Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

newdigital, 2014.01.02 21:48

31. How to trade support/resistance bounce in Forex

Forum on trading, automated trading systems and testing trading strategies

Indicators: Support and Resistance

newdigital, 2013.09.23 10:15

Support and Resistance Technical Indicator

Support and Resistance is one of the widely used

concepts in Forex trading. Most traders plot horizontal lines to show

support levels and resistance levels.

There is also an indicator used to plot Support levels automatically and indicate the resistance and support levels.

When it comes to these levels price can either bounce off these levels or break these levels.

If a resistance level is broken price will move higher and the resistance level will turn to a support.

If a support level is broken price will move lower and the support level will turn to a resistance.

Price where the majority of investors believe that prices will move higher, while resistance levels indicate the price at which a majority of investors feel prices will move lower.

Once price has broken through a support level or a resistance level then it is likely that the price will continue moving in that particular direction until it gets to the next support or resistance level.

The more often a support or resistance level is tested or is touched by the price and bounces, the more major that particular support level or resistance level becomes.

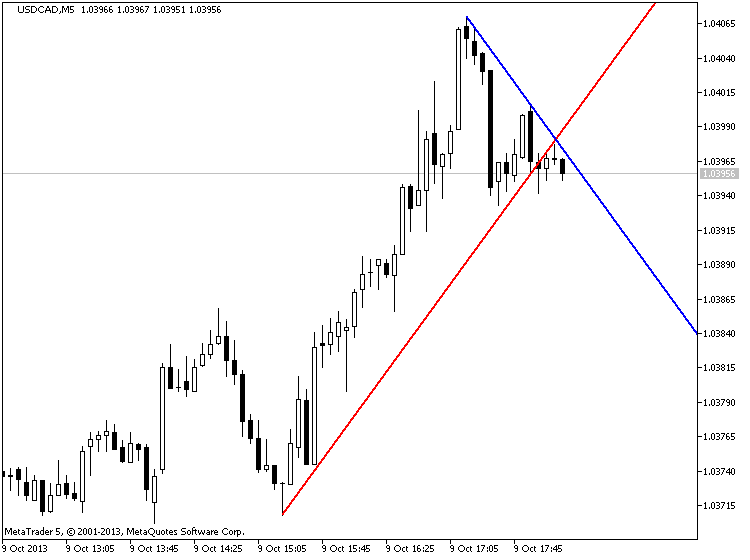

Technical Analysis of Resistance and Support Technical IndicatorThese levels are calculated a trend lines method.

Upward Trend

In an upward trend the resistance and support will generally head upwards

In a downward trend the resistance and support will generally head downwards

I think they are good benchmarks

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.10.09 18:20

How to Exit While Trading with Trendlines

Talking Points:

- Traders should focus on their exit plan just as much as their trade entries.

- Trendline traders could set their stop losses beyond the nearest support or resistance level and set their limits within the nearest support or resistance level.

- Setting exit prices according to support and resistance levels could tip the odds in your favor.

Many traders have a strong set of rules that they follow to enter trades, but have difficulty in selecting their exits. This is troubling because how we exit a trade should be just as important, if not more important than how a trade is entered. After all, our exits ultimately determine if our trades are profitable for us or not. So we need to make sure our exit strategy is just as logical as our entry strategy.

When we place our trades based on trendlines, we are placing them based on support and resistance levels. We are thinking the price will bounce off a trendline like it did in the past. I propose we use the same logic when setting our stops and limits.

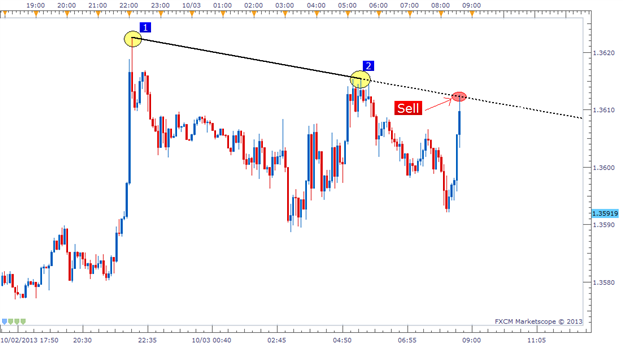

In the example above, it’s easy to see the sell entry that was given to

us based on the bearish trendline. We entered right at the trendline

looking for a bounce back down, but where do we want to exit? When do we

call it quits if the trade goes against us? Where do we place our

profit target? Let’s take a look.

Setting Stops Beyond Support/Resistance

We need to look at placing our stop somewhere above this trendline. If the resistance is broken through, we were wrong on the trade and should accept the loss quickly. It’s possible that price could return back to profitable territory after breaking this resistance, but we cannot rely on being lucky. We can only trade based on what we see.

I like to set my stop 5-25 pips from the closest support/resistance

level depending on the time frame I am trading. The smaller the time

frame of the chart, the tighter I will place my stops. On this trade, I

set my stop 5-6 pips away from my entry since that was beyond the

resistance line as well as the previous swing high (Bounce #2).

Remember that when we set our Stop loss, this is also setting our

monetary risk on the trade. So we also need to consider our trade side

in respect to our Stop loss distance.

Setting Limits Within Support/Resistance

Now that our stop is set, we need to focus on our profit target. For our limit placement, we have two objectives:

- Our limit’s distance needs to be further than our stop’s distance.

- Our limit needs to be placed within the closest support/resistance (by at least 5 pips).

And the reason we want our limit to be placed within the closest support/resistance level (by at least 5 pips) is for the exact same rationale we used to open this trade to begin with. We know prices have a tendency to bounce off price levels they have bounced off of before, so we want to make sure that no support/resistance is in between our entry and our limit level. In the example below you can see I placed my limit 5 pips above the swing low (potential support). This gives price a clear path to a profitable trade.

Trendline Strategy Complete

This trendline strategy is one that can be used universally across all currency pairs and time frames so it is definitely a worthwhile style of trading to learn. The logic behind the entry and exit rules is also something that can be tailored to other types of strategies as well. Good trading!

Forum on trading, automated trading systems and testing trading strategies

Indicator that draws trendlines automatically?

newdigital, 2013.10.30 17:21

Download : MaksiGen_Range_Move MTF

================================

- indicator to download

- some explanation about the system in general how to use

- Trading examples with MT5 statement, more trading is here.

- Paramon trading system iis on this post; How to trade the system - manual trading with live examples - read this page.

================================

MTF systems- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use