Machine learning in trading: theory, models, practice and algo-trading - page 2071

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

This is not the worst possible option :)))

I would turn it off after a month. It would be boring)

I'm training myself not to touch the TC - very difficult.

Not an answer, just a topic about patterns.

I made Morse-like ZigZag patterns (long - short, etc. I got 54 patterns).

Sometimes you can see how the same letter combinations alternate in a row.

And this is a histogram of the event frequencies of the long and short arm of the ZigZag (long with a + sign, short with a - sign). By the way, pattern X has long been the maximum among the 'long', and among the 'short' most often L and P.

Ok, if everything works for you.

I've been looking for a connection between the pattern and making a decision after detecting it - I've found that further decision to buy or sell is still 50/50,

I tried with short stops, in principle I got more in the plus than in the stop loss trades, but the amount of trades is very, very small, if I remember correctly - about 10 a year - I think the results are not statistically good, when 3-4 out of 10 trades are lossy, the rest are profit

ZZY: I tried to search for patterns (combinations, as you said Morse code) by Renko, even worse than by ZigZag, probably because Renko adds a lag to the already delayed decision making after finding a pattern

Igor Makanu:

that the further decision to buy or sell is still 50/50,

I wasn't looking for buy or sell, but for the condition that the current knee is bigger than the previous one.

I was not looking for buy or sell, but the condition - the current knee is larger than the previous one.

I test everything with the MT strategy tester - you get the result right away (or rather not)

So who will teach this strategy, he can earn, I think so :) I can pour a sample - to try my forces, if you can teach and share the secret - I will share the strategy in the code!

Basically on 1 indicator.Show me this information

I've tried to use the history from Saber's article where I know the minimum expected payoff and time with currency - the result is zero. So far the classical systems are winning over the MOSo who will teach this strategy, he can earn, I think so :) I can fill a sample - to try their forces, if you can teach and share the secret - will share the strategy in the code!

Basically on one indicator.Not an answer, just a topic about patterns.

I made Morse-type ZigZag patterns (long - short, etc. I got 54 patterns).

Sometimes you can see how the same letter combinations alternate in a row.

And this is a histogram of the event frequencies of the long and short arm of the ZigZag (long with a + sign, short with a - sign). By the way, pattern X has long been the maximum among the 'long', and among the 'short' most often L and P.

Nice work, you did a great job.

I think it is better not to look for a pattern after a pattern, but to look for a rebound price related to this pattern, it is much harder to formalize, but it seems to me to work better...

It is like teaching the algorithm to place orders at some prices, depending on the current pattern

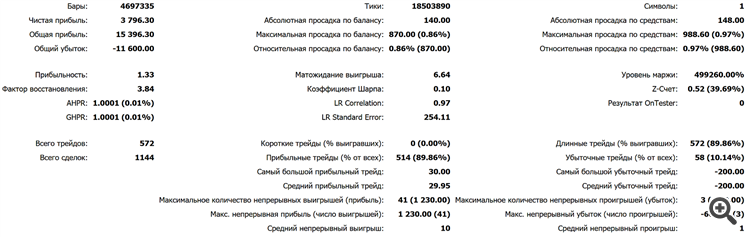

Show this information

I tried to train by the story from Saber's article, where both minimum expectation and time with currency are known - the result is zero. So far the classical systems are winning the MONot an answer, just a topic about patterns.

I made Morse-like ZigZag patterns (long - short, etc. I got 54 patterns).

Sometimes you can see how the same letter combinations alternate in a row.

And this is a histogram of the event frequencies of the long and short arm of the ZigZag (long with a + sign, short with a - sign). By the way, pattern X has long been the maximum among the 'long', and among the 'short' most often L and P.

How do you determine long and short shoulder?