newdigital, 2013.09.26 08:26

The Zig-Zag indicator is extremely useful for determining price trends, support and resistance areas, and classic chart patterns like head and shoulders, double bottoms and double tops. The Zig-Zag indicators uses both swing highs and swing lows in its calculation:

- Swing Highs: When a price (usually close) is both higher than the price previous to it and after it.

- Swing Lows: When a price is both lower than the price prior to it and lower than the price following it.

The Zig-Zag indicator can use both percentages or points in its construction. To construct the Zig-Zag indicator, there must be a certain percentage or number of points between a swing high and a swing low before a line will be drawn. The chart below of the E-mini Nasdaq 100 Futures contract visually illustrates the difference between a price retracement Zig-Zag of 3% and a price retracement Zig-Zag of 5%:

Notice how in the chart above that a Zig-Zag with a retracement percentage of 3% makes more distinct lines than the Zig-Zag with a retracement percentage of 5%. The purpose of using a Zig-Zag with a larger retracement percentage is to help eliminate price noise that is not significant for the trader's analysis.

Zig-Zag indicator is extremely effective at uncovering stock cycles while screening out short-term price noise.

The Zig-Zag indicator is extremely effective in filtering short-term noise and identifying significant trends and significant changes in market prices.

Below is a chart of the E-mini S&P 500 Futures contract that illustrates how effective the Zig-Zag indicator was in finding areas of support and resistance and price breakouts:

The chart above of the e-mini uses a 5% Zig-Zag retracement value; therefore, only price changes of 5% or greater are shown, helping a long-term trader or investor determine important areas of support, resistance, and areas of price breakouts.

On the left of the chart, the S&P 500 was forming a triangle consolidation pattern. When prices broke resistance, a long-term buy was generated. During the middle of the chart, the Zig-Zag indicator was effective in illustrating that the S&P 500 was in an upward price channel. Buying in areas where price touched the lower support trendline and selling when prices touched the upper resistance line would have proved extremely profitable.

Using the Zig-Zag indicator for shorter-term trades can prove profitable as well. The chart below of Intel (INTC) shows a classic chart head and shoulder pattern easily seen by the Zig-Zag indicator ($1 retracement):

The easily identified head and shoulders pattern gave a sell signal when price on the right shoulder broke the upward slanting trendline.

The Zig-Zag indicator is an excellent technical analysis tool for identifying classic charting patterns. The Zig-Zag indicator is also effective in reducing noise and helping the technical trader see the true market direction.

Indicators: Fibonacci retracement

newdigital, 2013.11.21 12:06

Fibonacci Retracements (based on stockcharts article)

Introduction

Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci Retracements are 61.8% and 38.2%. Note that 38.2% is often rounded to 38% and 61.8 is rounded to 62%. After an advance, chartists apply Fibonacci ratios to define retracement levels and forecast the extent of a correction or pullback. Fibonacci Retracements can also be applied after a decline to forecast the length of a counter trend bounce. These retracements can be combined with other indicators and price patterns to create an overall strategy.

The Sequence and Ratios

This article is not designed to delve too deep into the mathematical properties behind the Fibonacci sequence and Golden Ratio. There are plenty of other sources for this detail. A few basics, however, will provide the necessary background for the most popular numbers. Leonardo Pisano Bogollo (1170-1250), an Italian mathematician from Pisa, is credited with introducing the Fibonacci sequence to the West. It is as follows:

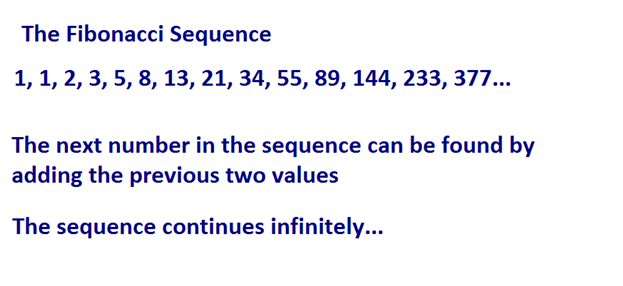

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610……

The sequence extends to infinity and contains many unique mathematical properties.

- After 0 and 1, each number is the sum of the two prior numbers (1+2=3, 2+3=5, 5+8=13 8+13=21 etc…).

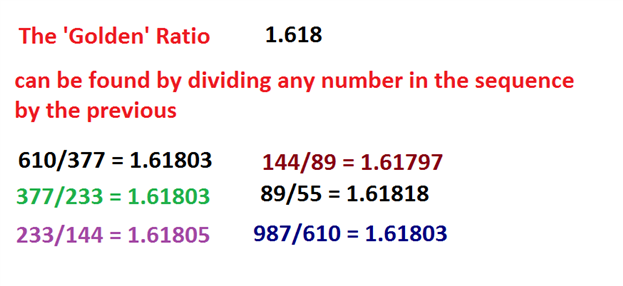

- A number divided by the previous number approximates 1.618 (21/13=1.6153, 34/21=1.6190, 55/34=1.6176, 89/55=1.6181). The approximation nears 1.6180 as the numbers increase.

- A number divided by the next highest number approximates .6180 (13/21=.6190, 21/34=.6176, 34/55=.6181, 55/89=.6179 etc….). The approximation nears .6180 as the numbers increase. This is the basis for the 61.8% retracement.

- A number divided by another two places higher approximates .3820 (13/34=.382, 21/55=.3818, 34/89=.3820, 55/=144=3819 etc….). The approximation nears .3820 as the numbers increase. This is the basis for the 38.2% retracement. Also, note that 1 - .618 = .382

- A number divided by another three places higher approximates .2360 (13/55=.2363, 21/89=.2359, 34/144=.2361, 55/233=.2361 etc….). The approximation nears .2360 as the numbers increase. This is the basis for the 23.6% retracement.

1.618 refers to the Golden Ratio or Golden Mean, also called Phi. The inverse of 1.618 is .618. These ratios can be found throughout nature, architecture, art and biology. In his book, Elliott Wave Principle, Robert Prechter quotes William Hoffer from the December 1975 issue of Smithsonian Magazine:

….the proportion of .618034 to 1 is the mathematical basis for the shape of playing cards and the Parthenon, sunflowers and snail shells, Greek vases and the spiral galaxies of outer space. The Greeks based much of their art and architecture upon this proportion. They called it the golden mean.

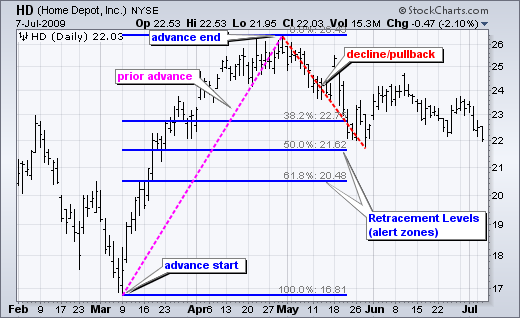

Alert Zones Retracement levels alert traders or investors of a potential trend reversal, resistance area or support area. Retracements are based on the prior move. A bounce is expected to retrace a portion of the prior decline, while a correction is expected to retrace a portion of the prior advance. Once a pullback starts, chartists can identify specific Fibonacci retracement levels for monitoring. As the correction approaches these retracements, chartists should become more alert for a potential bullish reversal. Chart 1 shows Home Depot retracing around 50% of its prior advance.

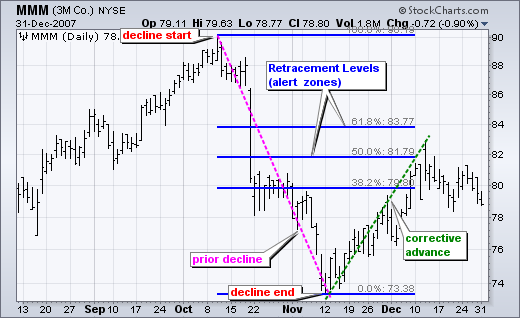

The inverse applies to a bounce or corrective advance after a decline. Once a bounce begins, chartists can identify specific Fibonacci retracement levels for monitoring. As the correction approaches these retracements, chartists should become more alert for a potential bearish reversal. Chart 2 shows 3M (MMM) retracing around 50% of its prior decline.

Keep in mind that these retracement levels are not hard reversal points. Instead, they serve as alert zones for a potential reversal. It is at this point that traders should employ other aspects of technical analysis to identify or confirm a reversal. These may include candlesticks, price patterns, momentum oscillators or moving averages.

Common RetracementsThe Fibonacci Retracements Tool at StockCharts shows four common retracements: 23.6%, 38.2%, 50% and 61.8%. From the Fibonacci section above, it is clear that 23.6%, 38.2% and 61.8% stem from ratios found within the Fibonacci sequence. The 50% retracement is not based on a Fibonacci number. Instead, this number stems from Dow Theory's assertion that the Averages often retrace half their prior move.

Based on depth, we can consider a 23.6% retracement to be relatively shallow. Such retracements would be appropriate for flags or short pullbacks. Retracements in the 38.2%-50% range would be considered moderate. Even though deeper, the 61.8% retracement can be referred to as the golden retracement. It is, after all, based on the Golden Ratio.

Shallow retracements occur, but catching these requires a closer watch and quicker trigger finger. The examples below use daily charts covering 3-9 months. Focus will be on moderate retracements (38.2-50%) and golden retracements (61.8%). In addition, these examples will show how to combine retracements with other indicators to confirm a reversal.

Moderate Retracements Chart 3 shows Target (TGT) with a correction that retraced 38% of the prior advance. This decline also formed a falling wedge, which is typical for corrective moves. The combination raised the reversal alert. Chaikin Money Flow turned positive as the stock surged in late June, but this first reversal attempt failed. Yes, there will be failures. The second reversal in mid July was successful. Notice that TGT gapped up, broke the wedge trend line and Chaikin Money Flow turned positive (green line).

Chart 4 shows Petsmart (PETM) with a moderate 38% retracement and other signals coming together. After declining in September-October, the stock bounced back to around 28 in November. In addition to the 38% retracement, notice that broken support turned into resistance in this area. The combination served as an alert for a potential reversal. William %R was trading above -20% and overbought as well. Subsequent signals affirmed the reversal. First, Williams %R moved back below -20%. Second, PETM formed a rising flag and broke flag support with a sharp decline the second week of December.

Chart 4 shows Pfizer (PFE) bottoming near the 62% retracement level. Prior to this successful bounce, there was a failed bounce near the 50% retracement. The successful reversal occurred with a hammer on high volume and follow through with a breakout a few days later.

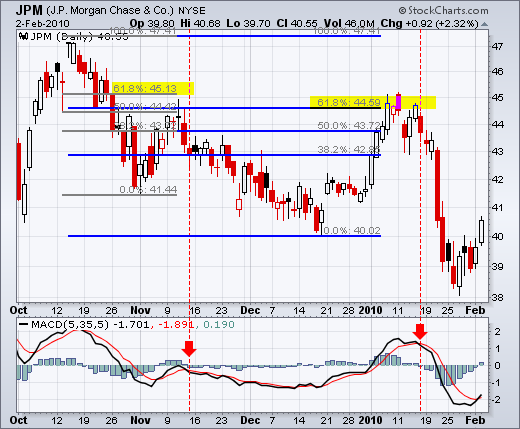

Chart 5 shows JP Morgan (JPM) topping near the 62% retracement level. The surge to the 62% retracement was quite strong, but resistance suddenly appeared with a reversal confirmation coming from MACD (5,35,5). The red candlestick and gap down affirmed resistance near the 62% retracement. There was a two day bounce back above 44.5, but this bounce quickly failed as MACD moved below its signal line (red dotted line).

Fibonacci retracements are often used to identify the end of a correction or a counter-trend bounce. Corrections and counter-trend bounces often retrace a portion of the prior move. While short 23.6% retracements do occur, the 38.2-61.8% covers the more possibilities (with 50% in the middle). This zone may seem big, but it is just a reversal alert zone. Other technical signals are needed to confirm a reversal. Reversals can be confirmed with candlesticks, momentum indicators, volume or chart patterns. In fact, the more confirming factors the more robust the signal.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.13 07:43

The Rabbit Hole of Fibonacci (adapted from this article)- We look at the history and background of the mathematical concept known as ‘The Fibonacci Sequence’

- We show you how traders can apply these mathematical studies to their trading.

Fibonacci

This is one of the more in-depth support and resistance methods out there, and there are a lot of different ways that traders look to integrate Fibonacci in their trading.

Taking a step back, Fibonacci is named after the 12th century mathematician, Leonardo of Pisa. In 1202 AD, Leonardo published a composition with the name of Liber Abaci that consisted of a numerical sequence that eventually became named after him. Leonardo of Pisa didn’t discover the sequence; he merely used it as an example in his composition.

The sequence is thought to have been originally used by Indian mathematicians as early as the 6th century; and in Liber Abaci, this numerical sequence was introduced the western world. The sequence introduced by Leonardo of Pisa was a system that found the next value in the sequence by adding the two previous numbers. The sequence shared in Liber Abaci was as follows:

Today these values are called ‘Fibonacci numbers’ and are used by many traders as input values for indicators along with a slew of other purposes.

But input values on trading indicators aren’t the only place that we’ll see this system at work. The Fibonacci sequence has excited mathematicians and scientists for thousands of years because of its numerous applications in the world around us. One of the initial applications that Leonardo of Pisa investigated in his original manuscript was the population growth of rabbits. He found that as an isolated population of rabbits grew, the population would grow according the Fibonacci sequence. Starting with one pair of rabbits, the population would then grow to two; which would become three, and then five, eight, thirteen, etc. The sequence is also prominent in population growth within honeybees, the number of petals on a flower, and the formation of pine cones just to name a few.

Many believe the Fibonacci sequence to be the language of nature itself. If you want to see more on this topic, Fibonacci was prominently featured as part of the movie Pi; the fictional movie released in 1998 that follows a mathematician’s quest in predicting the future based on mathematics. But even outside of fictional movies, the numerous manners with which the sequence appears in the world around us is fascinating and definitely worthy of a google-search.

But that’s not the only exciting aspect of the Fibonacci sequence. More fascinating is what we can see if we look just a little bit below the surface. If you take the ratio of any two successive numbers, such as 144 and 233 and divide the second number (233) by the first (144), you’ll eventually move towards a very special number of 1.618 (61.8%). In this specific example, the exact value would be ‘1.6180555…’ The deeper we get in the sequence, the closer this ratio moves towards 1.618 until eventually the ratio stands at exactly 1.618. This number is the prize behind Fibonacci, and it has fascinated mathematicians and scientists for thousands of years.

The number of 1.618 is called ‘The Golden Ratio,’ and can be found in numerous applications within nature ranging from the spirals of a sea shell to leaf arrangements of a houseplant.

Trading with Fibonacci (and the Golden Ratio)

Traders will often employ Fibonacci when looking to trade retracements in a trend, centering support and resistance levels around intervals defined by the Golden Ratio of 1.618.

The center of Fibonacci analysis is at the .618 interval of the trend, taken directly from the golden ratio. But we can take this a step further by dividing a number in the sequence by the number located two figures to further. If we take 34 and divide that number by 89; or if we take 133 and divide that by 377, we consistently receive values of ~.382 (38.2%). This is the next value that traders will plot via Fibonacci analysis.

We can then do the same thing with by dividing any number in the sequence with the digit located two places further. So, for example, if we divide 34 by 144; or if we divide 55 by 233, we consistently receive values of ~.236 (23.6%). Traders have taken this a step further to examine the mid-line of the move (.50, or 50%), and .786 (78.6% - or the reciprocal of .236). The finished result is what we have below using the weekly GBPUSD chart:

As you can see in the above chart, these price levels on a chart can exhibit phenomenal examples of support and/or resistance coming in the market place. And luckily for us, using Fibonacci as a trader is significantly easier than proving any ‘magical’ components behind it as mathematicians have attempted to do for the past couple thousand years.

To use Fibonacci, a trader needs to merely identify a most recent ‘major move.’ This is where subjectivity comes in to play. This major move can be on the 5-minute chart, the hourly chart, or the weekly chart (as we had done with GBPUSD above). But like we saw with Pivot Points, longer-terms and more data generally brings more value to the analysis simply because more traders may be seeing it. If we draw a Fibonacci retracement on a 5-minute chart; it might be seen by a few other traders whereas a retracement taken from the weekly chart will likely generate more interest from traders simply because it encapsulates significantly more data.

Traders can use the Fibonacci tool available in most trading platforms to define the move, and then levels at the proper intervals of .236, .382, .500, .618, and .786 can be drawn in. So, when prices move down to the .236 line, we can say that 23.6% of that trend has been retraced. Or if prices move down the .618 level, 61.8% of the trend has been re-traced.

Hi!

Noob here!

How can I insert some aditional fibo levels into this indi?

Thanks!

Thanks in advance for the answer.

Good afternoon, I was looking for something similar, can you tell me how to add or remove fibo levels in dynamics and statics? Unfortunately, I have not found it in the settings, if it is not in the settings, can it be in the code at least manually add or remove fibo levels? Is there one for MT4?

Thanks in advance for the answer.

What static and what dynamic? The very essence of the question is not clear! There is a static fib built on the penultimate top of the Zigzag, it does not change, and there is a dynamic fib from the last top, which changes. The fib switches in the input parameters are there, look closely. And no one has made it for MT4.

What static and what dynamic? The very essence of the question is not clear! There is a static fib built on the penultimate vertex of the Zigzag, it does not change, and there is a dynamic fib, from the last vertex, which changes. The fib switches in the input parameters are there, look closely. And no one has made it for MT4.

I understand perfectly well what the static and dynamic fibs are in your turkey, at the moment I use Fibonacci Golden Zone for MT4 and MT5 similar to your turkey.

By chance I came across your adder, the most interesting thing is that in the adder which I use in MT4 and in your adder I lack levels in both static and dynamic fibo, that's why I asked you if it is possible to add, delete and change levels in statistical and dynamic fibo of your adder in your adder as it is freely available....., unfortunately I am not a programmer but a good user in the code I can dig if you tell me how to do it, or if it is not difficult for you can add a function in the SETTINGS to add, delete and change levels, thank you in advance.

I understand perfectly well what static and dynamic fibo are in your turkey, at the moment I am using Fibonacci Golden Zone for MT4 and MT5 similar to your turkey.

By chance I came across your adder, the most interesting thing is that in the adder which I use in MT4 and in your adder I lack levels in both static and dynamic fibo, that's why I asked you if it is possible to add, delete and change levels in statistical and dynamic fibo of your adder in your adder as it is freely available....., unfortunately I am not a programmer but a good user in the code I can dig if you tell me how to do it, or if it is not difficult for you can add a function in the SETTINGS to add, delete and change levels, thank you in advance.

Here are the indicators, in which the number of fib levels can be added, but it is necessary to do programming. https://www.mql5.com/en/code/24617 https://www.mql5.com/en/code/24616

Or in these indicators just twist the input parameters a little.

- www.mql5.com

Here are indicators in which the number of fib levels can be added, but it is necessary to do programming. https://www.mql5.com/en/code/24617 https://www.mql5.com/en/code/24616

Or in these indicators just twist the input parameters a little.

I am familiar with these fibo links that you gave, also in the code of these indices I know and know how to change levels, unfortunately there is no static fibo in them, your variant is more suitable for me.....

I am familiar with these fibo links you gave, also in the code of these indices I know and know how to change levels, unfortunately there is no static fibo in them, I am more suitable for your variant.....

There are two indicators, one of which is a static fibo, they are normally put two on one chart. The code is written in a very clear way for a logically thinking individual so that he can add as many levels as he needs! Here is a variant of adding the 0.85 level:

- www.mql5.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

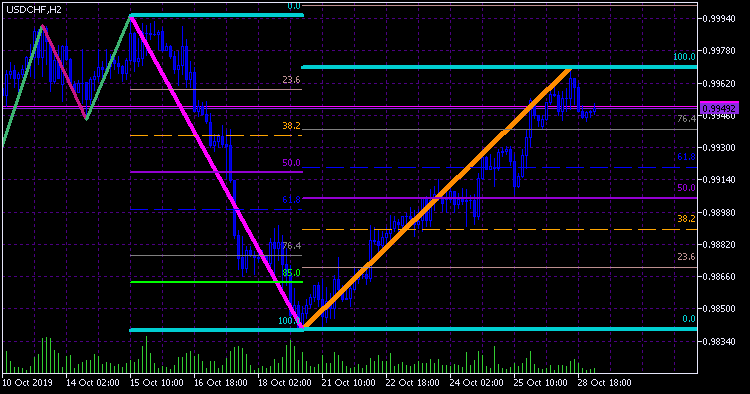

ZigZag + Fibo:

Author: Nikolay Kositsin