Pair trading and multicurrency arbitrage. The showdown. - page 106

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Which two couples are the ones that separate and ALWAYS come together?

Ask me what kind of couples with such gaps in the months :-)

Saw a slightly different formula:

This is a very simple formula for trading in a machine at Forex.

Risks on opening currency pairs should be single - therefore, out of 6 unknowns - 3 are long known.

Besides

It is enough to look at the multi-currency cluster indicator to understand that trading triangles is a futile topic.

Two sides of a triangle can expand or contract. And the reversal can occur at any time.

One triangle is the same as trading one currency pair, which catheti are the sides of the triangle.

Trade in this case should be octahedron, which has 28 triangles.

If there is a system of knowledge, then to implement such an algorithm based on the removed numbers from the cluster indicator - it is possible.

This is like in the hypothesis that Poincaré made about black holes in space.

Although he had such a system of knowledge that he was able to make the hypothesis, he could not prove it.

But Perelman made Poincaré's hypothesis a theorem, solved the problem and found the answer!

Widvinu perhaps thetheorem hypothesis , in order to trade pribilno 8 facets of 28 currency pairs

-it is enough tomake 16 formulas for input and 16 for output (this is for each currency pair separately - a total of 16x28 = 448 inputs and 448 outputs).

The initial data for it is 28*10=280 numbers, taken on one timeframe from the cluster indicator CCFp

.

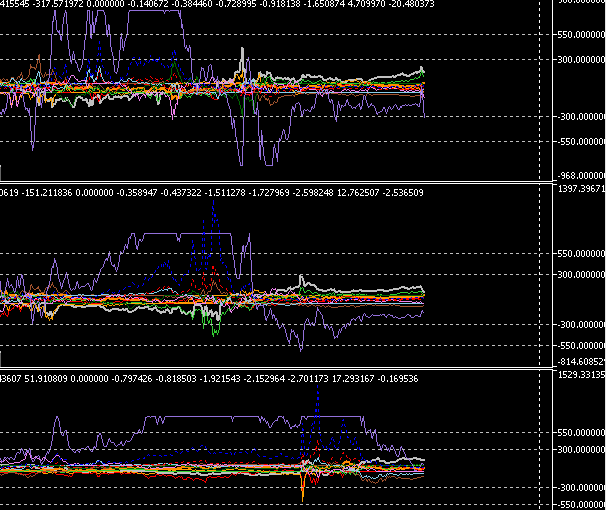

A little bit about working with window indicators (omitting the part about choosing window sizes)

at least you can work with pulses on separate ones through different-sized windows.

no MAs are used, only difference on window borders. (to read windows with mashes, it's a heck of a lot of work - windows through windows).

the beginning of today's XAUG journey

and its conclusion.

at the beginning of the pulse all three are in the same critical phase, at the end all three are in the opposite phase.

but all this is only during an increase in overall volatility and volume. When it's falling, it's very different.

Silver has taken this route on the dollar:

On silver, because all currencies are out and deep flat/sideways. It will be like this for the rest of the year, or until the shakeout.

at the beginning of the pulse all three are in the same critical phase, at the end all three are in the opposite phase.

It looks like encryption Eustace to Alex. ))))

What is the composition of this secret three?

And why are there a lot of participants on the graphs if three are enough?

In general, "to figure it out for three" is our way. )))

I made some other stuff - it turns out to be contagious. ))))

But it is also far from ideal, it does not always get to open accurately,

and with the exit in general trouble - I jump out of fear, although it should still hold and hold.

I will fully automate, because these experiments in manual mode take a lot of time and nerves.

It looks like encryption Eustace to Alex. ))))

What is the composition of this secret three?

And why are there a lot of participants on the charts if three are enough?

In general, "to think for three" is our way. )))

just a demonstration, one of the ways of using oscillators (window functions) - they are used in packs with increasing period and taking into account the current time.

On the chart, the participants are all currencies mentioned. The chart itself shows the relative lagging/overperformance of the leader of the rest of the group.

see above on the topic: we are looking for the event "all gathered in a narrow bundle, and the leader has strongly pulled out, between them there is a gap that will be filled" ;

for currencies the leader's breakaway more than 2 "thicknesses" of the central bundle is a serious limit, it will start to slow down and turn around. For metals 3

A bit about working with window indicators (omitting the part about choosing window sizes)

at least you can work with pulses on separate ones through different-sized windows.

no MAs are used, only difference on window borders. (to read windows with mashes, it's a heck of a lot of work - windows through windows).

the beginning of today's XAUG journey

and its completion

at the beginning of the pulse all three are in the same critical phase, at the end all three are in the opposite phase

but all this is only during an increase in overall volatility and volume. When falling everything is very different

Silver has made such a route on the dollar:

On silver, because all currencies are out and deep flat/sideways. It will be like this for the rest of the year, or until the shakeout.

The movement on the bottom screen is nothing but a buyers' undercutting, a lice test, so to say.

This upward movement is likely to continue.

I made some other stuff - it turns out to be contagious. ))))

But it is also far from ideal, it is not always possible to open accurately,

and with the exit in general trouble - I jump out of fear although it should still hold and hold.

I will fully automate, because these experiments in manual mode take a lot of time and nerves.

It's infectious, it's a fact.

and for a long time.

the movement on the bottom screen is nothing more than undercutting the buyers, a louse check, so to speak.

This upward movement is likely to continue

likely to continue- is that like 50/50 or more?

most likely tocontinue - is it as highly likely or less likely?

I accidentally wandered into the wrong thread.

but it came out of the local development dialogue:

these are the angles of Ghana, but obtained without the involvement of the Masons by analysing previously presented graphs.

The solid lines are the so-called 1:1 angle. Although it is better read as 0 - the rate of divergence. Consider that it is not a slope, but a kind of horizontal.

And it is not a point/minute, it is an integral or a series (since we have everything discrete), just it is close to convergence (but by the way it does not converge).