Do you want to know a "secret"?

Pro traders on the trading floor don't use ANY indicators at all — pure price action! The price/quotes says it all!

To add to Fernando's comment, most importantly of all, these pro traders and funds shape the market action and behaviour.

As Abraham Lincoln said " The best way to predict the future is to create it".

Sure, possible, im using combination of price action and indicators/quant techniques

Anyway - price action is a very wide range of techniques - from patterns, DOM II, ordermap/orderflow reading, trend lines based on hh/hl etc., pivots, fibo, patterns - compelx, one candle patterns etc.

so what to you think they use mostly - or what seems to be most important from price action for them?

Do you want to know a "secret"?

Pro traders on the trading floor don't use ANY indicators at all — pure price action! The price/quotes says it all!

As I wrote — "pure" price action — price only! Some, will not even look at the chart at all and only rely on the current prices.

As I wrote — "pure" price action — price only! Some, will not even look at the chart at all and only rely on the current prices.

yes but I dont mean investors, long term investors, I mean trading companies trading purchasing/selling every 1-3 days

How based on price they can know if price is okay for the moment and will grow or fall in next 3-10 days?

yes but I dont mean investors, long term investors, I mean trading companies trading purchasing/selling every 1-3 days

How based on price they can know if price is okay for the moment and will grow or fall in next 3-10 days?

You might find this interesting : (start at second 49 , the embed cannot do that automatically)

Hello

Which indicators and systems are used by pro traders in NY / Wallstreet and trading fund?

Surely they have profitable indicators and systems when they are trading big amounts of money, everyday, intraday.

I know this may be secret, but since trading companies, funds, big banks have big trading floors with hundreds people Im sure they cannot hide their methods forever.

So what are your thoughts and information big players can be using?

Thanks for sharing publicly or privately in message (privately I can share my information in message) too

I believe when you have money in surplus when you know that you dont need to make a living from trading but you have to be profitable with long term investment, then what you do is keep adding small percentage of your big funds everyday and it will make profit one day. Hedge funds are more focused for long term goals like 5 to 10 years so they definitely follow up averaging and hedging.

Additionally there are HFT traders who have designed algo which provides liquidity, they use fibonacci to do this.

When technology did not exist and people use to get info of price from newspaper or TV, when internet did not existed, then floor trader used to trade based on price formulas such as PIVOT point. Japanese candlestick was invented by a rice trader. WD Gann used astronomy and geometry. Even today in any of the chart trend channel works nicely. But now Do you think that without technical analysis and without looking chart is it possible to make money? Like if my friend says buy BTC its going to 100k so will I buy? Never.

In this century when technology is very advanced, it is must to have some kind of technical analysis responsible for every move. It is another fact that you and me dont know this.

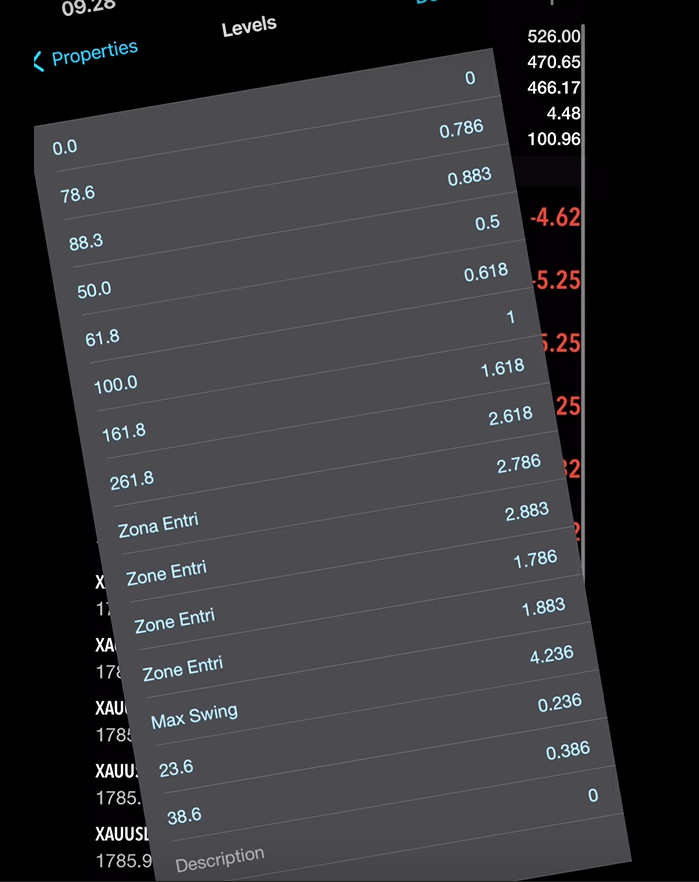

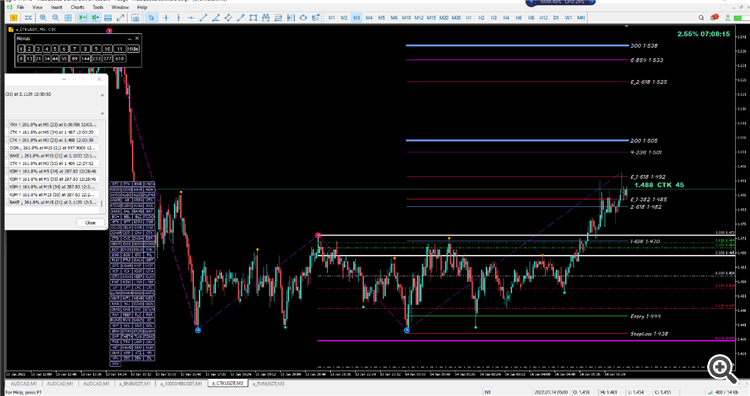

No indicator as they all lag, but some sort of fibonacci method is used. It can be called a system because it draws fibo like this

They made it intraday using fibonacci. Its a very broad topic, Retracement for entries, Extension for TP, Channel for dynamic trend analysis, Time for swing analysis, Fibo circle, Fibo wedge and it is also used in harmonics pattern calculation. Common fibo levels are 1.618 2.1618 and 4,236

Extended levels are

I know this may be secret, but since trading companies, funds, big banks have big trading floors with hundreds people Im sure they cannot hide their methods forever.

So what are your thoughts and information big players can be using?

Nothing is secret. All information is available on internet. but its matter of search, You have to spend months in research and years to actually find what works and what not. In today's era every loss making trader is also educating on Youtube while some genuine info is also being shared on forums and youtube but its all up to you if you are able to find and make it work for you. What symbol you trade also matters, If you trade CrudeOil you will have to understand the behaviour / psychology of the market participant in crudeoil, if you use a same strategy on CrudeOil and Gold, there is higher chances you may fail because you are not familiar of the psychology of group of traders who trade any particular instrument. You may also notice some EA sellers here also make a note in description that this EA trades EURUSD only. I told you the reason

No indicator as they all lag, but some sort of fibonacci method is used. It can be called a system because it draws fibo like this

They made it intraday using fibonacci. Its a very broad topic, Retracement for entries, Extension for TP, Channel for dynamic trend analysis, Time for swing analysis, Fibo circle, Fibo wedge and it is also used in harmonics pattern calculation. Common fibo levels are 1.618 2.1618 and 4,236

Extended levels are

Nothing is secret. All information is available on internet. but its matter of search, You have to spend months in research and years to actually find what works and what not. In today's era every loss making trader is also educating on Youtube while some genuine info is also being shared on forums and youtube but its all up to you if you are able to find and make it work for you. What symbol you trade also matters, If you trade CrudeOil you will have to understand the behaviour / psychology of the market participant in crudeoil, if you use a same strategy on CrudeOil and Gold, there is higher chances you may fail because you are not familiar of the psychology of group of traders who trade any particular instrument. You may also notice some EA sellers here also make a note in description that this EA trades EURUSD only. I told you the reason

Thanks for your opinion. But do you have any evidence that pro wallstreet traders and institutional traders / funds are using fibonacci really? Im asking because I hard at least 2 pro traders who worked for investment banks and they are laughing about fibonacci - thy say random numbers for retail, sometimes works, often not. Also legend Larry Williams wrote book where he showed evidences that Fibo is just random and it is more about brain imagination and some levels seems to work mostly because previous support/resistance levels not because fibo.

Sure in some markets like crypto or forex it may work because there is not so much fundamentals available. So do you have some exact evidence that pro wallstreet traders are using it?

Im speaking mostly about stocks, indices and futures - mostly traded by pros with biggest volumes. I tried here all kinds of fibo manual, automatic etc. doesnt seems to work often, what is system you showed in your picture please? (some automatic fibo based on zigzag levels or? and which asset?) Thanks

PS: Im not novice, in stock market for many years, read many books about technical analysis etc. Just want to share opinions.

Thanks for your opinion. But do you have any evidence that pro wallstreet traders and institutional traders / funds are using fibonacci really? Im asking because I hard at least 2 pro traders who worked for investment banks and they are laughing about fibonacci - thy say random numbers for retail, sometimes works, often not. Also legend Larry Williams wrote book where he showed evidences that Fibo is just random and it is more about brain imagination and some levels seems to work mostly because previous support/resistance levels not because fibo.

Sure in some markets like crypto or forex it may work because there is not so much fundamentals available. So do you have some exact evidence that pro wallstreet traders are using it?

Im speaking mostly about stocks, indices and futures - mostly traded by pros with biggest volumes. I tried here all kinds of fibo manual, automatic etc. doesnt seems to work often, what is system you showed in your picture please? (some automatic fibo based on zigzag levels or? and which asset?) Thanks

PS: Im not novice, in stock market for many years, read many books about technical analysis etc. Just want to share opinions.

well i laugh on those who say fibo is random, no body is going to tell you secret ofcourse, not even myself since its years of hard work.

but i can just give you example on recent TESLA 1min chart and you can see how nicely its rejecting from 1.618. Again its not going to work all time because no one is going to share why and when and at what condition it works and when it does not, its matter of research. Good luck

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Which indicators and systems are used by pro traders in NY / Wallstreet and trading fund?

Surely they have profitable indicators and systems when they are trading big amounts of money, everyday, intraday.

I know this may be secret, but since trading companies, funds, big banks have big trading floors with hundreds people Im sure they cannot hide their methods forever.

So what are your thoughts and information big players can be using?

Thanks for sharing publicly or privately in message (privately I can share my information in message) too