Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.05 15:15

Forex Weekly Outlook April 7-11The US dollar gained against most currencies and the euro was on the back foot in a busy week. And now, rate decisions in Japan and the UK, Australian employment data and the FOMC meeting minutes of Yellen’s first decision are the highlights of this week. Here is an outlook on the main market-movers ahead.

The all-important US Non-Farm Payrolls, slightly disappointed with a 192,000 jobs gain in March. The expectations were high since the winter storms were over and a strong rebound was anticipated. Nevertheless, the release still indicates recovery and consists of encouraging details. The taper train remains on track. Mario Draghi sent the euro lower on more dovish rhetoric and despite a lack of action. Is the ECB serious about QE? In the UK, PMIs weighed on the pound, and the loonie finally staged a recovery after a great Canadian jobs report. More volatility ahead? Let’s start:

- Japan rate decision: Tuesday. The Bank of Japan maintained its accommodative monetary policy for the sixth consecutive month, to help the ongoing growth trend in Japan’s economy. Deflation fears have subsided while the BOJ strives to achieve a 2% inflation rate. The bank also upgraded its assessment on capital investment amid a pick-up in business activity. This is the first decision of the BOJ after the sales tax hike and it comes in the one year anniversary of Kuroda’s monetary blitz.

- US JOLTS Job Openings: Tuesday, 14:00. The US economy increased its Job openings to 3.974 million in January from December’s revised print of 3.914 million. However the reading was below market forecast of 4.015 million. The hiring rate and separation rate remained nearly unchanged at 3.3% and 3.2%, respectively. The Federal Reserve’s new chair Janet Yellen highly regards JOLTS Report as a good indicator for hiring in the US economy. Jobs openings in February are expected to reach 3.99 million.

- FOMC Meeting Minutes: Wednesday, 18:00. These are the meeting minutes of Yellen’s first decision, in which a third taper of QE to $55 billion was announced and forward guidance was dropped. More importantly, markets will look for hints about the timing of a rate hike, something that was conveyed by Yellen in the press conference with the 6 months comment and ignited a dollar rally.

- Australian employment data: Thursday, 1:30. The Australian economy increased its labor force by 47,300 jobs in February, following 18,000 climb in January. The reading topped market forecast of 15,300 job addition. However the unemployment rate remained unchanged at a decade high of 6%. Full-time employment edged up by a staggering 80,500 but was offset by a drop in part-time workers. Despite a positive reading, both the RBA and the Treasury believe the unemployment rate will rise in the coming months as the economy struggles to transition from a fading mining investment boom to broader based growth. Australian economy is expected to add 14,300 jobs while the unemployment rate is predicted to remain 6%.

- UK rate decision: Thursday, 11:00. The BoE maintained its rate at a five –year low of 0.5%, in March. The Monetary Policy Committee decided to reinvest 8.1 billion pounds of proceeds from government bonds the Bank bought through its quantitative easing program and which are due to mature in March. The pick-up in recovery witnessed in recent months forced the central bank to reinvent its forward guidance policy. BoE last month broadened the focus of the guidance towards a wider assessment of spare capacity, or slack in the economy, to refrain from raising rates or tightening monetary conditions and also indicated that the first rate hike could come in the second quarter of 2015. No change in rates is expected.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits edged up more than expected last week, reaching 326,000, however the general trend indicates the Us labor market is continuing to improve. The 16,000 addition compared to the previous week increased the four-week moving average to 319,500. Despite this relapse, the number of claims has been generally stable in March suggesting acceleration in the US job market. Claims are expected to decline to 314,000.

- G20 Meetings: Thu-Fri. G20 meetings taking place in Washington DC are attended by finance ministers and central bankers from 20 industrialized nations including the G7 nations – Canada, Italy, France, Germany, Japan, the UK, and the US. The discussions are closed to the press but officials usually give statements to reporters after the meetings have been concluded.

- US Federal Budget Balance: Thursday, 18:00. The federal expenses generally increased in February, but this year the increase was 32% lower than last year. February’s budget deficit reached $193.5 billion compared to the $203.5 billion posted in February 2013. In the five months of the government’s fiscal year, the total is up to $377.5 billion, 24% smaller than last year. The good news is that the deficit has improved to where it’s running at about 3% of GDP, the normal 40-year average. US Federal budget deficit is expected to improve to -$127.5 billion.

- US PPI : Friday, 12:30. Prices of finished goods fell slightly in February, down by 0.1%, following a 0.2% rise in the previous month. Analysts expected a 0.2% increase. On a yearly base, producer prices rose 0.9%, the smallest 12-month increase since last May. The recent drop suggests, inflation remains low. However, Fed officials have expressed concern about the persistence of low inflation. If it remains below target, the Fed may stop scaling back its stimulus measures. A rise of 0.1% is expected this time.

- US UoM Consumer Sentiment: Friday, 13:55. U.S. consumer sentiment declined in March to 79.9 from 81.6 in the prior month, the lowest level since November 2013. Economists expected the index to rise to 81.9. Meanwhile, Conference Board consumer confidence report edged up to 82.3, the highest since 2008 but relied mostly on consumers’ expectations. Consumer sentiment is expected to rise to 81.2.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD D1 : bearish AB=CD pattern

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD D1 : bearish Gartley

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD D1 : bullish retrecement (formed pattern)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD D1 : bearish retracement forming

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.05 18:18

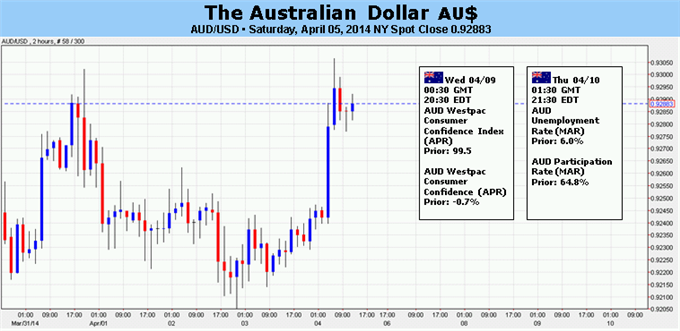

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- Australian Dollar May Rise if the Jobs Report Surprises vs Forecasts

- Hawkish March FOMC Minutes May Undermine Aussie Upside Push

Breakout was finsihing on D1 timeframe and price was on flat market condition within primary bullish trying to break 0.9303 resistance for bullish to be continuing.

Chinkou Span line of Ichimoku indicator is very close to historical price ready to cross it on any direction for good long term price movement. If the price will break 0.9294 resistance so we may see market rally up to the price reversal to primary bullish with secondary ranging.

It is the bullish on H4 with 0.9307 resistance to be crossed to be continuing.

If

D1 price will break 0.9303 resistance level on close so the bullish trend will be contimuing for D1.

If not so EURUSD D1 price will be on correction with ranging price movement within primary bullish.

- Recommendation for short: n/a

- Recommendation to go long: watch the price for breaking 0.9303 resistance level on close D1 bar for possible buy trade

- Trading Summary: breakdown

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-04-07 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - ANZ Job Advertisements]

2014-04-07 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Consumer Credit]

2014-04-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2014-04-08 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Job Openings]

2014-04-08 17:30 GMT (or 19:30 MQ MT5 time) | [USD - FOMC Member Speech]

2014-04-08 18:45 GMT (or 20:45 MQ MT5 time) | [USD - FOMC Member Speaks]

2014-04-09 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2014-04-09 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Home Loans]

2014-04-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-04-10 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

2014-04-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

2014-04-10 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]2014-04-10 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Budget Balance]

2014-04-11 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-04-11 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-04-11 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

| Resistance | Support |

|---|---|

| 0.9303 | 0.9227 |

| 0.9307 | 0.9205 |

| 0.9450 | 0.9119 |

SUMMARY : breakdown

TREND : reversal

Intraday Chart

Good afternoon Newdigital:

Where I can find the indicators that you are using and the template.

I do not have the same image.

Thanks in advance.

A hug.

Hermo.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Breakout was finsihing on D1 timeframe and price was on flat market condition within primary bullish trying to break 0.9303 resistance for bullish to be continuing.

Chinkou Span line of Ichimoku indicator is very close to historical price ready to cross it on any direction for good long term price movement. If the price will break 0.9294 resistance so we may see market rally up to the price reversal to primary bullish with secondary ranging.

It is the bullish on H4 with 0.9307 resistance to be crossed to be continuing.

If D1 price will break 0.9303 resistance level on close so the bullish trend will be contimuing for D1.

If not so EURUSD D1 price will be on correction with ranging price movement within primary bullish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-04-07 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - ANZ Job Advertisements]

2014-04-07 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Consumer Credit]

2014-04-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2014-04-08 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Job Openings]

2014-04-08 17:30 GMT (or 19:30 MQ MT5 time) | [USD - FOMC Member Speech]

2014-04-08 18:45 GMT (or 20:45 MQ MT5 time) | [USD - FOMC Member Speaks]

2014-04-09 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2014-04-09 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Home Loans]

2014-04-09 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-04-10 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

2014-04-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

2014-04-10 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]2014-04-10 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Budget Balance]

2014-04-11 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-04-11 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]2014-04-11 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : breakdown

TREND : reversal

Intraday Chart