what planet are you from? why dont you test it yourself and show us how much profit or loss you made with it then we maybe want to test it or not. Yes it's a free source code i know that but your approach to users are way way wrong.

I would not spend 1 second of my time testing stuff like this

Hello

Sorry if I have offended you.You are 100 percent right ,don't use this EA,trading is not for people like you.

I am trying to feed you with a spoon, and still there will be someone like you to complain,

A wise person would understand from a simple hint.

Hi guys

Thanks to Aharon Tzadik at first,for his continuous contributions (Indicators,EAs) to trading community since long,almost his stuff mostly self descriptive (commented within lines) help to many learners/interested/exercising ones,so we may pay thanks and encourage him rather than commenting like that i see in above post,really sad and shame.

regards

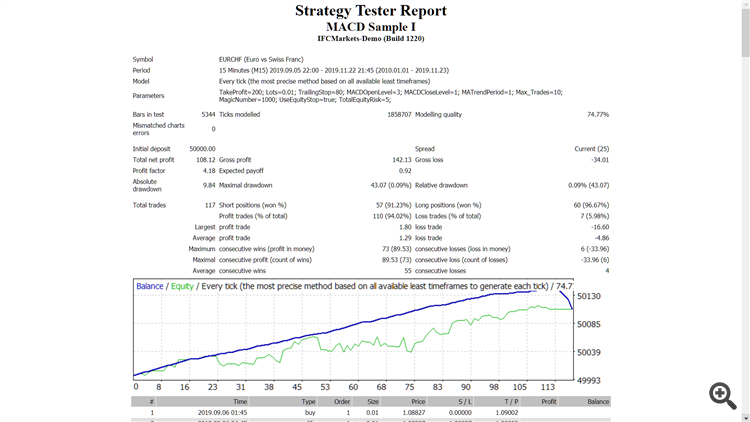

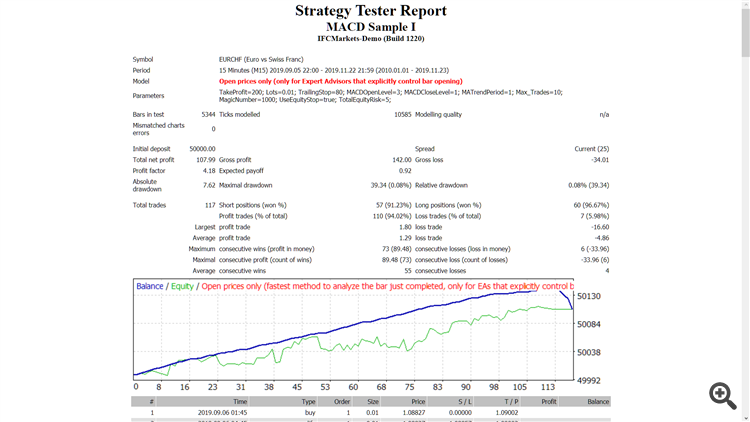

Strategy Tester Report |

||||||||||||

***Markets-Live (Build 2085) |

||||||||||||

Settings

|

||||||||||||

| Expert: | MACD Sample I | |||||||||||

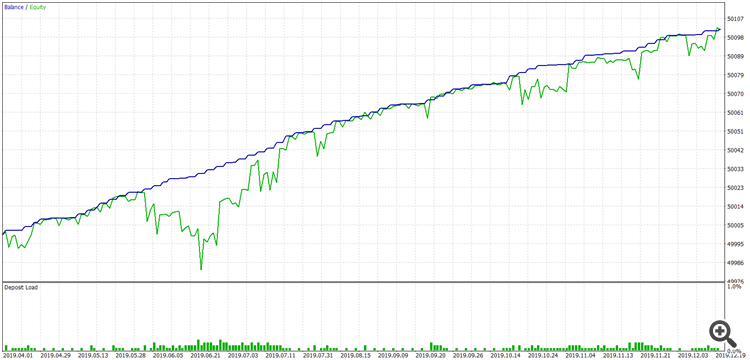

| Symbol: | EURUSD | |||||||||||

| Period: | M15 (2019.04.01 - 2019.12.21) | |||||||||||

| Inputs: | TakeProfit=200 | |||||||||||

| Lots=0.01 | ||||||||||||

| TrailingStop=70 | ||||||||||||

| MACDOpenLevel=6 | ||||||||||||

| MACDCloseLevel=3 | ||||||||||||

| MATrendPeriod=26 | ||||||||||||

| Max_Trades=10 | ||||||||||||

| MagicNumber=1000 | ||||||||||||

| UseEquityStop=true | ||||||||||||

| TotalEquityRisk=2.0 | ||||||||||||

| Broker: | *** Markets AS | |||||||||||

| Currency: | EUR | |||||||||||

| Initial Deposit: | 50 000.00 | |||||||||||

| Leverage: | 1:50 | |||||||||||

Results

|

||||||||||||

| History Quality: | 100% real ticks | |||||||||||

| Bars: | 18236 | Ticks: | 13447007 | Symbols: | 1 | |||||||

| Total Net Profit: | 102.24 | Balance Drawdown Absolute: | 0.00 | Equity Drawdown Absolute: | 17.51 | |||||||

| Gross Profit: | 102.38 | Balance Drawdown Maximal: | 0.14 (0.00%) | Equity Drawdown Maximal: | 38.92 (0.08%) | |||||||

| Gross Loss: | -0.14 | Balance Drawdown Relative: | 0.00% (0.14) | Equity Drawdown Relative: | 0.08% (38.92) | |||||||

| Profit Factor: | 731.29 | Expected Payoff: | 1.29 | Margin Level: | 62478.11% | |||||||

| Recovery Factor: | 2.63 | Sharpe Ratio: | 1.61 | Z-Score: | 3.34 (99.74%) | |||||||

| AHPR: | 1.0000 (0.00%) | LR Correlation: | 1.00 | OnTester result: | 0 | |||||||

| GHPR: | 1.0000 (0.00%) | LR Standard Error: | 2.28 | |||||||||

| Total Trades: | 79 | Short Trades (won %): | 49 (100.00%) | Long Trades (won %): | 30 (96.67%) | |||||||

| Total Deals: | 158 | Profit Trades (% of total): | 78 (98.73%) | Loss Trades (% of total): | 1 (1.27%) | |||||||

| Largest profit trade: | 3.35 | Largest loss trade: | -0.14 | |||||||||

| Average profit trade: | 1.31 | Average loss trade: | -0.14 | |||||||||

| Maximum consecutive wins ($): | 63 (81.55) | Maximum consecutive losses ($): | 1 (-0.14) | |||||||||

| Maximal consecutive profit (count): | 81.55 (63) | Maximal consecutive loss (count): | -0.14 (1) | |||||||||

| Average consecutive wins: | 39 | Average consecutive losses: | 1 | |||||||||

The strategy is ok I think, it's a simple Macd with support grid, and there's nothing to complain about the test results. It's carrying the risk

of blowing the account as with all grid strategies.

Hello

This EA is not like all grid strategies ,and you will not blow your account so easy because it has the "UseEquityStop" function, if a trade risks more the a certain percent form your total account then it will be closed, there is no use here of stoploss or any exit strategy, this is the reason you need to use small lotsize.

Also some trades will not close immediately , it can take few weeks, but eventually at least 90 % of trades will be closed with profit, this is the reason that you have a very high "profit factor "

And you can use "open prices only" for testing because all of this EAs functions work with open candle price the results are the same.

Thanks for the support.

Hello Aharon,

Thank you for publishing some great EAs. I have a question about this one.

Why does it say in the description "You need to optimize this EA once a week and use the exact same inputs from above"?

Let's say I used last one year of data to optimize the EA and then started trading with the optimized inputs I found. Do you mean that after one week of trading, I will have to optimize with last 1 year + 1 week of data once again and then use the latest set of inputs? Or do I optimize with just the last 1 week of data?

Hello

Yes you will need to optimize one year back from the date that you are in, or last 1 year + 1 week of data once again.

Hello Aharon,

The code has some lines commented out. Please see attached screenshot. Does that affect functionality?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

MACD Sample I:

classic MACD Sample EA with a little twist

Author: Aharon Tzadik