Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.28 10:53

Forex Weekly Outlook Jun 30-Jul 4The US dollar was on the back foot in a week that saw quite a few breakouts. As the new quarter begins, top tier events are due in the busy calendar. The peak is the early Non-Farm Payrolls release, which happens at the same time that Draghi begins talking. Here is an outlook on the highlights of this week.

The divergence between past and present data became extreme: Q1 contraction was revised to a terrible 2.9% and it certainly hurt the dollar. How will the US reach 2.2% growth in 2014 this way? Well, Q2 continues to look good, with excellent home sales and rising consumer confidence. In the euro-zone, data remains weak, while in the UK, the BOE watered down its comments and sent GBPUSD down. NZD/USD stood out with a challenge of the yearly highs and the loonie continued recovering.

- Canadian GDP: Monday, 12:30. The Canadian economy continued to expand in March rising 0.1%, after a 0.2% increase in the previous month while growing at a yearly rate of 2.1% following 2.5% in February. The reading was in line with market forecast. The Bank of Canada maintained its interest rate in its last meeting in June but is under pressure to deliver some policy tightening in the face of an asset bubble that is forming in the housing market. The Canadian economy is expected to grow by 0.2% in April.

- US Pending Home Sales: Monday, 14:00. The index of pending U.S. home sales increased modestly in April up by 0.4% to 97.8, indicating the housing market is stabilizing after the harsh winter. The increase was below market forecast of 1.1% and followed a 3.4% jump in the previous month. The index has risen for two consecutive months. However, they fell 9.2% in the 12 months through April. U.S. pending home sales is expected to rise 1.4% this time.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 2.50% in its June meeting. The reading was in line with market expectations posting the eight consecutive meeting of unchanged rates. The Bank’s statement was also the same as in the previous month. Financial conditions are accommodative and price volatility is low. Domestic economy is adjusting to the sharp decline in the resource sector investments and unemployment reaches record highs. No change is expected now.

- US ISM Manufacturing PMI: Tuesday, 14:00. The U.S. manufacturing sector continued to expand, in May reaching a revised 55.4 from an initial reading of 53.2. The figure was better than the 54.9 release posted in April, slightly below the 55.7 expected by analysts. This improvement indicated that the manufacturing sector had advanced more rapidly in May compared to April. The U.S. manufacturing sector is predicted to rise further to 55.6 .

- US ADP Non-Farm Employment Change: Wednesday, 12:15. US employers hired fewer workers than expected in May adding 179,000 positions from 215,000 in the previous month, but a growth trend was visible in the services sector suggesting the pick-up in economic growth continues after a sluggish start early this year. Nevertheless the ADP release did not forecast the strong job addition of 217,000 posted later that week in the Non-farm Payrolls. US employment market is expected to grow by 206,000 this time.

- Janet Yellen speaks: Wednesday, 15:00. Federal Reserve Chair Janet Yellen will speak in Washington D.C. at the International Monetary Fund. Fed Chair Yellen delivered mixed messages after the FOMC meeting leaving investors puzzled about a possible rate hike. Market volatility is expected.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank decided to act in its last meeting in June agreed to impose a negative interest rate of -0.10% on its overnight depositors, to encourage banks to lend rather than hoard cash with their central banks and prevent the euro zone from falling into deflation. The ECB was the first central bank to set negative interest rates on banks. The Central bank also cut rates to 0.15% from 0.25%. Economists expected the ECB to cut its rate to 0.10% and reduce deposit rate to -0.10% from zero. The ECB is not expected to make further changes at this point but we Draghi always rocks the markets, as he did last time by closing the door to more cuts.

- US Non-Farm Employment Change and Unemployment Rate: Thursday, 12:30. The U.S. economy created 217,000 jobs in May, backing claims that the five-year-long recovery accelerated this spring. The reading cane above forecast for a 214,000 addition, following a huge increase of 282,000 posted in the prior month. The jobless rate remained unchanged at 6.3% beating forecasts for a rise to 6.4%. An addition of 211,000 positions is expected, while the unemployment rate is expected to remain unchanged at 6.3%

- US Trade Balance: Thursday, 12:30. US trade deficit edged up 6.9% in April to a two-year high of $47.2 billion, amid a sharp increase in imported goods such as cars, cellphones, computers and networking gear, indicating consumer spending is picking up. However, slower than expected growth in the second quarter increases deficit. The 4-week moving average edged up 2,000 reaching 314,250. US trade deficit is expected to reach 45.1 million this time.

- US ISM Non-Manufacturing PMI: Thursday, 14:00. The U.S. service sector continued to expand in May, rising to 56.3 from 55.2 in April, exceeding market forecasts by 0.7 points. The majority of respondents were positive about current and future conditions. The employment index edged up to 52.4, from 51.3 in April, new orders rose to 60.5, from the previous reading of 58.2 and the business activity climbed to 62.1, from 60.9. The U.S. service sector is expected to reach 56.2.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.28 17:57

EUR/USD forecast for the week of June 30, 2014, Technical AnalysisThe EUR/USD pair broke higher during the course of the week, but still remains stuck in the consolidation area we have been in for several weeks now. It is not until we get above the 1.37 level of that we feel comfortable buying this market on more of a longer-term move. A break down below the 1.35 level since this market much lower, probably looking for the 1.33 handle, or perhaps even as low as the 1.31 level. In the meantime, we think this market going to be a little bit tight for longer-term traders to be involved in.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.30 13:50

2014-06-30 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sale]

- past data is -1.5%

- forecast data is 0.7%

- actual data is -0.6% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Retail Sale] = Change in the total value of inflation-adjusted sales at the retail level, excluding automobiles and gas stations. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Also Called : Real Retail Sales.

==========

German Retail Sales Fall Unexpectedly In May

German retail sales fell unexpectedly in May from the prior month, official data revealed Monday.

Retail sales were down 0.6 percent month-on-month in May, but slower than the 1.5 percent drop seen in April, provisional results from Destatis showed. This was the second consecutive fall in sales. Economists had forecast a 0.8 percent rise in turnover in May.

Meanwhile, retail turnover grew 1.9 percent in May from the same period of last year, when it was expected to rise by 1 percent. Nonetheless, the rate of growth slowed from 3.2 percent logged in April.

Compared with the previous year, turnover in retail trade was in the first five months of the year in real terms 1.4 percent larger than that in the corresponding period of the previous year.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 13 pips price movement by German Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.30 17:34

2014-06-30 14:30 GMT (or 16:30 MQ MT5 time) | [USD - Dallas Fed Manufacturing Business Index]

- past data is 8.0

- forecast data is n/a

- actual data is 11.4 according to the latest press release

[USD - Dallas Fed Manufacturing Business Index] = The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state's factory activity. Firms are asked by Federal Reserve Bank of Dallas whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase.

==========

DALLAS FED MANUFACTURING HEATS UP

The Dallas Fed's latest manufacturing outlook survey is out, and the numbers look good.

The headline index jumped to 11.4 in June from 8.0 in May.

Economists were looking for a reading of 8.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 31 pips price movement by USD - Dallas Fed Manufacturing Business Index news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.29 17:50

EUR/USD weekly outlook: June 30 - July 4The euro moved higher against the broadly weaker dollar on Friday as concerns over the outlook for U.S. economic growth continued to weigh, despite a report showing that U.S. consumer sentiment improved this month.

EUR/USD ended Friday’s session at 1.3649, up 0.28%. For the week, the pair added 0.43%.

The pair is likely to find support at 1.3600 and resistance at 1.3670.

The dollar remained lower after data on Friday showed that the final reading of the University of Michigan's consumer sentiment index rose to 82.5 this month from 81.9 in May, compared to expectations of 82.2.

The report did little to alter expectations that the Federal Reserve will keep rates on hold for an extended period after data earlier in the week showed that U.S. first quarter growth was revised sharply lower.

The dollar weakened across the board after the Commerce Department said Wednesday that the economy contracted at an annual rate of 2.9% in the first three months of the year, compared to the consensus forecast for a decline of 1.7%.

U.S. first quarter GDP was initially reported to have increased by 0.1%, but was subsequently revised to show a contraction of 1.0%.

The dollar came under additional pressure after data on Thursday showed that U.S. consumer spending rose by just 0.2% in May, below forecasts for 0.4%.

The euro was flat against the yen late Friday, with EUR/JPY at 138.45, and ended the week down 0.22%.

The yen was boosted after stronger-than-forecast data on Japanese retail sales for May curbed expectations for additional monetary easing by the Bank of Japan.

In the week ahead, investors will be looking to the U.S. nonfarm payrolls report on Thursday for further indications on the strength of the labor market, while Monday’s euro zone inflation report will also be in focus, ahead of the European Central Bank’s policy meeting and press conference on Thursday.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 30

- The euro zone is to produce preliminary data on consumer price inflation, which accounts for the majority of overall inflation. Meanwhile, Germany is to publish data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to produce data on manufacturing activity in the Chicago region and a report on pending home sales.

- The euro zone is to release data on the unemployment rate. Germany is release data on the change in the number of people unemployed, while Spain and Italy are to release reports on manufacturing activity.

- Later Tuesday, the Institute of Supply Management is to publish a report on U.S. manufacturing activity.

- In the euro zone, Spain is release data on the change in the number of people unemployed.

- The U.S. is to release the ADP report on private sector job creation, as well as data on factory orders.

- Later Wednesday, Fed Chair Janet Yellen is to speak at an event in Washington; her comments will be closely watched.

- The euro zone is to release data on retail sales, while Spain and Italy are to publish data on service sector activity. The ECB is to announce its benchmark interest rate. The announcement is to be followed by a press conference with President Mario Draghi.

- The U.S. is to release data on the trade balance, as well as the weekly report on initial jobless claims.

- The U.S. is also to publish what will be closely watched government data on nonfarm payrolls and the unemployment rate, one day ahead of schedule due to the fourth of July holiday.

- Later Thursday, the ISM is to publish a report service sector activity.

- Germany is to publish data on factory orders.

- Markets in the U.S. are to remain closed for the Independence Day holiday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.01 12:03

2014-07-01 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

- past data is 11.6%

- forecast data is 11.7%

- actual data is 11.6% according to the latest press release

if actual < forecast = good for currency (for EUR in our case)

[EUR - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions.

==========

Eurozone May Jobless Rate Stable At 11.6%

The Eurozone unemployment rate remained unchanged in May, latest figures from Eurostat showed Tuesday.

The jobless rate held steady at seasonally adjusted 11.6 percent in May after April's figure was revised down from 11.7 percent. Economists had forecast the unemployment rate to remain at 11.7 percent.

The number of unemployed decreased by 28,000 from April to 18.55 million. Compared to last May, unemployment declined by 636,000.

The EU28 jobless rate fell to 10.3 percent in May from 10.4 percent in April.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 11 pips price movement by EUR - Unemployment Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.01 19:37

2014-07-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

- past data is 55.4

- forecast data is 55.8

- actual data is 55.3 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

U.S. Manufacturing Index Indicates Slightly Slower Growth In June

Activity in the U.S. manufacturing sector unexpectedly grew at a slightly slower rate in the month of June, according to a report released by the Institute for Supply Management on Tuesday.

The ISM said its purchasing managers index edged down to 55.3 in June from 55.4 in May, although a reading above 50 still indicates growth in the manufacturing sector.

The modest decrease came as a surprise to economists, who had expected the index to inch up to a reading of 55.8.

Despite the modest decrease, Rob Carnell, chief international economist at ING, noted that the index continues to point to robust growth.

"Such a headline manufacturing ISM figure is consistent with GDP growth of 3.5%, and in all likelihood, the U.S. will grow a good deal faster than that in 2Q14 following the execrable 1Q14 GDP result," Carnell said.

The modest decrease by the headline index was partly due to a slowdown in production growth, as the production index dipped to 60.0 in June from 61.0 in May.

On the other hand, growth in new orders accelerated compared to the previous month, with the new orders index climbing to 58.9 in June from 56.9 in May.

The report also showed that the employment index came in unchanged at 52.8, indicating the twelfth consecutive month of job growth in the manufacturing sector.

While recent inflation data has pointed to prices rising at a faster rate, the ISM said its prices index fell to 58.0 in June from 60.0 in May.

Thursday morning, the ISM is scheduled to release a separate report on activity in the service sector in the month of June.

Economists expect the index of activity in the service sector to edge down to 56.2 in June after climbing to 56.3 in May.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 16 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.02 07:04

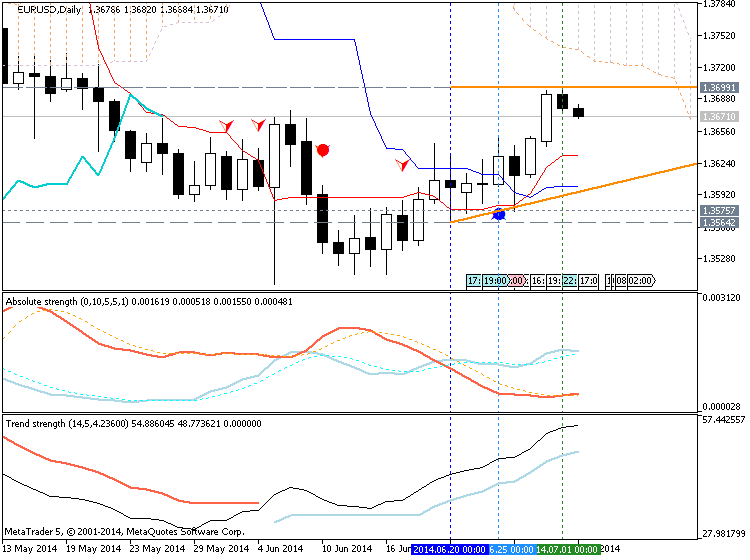

EUR/USD Technical Analysis – Rally Stalls Below 1.37 Mark (based on dailyfx article)

- EUR/USD Technical Strategy: Pending Short

- Support: 1.3620, 1.3585, 1.3476-1.3502

- Resistance:1.3689, 1.3747, 1.3805

The Euro paused to digest gains following an expected rally against the US Dollar,

failing to overcome resistance below the 1.37 figure. A daily close

above the 38.2% Fibonacci retracement at 1.3689 initially exposes the

50% level at 1.3747. Alternatively, a move below

resistance-turned-support marked by a falling trend line set from

mid-May, now at 1.3620, clears the way for a challenge of the May 29 low

at 1.3585.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.02 11:22

EUR/USD consolidates after Monday's risec

EUR/USD started the new quarter with a dull trading session. The pair hovered directionless in a 20 pips range between 1.3680 and 1.37. The EMU data were second tier and thus ignored. The US manufacturing ISM was slightly weaker than expected, but close to expectations and thus also unable to support the greenback. Rallying equities were also unable to give EUR/USD direction. The pair closed the dull session at 1.3679, down 13 pips from Monday’s close at 1.3679..

Overnight, Asian equities trade with a bullish touch, after the S&P and Dow set closed at new records yesterday. The dollar is flat versus euro and yen. US Treasuries trade little changed, while the Bund opened just below 147 this morning. So, FX trading starts the European session ina neutral mode.

Later today, the euro zone eco calendar is thin with only the PPI inflation data. These data are however rather outdated (May) and shouldn’t have a lasting impact on trading. In the US, the focus will be on the ADP employment report, ahead of tomorrow’s payrolls. We see risks for a slightly weaker outcome, which might be slightly negative for the US dollar. Nevertheless, a significant deviation from the consensus is probably needed to have a lasting impact on markets, especially ahead of tomorrow’s payrolls and ECB meeting. The dollar probably needs a strong payrolls report to make a meaningful comeback against the euro and/or the yen.

nice info

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on secondary rally within primary bearish market condition trying to break 1.3651 resistance level. Chinkou Span line of Ichimoku indicator is very near to be crossed with historical price for possible breakout of the price movement.

H4 price is on primary bullish crossing 1.3645 on open bar for the breakout to be continuing.

W1 price is on primary bullish with Chinkou Span line of Ichimoku indicator to be very near to be crossed with the price for good breakout.

If D1 price will break 1.3651 resistance level together with Chinkou Span line crossing the price from below to above so the secondary rally will be continuing with good breakout situation.

If not so we may see ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-06-30 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sale]

2014-06-30 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - M3 Money Supply]

2014-06-30 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2014-06-30 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-06-30 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-07-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-07-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-07-01 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Manufacturing PMI]

2014-07-01 07:55 GMT (or 09:55 MQ MT5 time) | [EUR - German Unemployment Change]

2014-07-01 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-07-01 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

2014-07-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-07-02 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

2014-07-02 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - GDP]

2014-07-02 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-07-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Factory Orders]

2014-07-02 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-07-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-07-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]

2014-07-03 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]

2014-07-03 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Retail Sales]

2014-07-03 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

2014-07-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

2014-07-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-07-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : rally

Intraday Chart