You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBPAUD H1 - Potential bearish cypher pattern.

It did not work out. I got stopped out but then it turned the other way drastically. Well this is what I call "Market Trolling".

We now have a potential bearish cypher pattern.Do you know where the market live?

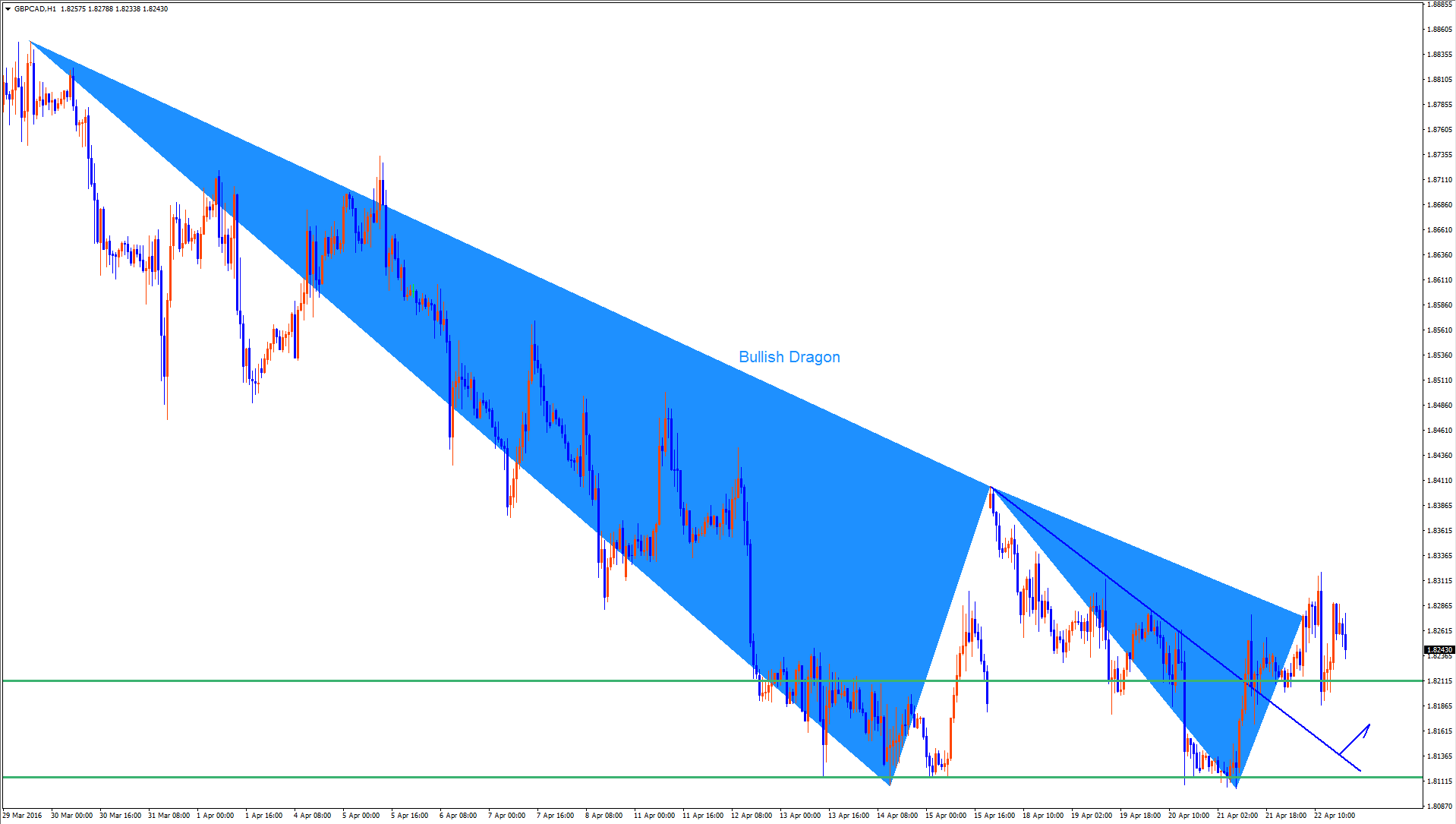

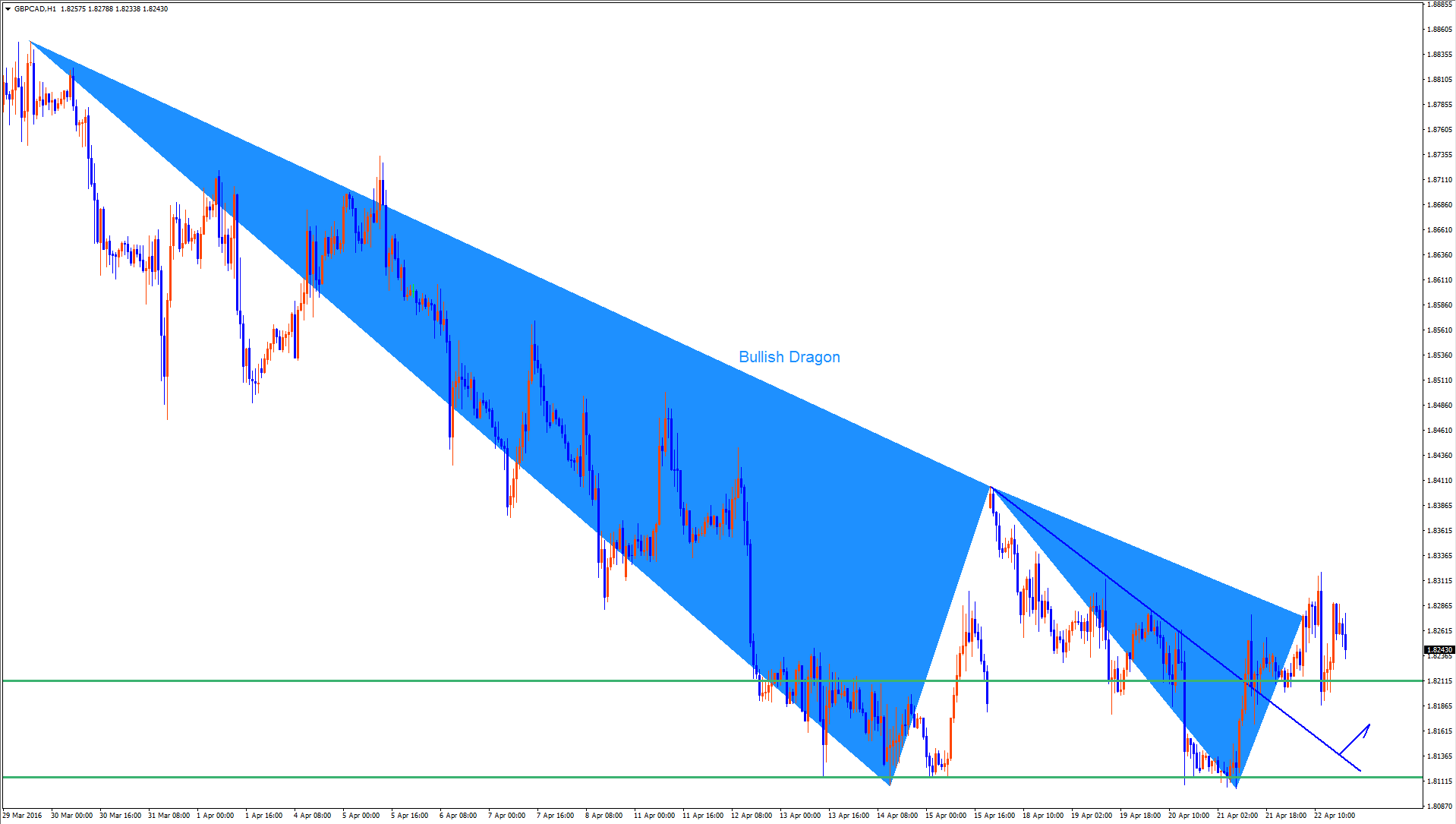

I see a Bullish Dragon on GBPCAD and this pair seems to like Dragons on higher TFs. PA and PVA confirms this Dragon, so for me it's a high potential one.

Do you know where the market live?

I see a Bullish Dragon on GBPCAD and this pair seems to like Dragons on higher TFs. PA and PVA confirms this Dragon, so for me it's a high potential one.

Be careful. The last daily candle is a bearish pin bar. The pair could keep going down and break structure.

AUDCAD Daily - potential bullish gartley + ABCD.

Price broke the channel and bounced twice at the top channel bar. The third time could occur.

That's ok, it's a weak pin bar in a consolidation.

That's ok, it's a weak pin bar in a consolidation.

Have you taken the dragon you posted?

I actually would, but I only trade on M5 and only PA/PVA and am totally happy. H4 or D1 is way to slow for me. Target of this Dragon is 137% of XA.

I heard some traders reviews of what they used for tools in their history. First they tried Bollinger bands and/or MACD, but they totally failed (what a wonder). Then they were into Harmonics, but most ended up with PA and maybe PVA. Complete same story as me and as I read your post (#3517 on p.235) I had to smile. Reminds me again on my history. Seems that many traders have similar experiences and histories.

I actually would, but I only trade on M5 and only PA/PVA and am totally happy. H4 or D1 is way to slow for me. Target of this Dragon is 137% of XA. I heard some traders reviews of what they used for tools in their history. First they tried Bollinger bands and/or MACD, but they totally failed (what a wonder). Then they were into Harmonics, but most ended up with PA and maybe PVA. Complete same story as me and as I read your post (#3517 on p.235) I had to smile. Reminds me again on my history. Seems that many traders have similar experiences and histories.

M5 chart must be too choppy to trade when it comes to PA.However, it is possible to conquer M5 if you practice. I'd like to see your M5 analysis and strategy.

That's interesting to hear. Harmonic patterns are part of PA. PA is the mother of trading in my opinion. I just need to take care of the mother to be profitable. I hit 40% this month but then I got drawdown. I missed many opportunities because of stupid spreads. Also I made stupid mistakes. Well lesson learned.

That's true, Harmonics are PA, but you can't never be sure, same as Japanese cadle sticks. So I read a lot of books, threads and articles to a lot of approaches what fits swing trading, tried out a lot of non-indicator-systems and think, I have my Grail. As often said, M5 isn't better or worse than bigger time frames, but it has some crucial and totally underestimated advantages to them: volume and visual correlation. What very most trader call choppy or trolling of the market do I call opportunity. I absolutely don't care staying in the trend if I see opportunity to counter trade it and choppy markets are also very welcome, it's even easier in choppy markets. It's like a card game (Skat or Hearthstone) and you must learn see the next step - like in fuzzy logic. There are fix rules and everything you have to know is your opponent and what is the most likely next step (learn to think like the money makers and don't care what mass thinks or does, it's wrong).

I like the metapher of the Kansas City Shuffle in financial markets (from Lucky Number Slevin). Adjusted for financial markets: while the crowd (the prey) looks in one direction, the predator looks into the other direction (bullish und bearish) - and because the KCS is no KSC without a murderer, someone has to be 'slaughtered'. You can guess 3 times who this will be. Best example these days is VW. The stock fell like a stone on purpose although everyone knew that every car brand cheated on their exhaust gas tests. Wallstreet banks now can buy very cheap stocks hidding in dark pools - You shall only see theater, but this, and only this was the plan, nothing else.

If you begin to ask the right questions, it's a good start. Newbies ask, what can they win, older traders ask what they can loose.

I actually would, but I only trade on M5 and only PA/PVA and am totally happy. H4 or D1 is way to slow for me. Target of this Dragon is 137% of XA.