Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.02 10:26

Forex Weekly Outlook August 4-8The US dollar was the star during most of the week, although it lost some of its shine towards the end. Rate decisions in Australia, the UK, Japan and the Eurozone, Employment data, in Australia, Canada and US trade data are some of the highlight events on Forex calendar. Here is an outlook on the main market movers for this week.

The US dollar was on a roll in the past week: the excellent GDP report that showed 4% Q2 growth (annualized) and speculation about an upcoming rate hike (despite a not-too hawkish Fed) boosted the greenback. The below expectations Non-Farm Payrolls report took out some of the shine of the greenback, but the US economy continues doing well. In the euro-zone, inflation fell deeper, to 0.4%, and cast a dark cloud on not-too-shabby employment and consumption data. The pound continued falling on more weak data in what looks like a u-turn rather than a correction. Weak data in Japan helped USD/JPY move higher and weak Australian data finally sent the Aussie below 0.93. The kiwi and the loonie were not spared, but also managed to stage a recovery in an exciting week.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia maintained rates at 2.5% on its last meeting in July, despite rumors of a possible rate cut. RBA Governor Glenn Stevens declared the currency was “overvalued” but kept monetary policy unchanged. Stevens noted the growth signs and the pickup in demand saying accommodative policy would continue to boost economic activity. It is unlikely that the RBA would step in again with further stimulus measures. No change in rates is expected this time.

- US ISM Non-Manufacturing PMI: Tuesday, 14:00. Service sector activity expanded slower than expected in June, reaching 56 after posting 56.3 in May, amid bleak economic outlook. Economists expected a smaller drop to 56.2. New Orders Index increased by 0.7 points to 61.2. Employment Index increased 2.0 points to 54.4. Overall, the non-Manufacturing sector reported growth in June. A rise to 56.6 is expected now.

- New Zealand employment data: Tuesday, 22:45. Unemployment in New Zealand remained unchanged at 6% in the first quarter, with an increase in labor force and the highest participation rate in New Zealand’s history. Economists expected the unemployment rate to fall to 5.8%. However, the participation rate edged up 0.4% to 69.3%, reaching a record high for New Zealand. Wages increased an annualized 1.6% (including overtime) in the March quarter, unchanged from the previous quarter. New Zealand job market is expected to rise by 0.7%, while the unemployment rate is predicted to tick down to 5.8%.

- US Trade Balance: Wednesday, 12:30. The U.S. trade deficit narrowed to $44.4 billion in May as U.S. exports expanded to an all-time high of $195.5 billion, while, imports declined slightly. The trade deficit narrowed 5.6% in May after hitting a two-year high of $47 billion in the prior month. The low trade deficit ensures better growth rate. The U.S. trade deficit is expected to shrink further to 44.2B this time.

- Australian employment data: Thursday, 1:30. Australia’s jobless rate increased to 6.0% in June following 5.9 registered in the previous month. However the labor force increased by 15,900, beating forecast for a 13,200 job addition. The number of full-time jobs declined by 3,800, and part-time employment edged up by 19,700. Australia’s participation rate climbed to 64.7% in June from 64.6% in May. Australia is expected to add 13,500 jobs, while the unemployment rate is expected to remain at 6%.

- UK rate decision: Thursday, 11:00. The Bank of England maintained its benchmark interest rates at a record low of 0.5% in July. However economic activity has greatly improved, bouncing back from a long period of stagnation, raising calls for a rate hike at the end of this year or in early 2015. BoE’s Quarterly Inflation Report will be released this month and may act as a catalyst for the more hawkish members of the committee to contemplate voting for a tightening. The BOE is not expected to change its monetary policy this time.

- Eurozone rate decision: Thursday, 11:45. The ECB kept rates on hold in July’s meeting after cutting them to boost economic growth. Mr. Draghi said interest rates will remain put for an “extended period of time in view of the current outlook for inflation“. Inflation remained at the “danger zone” below 1% in June, reaching 0.5%. However Markit’s survey shows a pickup in new orders suggesting economic activity will grow in the second half of the year. No change in rates is forecasted.

- US Unemployment Claims: Thursday, 12:20. The number of people seeking U.S. unemployment benefits edged up by 23,000 last week reaching 302,000. The reading was broadly in line with market forecast while remaining at pre-recession levels. The four-week average, a less volatile measure, fell 3,500 to 297,250, posing the lowest average since April 2006. Fewer layoffs and strong confidence in the US economic outlook strengthens the US labor market. The number of jobless claims is expected to rise to 305,000.

- Japan rate decision: Friday. The Bank of Japan decided to continue increasing monetary base at an annual pace of ¥60 trillion to ¥70 trillion and lowered its growth forecast for the fiscal year of 2014 to 1%. The pace of recovery was in line with forecasts, despite a decline in domestic demand following the consumption tax hike. The BOE forecasts economic growth will increase in the coming months. Rates are expected to remain unchanged.

- Canadian employment data: Friday, 12:30. Canadian workforce narrowed by 9,400 jobs in June after a 25,800 addition registered in the previous month. The unemployment rate increased to 7.1% following 7.0% in May. On a yearly base, Canada’s labor market increased 0.4%, the lowest growth rate since February 2010. Canada added 33,500 full-time jobs, while part-time jobs and positions held by youths aged 15-24 dropped 43,000. Youth unemployment remains a major problem. Canadian workforce is expected a job gain of 25,400, while the unemployment rate is expected to reach 7%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.03 16:31

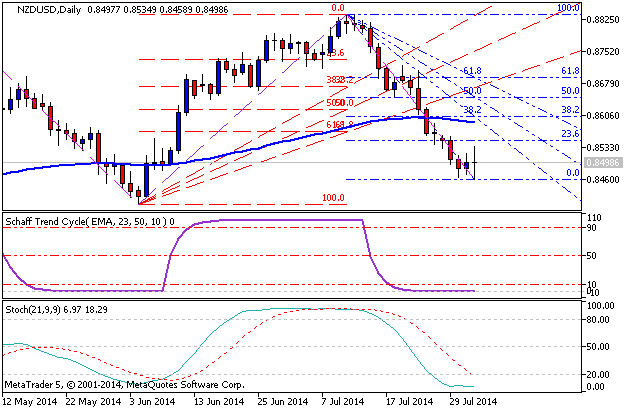

NZD/USD Technical Analysis for the week of August 4, 2014The NZD/USD pair fell during the course of the week, dropping down to

the 0.8450 region, and then closing at the 0.85 handle. Because of that,

it appears that the market is ready to bounce, and on a break of the

top of the hammer we believe that this market returns to the 0.88 level.

With that, we feel that this market can be bought, but that being the

case we feel that a move below the 0.84 level would in fact be very

bearish. Either one of those two moves gets us involved in this market.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.03 21:00

NZD/USD weekly outlook: August 4 - 8The New Zealand dollar rebounded from a two-month low against its U.S. counterpart on Friday, as weaker than expected U.S. employment data forced investors to recalibrate their assumptions about the future course of the Federal Reserve's monetary policy.

NZD/USD hit 0.8462 on Friday, the pair’s lowest since June 5, before subsequently consolidating at 0.8514 by close of trade on Friday, up 0.16% for the day but 0.47% lower for the week.

The pair is likely to find support at 0.8462, the low from August 1 and resistance at 0.8556, the high from July 29.

The Labor Department reported that that U.S. economy added 209,000 jobs in July, below forecasts for jobs growth of 233,000. The previous month’s figure was revised up to a gain of 298,000 from a previously reported increase of 288,000.

Although it was the sixth successive month that the U.S. economy added more than 200,000 jobs, the unemployment rate unexpectedly ticked up to 6.2% from 6.1% in June. In addition, wage growth was flat, pointing to underlying slack in the economy.

The data prompted investors to trim back expectations on the timing of a possible rate hike by the Federal Reserve, sending the dollar lower.

The greenback had rallied earlier in the week, as strong economic data underlined the view that the recovery is gaining momentum. Official data on Wednesday showed that U.S. economy expanded at an annual rate of 4.0% in the three months to June, outstripping forecasts of 3.0%.

The kiwi also found support after official data released Friday showed that China's manufacturing purchasing managers’ index rose to a two-year high of 51.7 in July from 51.0 in June, beating market expectations for a 51.4 reading.

Still, China's HSBC final manufacturing PMI for July ticked down to 51.7 from a preliminary reading of 52.0. Analysts had expected the index to remain unchanged.

The Asian nation is New Zealand’s second-largest trade partner.

The New Zealand dollar had been under broad selling pressure since the Reserve Bank of New Zealand last week raised its benchmark interest rate to 3.50% from 3.25%, but signaled that rates will not go any higher this year.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the New Zealand dollar in the week ending July 22.

Net longs totaled 15,289 contracts, up slightly from net longs of 15,132 in the preceding week.

In the week ahead, investors will be looking ahead to key U.S. data on service sector activity in July, while second quarter employment data out of New Zealand will also be in focus.

Tuesday, August 5

- The U.S. is to publish data on factory orders, while the Institute of Supply Management is to release data on service sector growth.

- New Zealand is to release data on the change in the number of people unemployed and the unemployment rate.

- Later in the day, the U.S. is to publish data on the trade balance.

- The U.S. is to publish the weekly report on initial jobless claims.

- China is to release a report on its trade balance.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.06 06:22

2014-08-05 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Unemployment Rate]

- past data is 5.9%

- forecast data is 5.8%

- actual data is 5.6% according to the latest press release

if actual > forecast = good for currency (for NZD in our case)

[NZD - Unemployment Rate] = Percentage of total work force that is unemployed and actively seeking employment during the previous quarter. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions.

==========

New Zealand Q2 Jobless Rate Drops More Than Expected

The unemployment rate in New Zealand decreased more than expected in the second quarter while participation rate declined, data showed Wednesday.

The jobless rate came in at 5.6 percent in the second quarter, figures from Statistics New Zealand showed.

This was less than the jobless rate of 5.9 percent in the first quarter and the 5.8 percent rate expected by economists.

The number of employed people rose 3.7 percent year-over-year in the second quarter, the same rate as in the previous quarter. Economists had expected the number of employed people to increase 4 percent.

On a quarter-over-quarter basis, employment increased 0.4 percent, which was slower than the 0.9 percent in the first quarter and the 0.7 percent consensus estimate.

Meanwhile, the participation rate fell to 68.9 percent from 69.2 percent in the first quarter. Economists expected the participation rate to rise to 69.3 percent.

NZDUSD M5 : 43 pips price movement by NZD - Unemployment Rate news event

newdigital:

- Recommendation for short: watch D1 price for breaking 0.8462 support level on close bar for possible sell trade

- Recommendation

to go long: n/a

- Trading Summary: ranging

NZDUSD price broke 0.8462 support from above to below but today on open D1 bar only. If someone opened sell stop order at 0.8462 for intra-day trading so it is +11 pips in profit by equity now. As to D1 timeframe so we need to wait for this daily bar to be closed and new D1 bar to be open tomorrow for more confirmation for example.

Yesterday's bar was opened at 0.8471 with 0.8422 resistance.

Some people say that it is necessary to place sell stop/buy stop pending orders on the distance between support/resistance lines. I mean:

- if we have support level as 0.8462 so please sell stop at 0.8460 or 0.8458;

- if we have resistance at 0.8556 so please buy stop order at 0.8560 for example.

This is updated situation for now:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on strong bearish with 0.8462 as the nearest support level.

W1 price is on correction within primary bullish with the nearest support level as 0.8401 and Chinkou Span line which is near to be crossed with the price for good breakdown.

H4 price is ranging between 0.8458 support and 0.8534 resistance levels with primary bearish.

If D1 price will break 0.8462 support level on close bar so the primary bearish will be continuing.

If not so we may see ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2014-08-04 01:00 GMT (or 03:00 MQ MT5 time) | [NZD - ANZ Commodity Prices]

2014-08-05 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]

2014-08-05 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-08-05 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Unemployment Rate]

2014-08-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-08-07 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart