You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Yeah I've noticed that once Katala clearly screws up...like setting orders to catch geps. North 29 asked him more than once... Katala freezes, pretends he didn't notice the question.) He does not answer questions when he realizes he is obviously very stupid.In general, I would not be surprised if this theme ends with the words - all wishing to buy a miracle TC Lavina write in person))). And not only Avalanche ... there's already started a PR for another miracle TC. It's starting to smell like marketing.

Yeah not.... I highly doubt it.....

Yeah I've noticed that once Katala clearly screws up...like setting orders to catch geps. North 29 asked him more than once... Katala freezes, pretends he didn't notice the question.) He does not answer questions when he realizes he is obviously very stupid.In general, I would not be surprised if this theme ends with the words - all wishing to buy a miracle TC Lavina write in person))). And not only Avalanche ... there's already started a PR for another miracle TC. It's beginning to smell like marketing.

Come on, it's a lost cause. What are you up to? You're the only one keeping this thread alive. Annoying, don't bother. There's an interesting thread at https://www.mql5.com/ru/forum/125370. Get involved, do some good and save yourself a lot of grief.

Come on, it's a lost cause. What are you up to? You're the only one keeping this branch alive. Annoying, don't bother. There's an interesting thread at https://www.mql5.com/ru/forum/125370. Get involved, help yourself and your nerves.

+100000000Биржа существует уже лет 100 думаешь хедж фонды или инвестиционные за 100 лет не поняли что такое мартин?

)))) Не переживай..никто лавочку не прикроет и денег твоих не заработает..успеешь по мартину наторговаца .

100 years? Quote from Wikipedia:

History of Forex

On August 15, 1971 the President of USA Richard Nixon announced his decision to cancel free convertibility of dollar into gold (rejected gold standard). In December 1971 in Washington the Smithsonian agreement was reached whereby instead of 1% fluctuation of currency rates against the United States dollar 4.5% (9% for non-dollar currency pairs) were allowed. This ruined the system of stable exchange rates and became the culmination of the crisis of the post-war Bretton Woods monetary system. It was replaced by the Jamaican monetary system whose principles were established in March 1971 on the island of Jamaica with the participation of 20 most developed states of non-communist bloc. The essence of the changes that took place was a more liberal policy with regard to the price of gold. Whereas previously exchange rates had been stable because of the gold standard, after such decisions, the floating gold exchange rate led to inevitable fluctuations in the exchange rates between currencies. This created a relatively new business, currency trading, where the exchange rate began to depend not only on the gold equivalent of the currency, but also on the market supply/demand for it. A number of problems quickly emerged for which in 1975 French President Valery Giscard d'Estaing and German Chancellor Helmut Schmidt (both former finance ministers) invited the heads of other leading Western nations to gather in a small informal circle for face-to-face discussions. The first summit ofthe G8(then only six members) was held in Rambouillet with the participation of the United States, Germany, Britain, France, Italy and Japan ( Canada joined the club in 1976, and Russia in 1998 ). One of the main topics of discussion was structural reform of the international monetary system.

On 8 January 1976, at a ministerial meeting of the IMF member countries in Kingston (Jamaica), a new agreement was adopted on the structure of the international monetary system, which took the form of amendments to the IMF statutes. The system replaced the Bretton Woods monetary system. Many countries effectively abandoned the pegging of national currencies to the dollar or to gold. It was not until 1978, however, that the IMF formally permitted this renunciation. From then on, free-floating exchange rates became the main way of exchanging currencies.

The new monetary system definitively abandoned the principle that the purchasing power of money was determined by the value of its gold equivalent(gold standard). The money of the signatory states was no longer officially denominated in gold. Exchange started to take place on a free-market system( foreign exchange market, forex) at free prices.

The development of the bot for the trap strategy continues.

Also Dmitry and I invite everyone to take part in it.

We will be glad for any help, so if you have any thoughts that will help improve something get in touch :)

The latest version 5.3 has been tested.

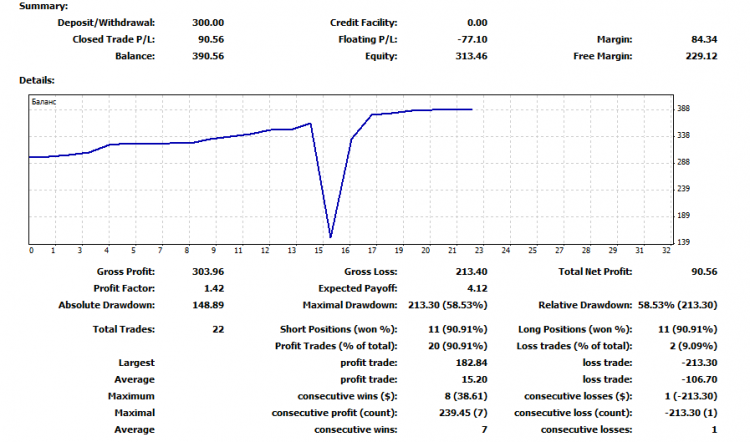

Here is the first report of the day.

This version is not the last so there is no point in giving the password from the demo.

I THINK IT IS WORTH TO CHECK IN PRACTICE, AND FINALLY FIND OUT WHETHER SUCH A STRATEGY HAS THE RIGHT TO LIFE, WHETHER YOU CAN EARN BY USING TRAP.

At least they may not have been called that, but they had a semblance of it.

Galina I don't know version 53 this is version 5 that Dimitri posted I think you will find this screenshot unnatural :)

Not optimized - default parameters as in Dmitry's archive

demo test over 3 days first trade at 9-20 19-04-10 screenshot taken at 17-50 21-04-10 ....

100 лет? Цитата из Википедии:

История Форекса

15 августа 1971 года президент США Ричард Никсон объявил решение об отмене свободной конвертируемости доллара в золото (отказался от золотого стандарта). В декабре 1971 года в Вашингтоне было достигнуто Смитсоновское соглашение, по которому вместо 1 % колебаний курса валют относительно доллара США стали допускаться колебания в 4,5 % (на 9 % для недолларовых валютных пар). Это разрушило систему стабильных валютных курсов и стало кульминационным моментом в кризисе послевоенной Бреттон-Вудской валютной системы. На смену пришла Ямайская валютная система, принципы которой были заложены в марте 1971 года на острове Ямайка при участии 20 наиболее развитых государств некоммунистического блока. Суть произошедших изменений сводилась к более либеральной политике в отношении цен на золото. Если ранее курсы валют были стабильны в силу действия золотого стандарта, то после таких решений плавающий курс золота привёл к неизбежным колебаниям курсов обмена между валютами. Это породило относительно новую сферу деятельности — валютную торговлю, когда курс обмена начал зависеть не только от золотого эквивалента валюты, но и от рыночного спроса/предложения на неё. Достаточно быстро наметился ряд проблем, для обсуждения которых в 1975 году президент Франции Валери Жискар д’Эстен и канцлер ФРГ Гельмут Шмидт (оба — бывшие министры финансов) предложили главам других ведущих государств Запада собраться в узком неофициальном кругу для общения с глазу на глаз. Первый саммит «Большой восьмёрки» (тогда ещё только из шести участников) прошёл в Рамбуйе с участием США, ФРГ, Великобритании, Франции, Италии и Японии (в 1976 году к работе клуба присоединилась Канада, а в 1998 году — Россия). Одной из основных тем обсуждения была структурная реформа международной валютной системы.

8 января 1976 года на заседании министров стран-членов МВФ в г. Кингстон (Ямайка) было принято новое соглашение об устройстве международной валютной системы, которое имело вид поправок к уставу МВФ. Система заменила Бреттон-Вудскую валютную систему. Многие страны фактически отказались от привязки национальных валют к доллару или к золоту. Однако лишь в 1978 году МВФ официально разрешил такой отказ. Начиная с этого момента свободно плавающие курсы стали основным способом обмена валют.

В новой валютной системе окончательно произошёл отказ от принципа определения покупательной способности денег на основании стоимости их золотого эквивалента (Золотой стандарт). Деньги стран, участников соглашения, перестали иметь официальное золотое содержание. Обмен начал происходить на свободном валютном рынке (англ. foreign exchange market, forex) по свободным ценам.

Clown, you even made a puncture in the woodwork here, or just google when the first stock exchange was founded))Magdeburg Stock Exchange - founded 1824 -- https://ru.wikipedia.org/wiki/%D0%9C%D0%B0%D0%B3%D0%B4%D0%B5%D0%B1%D1%83%D1%80%D0%B3%D1%81%D0%BA%D0%B0%D1%8F_%D1%84%D0%BE%D0%BD%D0%B4%D0%BE%D0%B2%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0

London Metal Exchange 1876 --- https://ru.wikipedia.org/wiki/%D0%9B%D0%BE%D0%BD%D0%B4%D0%BE%D0%BD%D1%81%D0%BA%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0_%D0%BC%D0%B5%D1%82%D0%B0%D0%BB%D0%BB%D0%BE%D0%B2

Tokyo Stock Exchange 1878. https://ru.wikipedia.org/wiki/%D0%A2%D0%BE%D0%BA%D0%B8%D0%B9%D1%81%D0%BA%D0%B0%D1%8F_%D1%84%D0%BE%D0%BD%D0%B4%D0%BE%D0%B2%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0

New York Stock Exchange - May 17, 1792 https://ru.wikipedia.org/wiki/%D0%9D%D1%8C%D1%8E-%D0%99%D0%BE%D1%80%D0%BA%D1%81%D0%BA%D0%B0%D1%8F_%D1%84%D0%BE%D0%BD%D0%B4%D0%BE%D0%B2%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0

Бостончкая фондовая биржа 13 октября 1834 года https://ru.wikipedia.org/wiki/%D0%91%D0%BE%D1%81%D1%82%D0%BE%D0%BD%D1%81%D0%BA%D0%B0%D1%8F_%D1%84%D0%BE%D0%BD%D0%B4%D0%BE%D0%B2%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0

Бомбейская фондовая биржа 1875 год https://ru.wikipedia.org/wiki/%D0%91%D0%BE%D0%BC%D0%B1%D0%B5%D0%B9%D1%81%D0%BA%D0%B0%D1%8F_%D1%84%D0%BE%D0%BD%D0%B4%D0%BE%D0%B2%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0

Chicago Stock Exchange 21 March 1882 https://ru.wikipedia.org/wiki/%D0%A7%D0%B8%D0%BA%D0%B0%D0%B3%D1%81%D0%BA%D0%B0%D1%8F_%D1%84%D0%BE%D0%BD%D0%B4%D0%BE%D0%B2%D0%B0%D1%8F_%D0%B1%D0%B8%D1%80%D0%B6%D0%B0

Do you need me to teach you how to Google, dumbass? Or are you just trying to kick it up a notch? You better figure out how the margin will grow on MT4 with the lock...

I'm talking about the stock market, you're so stupid you should know that forex is an over-the-counter market. -- You can read it in the same place where you cited a link about the history of FOREX. Under "Daily turnover" in black and white it says "No exact data, as it is an OTC market.

Read it carefully.