You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Fibonacci

Here a dense Fibonacci e-book that covers about everything Fibonacci, including Fibonacci Ratios on the TIME AXIS of the market witch may interest you Kenneth and others. It is filled with trade setup examples and will greatly enhance anyone Fibonacci comprehension as there is materials that will help every one from beginners to advance traders.

Click this link.

Here a dense Fibonacci e-book that covers about everything Fibonacci, including Fibonacci Ratios on the TIME AXIS of the market witch may interest you Kenneth and others. It is filled with trade setup examples and will greatly enhance anyone Fibonacci comprehension as there is materials that will help every one from beginners to advance traders. Click this link.

On behalf of all readers, we want to thank you for this link.

I am most keen about it especially now that I am doing my research on Time Studies. With the knowledge of Fibonacci price levels and their targeted dates, like what past dictators said: "WE SHALL RULE THE FOREX WORLD" - hehehe. Dont take me seriously - it is a joke for myself. If I dont lose money in forex, I am already happy and if it helps me to make money, I shall be a happier man.

Thanks again, GreatYves.

Kenneth

Wht Improvement in ELWave 9

Elwave 7.6 Hourly eur/usd still very jovial,

F1man, can you please show your 9.1 eur/usd hourly analysis?\

Hi GreatYES can u tell me what are the improvements in ELWAVE 9 as compared to ELWAVE 7.6...thanx

Some major difference in between the signals. But 7.6 is very good at finding major trends. From what i read 9.1 support multiple cpu core so analysis should be faster. I am still using v7.6, as v9.1 is too expensive for me. I am still demo trading.

I have not been able to participate much in this thread as I was "immobilized" due to the fact I was unable to install my old version of Elwave 6.2 in my laptop with a Windows Vistia Home Basic o/s.

Now I managed to have it installed into the X/P o/s which has been added as a partition in my laptop so I can have both Vista and XP.

This old version of Elwave still works fine, and I am attaching herewith the Elwave 6.2 chart for USDJPY which has signaled a SELL with 5 Consecutive Negatives and 5 Consecutive Downs starting from Cycle to Minute with a R/R ratio of 4.59??? This is a rare occasion where we see 5 straights.

I have already executed an order to Sell and I am prepared to hold it for a few days in view of such a strong signal with all the price channels pointing downwards.

Kenneth

As a matter of follow up, I just wanted to see what is the difference between Elwave chart for yesterday and today, and I am attaching herewith the chart for today so that readers can compare it with yesterday's chart.

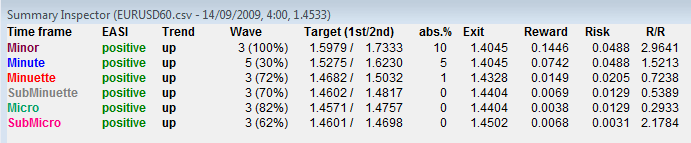

Yesterday, we saw the Summary Inspector was displaying 5 consecutive EASI Negatives and 5 consecutive Trend Downs from Cycle to Minute.

Today the Signals have changed entirely. From Cycle to Primary it is Negative Down, Intermediate is Neutral and No triggers for Minor and Minute.

Based on yesterday's Summary Inspector, USDJPY was a good SELL and what about today???

Let us take a look at the CHART PATTERN and the Wave Tree to see whether we can find some clues as to whether we should continue to Sell/Buy or Stay Aside.

If you want to go into details of the lower levels of waves, then you have to look at the Wave Tree.

Wave Tree: The Primary Trend is the third wave Y of WXY and is a Down trend. Its next lower level is wave c of an Intermediate Wave (a), (b), c and is also a Down trend. Intermediate wave c has 5 legs and it is now in its last leg of Minor wave 5 which in turn is broken down into 5 legs ie Minute. Minute i has been completed. Minute ii – to be sure it has completed, you check it with Fibonacci Ratio and see what ratio it has hit.

(In Elliott Wave Theory, it uses a lot of Fibonacci ratios to calculate. You do not need to know EW theory to use Fibonacci. Fibonacci Ratios can be a system by itself.)

If it is confirmed that Minute ii is completed, you can then conclude Minute iii Down will resume, and you can do a SHORT on this pair.

This morning, I short USDJPY at 90.35 and closed at 90.21 for a gain of 14 pips ??? or US$155.00; saw it was losing momentum, so closed the trade. Now it is only down by 26 pips. (After an order has been executed, it is NO LONGER ELLIOTT WAVE, you have to use your technical tools or judgment to see how far it will take you. As I have always emphasized Elliott Wave is NOT EVERYTHING.)

If you find the explanation a headache, look at the Wave Tree hierarchy as it is easier to understand.

Chart Patterns: I placed EQUAL EMPHASIS on CHART PATTERNS to see (1) the OVERALL DIRECTION and (2) the DIRECTION OF THE SUBWAVES. If they all point in the same direction, then I would seriously consider a trade; if it is sideways, I stay sideways and if it is in waves 2 and 4, I also stay aside. The wave counts help me in that way.

The red dot horizontal line showing 92.42 is the Resistance Line of an earlier minor wave 4. If this line is broken, the wave count will change. So you have to monitor closely.

General: The inconsistencies in Elwave has once again reminded me of a commercial axiom: Let the Buyer Beware of What He is Buying? They are issues which the developers themselves should address.

For me, such softwares are only tools and if the tools have a problem, forget it and if they are useful, why not?

Kenneth

-----------------

Discovery: I just discovered it was not the chart I have attached. My apologies. I am going to do right now.

Attached is the Elwave chart for USDJPY.

My apologies for attaching wrong file earlier.

Kenneth

backtesting and out of sample

Hello everybody,

It's my first post on this thread as by chance I have ELWAVE 7.1 since yesterday and after playing with ELWAVE a bit and reading this thread I have a few questions.

Obviously ELWAVE soft is quite advanced but what is clearly missing for me is a possbility to make automatic backtest and out of sample test for certain settings so actually is quite difficult to verify if Elliot waves are making consistent money. Did anybody try to make kind of backtest and out of sample for signals generated by ELWAVE ??

Another question. I see that TF under consideration is 1H TF ?? Any logic explanation of this choice ?? why not 1m ?? Did anybody try to use it for daytrading ??

Did anybody try to start DDE server and real time data feed ??

Krzysztof

Hello everybody,

It's my first post on this thread as by chance I have ELWAVE 7.1 since yesterday and after playing with ELWAVE a bit and reading this thread I have a few questions.

Obviously ELWAVE soft is quite advanced but what is clearly missing for me is a possbility to make automatic backtest and out of sample test for certain settings so actually is quite difficult to verify if Elliot waves are making consistent money. Did anybody try to make kind of backtest and out of sample for signals generated by ELWAVE ??

Another question. I see that TF under consideration is 1H TF ?? Any logic explanation of this choice ?? why not 1m ?? Did anybody try to use it for daytrading ??

Did anybody try to start DDE server and real time data feed ??

KrzysztofTo identify major trend, it works. As for the signals, it works sometime. As for Time Frame, you better trade the higher time frame. It doesnt work on the micro time frame. I didn't try.

My v7.6 didn't work with the DDE server. You would need to pay for the last version 9.1. Out of reach for me.

Good luck! Let us know if you make lots of pips with it!

I came to the conclusion that i did not need it. As i said in another thread The use of trend line, S&R, some moving average and mostly Fibonacci levels suffice me.