You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

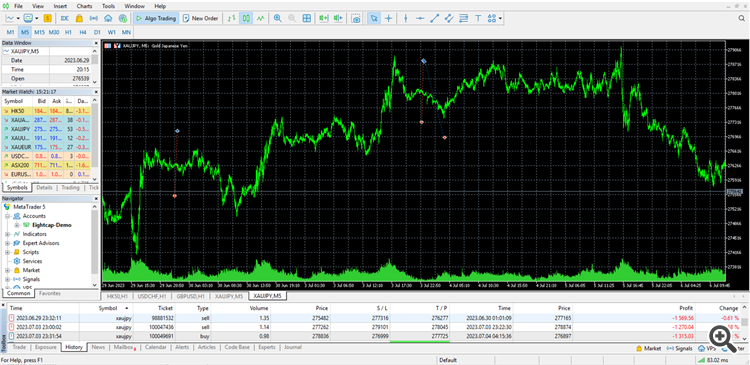

Hello can anybody with much experience can tell me what exactly happened here?

I use a Trade Copier Software and copied my trade from IC-Markets to Eightcap but the Trade was opened and closed in a range where there is no chart. Is this slippage or what exactly has been the problem? I made a profit on IC-Markets and a huge loss on Eightcap. Is Eightcap possibly not suitable for gold trading especially in rollover time?

just click on my 2 screenshots and fasten your seat belts 💺

Yeah liquidity/volume and filling policies can't be tested with the Strategy Tester. (and from my last tests the delays/latency settings are useless for serious testing on slippage, but I didn't check recently).

According to the Tick data, and the Excel sheet provided by the broker, the position was closed at a bid price of 273845.

So, the data is congruent. However, the Broker's response does not explain how the position was closed at 273022.

The broker's own response shows that the price data in the OHLC and tick data is correct and that the position's exit price is incorrect.

I would suggest arguing this out with the broker, stating that their own data (the Excel sheet) proves that there is an error.

Since nothing new has been posted by the other forum members our final decision now is that it was probably a mistake by the broker?

by the way: I was able to replicate the same case. It seems to only occur in XAU/JPY.

By the way, you trade copier should take into consideration the spread, as even without the discussed issue about the close (sell) filling price, the TP of your BUY position was below the opening price from the start.

Yes I know. My Copier has a setting for that. But back to topic.

-> 3 times the same error from broker side?

Yes I know. My Copier has a setting for that. But back to topic.

-> 3 times the same error from broker side?

Yeah, from my knowledge and experience, it's a broker issue as I already said : a sell, executed at Bid price, should always be within the bars on a Bid chart.

To be sure I asked a confirmation to MetaQuotes, but didn't get an answer yet.

Yeah, from my knowledge and experience, it's a broker issue as I already said : a sell, executed at Bid price, should always be within the bars on a Bid chart.

To be sure I asked a confirmation to MetaQuotes, but didn't get an answer yet.

->>> if you get a message from Metaquotes in a few days/weeks, feel free to let us know. If I hear anything new, I'll let you all know.

Yeah, from my knowledge and experience, it's a broker issue as I already said : a sell, executed at Bid price, should always be within the bars on a Bid chart.

To be sure I asked a confirmation to MetaQuotes, but didn't get an answer yet.

I´ve made a Screen Recording now to show live what happens. For me it looks really suspect the opening price was not even executed at the current ask price and the closing of the trade far below the bid candles. Normally the trade should be drawed in the bid candles but instead we are moving in the universe.

https://youtu.be/GeRvhIfwfko

I am now in touch with Eightcap and am curious what the solution and answer is

-->>> Community. Big News Today.

The problem has now been ✅ confirmed and fixed by Eightcap. It was a wrong setting on their broker server. It took a long time and required a lot of persistence from me to tell them that there is a serious issue.

Even the Eightcap technical support didn't understand it for a long time. The XAU/JPY pair got fixed now.

If someone else has a similar problem, it is probably due to an internal misconfiguration at Eightcap again.

❗️NEWS ❗️

-->>> Community. Big News Today.

The problem has now been ✅ confirmed and fixed by Eightcap. It was a wrong setting on their broker server. It took a long time and required a lot of persistence from me to tell them that there is a serious issue.

Even the Eightcap technical support didn't understand it for a long time. The XAU/JPY pair got fixed now.

If someone else has a similar problem, it is probably due to an internal misconfiguration at Eightcap again.