You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

As we can see, USDJPY is still our horse for the week, Only problem, RISK/REWARD is still too low, so we'll just have to wait rally for a sell, I would sell eur jpy too but same thing, waiting for a rally in order to sell. But the occasion of a short may just slip off our hand, since the momemtum can really pick up on those pair and sink too the bottom of the chart.... That's the dilemna of the trader. It sometimes can be hard to adjust to increased volatility. Better be safe then sorry.

Hi, GreatYves:

Waiting to chat with you.

Kenneth

To FormulaOneFan:

Thanks for posting the Elwave Daily charts for the 5 currency pairs.

Especially the chart for USDJPY gave me greater confidence in shorting it this morning on the opening bell of the Pacific market, as I saw there were 4 consecutive Negatives and 4 consecutive Downs and chartwse all the price channels were pointing the same direction ie downpath.

Hope you can continue to post these charts as long as your Trial software allows you to.

Regards

Kenneth

To FormulaOneFan:

Thanks for posting the Elwave Daily charts for the 5 currency pairs.

Especially the chart for USDJPY gave me greater confidence in shorting it this morning on the opening bell of the Pacific market, as I saw there were 4 consecutive Negatives and 4 consecutive Downs and chartwse all the price channels were pointing the same direction ie downpath.

Hope you can continue to post these charts as long as your Trial software allows you to.

Regards

KennethHello Kenneth,

I will post these charts until trial version runs out. I may even extend the trial version. lets see how it goes.

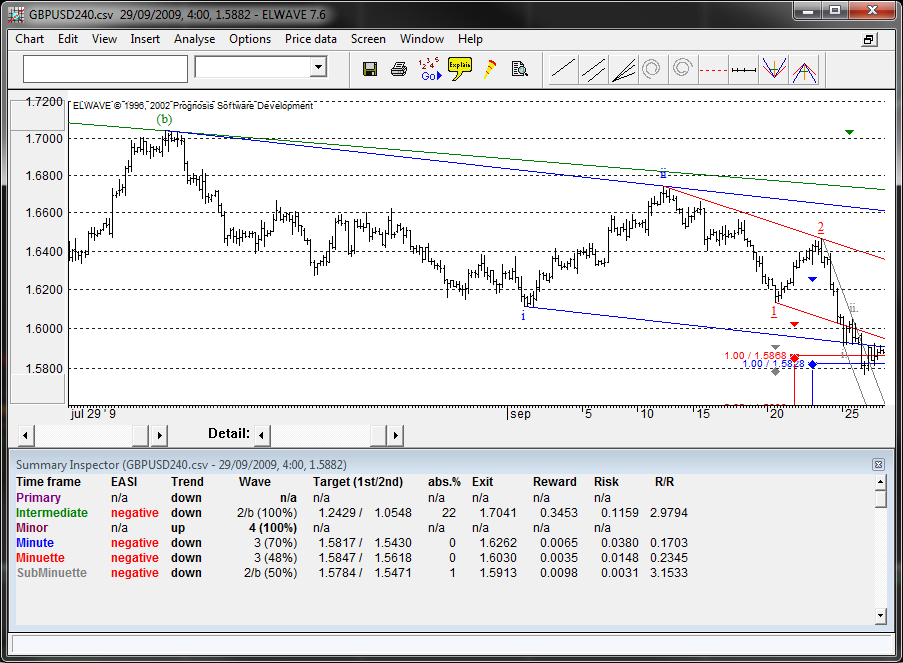

Ok, No more 4 consecutive wave degree pair. After a quick scan, the best outlook would now be sell GBPUSD because it have an interesting R/R and 3 consecutive wave degree. Almost 4. But only on the 4hr chart.

So i should be shorting, with stop very near at 5929. Target 5784 or Mechanical stop.

Ok, No more 4 consecutive wave degree pair. After a quick scan, the best outlook would now be sell GBPUSD because it have an interesting R/R and 3 consecutive wave degree. Almost 4. But only on the 4hr chart.

So i should be shorting, with stop very near at 5929. Target 5784 or Mechanical stop.Yeah that was to tight... Will see later..

This is a wonderful discussion. I have joined this forum mainly because I found this discussion.

However, I do not trade in Forex and hence, I will not be able to follow the discussion here though I am also interested in Elwave.

Can someone explain the text export file from Summary Inspector (attached. Kindly open the same using excel). I find it to be very confusing as there are too many lines of instruction/information.

This is a wonderful discussion. I have joined this forum mainly because I found this discussion.

However, I do not trade in Forex and hence, I will not be able to follow the discussion here though I am also interested in Elwave.

Can someone explain the text export file from Summary Inspector (attached. Kindly open the same using excel). I find it to be very confusing as there are too many lines of instruction/information.Hi, Lalthan:

Interesting to observe that though you do not trade in forex, you have however played with the Elwave software for some other reasons??

Not many who have used Elwave may have gone that far as you in going into this area of Summary Inspector in text file format where you find the report somewhat confusing.

Over the weekend, after I have done my normal weekend articles in this forum, I shall explain to you what all the matrix of figures and jargon of words mean. You are in the mystical world of Elliott Waves.

Until then, be patient.

Kenneth

Thanks Kenneth, i was waiting for you to respond to Lathan, as you are our authority in Elwave software. I would say these are all alternates combinations wave counts and their sub wave count. But since i am not sure i'll let you figure it out.

Thanks Kenneth, i was waiting for you to respond to Lathan, as you are our authority in Elwave software. I would say these are all alternates combinations wave counts and their sub wave count. But since i am not sure i'll let you figure it out.

You make me blush when you said I am "an authority" on Elwave. It happens I have explored into Elwave more but now I am outdated. Normal days we do not have much time to answer these questions, but over weekend we can.

What are friends for? GreatYves. I am always around to give a helping hand.

Did you make some money on your GBPJPY trade yesterday or are you still holding on? I closed mine - just cant resist the money in my pocket than money in the street. - hehehe

Kenneth

You make me blush when you said I am "an authority" on Elwave. It happens I have explored into Elwave more but now I am outdated. Normal days we do not have much time to answer these questions, but over weekend we can.

What are friends for? GreatYves. I am always around to give a helping hand.

Did you make some money on your GBPJPY trade yesterday or are you still holding on? I closed mine - just cant resist the money in my pocket than money in the street. - hehehe

KennethI am holding on. This is a real nice short position, was already 140 pips tonight. I am keeping it till the figure i said in your thread. I moved my stop to break even already, so will it go there? I think it will even go down to at least 135.65, the 61.8 retracement of the whole 2009 correction since we are already pas 50% correction of the wave 4, an if our count is good, i don't see why i would be afraid. You should position a 0.1 lot on this and let it run... It's not to latell