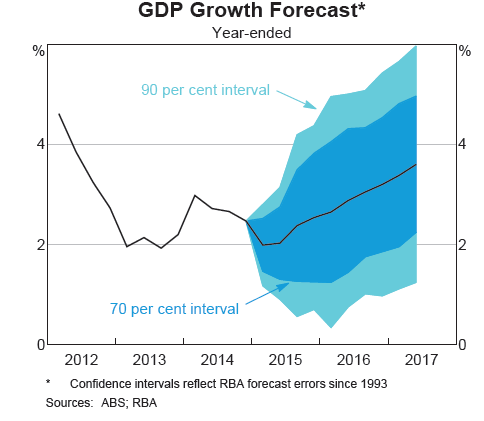

- US GDP: Friday, 12:30. According to the first release for Q1, the economy grew at an annual rate of only 0.2%, below expectations. Things are expected to turn even lower, with a downgrade to contraction of around 0.9% this time . Fed Reserve chair, Janet Yellen also discussed the possibility of raising rates if the employment market will show substantial signs of growth.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.25 10:49

Forex technical analysis: AUDUSD makes a break back below the 100 day MA (based on forexlive article)

The AUDUSD made another stride in the bears direction by falling below the 50 % retracement of the move up from the April 1 low and the 100 day MA (blue line in the chart above). Those levels come in at 0.7847 and 0.78415 respectively. This is the new risk defining level for the pair. Stay below and the bears remain in control. Move above and the waters get more muddy.

The pair has been down 6 of the last 7 days. The high corrective price

today, stalled right at the 100 hour MA (blue line in the chart below).

Traders short from that risk defining level, were rewarded with a kick

lower after the US CPI data. Next support target at 0.7800, then 0.7772

(61.8% of the move up).

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.25 18:34

Yellen's Words Fuels The Greenback's Rise (based on forbes article)

"The U.S. dollar hit a two-month high against the yen and is holding firm against other Group of 10 currencies on Monday after Federal Reserve Chair Janet Yellen suggested late last week the central bank will raise interest rates in 2015."

"With U.S. markets and most of Europe on holiday today, the thinned trading conditions will have most investors looking ahead to tomorrow’s forward-looking U.S. durables data, and Friday’s release of second estimate of U.S. gross domestic product (GDP) as key fundamental touch points for the dollar’s direction. Obviously, any news on Greece or of a potential Grexit will have an immediate impact on the EUR, similar to what happened in the overnight session in Asia."

"Yellen argued that the slowdown in first-quarter GDP growth was “largely” due to temporary factors, such as the record cold weather and a port dispute. The market took “largely” as being more important or convincing than Yellen’s “in part” verbiage that was used in the most recent FOMC statement (there will be a rebound in growth in the second quarter)."

"Yellen repeated her assessment that “it will be appropriate at some point this year to take the initial step to raise the federal funds target.” Not a very transparent statement on timing, but if you include rebounding economic growth, plus a pickup in consumer prices that’s supported by wage growth, you have a fixed-income market now pricing in a rate hike no later than September."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.26 06:12

Sell AUD/USD At S/T Resistance; Sell EUR/USD At Breakout Zone - Credit Suisse (based on efxnews article)

Credit Suisse looked at the technical setups for AUD/USD, and

EUR/USD where CS is bearish near-term, and recommends selling

limit-orders on approaching specific technical levels.

AUDUSD

Starting with AUD/USD, CS notes that the immediate focus turns towards a cluster of supports at .7790/74.

"AUDUSD has reversed its early gains, completing a bearish “outside” session to weigh on a cluster of supports at .7790/74 - the early May low, 61.8% retracement and 55-day average support – where we would expect fresh buying to show here". "A direct break lower though can trigger further selling for .7683 initially, followed by a stronger support from the range lows at .7555/33. Near-term resistance moves lower to .7861/67, followed by .7936. Above can target .7976/86 and then .8030/63 which we look to ideally cap".

CS runs a limit order to sell AUD/USD at 0.7855, targeting a move to 0.7605.

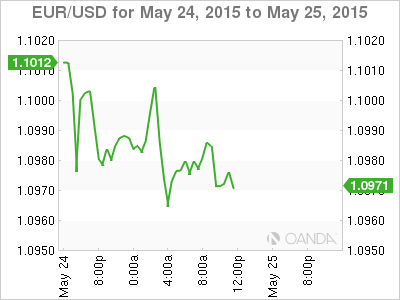

EURUSD

"We look for further weakness here to test the 55-day average at 1.0918 at first, through which can aim at the 61.8% retracement level at 1.0849/43, followed by the low end of the former range at 1.0660/14". "Near-term resistance moves to 1.1062, then 1.1101 with

price and “neckline” resistance at 1.1208/48 expected to cap to keep

the trend lower. Strategy: Flat. Sell at 1.1060, stop above 1.1248 for

1.0525".

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.26 09:42

AUD/USD – Consolidates Below Key 0.7850 Level (based on marketpulse article)

| S3 | S2 | S1 | R1 | R2 | R3 |

|---|---|---|---|---|---|

| 0.7700 | — | — | 0.8200 | — | — |

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trading in a very narrow range above 0.7820. Current range: trading right above 0.7820.

Further levels in both directions:

• Below: 0.7700.

• Above: 0.8200.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.26 20:04

Tech Setups For EUR/USD, USD/JPY, GBP/USD, AUD/USD - Barclays (adapted from efxnews article)

The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, and AUD/USD as provided by the technical strategy team at Barclays Capital.

EUR/USD: Our bearish view was encouraged by the close below former range highs near 1.1055. We are looking for a move lower towards targets near 1.0850 and then the 1.0660 area. Our greater targets are towards 1.0460. 1.1055 reverts to resistance.

USD/JPY: The break above the 122.05 highs confirms our bullish view and completion of the six-month range trade. Our greater upside targets are in the 124.15 area.

GBP/USD: Last Friday’s bearish engulfing candle and the subsequent move through 1.5445 signals a squeeze lower towards our targets near 1.5335. Breaking below there would signal deeper setback towards 1.5130, the 50-dma.

AUD/USD: Last week’s bearish engulfing candle encourages our bearish view. A close below our initial downside targets near 0.7790 would signal lower towards 0.7680.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.27 08:10

Cool Down: A Look At AUD/USD (adapted from seekingalpha article)

"With below trend growth, low inflation expectations and an accommodative monetary policy, it is difficult to see strengthening in AUD/USD. As a result the recent rally in AUD/USD should be shorted. Investors and traders without access to a forex account should consider to short FXA at current levels and exit the position when AUD/USD falls to 0.7635, a 2.51% return."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.27 18:14

RBA Deputy Gov Lowe Speaks - Due to speak at the Thomson Reuters’ 3rd Australian Regulatory Summit, in Sydney (adapted from exchangerates.org.uk article)

The Australian Dollar softened against a host of other majors after

central bank warnings resonated with investors. Reserve Bank of

Australia (RBA) Deputy Governor Phillip Lowe spoke at a business

conference this week and suggested that the markets should expect some

extreme volatility if the Federal Reserve begins to increase borrowing

costs. However, the weaker ‘Aussie’ would be favourable to the central

bank which has made numerous attempts to jawbone the currency.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.28 07:48

2015-05-28 02:30 GMT (or 04:30 MQ MT5 time) | [AUD - Private Capital Expenditure]- past data is -1.7%

- forecast data is -2.3%

- actual data is -4.4% according to the latest press release

if actual > forecast (or previous data) = good for currency (for AUD in our case)

[AUD - Private Capital Expenditure] = Change in the total inflation-adjusted value of new capital expenditures made by private businesses. It's a leading indicator of economic health - businesses are quickly affected by market conditions, and changes in their investment levels can be an early signal of future economic activity such as hiring, spending, and earnings.

==========

- The trend volume estimate for total new capital expenditure fell 2.3% in the March quarter 2015 while the seasonally adjusted estimate fell 4.4%.

- The trend volume estimate for buildings and structures fell 3.7% in the March quarter 2015 while the seasonally adjusted estimate fell 6.5%.

- The trend volume estimate for equipment, plant and machinery rose 0.7% in the March quarter 2015 while the seasonally adjusted estimate fell 0.5%.

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.28 12:51

AUD Resuming Downtrend Backed by FX Sentiment & Volume Analysis (adapted from dailyfx article)

- AUDUSD trading volume was muted on recent counter-trend price spike

- Volatile Corrective Pattern looks to have finished at the 38.2% Fib Level

The recent spike in AUDUSD happened on muted volume, which favors prior trend. Combining the lack of volume on the terminal move in an addition to the following factors of sentiment and chart patterns. This article will guide you through what to look for on the chart while adding sentiment and volume analysis to see if the trend is ready to resume or rather a reversal is underway.

Technical analysis looks for potentially repeatable patterns that can provide an edge, so long as risk is managed. The chart above shows AUDUSD traced out a clean broadening pattern (diverging red trend lines), which communicates trend interruption more than trend reversal and often favors a new low is likely in a larger downtrend.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price is on primary bullish with the secondary correction which was started in the middle of this month and it is continuing up to now: the price is breaking 0.7860 support level for the correction to be continuing with possible price reversal to the primary bearish by good possible breakdown.

D1 price is on primary bullish with secondary correction:

W1 price is on bearish market condition with secondary ranging between 0.7532 support and 0.8162 resistance levels

MN price is on primary bearish with secondary ranging to be started

If D1 price will break 0.7860 support level on close D1 bar so we may see the correction to be continuing with good possibility for breakdown up to reversal to the primary bearish

If D1 price will break 0.8162 resistance level so the bullish trend will be continuing

If not so the price will be ranging between 0.8162 and 0.7860 levels

SUMMARY : correction to breakdown

TREND : reversal