Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.01 18:01

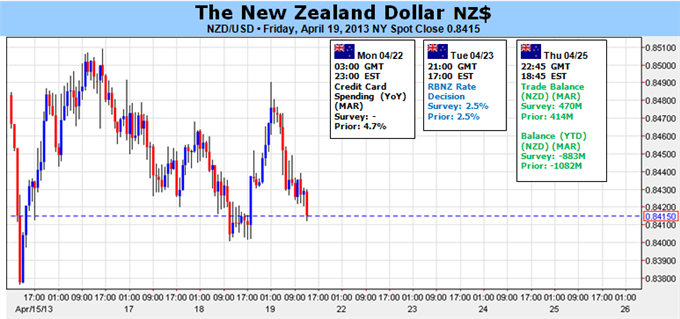

NZDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Canadian Dollar: Neutral

- USD/CAD Pullback May Yield Long Entry

- US New Home Sales Rose to 417K; USDCAD Mixed

- Canadian Dollar Gains after March CPI Slows down

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.03 17:48

2013-02-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

- past data is 57.0

- forecast data is 56.0

- actual data is 51.3 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Manufacturing Index Indicates Notably Slower Growth In January

While the Institute for Supply Management released a report on Monday showing modest growth in U.S. manufacturing activity in the month of January, the pace of growth slowed much more than economists had been anticipating.

The ISM said its purchasing managers index fell to 51.3 in January from a revised 56.5 in December. A reading above 50 indicates continued growth in the manufacturing sector, but economists had expected the index to show a much more modest decrease to a reading of 56.0.

With the much steeper than expected decrease, the purchasing managers index fell to its lowest level since hitting 50.0 in May of 2013.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 43 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.04 19:56

NZD/USD Fundamental Analysis February 5, 2014 (based on fxempire article)

The NZD/USD

gained 40 points this morning against the weak US dollar and a jump in

commodity prices which is helping to support the kiwi economy. The pair

is trading at 0.8126 after falling below the 81 level earlier this week.

New Zealand commodity prices have risen 23 per cent over the past year,

according to the ANZ Commodity Price Index. International prices for 10

of New Zealand’s main commodities increased in the month, three fell

and four were unchanged. Butter prices led the gains, up four per cent

from December and 33 per cent above January last year. Prices of wood

pulp and skim milk powder rose three per cent, while wool, cheese and

whole milk powder prices increased two per cent and casein and logs

advanced one per cent. ANZ said the forestry sub-group reached a record

in January and the dairy sub-group rose to a nine-month high.

Economic Data February 4, 2014 actual v. forecast

Date | Currency | Event | Actual | Forecast | Previous |

|---|---|---|---|---|---|

Feb. 04 | KRW | South Korean CPI (YoY) | 1.1% | 1.1% | 1.1% |

| KRW | South Korean CPI (MoM) | 0.5% | 0.5% | 0.1% |

| JPY | Monetary Base (YoY) | 51.9% | 47.2% | 46.6% |

| NZD | ANZ Commodity Price Index | 1.2% |

| 1.0% |

| AUD | Interest Rate Decision | 2.50% | 2.50% | 2.50% |

| AUD | RBA Rate Statement |

Upcoming Economic Events that affect the AUD, NZD, JPY and USD

Date | Time | Currency | Event | Forecast | Previous |

|---|---|---|---|---|---|

Feb. 05 | 01:45 | CNY | Chinese HSBC Services PMI | 50.9 | |

| 13:15 | USD | ADP Nonfarm Employment Change | 180K | 238K |

| 15:00 | USD | ISM Non-Manufacturing PMI | 53.5 | 53.0 |

| 15:00 | USD | ISM Non-Manufacturing Employment | 55.6 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.04 20:17

Trading the News: New Zealand Employment Change (based on dailyfx article)

Job growth in New Zealand is expected to expand another 0.6% during the

third-quarter, and a marked pickup in employment may spark a near-term

rally in the NZDUSD as it puts increased pressure on the Reserve Bank of

New Zealand (RBNZ) to normalize monetary policy.

What’s Expected:

- Time of release: 02/04/2014 21:45 GMT, 16:45 EST

- Primary Pair Impact: NZDUSD

- Expected: 0.6%

- Previous: 1.2%

-

Forecast: 0.6% to 1.0%

Why Is This Event Important:

There’s growing bets that the RBNZ will raise the benchmark interest

rate at the March 12 meeting as the region faces a heightening risk for

an asset-bubble, and Governor Graeme Wheeler may introduce a series of

rate hikes in 2014 as the economic recovery continues to gather pace.

Bullish NZD Trade: Employment Rises 0.6% or Greater

- Need green, five-minute candle following the release for a potential bullish NZDUSD trade

- If market reaction favors a long trade, buy NZDUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

- Need red, five-minute candle to consider a short New Zealand dollar position

- Carry out the same setup as the bullish NZDUSD trade, just in the opposite direction

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.05 07:49

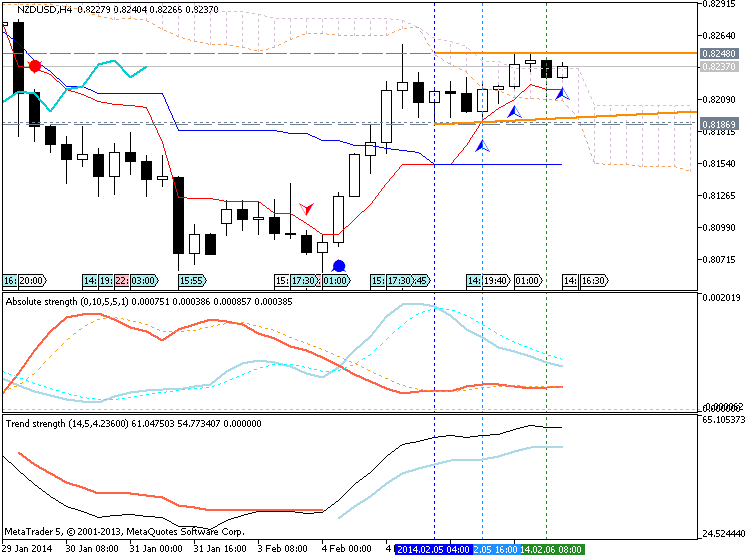

2013-02-04 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - Unemployment Rate]

- past data is 6.2%

- forecast data is 6.0%

- actual data is 6.0% according to the latest press release

if actual < forecast = good for currency (for NZD in our case)

==========

New Zealand Unemployment Rate 6.0% In Q4The jobless rate in New Zealand was 6.0 percent in the fourth quarter of 2013, Statistics New Zealand said on Wednesday.

That was in line with expectations and down from 6.2 percent in the third quarter.

"We're seeing strength across the labor market, particularly in the industries that provide services," industry and labor statistics manager Diane Ramsay said. "The unemployment rate has been falling and employment rising for the last 18 months, with both now at levels last seen in early 2009."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 33 pips price movement by NZD - Unemployment Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.02.06 12:34

NZD/USD higher as rate hike expectations support (based on investing article)

The New Zealand dollar was higher against its U.S. counterpart on Thursday, as recent news the Reserve Bank of New Zealand will hike rates at its next policy meeting in March supported demand for the kiwi.

NZD/USD hit 0.8248 during late Asian trade, the pair's highest since Tuesday; the pair subsequently consolidated at 0.8227, adding 0.16%.

The pair was likely to find support at 0.8188, Thursday's low and resistance at 0.8299, the high of January 29.

The kiwi remained supported after the RBNZ indicated last week that rates are likely to rise in March, while an upbeat fourth quarter jobs report on Wednesday also provided support.

Statistics New Zealand said the number of people employed in the three months to December increased by 1.1% or 24,000, after an additional 28,000 jobs were created in the third quarter. Market expectations had been for an increase of 0.6%.

The unemployment rate fell to 6.0% in the fourth quarter from 6.2% in the previous quarter, in line with market expectations.

Later in the day, the U.S. was to publish data on the trade balance, as well as the weekly report on initial jobless claims.

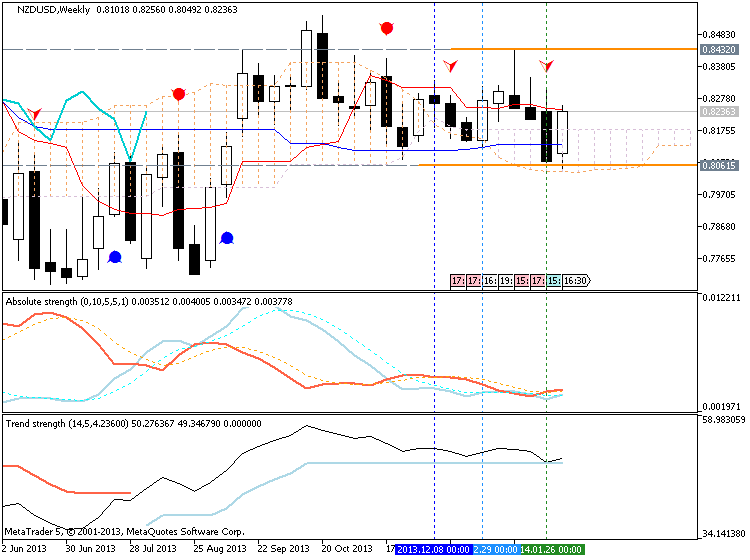

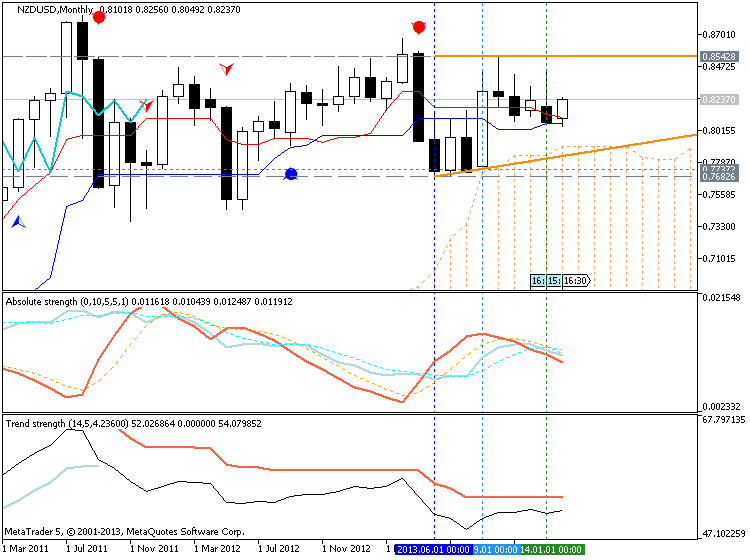

If not so we may see the ranging market condition.

The second scenario is going on to be implemented - for ranging market condition:

- W1 price is inside Ichimoku cloud/kumo for ranging

- D1 price was on local uptrend (market rally) and the price came to Ichimoku cloud too. Ranging.

- H4 timeframe - ranging as well (price is inside kumo)

- MN timeframe - flat

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish and breakdown is going on. Price is trying to break 0.8125 support level on close bar for downtrend to be continuing on D1 timeframe.

H4 : Ranging market condition within primary bearish. If the price will break 0.8061 support so the downtrend will be continuing with good possibility for sell trade.

W1 : Chinkou Span line is going to cross with historical price from above to below

If the price will break 0.8125 support level on close bar on D1 timeframe, and if H4 price will break 0.8061 support so we may see good breakdown for both timeframe (good to open sell trade). If Chinkou Span line will break historical price on W1 timeframe together with the price breaking 0.8116 support on close bar so W1 price will be fully reversed from bullish to bearish.

If not so we may see the ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2013-02-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]2013-02-04 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - Unemployment Rate]

2013-02-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]2013-02-07 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Trade Balance]

2013-02-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bearish

TREND : breakdown

Intraday Chart