Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.20 11:42

Forex Weekly Outlook July 21-25Glenn Stevens’ speech, US housing data, inflation and industrial data, NZ rate decision, British GDP data are the main events on FX calendar this week. Here is an outlook on the main market-movers ahead.

Last week the Philly Fed Index jumped to 23.9 points in July marking the highest reading since March 2011. Current activity rose to 23.9 from 17.8 in June, orders index jumped to 34.2 from 16.8. Economists expected the index to fall to 15.6. This release suggests manufacturing has accelerated across the board in the Philadelphia region heading towards a successful second half –year. More positive news came from the US employment market with a lower than expected release of 302,000 clams, down 3,000 from the prior week, beating expectations for a rise to 310,000. Will the US economy continue its upturn trend?

- Glenn Stevens speaks: Tuesday, 3:00. Governor Glenn Stevens, head of the Reserve Bank of Australia will speak in Sydney. He may talk about the increasing value of the Australian dollar. In a former speech Stevens noted that the zero interest rate policies of major central banks are partly to blame for the inflation of the Australian dollar, and also warned market participants that this was no reason to remain complacent on the value of the currency. He continued to say that the RBA still has room to cut interest rates when required.

- US inflation data: Tuesday, 12:30. U.S consumer prices edged up 0.4% in May, amid sharp rise in food prices. Economists expected a smaller increase of 0.2 %, getting close to the Fed’s target of 2.0%. Meanwhile, core prices also climbed more than expected, rising 0.3% from a 2.0% gain posted in April. In a yearly base, the core CPI increased 2.0 %, up from 1.8 % in April and the biggest gain since February of last year. The increase in prices, suggest the Fed may raise interest rates sooner than expected. U.S consumer prices are expected to gain 0.3% while core prices are predicted to increase by 0.2%.

- US Existing Home Sales: Tuesday, 14:00. The number of pre-owned home sales edged up in May to a nearly three year high, reaching an annualized rate of 4.89 million from 4.66 million posted in the previous month. Analysts expected a lower rise to 4.74 million units. The housing recovery continues amid higher income and lower housing prices, which increase affordability. A further rise to 4.98 million is expected this time.

- NZ rate decision: Wednesday, 21:00. New Zealand’s central bank announced a rate hike of 25 basis points in its June meeting, reaching 3.25%. This was the highest level since January 2009 and the third consecutive rise. The central bank said rates need to be higher as long as economic growth fuels inflation. Annual inflation slowed mildly to 1.5 % in the first quarter, while the RBNZ wants rates to be around 2 %, the mid-point of its 1-3 % target band. New Zealand’s central bank is expected to raise rates again to 3.50%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined 3,000 last week reaching 302,000, indicating the US labor market recovery is picking up. Analysts expected claims to reach 310,000 last week. The four-weak average fell 3,000 to 309,000, the lowest level since June 2007. Yellen warned that the Fed may kike rates sooner than planned in case the labor market continues to strengthen. The numer of claims is expected to rise to 310,000.

- US New Home Sales: Thursday, 14:00. Sales of new U.S. single-family homes climbed to a six-year high in May, reaching a seasonally adjusted annual rate of 504,000 units, 18.6% more than in the previous month, beating predictions for 442,000 units. The high mortgage rates seen in the second half of 2013 are beginning to settle increasing affordability. The median price of a new home increased 6.9% from May since inventory remained unchanged, but prices are beginning to settle and should help to stimulate demand for houses. Sales of new homes is predicted to reach 485,000.

- Eurozone German Ifo Business Climate: Friday, 8:00. German business climate index declined to 109.7 in June from 110.4 in May, posting its second consecutive monthly fall. Economists expected a minor drop to 110.3. German manufacturers fear the potential consequences of the crises in Ukraine and Iraq. More than 6,000 German companies are related to Russia and business and trade bodies have warned that further escalation in tensions over Ukraine may result in catastrophic losses for firms. Business sentiment is expected to edge down to109.6.

- UK Prelim GDP: Friday, 8:30. In Q1 2014 the UK economy expanded by 0.8% in the first quarter and by 3.1% when compared with 2013 Q1. This was the fifth consecutive rise, the longest growth period since the economic downturn reaching 0.6% below its pre-downturn peak in Q1 2008. The main contributor to growth was the services industry, which grew by 0.9% on the quarter. The labor market also performs well. UK economy is predicted to expand 0.8% in the second quarter.

- US Core Durable Goods Orders: Friday, 12:30. Orders for U.S. durable goods fell 1 % in May amid a sharp decline in demand for military equipment. The reading was worse than the 0.1% drop predicted by analysts and lower than the previous release of 0.6%. However, excluding defense-related goods, orders actually rose, and orders in a key category that signals business investment also increased. Meanwhile core orders excluding transportation, declined by 0.1%, while expected to rise 0.3%. Durable goods orders are expected to rise 0.4%, while core orders are predicted to gain 0.6%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.20 11:47

EUR/USD forecast for the week of July 21, 2014, Technical AnalysisThe EUR/USD pair fell during the course of the week after initially trying to rally. However, we remain above the 1.35 handle, and therefore we feel that the market is still simply going to consolidate in this relatively tight range. Because of that, we don’t necessarily like the idea of being involved in this market from a longer-term perspective, and with this, we are positive, but only for the very short-term. If we break down below the 1.35 level however, this market could go down to the 1.33 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.22 10:44

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

- U.S. Consumer Price Index to Hold at 2.1% for Second Month.

- Core Inflation to Retain Fastest Pace of Growth Since October 2012.

The U.S. Consumer Price Index (CPI) may spur a bullish reaction in the

U.S. dollar (bearish EUR/USD) should the report undermine the Fed’s

dovish outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

Sticky price growth in the world’s largest economy may heighten the appeal of the greenback as it puts increased pressure on the Federal Reserve to move away from its easing cycle, and the next policy meeting on July 30 may generate an improved outlook for the reserve currency should a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather than later.

Higher input costs along with the pickup in wage growth may generate another stronger-than-expected inflation print, and an unexpected uptick in the CPI may fuel a near-term rally in the USD as it boosts interest rate expectations.

However, the persist slack in the real economy paired with the slowdown

in private sector consumption may drag on price growth, and a weak

inflation print may heighten the bearish sentiment surrounding the

greenback as it gives the Fed greater scope to retain its highly

accommodative policy stance for an extended period of time.

How To Trade This Event Risk

Bullish USD Trade: Headline Reading for Inflation Climbs 2.1% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

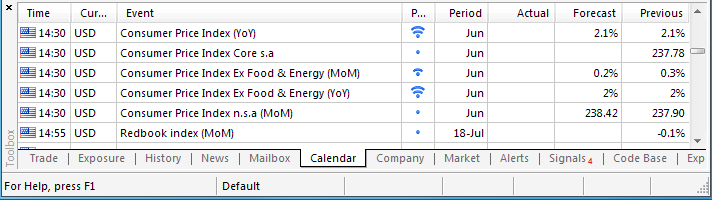

EUR/USD Daily

- Remains at Risk for a Lower-Low as Downward Trending Channel Takes Shape

- Interim Resistance: 1.3650 (78.6% expansion) to 1.3670 (61.8% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| MAY 2014 |

06/17/2014 12:30 GMT | 2.0% | 2.1% | -23 | -23 |

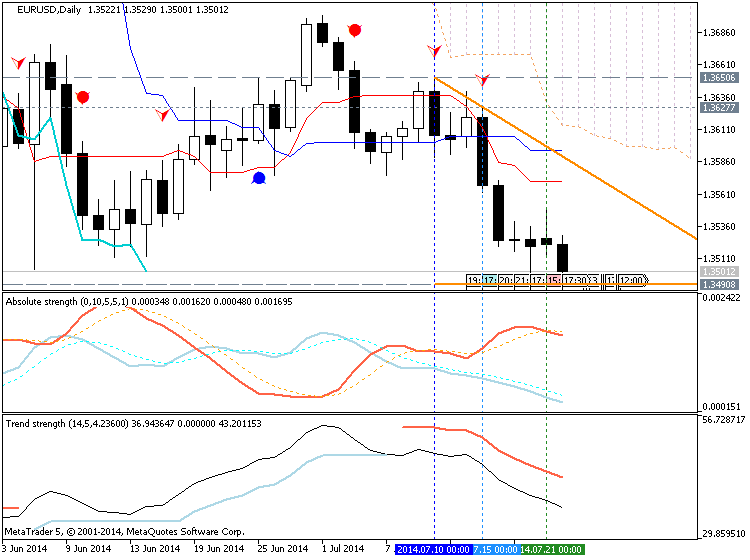

May 2014 U.S. Consumer Price Index (CPI)

EURUSD M5 : 33 pips price movement by USD - CPI news event

The headline reading for U.S. inflation unexpectedly climbed to an

annualized 2.1% in May to mark the fastest pace of growth since October

2011, while the core Consumer Price Index (CPI) advance to 2.0% amid

forecasts for 1.9% print. The stronger-than-expected print sparked a

bullish reaction in the reserve currency, with the EUR/USD slipping

below the 1.3550 region, and the greenback retained the gains throughout

the North American session as the pair ended the day at 1.3545.

EURUSD M5 : 37 pips range price movement by USD - CPI news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.20 18:53

EUR/USD weekly outlook: July 21 - 25The broadly weaker euro fell to its lowest level in five months against the safe haven dollar and Japanese yen on Friday before recovering some of these losses late in the session.

EUR/USD touched lows of 1.3491, the weakest since February 6 before pulling back to 1.3525 late Friday. For the week, the pair was down 0.56%.

The drop in the euro came amid increased demand for safe haven assets following the shooting down of a Malaysia Airlines jet in eastern Ukraine on Thursday.

Moscow has denied involvement in the crash, which came a day after the U.S. announced a fresh round of sanctions against Russia for supporting separatists in east Ukraine.

Markets were also unsettled as Israel expanded its ground offensive in Gaza.

The euro came under additional pressure after the Bank of Italy cut its growth forecast for this year to 0.2% from 0.7% on Friday and warned that risks to the economy remained to the downside. The announcement underlined concerns over the faltering economic recovery in the currency bloc.

Earlier in the week European Central Bank President Mario Draghi said that large scale asset purchases are “squarely” within the bank’s mandate. The remarks were the latest indication that the central bank is open to further monetary easing measures to stave off the risk of deflation in the euro area.

Demand for the dollar continued to be underpinned after Federal Reserve Chair Janet Yellen indicated earlier in the week that interest rates may rise sooner if the economy continues to improve.

Elsewhere, EUR/JPY hit lows of 136.72, the lowest since February 5 and was last at 137.07. The pair lost 0.59% for the week.

In the week ahead, the U.S. is to release what will be closely watched data on consumer prices, home sales and manufacturing orders. Investors will also be awaiting surveys on private sector activity in the euro zone.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Wednesday as there are no relevant events on this day.

Monday, July 21

- In the euro zone, Germany’s Bundesbank is to publish its monthly report.

- The U.S. is to release reports on consumer price inflation and existing home sales.

- The euro zone is to publish preliminary data on manufacturing and service sector activity, while Germany and France are to publish individual reports on private sector growth.

- Meanwhile, Spain is to release its latest employment report.

- The U.S. is to produce data on unemployment claims, manufacturing activity and new home sales.

- In the euro zone, Germany is to publish the Gfk report on consumer climate and the Ifo report on business climate.

- The U.S. is to round up the week with data on durable goods orders.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.23 16:43

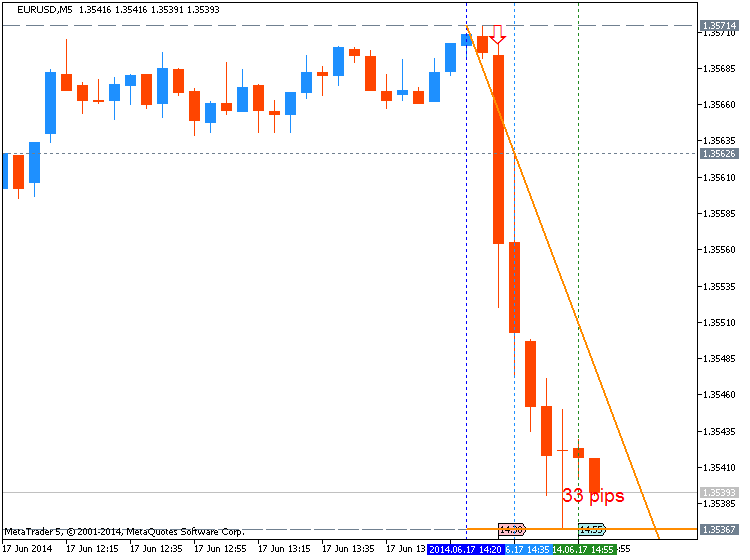

2014-07-23 14:00 GMT (or 16:00 MQ MT5 time) | [EUR - Consumer Confidence]

- past data is -7

- forecast data is -7

- actual data is -8 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - Consumer Confidence] = Level of a diffusion index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========

Eurozone Consumer Confidence Unexpectedly Falls In July

Euro area consumer confidence deteriorated for a second straight month in July, preliminary data from the European Commission showed Wednesday.

The flash consumer confidence index for Eurozone fell to -8.4 from -7.5 in June. Economists had forecast the score remain unchanged.

The confidence index for the EU declined by 1.2 points to -5.5.

The final figures will be released along with the economic sentiment data on July 30.

EURUSD M5 : 8 pips range price movement by EUR - Consumer Confidence news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.24 15:20

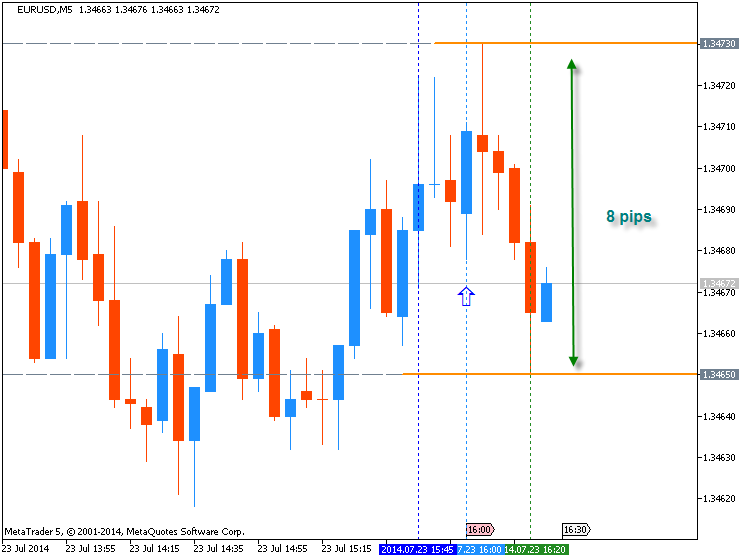

2014-07-24 12:30 GMT (or 14:30 MQ MT5 time) | [EUR - Unemployment Claims]

- past data is 303K

- forecast data is 308K

- actual data is 284K according to the latest press release

if actual < forecast = good for currency (for USD in our case)

[EUR - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy.

Also Called = Jobless Claims, Initial Claims.

==========

U.S. Weekly Jobless Claims Show Unexpected DecreaseThe European Union is stronger today because of U.K 's contribution to it, European Central Bank's Jens Weidmann said in his speech at the annual dinner of the German-British Chamber of Industry & Commerce.

"The European economy is more open and dynamic as a result of Britain's commitment to open and flexible markets - a position very much in tune with the Bundesbank's" he said.

The European Union, or EU, membership has also benefited Britain, he added.

"Half of its trade is with the European Union, and studies suggest that EU membership has boosted Britain's trade in goods with other EU countries by more than 50 %"

Stressing on the need for a single market, he said, "A lot of the potential inherent in our most important European catalyst for growth, the single market, is still untapped."

"Britain, in particular, with its advanced services sector stands to gain from dismantling the existing barriers to cross-border trade in services.", he said.

Also, the digital markets should be integrated into a single market, he added.

Talking about the vulnerabilities that will arise due to the integration , "a combination of this kind gives rise to a deficit bias, as it allows the costs of fiscal imprudence to be shifted partially on to others. An unsustainable fiscal situation in one country has repercussions for monetary union as a whole. You can compare this to what economists call the "tragedy of the commons".", he said.

"Just as overfishing creates negative externalities for other countries, excessive public debt harms the euro area as a whole. Excessive debt in one member state drives up longer-term interest rates for all euro-area countries."

"And second, each member state issues debt in a currency it cannot create. Hence, a high level of fiscal discipline is needed to ensure that solvency concerns do not spiral out of control." he added.

"establishing a sustainable fiscal framework and consolidating public budgets are only two of the numerous challenges facing the euro area in becoming more stable." he noted.

"Equally important is to correct macroeconomic imbalances - through the restoration of competitiveness in those countries that have fallen behind and through a further reduction of indebtedness in the private sector there."

Further work has to done with respect to financial regulation, not just in the euro area, but globally, Weidmann said.

"Some key objectives in this respect are: spelling out international standards on the loss-absorbing capacity of systemically important banks, achieving cross-border acceptance of a bank resolution, peer reviewing measures regulating the shadow banking sector and establishing saver derivative markets."

Stressing on the importance of Britian being a member of the euro area, he concluded, "If Britain continues to make its voice heard in Europe, I am confident that the Union will become more outward-looking, open and prosperous for that."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 8 pips price movement by USD - Unemployment Claims news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.25 06:50

EUR/USD Technical Analysis (based on dailyfx article)

- EUR/USD Technical Strategy: Short at 1.3644

- Support: 1.3454, 1.3396, 1.3324

- Resistance:1.3502-12, 1.3583, 1.3637

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.25 10:46

2014-07-25 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

- past data is 109.7

- forecast data is 109.4

- actual data is 108.0 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - GfK German Consumer Climate] = This survey is highly respected due to its large sample size and historic correlation with German and wider Eurozone economic conditions. It tends to create a hefty market impact upon release. Source changed series from a base year of 2000 to a base year of 2005 as of May 2011. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

==========

German Ifo Business Confidence Declines More Than Expected In July

Germany's business confidence declined for a third successive month in July and at a faster-than-expected pace, reports said Friday, citing the survey results from the Ifo Institute.

The Ifo Business Climate Index fell to 108, which was worse than the 109.4 score forecast by economists. In June, the index had eased to a six-month low of 109.7.

The current conditions index dropped to 112.9, also much below economists' expectations for a print of 114.5. In June, the reading was 114.8.

The expectations measure declined to 104.5, which was slightly above the consensus estimate of 104.4. In June, the score was 104.8.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 21 pips price movement by EUR - German Ifo Business Climate news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish market condition trying to break 1.3516 support level for the bearish to be continuing.

H4 price is ranging between 1.3535 resistance and 1.3490 support levels since the middle of the last week.

If D1 price will break 1.3516 support level so the primary bearish will be continuing.If not so we may see ranging market condition to be continuing.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-07-21 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

2014-07-21 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German Buba Monthly Report]

2014-07-22 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-07-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-07-24 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-07-24 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - Spanish Unemployment Rate]

2014-07-24 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-07-24 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2014-07-24 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-07-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-07-25 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]

2014-07-25 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-07-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : ranging

Intraday Chart