Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.22 18:01

Forex Weekly Outlook August 25-29The dollar dominated once again, with multi-month gains against major currencies. Is it time for a correction or will this trend continue? German Ifo Business Climate, US housing data, Durable Goods Orders and GDP are amongthe highlights of this week. Follow along as we explore the Forex market movers coming our way.

This was quite a week in financial markets: upbeat US data (especially housing) pushed the dollar higher, and it later got a boost from the not-too-dovish FOMC minutes. In Jackson Hole, Janet Yellen’s much awaited speech did not contain any major surprises, and that was enough to keep the ball rolling for the US dollar. EUR/USD dropped to an 11 month low, also due to ongoing tensions around Ukraine and despite not-too-shabby PMIs. The pound was hit hard by weak inflation and despite two members voting for a rate hike. The Aussie showed resilience, defying a weak Chinese figure.

- German Ifo Business Climate: Monday, 8:00. German business mood continued to deteriorate in July reaching a worse than estimated reading of 108.0, following 109.7 reading posted in June. Tensions in Ukraine and the Middle East remained the chief concern of German businesses. Easing economic momentum after a strong first quarter also contributed to this fall. Domestic activity remained elevated pointing to growth. Business climate is expected to fall to 107.1 this time.

- US New Home Sales: Monday, 14:00. The U.S. housing market was unable to gain traction in June posting a lower than expected annualized pace, reading of 406,000 from 442,000 in May. Analysts expected sales to pick up to 485,000. Restrictive lending rules, limited land supply and higher mortgage rates weigh on the housing market. Federal Reserve Chair Janet Yellen expressed her concern that the industry is underperforming. New home sales is forecasted to reach 426,000 in July.

- US Durable Goods Orders: Tuesday, 12:30. Orders for long-lasting U.S. manufactured goods edged up more than expected in June rising 0.7% amid a rise in demand from transportation to machinery and computers and electronic products. The reading was well above predictions of a 0.4% rise following May’s 0.9% decline, suggesting a growth trend in the economy at the end of the second quarter. Meanwhile Core orders picked up 0.8% after a flat reading in May, while expected to gain 0.6%. Orders for durable goods are expected to pick-up 7.4% in July, while Core orders are predicted to gain 0.5%.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence rose in July to a nearly seven-year high, reaching 90.9, the highest since October 2007. This increase was higher than the 85.5 anticipated by analysts and followed 86.4 points posted in July. The labor market growth trend had a positive effect on consumer spending and equity markets remain strong. Nevertheless, the Federal Reserve policy makers are forecast to keep interest rates low well into 2015 even as they stop monetary stimulus. Consumer confidence is expected to reach 89.1 this time.

- US GDP: Thursday, 12:30. The US economy grew at annualized pace of 4% in Q1, according to the initial publication. This was certainly encouraging, especially after a significant contraction of 2.1% in Q1 (after yet another revision). The second estimate of GDP is expected to show a minor tick down to 3.9%. Components of growth will also be watched: more consumption and investment will cheered upon, while a buildup of inventory will not be very encouraging

- US Unemployment Claims: Thursday, 12:30. US Jobless claims fell by 14,000 to 298,000 last week showing the labor market is making progress hand in hand with the growth momentum in the US economy. Last week’s reading was much better than the 302,000 reading expected by analysts. The four week average of claims, a less volatile measure than the weekly figures, increased to 300,750 last week from 296,000. The number of people on jobless benefit rolls dropped by 49,000 to 2.5 million in the week ended Aug. 9, posting the lowest level since June 2007. Jobless claims are predicted to rise 299,000 this week.

- US Pending Home Sales: Thursday, 14:00. The number of contracts to buy previously owned homes declined 1.1% in June, following a 6.0% gain in May, worse than the 0.2% decline forecasted by analysts. The unexpected fall indicates residential housing is struggling to gain momentum. Limited availability of credit and sluggish wage growth were the main cause for this setback, making it harder for potential buyers to close real estate deals. Federal Reserve Chair Janet Yellen has underlined the sluggish state of the housing market. Analysts believe, the housing market will not get better until a more substantial improvement will occur in the labor market and wage growth. Pending Home Sales are expected to rise 0.6%.

- Canadian GDP: Friday, 12:30. The Canadian economy expanded in May at the fastest pace in four months rising 0.4% amid a surge in car production. The increase followed a 0.1% gain in April. Analysts expected a smaller rise of 0.3%. Canada registered the fifth consecutive monthly gain, indicating the economy is getting stronger. The central bank estimates a 2.5% gain in the April-to-June period. Manufacturing increased 0.8%, led by a 13% climb in motor vehicle production. Wholesalers registered a 1.2% gain in output in May, making the sector the second largest contributor of growth during the month. The expansion was visible across the board. The economy’s growth rate is expected to reach 0.3% now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.24 09:55

EURUSD forecast for the week of August 25, 2014, Technical AnalysisThe EUR/USD pair fell during the course of the week, breaking the back of three hammers that had formed in the previous weeks. Because of this, this market looks like it’s extraordinarily weak, and it could in fact continue to go much lower. We believe that this market will more than likely continue down to the 1.30 handle, which is an area that has much more significant on a longer-term chart as it is a large, round, psychologically significant number and has proven to be supportive in the past as well as resistive. With that, we should be talking about a significant amount of order flow there, and ultimately a reason to get involved for longer-term, big-money players.

The 1.30 level could very well be the absolute bottom, but if we break down below there, things get truly ugly for the Euro. Remember, the European Central Bank needs a relatively weakened Euro in order to boost economic activity, and with that we are very bearish of the Euro in general. The marketplace should offer plenty of selling opportunities every time we bounce, but the real question is going to be whether or not the bounces will be big enough in order for the longer-term trader to take advantage of them. In our opinion, that’s probably not going to be the case. We ultimately believe that the longer-term trader will probably catch the bigger move, perhaps a bounce. But we are very cautious to get involved until we see a clear-cut signal from the longer-term perspective. At this point in time, it’s just going to be simpler and much easier to short this market on the shorter-term charts.

You also have to keep in mind that we are in the middle of summer, and as a result not all major firms are putting a lot of money into the marketplace. The real answers will be shown in September as to what the market will probably do. With that being the case, we are hesitant to get involved long-term traders standpoint, but very cognizant of what’s happening on the weekly chart as it could give us a nice long-term trade soon.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.26 12:31

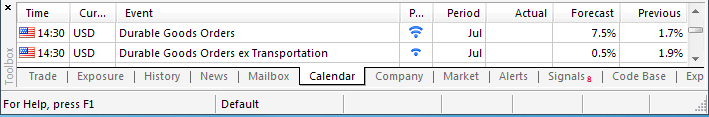

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

- U.S. Durable Goods Orders to Increase for Second Month

- 7.1% Rise Would Mark Fastest Pace of Growth Since March 2011

A 8.0% rise in demand for U.S. Durable Goods may spur a bullish reaction

in the greenback (bearish EUR/USD) as it raises the scope for a

stronger recovery in the second-half of 2014.

What’s Expected:

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is running

out of arguments to retain its highly accommodative policy stance amid

the ongoing improvements in the world’s largest economy, and the bullish

sentiment surrounding the dollar may gather pace throughout the coming

months should we see a growing number of central bank officials adopt a

more hawkish tone for monetary policy.

The pickup in household sentiment along with the resilience in private

sector consumption may generate increased demand for U.S. Durable Goods,

and a positive print may heighten the bullish sentiment surrounding the

dollar as it raises the outlook for growth and inflation.

However, sticky inflation paired with subdued wage growth may drag on

demand for large-ticket items, and a dismal development may serve as a

fundamental catalyst to spur a larger correction in the reserve currency

as it weighs on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Orders Increase 8.0% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

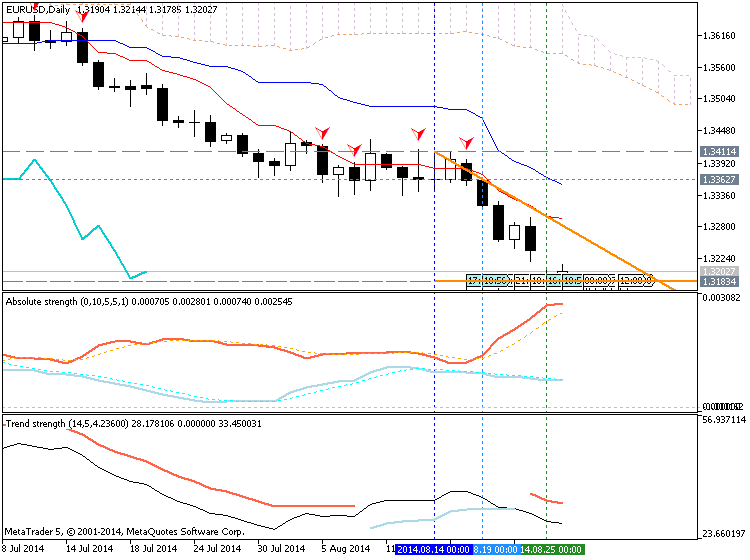

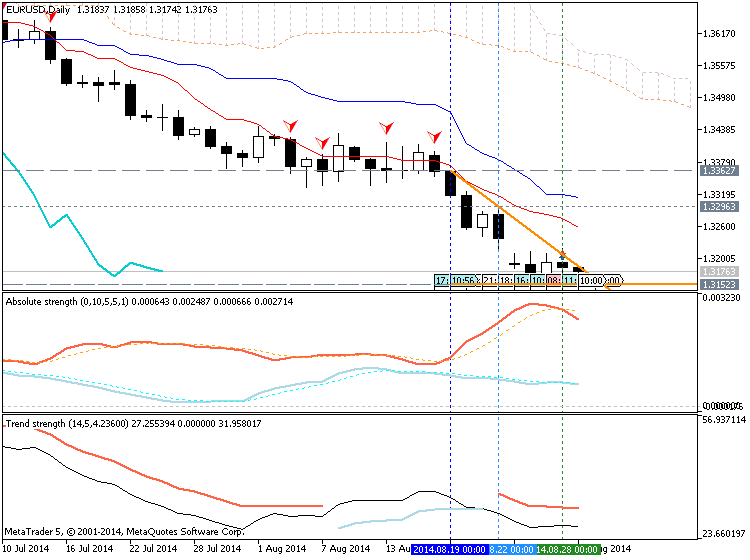

EUR/USD Daily

- Downside targets remain favored as long as RSI holds in oversold territory

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JUN 2014 |

07/25/2014 12:30 GMT | 0.5% | 0.7% | - 4 | - 8 |

June 2014 U.S. Durable Goods Orders

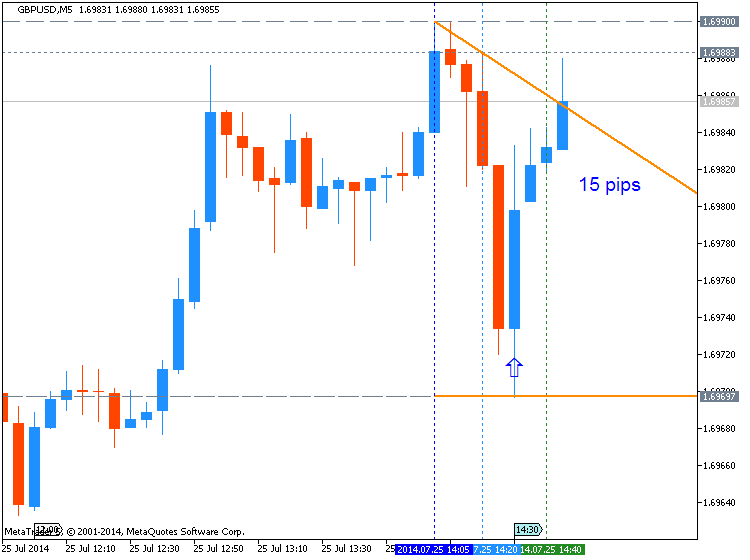

GBPUSD M5 : 15 pips price movement by USD - Durable Goods Orders news event

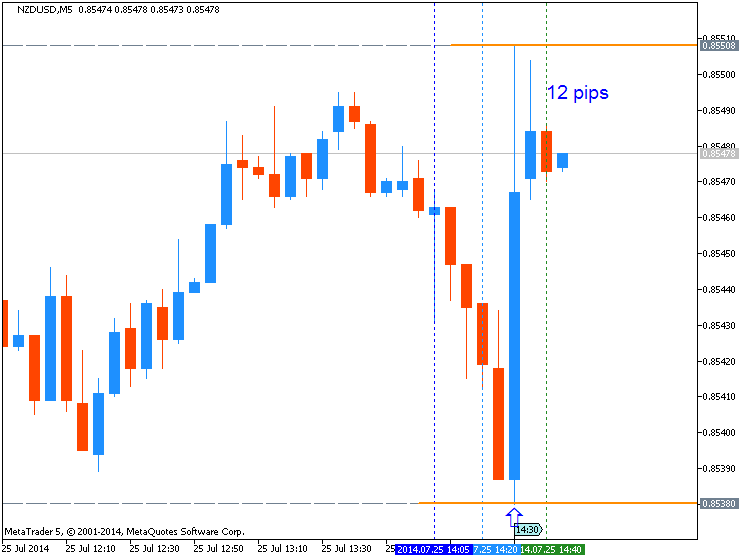

NZDUSD M5 : 12 pips price movement by USD - Durable Goods Orders news event

Orders for U.S. Durable Goods accelerated at a rate of 0.7% in June, exceeding estimates for 0.5% rise. The print was also much better than that in May, which showed a revised 1.0% contraction. The strength mainly came from increase in demand for commercial aircraft and machinery. However, the better-than-expected figure had a limited impact on the dollar. During the rest of the North America trade, the EUR/USD fluctuated around 1.3430 and closed at 1.3429.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.27 13:33

2014-08-27 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]- past data is 8.9

- forecast data is 8.9

- actual data is 8.6 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - GfK German Consumer Climate] = Level of a composite index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========

German Consumer Confidence Seen Falling in September

German consumer confidence is expected to decline in September as international upheaval weighs on sentiment, a survey showed Wednesday, casting doubt on hopes that domestic consumption will offset export weakness in Europe's largest economy.

The monthly GfK survey showed consumer confidence falling to 8.6 in September from 8.9 in August. It was the first decline in the consumer climate indicator since January 2013. GfK uses survey data from the current month to derive a figure for the month to come. Experts polled by The Wall Street Journal last week had predicted the indicator would be 9.0 in September.

The figure is still "at a rather high level," GfK said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 16 pips price movement by EUR - GfK German Consumer Climate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.28 09:49

2014-08-28 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Flash CPI]- past data is -0.3%

- forecast data is -0.2%

- actual data is -0.5% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - Spanish Flash CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate

==========

Spain Consumer Prices Fall Most Since 2009

Spain's consumer prices declined at the fastest pace since October 2009, flash data from the statistical office INE showed Thursday.

Consumer prices fell 0.5 percent year-on-year in August, this was the biggest fall since October 2009, when prices declined by 0.7 percent. Consumer prices dropped for the second consecutive month.

Economists had forecast prices to fall 0.6 percent annually after decreasing 0.3 percent in July.

The harmonized index of consumer prices decreased 0.5 percent from last year following a 0.4 percent drop in July. The index was expected to drop by 0.6 percent.

On a monthly basis, both consumer prices and harmonized prices edged up 0.1 percent each in August.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 14 pips price movement by EUR - Spanish Flash CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.29 06:49

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

- Euro-Zone Consumer Price Index (CPI) to Slow to 0.3%- Lowest Since October 2009

- Core Inflation to Hold Steady at 0.8% for Third Consecutive Month

Trading the News: Euro-Zone Consumer Price Index (CPI)

Another downside in the Euro-Zone’s Consumer Price Index (CPI) may

heighten the bearish sentiment surrounding the EUR/USD as it puts

increased pressure on the European Central Bank (ECB) to further embark

on its easing cycle.

What’s Expected:

Why Is This Event Important:

ECB President Mario Draghi may show a greater willingness to implement

more non-standard measures at the September 4th meeting should the CPI

print show a larger threat for deflation, and the EUR/USD may continue

to weaken throughout the second-half of 2014 as interest rate

expectations deteriorate.

The slowdown in business outputs paired with the renewed weakness in

private sector consumption may drag on price growth, and the growing

risk for deflation may push the ECB to adopt more emergency measures in

an effort to achieve its one and only mandate to deliver price

stability.

The pickup in producer prices along with the expansion in the money

supply may limit the downside risk for inflation, and a

better-than-expected CPI print may encourage a more meaningful rebound

in the EUR/USD as it gives the ECB greater scope to retain its current

approach for monetary policy.

How To Trade This Event Risk

Bearish EUR Trade: Euro-Zone CPI Slips to 0.3% or Lower

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

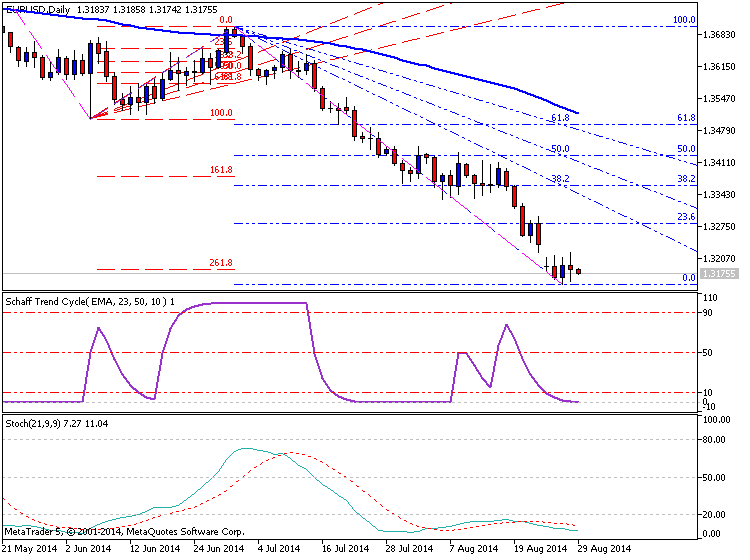

EUR/USD Daily

- Remains at Risk for Further Losses as Long as RSI Holds in Oversold Territory

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JUL 2014 | 07/31/2014 9:00 GMT | 0.4% | 0.5% | -4 | -4 |

The Euro-Zone Consumer Price Index (CPI) narrowed to an annualized rate of 0.4% from 0.5% the month prior, hitting a 5-year low. The print was also below the average estimate of 0.5%. Even though the core rate of inflation held steady at 0.8% for the second-month, price growth remains well below the ECB’s 2.0% target. Nevertheless, the ECB argued that lackluster print was attributed to volatile components, such as food and energy. However, there is no evidence that the inflation would pick up with the target soon, since ECB just announced a rate cut in June. The pair EUR/USD declined slowly after the release of the Eurozone CPI, but came back soon after and ended the day at 1.3386.

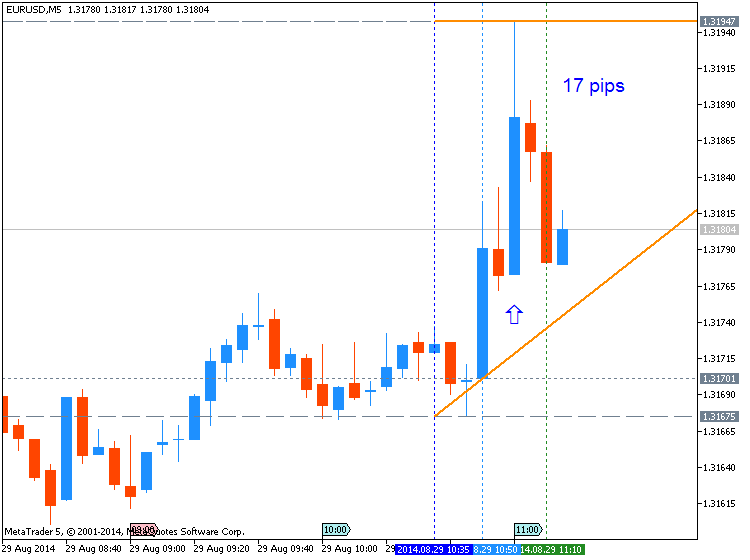

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 17 pips price movement by EUR - CPI news event

Forum on trading, automated trading systems and testing trading strategies

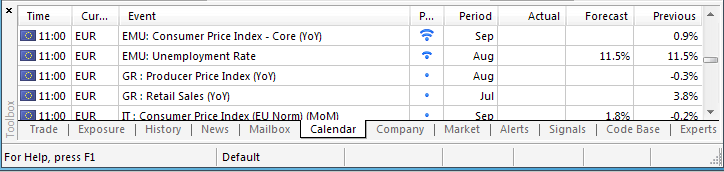

newdigital, 2014.09.30 06:48

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

- Euro-Zone Consumer Price Index (CPI) to Mark the Slowest Pace of Growth Since October 2009.

- Core Inflation to Hold Steady at 0.9% for Second Straight Month.

A further slowdown in the Euro-Zone’s Consumer Price Index (CPI) may

prompt fresh monthly lows in the EUR/USD as it puts increased pressure

on the European Central Bank (ECB) to implement more non-standard

measures.

What’s Expected:

Why Is This Event Important:

The ECB may continue to push monetary policy into uncharted territory as

the Governing Council struggles to achieve its one and only mandate to

deliver price stability, and the bearish sentiment surrounding the Euro

may gather pace throughout the remainder of the year amid the weakening

outlook for growth and inflation.

The persistent slack in the real economy may paint a weakened outlook

for price growth, and a dismal CPI print may generate a bearish reaction

in the EUR/USD should the report highlight a greater threat for

deflation.

However, the unprecedented steps taken by the ECB may help to mitigate

the downside risk for inflation, and a better-than-expected release may

generate a more meaningful rebound in the Euro as it curbs bets of

seeing a new wave of monetary support.

How To Trade This Event Risk

Bearish EUR Trade: Headline & Core CPI Highlight Greater Threat for Deflation

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

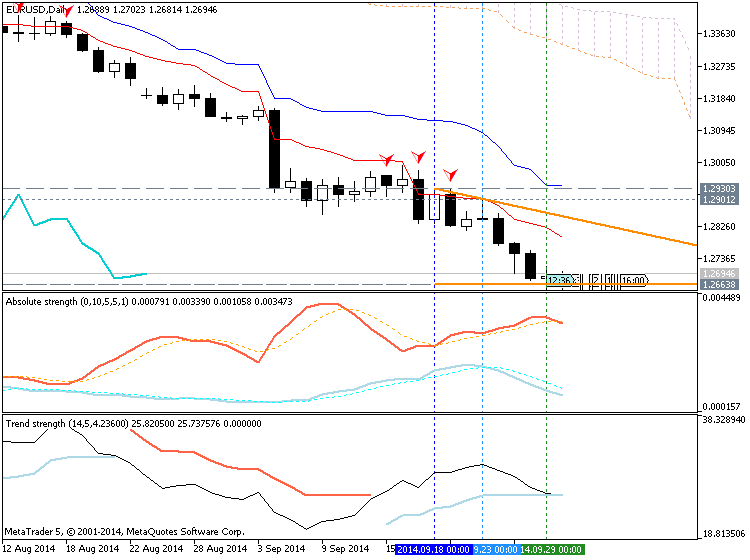

EUR/USD Daily

- Downside targets remain favored as RSI retains bearish momentum & pushes deeper into oversold territory

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2590 (100% expansion) to 1.2600 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| AUG 2014 | 08/29/2014 9:00 GMT | 0.3% | 0.3% | -44 |

August 2014 Euro-Zone Consumer Price Index (CPI)

EURUSD M5 : 17 pips price movement by EUR - CPI news event:

The Euro-Zone’s annualized Consumer Price Index (CPI) continued the downward trend and slipped to a 5-year low of 0.3% from 0.4% the month prior, while the core inflation rate unexpectedly rose 0.9% during the same period amid forecasts for a 0.8% print. The ongoing weakness in price growth may put increased pressure on the European Central Bank (ECB) to implement its own quantitative easing program amid the growing threat for deflation. Nevertheless, the initial reaction in the EUR/USD was short-lived as the pair consolidated around 1.3182 following the release, but the euro-dollar came under increased pressure during the North American trade as it ended the day at 1.3133.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 68 pips price movement by EUR - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.30 16:49

Next EUR/USD Leg Lower Begins; Trade Opportunities in EUR/AUD, EUR/GBP

- EURUSD cracks weekly low and tumbles below $1.2600.

- New EURGBP trade on the table.

- EURUSD has been on a major losing streak since mid-August.

Euro-Zone economic data came out roundly weaker than expected today, and the aftershocks have been felt throughout EUR-complex. The depth of impact stemming from the disappointing preliminary September Euro-Zone CPI may have to do with expectations for the core: +0.9% y/y was expected when +0.7% y/y was delivered. The scope of disinflation widens.

Over the next few months, Euro-Zone CPI may start to bottom. For starters, if it takes three to nine months for changes in interest rates and exchange rates to impact an economy, then the EURUSD peak in early-May is a good watermark to look back at; the window for peak drag on CPI by FX is just about now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.01 05:48

EUR/USD Downside Targets in Focus- Gold Eyes Key $1,179 Support

- EUR/USD Downside Targets in Focus Ahead of ECB Policy Meeting.

- Gold Eyes Key $1,179 Support as Bearish RSI Momentum Remains in Play.

- EUR/USD marks fresh monthly low of 1.2569 as Euro-Zone Consumer Price Index (CPI) narrows to 0.3%, while core inflation unexpectedly slips to 0.7% from 0.9%.

- Downside objectives remain favored ahead of the European Central Bank (ECB) policy meeting as the Relative Strength Index (RSI) retains bearish momentum & pushes deeper into oversold territory.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish for trying to break 1.3241 support level for the bearish trend to be continuing.

W1 price was reversed from primary bullish to primary bearish by breakdown breaking 1.3332 support level on close W1 bar.

H4 price is on bearish ranging between 1.3296 resistance and 1.3220 support levels.

If D1 price will break 1.3241 support level on close bar so the primary bearish will be continuing (good to open sell trade).

If not so we may see the ranging market condition within primary bearish.

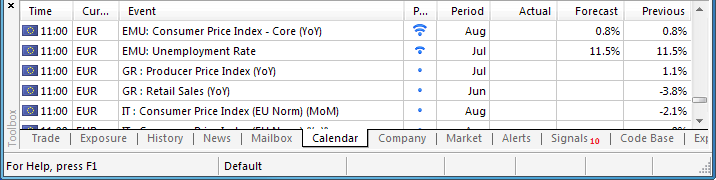

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-08-25 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-08-25 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-08-26 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-08-26 14:00 GMT (or 16:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-08-28 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Flash CPI]

2014-08-28 07:55 GMT (or 09:55 MQ MT5 time) | [EUR - German Unemployment Change]

2014-08-28 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-08-28 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-08-28 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-08-29 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

2014-08-29 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2014-08-29 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

2014-08-29 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Core PCE]

2014-08-29 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-08-29 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart