- How to cancel several orders at a certain profit

- How do we set up auto-renewal for payment of signals?

- Canceling pending orders by reaching certain price level

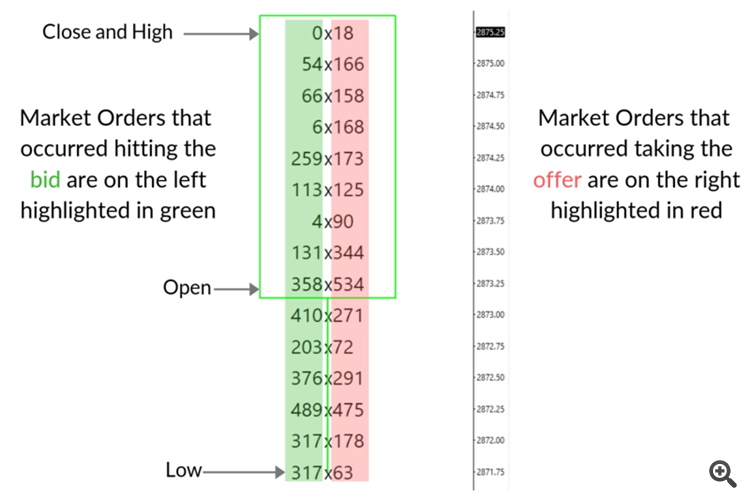

`There is no debate over what makes price move.

-Limit (resting) orders supply liquidity.

-Market orders consume liquidity.

Example:

-There is a sell limit order asking 10 with a volume of 5 lots.

-There is a sell limit order asking 11 with a volume of 3 lots.

-There is a sell limit order asking 12 with a volume of 4 lots.

So, the current ask is 10. A market buy order comes in wanting to buy 8 lots. The market order get filed with 5 lots at 10 and 3 lots at 11 (slippage). The ask now moved to 12.

The orderflow you are talking about is from some youtuber who miss-uses terms. There is no such thing as an outflow of orders. For a transaction to be made there has to be a buyer and a seller so buyers and sellers are always equal. Orderflow means literally just the flow of orders. This can be made representable in various ways like:

https://www.mql5.com/en/docs/marketinformation/marketbookadd

Subscribe, measure.

There is no way to know a cancelation other than notice reduction in volume.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use