Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.19 14:24

'EURUSD would trade down to about .9840 in August before trading back to 1.1450+' (based on dailyfx article)

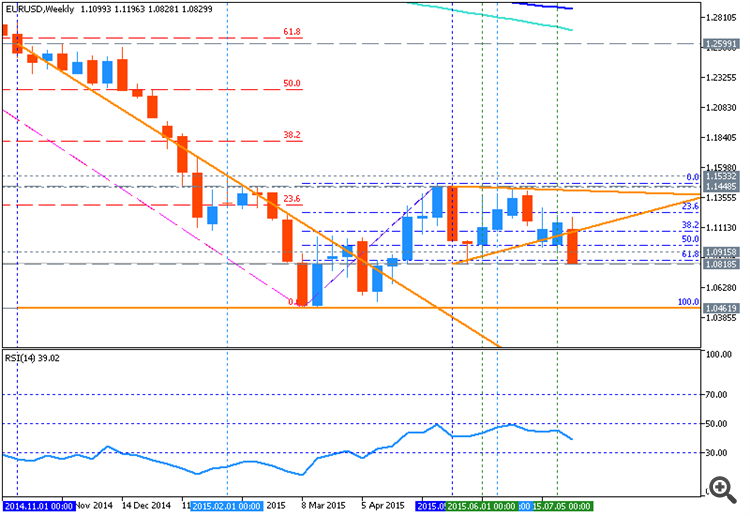

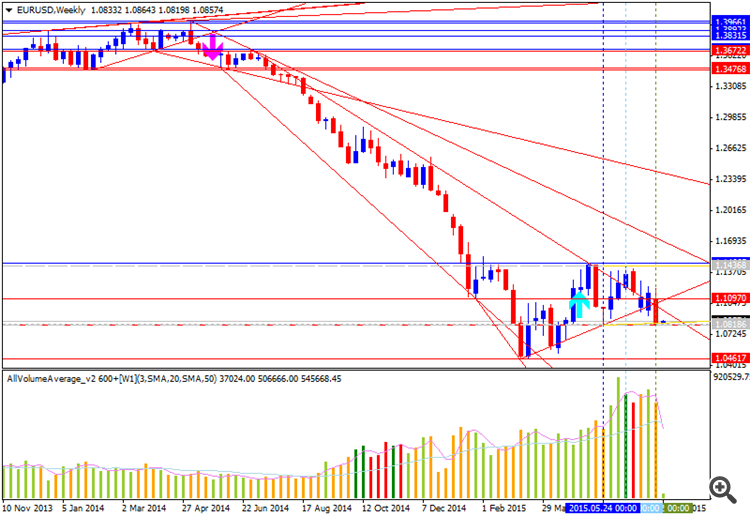

W1 price is located below 200 period SMA and below 100 period SMA for the primary bearish market condition with secondary ranging between 1.0461 support level and 1.1466 resistance level:

- The price is ranging between 1.0461 and 1.1466 levels.

- The price broke triangle pattern from above to below together with 50.0% Fibo level at 1.0966 for the bearish breakdown to be continuing.

- If weekly price will break 1.0461 support

level so the primary bearish will be continuing, otherwise the price will be ranging within the familiar levels;

- “The tightening range since the May high could compose a triangle within a larger advance from the March low.” A broader range does of course remain possible but with EURUSD breaking support this week, one must consider a more immediate bearish alternative. Comparisons with 1997 (pre euro trading but a calculated value is plotted) price behavior are striking.”

- “EURUSD would trade down to about .9840 in August before trading back to 1.1450+.”

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.19 18:33

Morgan Stanley - Outlooks For The Coming Week (based on efxnews article)

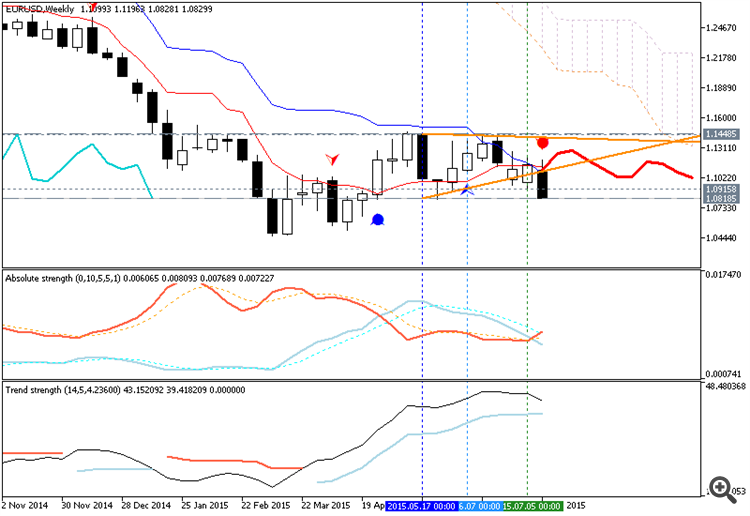

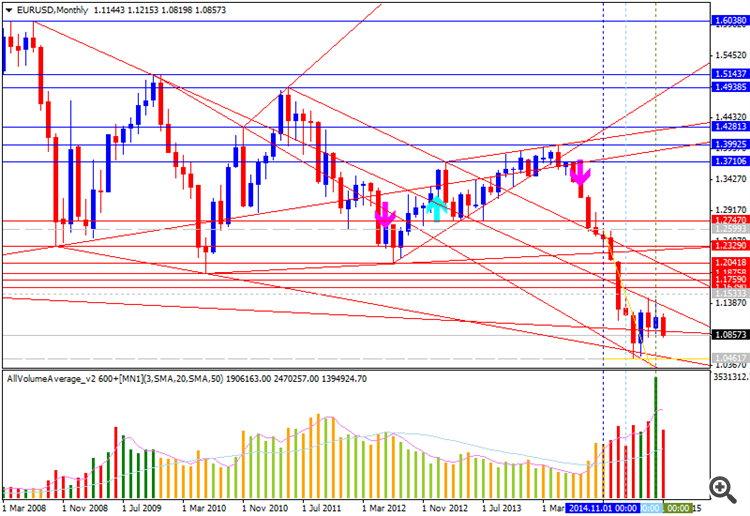

EUR: Bearish

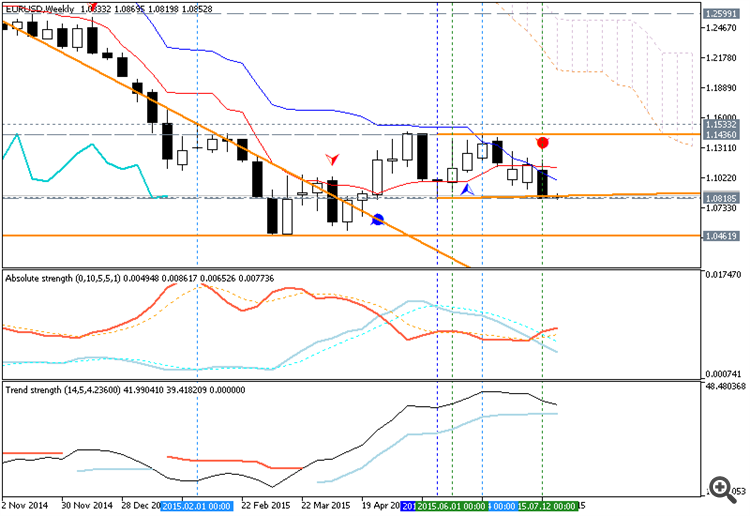

- Weekly price is on primary bearish market condition located below Ichimoku cloud for trying to break key support level for the bearish to be continuing.

- Price is located below 100 SMA and below 200 SMA for the primary bearish.

- The data of AbsoluteStrength indicator and Trend Strength indicator are in contradiction with each other for ranging market condition

- "With uncertainty regarding Greece diminished, we believe that investors will feel more comfortable reinitiating EUR shorts, as evidenced by the latest break in EURUSD below the 100 DMA. Draghi has reiterated that the ECB stands ready to act if needed, which could be enough to weigh on EUR, particularly if it supports equities, given the inverse relationship between European stocks and EUR."

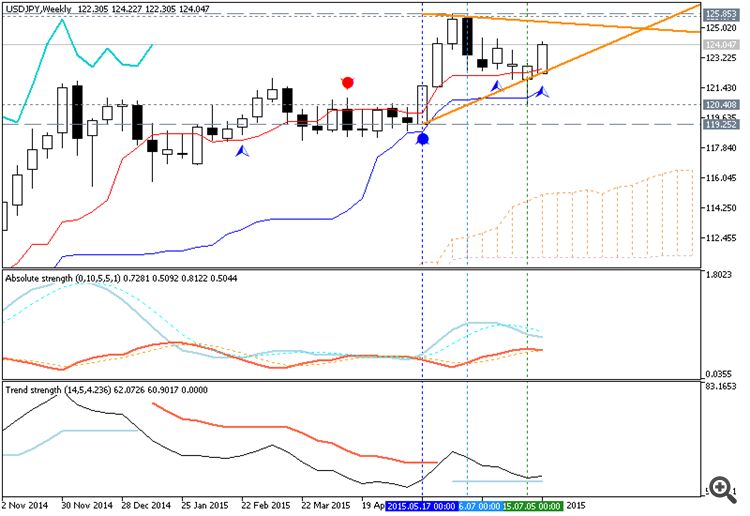

JPY: Bullish

- Weekly price is located far above Ichimoku cloud for the primary bullish market condition to be continuing.

- Price is located above 100 SMA and above 200 SMA for the bullish trend.

- The values of Absolute Strength indicator are estimating the secondary ranging which is going between 119.25 support and 125.85 resistance levels.

- "We expect JPY weakness to reverse, and maintain our bullish view, despite the recent pick-up in equity markets. Recent data from Japanese pension funds point to the reallocation process being largely complete, suggesting that foreign outflows from Japan could slow."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.20 10:15

Credit Suisse - 'run a limit order to sell EUR/USD at 1.0962, with a stop at 1.1036 and a target at 1.0745.' (based on efxnews article)

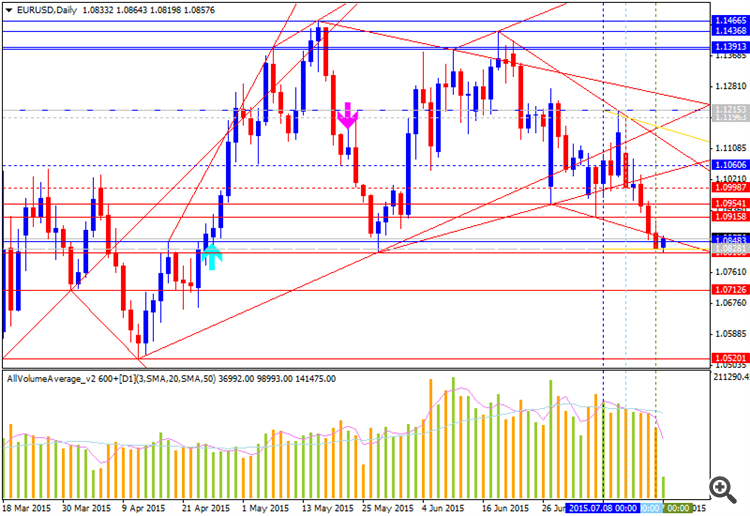

Credit Suisse is still considering the bearish breakdown for EURUSD to be going very soon from now. The key support level to be crossed for the breakdown to be started is 1.7041:

- "This is holding for now, and we allow for a potential bounce from here. However, we look for an eventual breakdown to test trendline support, now at 1.7041. We would expect a bounce here, but beneath it can trigger a move down to 1.0660."

- "EUR/USD has extended its decline in its broader “triangular” range to weigh on the May low and 61.8% retracement support at 1.0819."

And there is some strategy which CS proposed for us:

- "Near-term resistance shows at 1.0962/66, above which can see a move back to 1.1035, with 1.1083/89 expected to cap."

- "In line with this view, we run a limit order to sell EUR/USD at 1.0962, with a stop at 1.1036 and a target at 1.0745."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.20 17:52

Fundamental Reasons to Sell EUR - Credit Agricole (based on efxnews article)

Credit Agricole suggested to sell for EUR just because of the following:

- "The EUR has been under pressure regardless of the Greek parliament voting in favour of the agreed bailout package. Even if all measures are implemented successfully it still appears questionable whether debt-sustainability can be achieved. From that angle Greece-related uncertainty is likely to continue for longer."

- "ECB President Draghi reiterated anew that QE will run its course regardless of stabilising growth and price developments."

- "In terms of data, this week’s focus will be on July PMIs."

- "We expect the single currency to stay subject to downside risk. This is especially true when considering that speculative positioning is close to neutral territory, which suggests limited position-squaringrelated upside risk."

From the technical point of view, the next target for EURUSD is 1.0461 after crossing 1.0818 resistance level so the fundamental expectations of Credit Agricole are more than real ones in this situation for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.21 12:56

Citibank - pause in the heavy EUR selling, another round of GBP strength (based on efxnews article)

EUR:

- This is the third week Citi is celebrating the EUR has been sold aggressively by Citi’s client base:

"Overall, this highlights that the Greek risk is not a predominant driver of positioning, but that rates and policy expectations are. With the ECB highlighting policy will remain unchanged deep into 2016, there may be a pause in the heavy EUR selling." - By the way, Citi is estimating some pausing in aggressive EUR bearish tendency for now.

GBP:

- Citi is predicting an another round of GBP strength:

"Leveraged accounts were the strong buyers of GBP in the past week, after BOE signaled earlier rate hikes were likely. However, Real Money, which has long been a GBP buyer failed to follow through."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.21 17:10

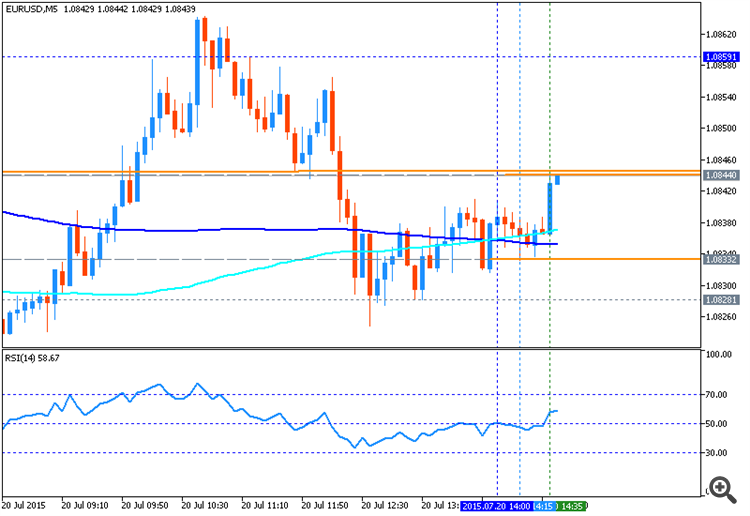

EURUSD price and 100 hour MA (based on forexlive article)

'The EURUSD price and the 100 hour MA are meeting as NY traders enter for

the trading day. The 100 hour MA (blue line in the chart below) is at

1.0878 and that is the high for the day. Risk can defined and limited at

the level. The 22 day Average true range is 124 pips. Yesterday's range was a year

tying low of 50 pips. All of this says, look for an extension. So

although the 100 hour MA is a risk defining level and the price is

currently stalling - suggesting a selling interest, it remains a finger

on the button trade. That is if the price moves above the 100 hour MA.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.22 11:15

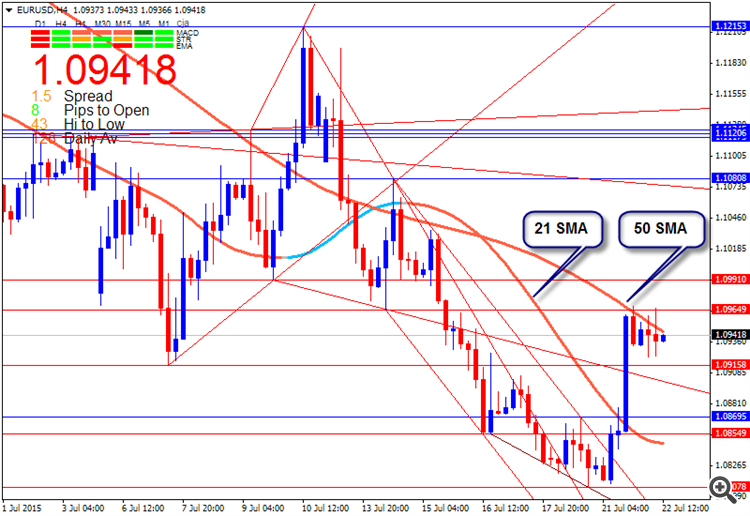

Intraday Outlooks For EUR/USD - Skandinaviska Enskilda Banken (based on efxnews article)

- The price is ranging between 1.0830 & 1.0995 levels for the primary bearish.

- The price will go to be out of ranging zone in case of 1.0879 support level to be broken from above to below.

- The

price is located between 21 SMA and 50 SMA, and it is going along with

50 SMA as the strong resistance level of the value of it.

- "With fresh mid body support at 1.0879, near-term bulls should be inspired to at least test resistance at the lower end of the "Cloud" at 1.0994. If not stopping there a short-term descending trendline, now at 1.1105 would also deserve some attention. Current intraday stretches are located at 1.0830 & 1.0995."

The resistance level may be broken by price from below to above for the new rally, or the price will continuing with ranging between the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.22 20:05

EURUSD bangs on support (based on forexlive article)

"Key level for the pair being tested.The 61.8% is at 1.08688. The 100 hour MA is at 1.08746. This is the patient level for buyers outlined in an earlier post. Getting back above the 50% at the 1.08878 will be eyed on a rebound."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bearish market condition for ranging between the followings/r levels:

Chinkou Span line is indicating the bearish breakdown to be continuing in the near future (this week or in tyhe next week for example).

D1 price - ranging market condition:

W1 price is on bearish market condition with secondary ranging between 1.0818 (W1) support level and 1.1448 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0818 support level on close D1 bar so the bearish trend to be continuing for the week.

If D1 price will break 1.1215 resistance level so the price will be reversed to the bullish market condition.

If not so the price will be on ranging between 1.0818 and 1.1215 levels.

SUMMARY : bearish

TREND : bearish breakdown