...

Forgot to post : back testing results for EURUSD 1 hour time frame from 01.01.2008

Thanks a lot Mladen.

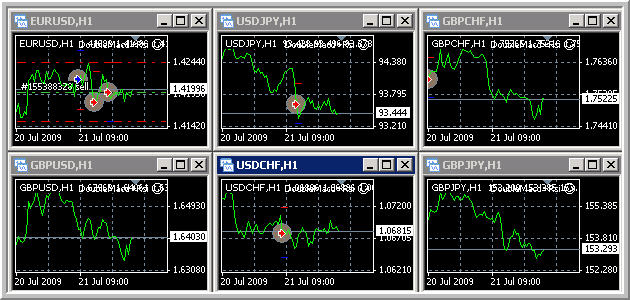

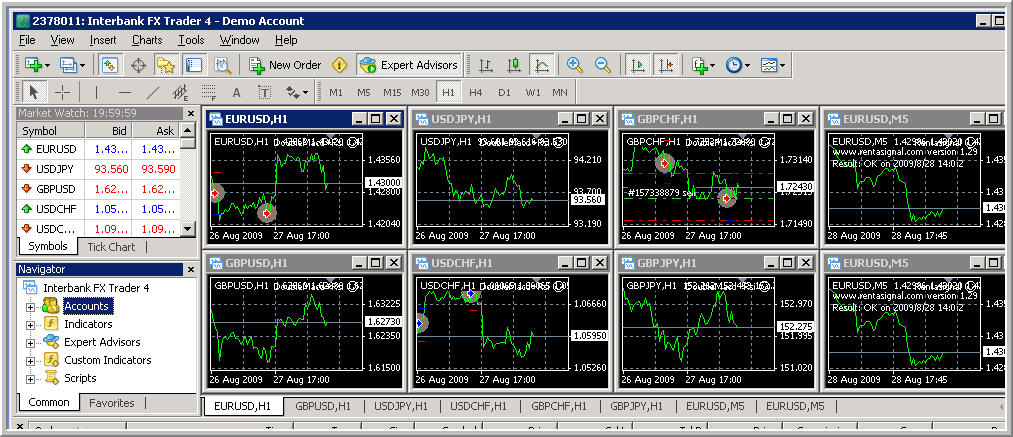

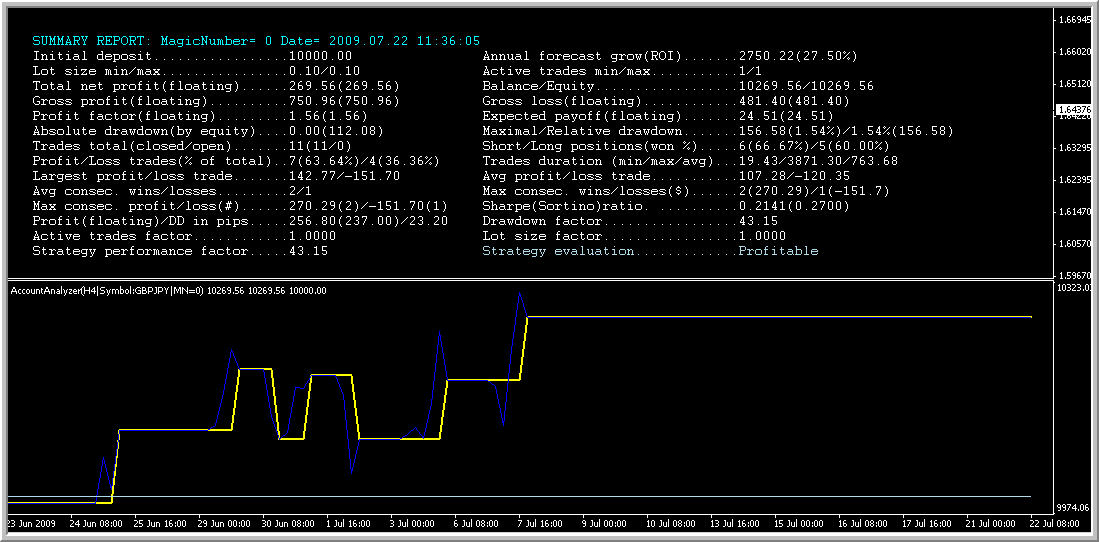

I am forward testing this EA with the following pairs/timeframes for IBFX broker (see image):

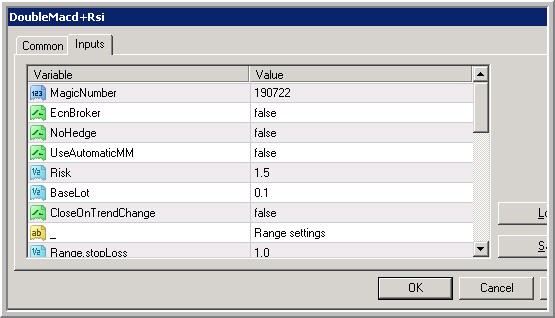

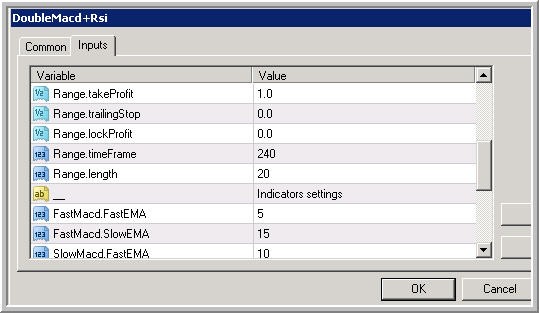

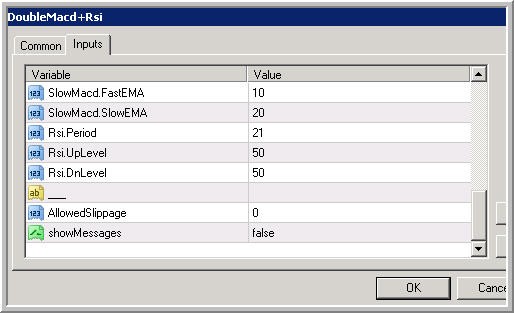

and with the following settings for all the pairs:

----------

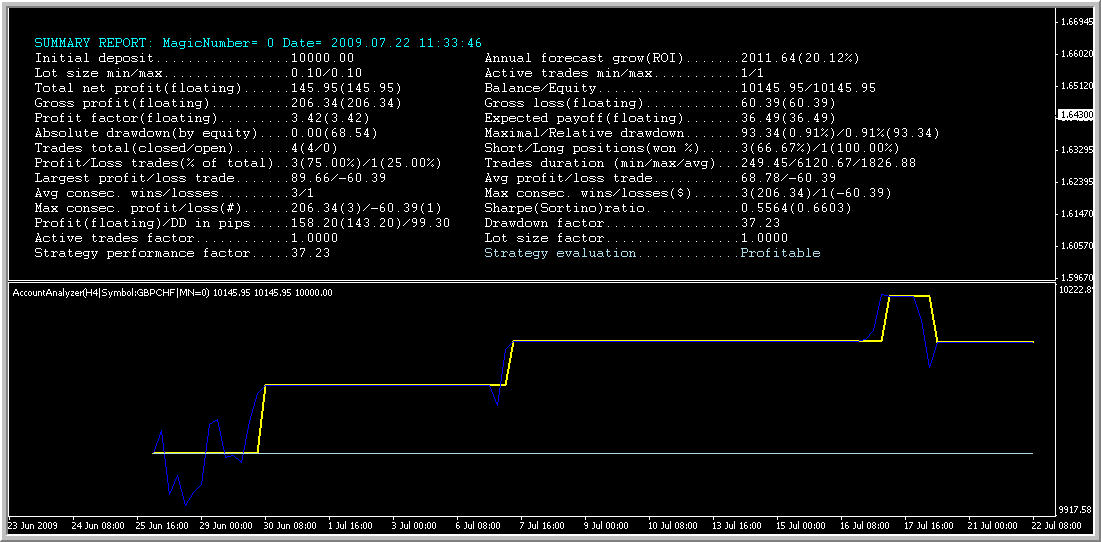

Statements since 16th of June are attached.

Winrar to open attachments https://www.mql5.com/en/forum/173397/page11

-----------

This EA was connected with RAS: https://www.mql5.com/en/forum/173397/page79 as 2 IDs - with and without timefilter.

Interesting

Hi mladen and NewDigital,

interesting system here.

I have a few technical and one serious questions.

1. Once upon a time there was a version with time filter. Where has it gone?

2. mladen: I do not manage to backtest the EA in visual mode. I.e: it doesn't open any trade. Is it normal?

3. NewDigital: in RAS the system is having an overall dismal performance. While some pairs perform very good. Are you using there different parameters for each currency, optimized accordingly, or the same set of parameters for all pairs?

4. The serious question to mladen. I appreciate you as one of the brightest people in this forum. I know that there are many others but you are my preferred, especially because your code is clean and almost 100% understandable also for a non-profi as I am. Now: you are the hero who recoded 70% of indicators here around, correcting them. This means you have a deep understanding and broad knowledge of all the elaborate, complicate, sophisticated things here. Why, then, in your (first public?) EA do you use, for detecting trends, just the two very nice, old, simple, dismissed-by-most-people indicators... MACD and RSI??? Note: this is not a critique, rather the opposite. And I can guess an answer, but I want to have yours.

I mean: there are gazillions of "super-trend, wavish things, digital filters, coloured dashboards and lines, fourier transforms... There are also the last Pee's things you're coding. And you take.... MACD and RSI!

Thanks for all the work you both are sharing!

Bye

F

No timefilter here. I am using normal timefilter in RAS EA for sellers (it is timefilter for vendors in RAS EA). You can see from the image: 2 charts with RAS EA? 1 is normal one, the the other RAS EA with timefilter = true.

So, I am using 1 Metatrader to send the trades with and without timefilter.

No, I did not optimize so much.

I am doing it in the same way as many other elite section EAs: showing the potential of the system using same unchanged settings.

This EA is profitable for few pairs but I attached it to many pairs. Just to see what we will have.

Of course, if you are planning to use this EA so you will have to optinmize the settings for every pair. Or select the profitable ones.

And answers to questions for me :

question 2. There should be trades in visual mode too (not so often, and sicne visual mode does take it time ...) Will check this ...

question 4. An interesting question

From time to time I have a need to "recapitulate" and to take a "fresh start". I have a strong feeling that sometimes, in a rush to make a holly grail (which we all are after - does not matter if we are admitting or not, or what is the form of the "holly one" someone is looking for) we tend to forget some of the basic rules of TA. And then I usually step back a couple of steps and make a new run for it (you can see the direction I am thinking right now from the indicators I am posting - almost like a "tell" in poker). If you take a closer look on internals of Pee's indicators, they are not that far from the "basic line", so they too conform to that "tell"

Taking their age into account, MACD and RSI are two of a very few that managed to survive "time filter" (just imagine 1000s of indicators that were invented in those times and today we do not know their names) and I think and believe that they are a sound base for any system (if we go a bit deeper, than this system is a system of 4 MAs and a RSI and we all must agree that MAs or RSIs are useful)

And, as ND already said : it should be tuned for every symbol separately. After all, those are quite different "beasts" we are trying to beat

regards

mladen

Hi mladen and NewDigital,

interesting system here.

I have a few technical and one serious questions.

1. Once upon a time there was a version with time filter. Where has it gone?

2. mladen: I do not manage to backtest the EA in visual mode. I.e: it doesn't open any trade. Is it normal?

3. NewDigital: in RAS the system is having an overall dismal performance. While some pairs perform very good. Are you using there different parameters for each currency, optimized accordingly, or the same set of parameters for all pairs?

4. The serious question to mladen. I appreciate you as one of the brightest people in this forum. I know that there are many others but you are my preferred, especially because your code is clean and almost 100% understandable also for a non-profi as I am. Now: you are the hero who recoded 70% of indicators here around, correcting them. This means you have a deep understanding and broad knowledge of all the elaborate, complicate, sophisticated things here. Why, then, in your (first public?) EA do you use, for detecting trends, just the two very nice, old, simple, dismissed-by-most-people indicators... MACD and RSI??? Note: this is not a critique, rather the opposite. And I can guess an answer, but I want to have yours.

I mean: there are gazillions of "super-trend, wavish things, digital filters, coloured dashboards and lines, fourier transforms... There are also the last Pee's things you're coding. And you take.... MACD and RSI!

Thanks for all the work you both are sharing!

Bye

FHallo Heroes,

and thank you very much for your clear and useful answers.

NewDigital: don't worry. If I'll use this system, I'll optimize it for all pairs, and probably with more advanced techniques than the usually adopted and suggested here. I posted a message a few days agoabout the Pardo's book, but probably there is not a lot of interest about these topics. Nonetheless I am not so convinced that the method of running EA's on live or demo accounts with "fixed parameters" is a good way to show their potential profitability. Exactely because bad results will likely "buffer out" nice performances. And, with all the nice efforts of developers, I think it is unlikely that a quantitative variable like MACD or RSI (as opposed to qualitative variables e.g. candlestick patterns) without a proper optimization, can be valid as a signal over different instruments and different times. Therefore, if you extend it to other examples, I consider "default parameters" as a sort of "random-guess parameters".

Mladen: two things.

1. Nope, I'm sorry. It is not just matter of being patient. In my tester, in visual mode, it makes NO trades (and not at the time points where I see them after running in background and opening the chart at the end). I fear the problem could be the multitimeframe of the range calculation, that is hard coded within the script. If you run it with showMessages = true, you get from the beginning the warning that there are not enough data for range, and it doesn't disappear even after much more than the equivalent of 20 x H4 bars have appeared on the historical simulation (H1).

2. The second part of your reply is something very valuable, and helps me (and probably any reader) very much.

I eagerly join the team of the holy grail searchers (LOL, how correct you are!  ). Although not skilled and probably experienced as you are, I consumed already several pairs of shoes on the path. And the increasing complexity of systems and indicators sometimes is discouraging, because after transforming, combining, modifying and tweaking indicators, at last you find yourself not far away from the starting point. One of the things I think to have learned (your feedback VERY appreciated) is that probably, in a trade system, it is not what I call the "directional device" (the tool telling you whether to go long or short) that makes the difference, rather, much more, the structure of the system, i.e. the interaction of this directional device with the "trade management" and the "risk management" devices. And so, probably, a 4 MA's + RSI (or another momentum indicator) might have a better effect of the last Fourier transform + TimeSeriesForecast + .... in a not so well structured system.

). Although not skilled and probably experienced as you are, I consumed already several pairs of shoes on the path. And the increasing complexity of systems and indicators sometimes is discouraging, because after transforming, combining, modifying and tweaking indicators, at last you find yourself not far away from the starting point. One of the things I think to have learned (your feedback VERY appreciated) is that probably, in a trade system, it is not what I call the "directional device" (the tool telling you whether to go long or short) that makes the difference, rather, much more, the structure of the system, i.e. the interaction of this directional device with the "trade management" and the "risk management" devices. And so, probably, a 4 MA's + RSI (or another momentum indicator) might have a better effect of the last Fourier transform + TimeSeriesForecast + .... in a not so well structured system.

Of course I have followed with deep interest your last work on Pee. Well, just a comment: sometimes (e.g. the Trend Trigger Factor) look to me like the good old Welles Wilder in a different flavour. The metrics of volatility and the elaboration thereafter are different, but the logic behind is quite similar to the "directional movement system": would you agree?

To conclude, just because I feel so "comfortable" and close to your viewpoit. My "quest" in the moment is focusing on an indicator or a system able to distinguish between ranging and trending markets (without a lot of lag). I know that this is the quest, LOL. But, as I trust you very much, among all the indi's presented in this forum, and of which you're surely a master, which one would be your preferred?

Bye and thanks again.

F

Yes, the parameters were optimized for 1 or 2 pairs and I extended the parameters/settings to the other pairs.

In this case: 1 or 2 pairs are having normal optimized settings and the others - "random-guess parameters" as you said.

As to efforts ... I am forward testing some EAs since 2006 with same paramemets. If EA does not work with long term running so this EA should be improved. Because we are not going to run it for few month or few week. We are trading with it for few years. And the market is changed very often for few years. So, the system works for some pairs, or the system do not work for some pairs. It is the only conclusion should be made.

If the system does not work for some pairs but we want to use it anyway for this pair - the EA should be improved especially for this pair.

...

Just two fast answers for now :

1. Tested it in visual mode on my PC and it works (see the attached picture : it is a visual test with starting date 05.01.2009 on EURUSD)

2. just the part on trending / ranging : we (ND and me) are already working on a couple of solutions. Just one example (don't worry, it is not as complicated as the theory behind it  ) of several we are working on right now : see the picture (all of them are from the same family) and see when the stochastic version is around 0 and when it is not. (a bit bigger picture than necessary but this way shows more)

) of several we are working on right now : see the picture (all of them are from the same family) and see when the stochastic version is around 0 and when it is not. (a bit bigger picture than necessary but this way shows more)

Hallo Heroes,

and thank you very much for your clear and useful answers.

NewDigital: don't worry. If I'll use this system, I'll optimize it for all pairs, and probably with more advanced techniques than the usually adopted and suggested here. I posted a message a few days agoabout the Pardo's book, but probably there is not a lot of interest about these topics. Nonetheless I am not so convinced that the method of running EA's on live or demo accounts with "fixed parameters" is a good way to show their potential profitability. Exactely because bad results will likely "buffer out" nice performances. And, with all the nice efforts of developers, I think it is unlikely that a quantitative variable like MACD or RSI (as opposed to qualitative variables e.g. candlestick patterns) without a proper optimization, can be valid as a signal over different instruments and different times. Therefore, if you extend it to other examples, I consider "default parameters" as a sort of "random-guess parameters".

Mladen: two things.

1. Nope, I'm sorry. It is not just matter of being patient. In my tester, in visual mode, it makes NO trades (and not at the time points where I see them after running in background and opening the chart at the end). I fear the problem could be the multitimeframe of the range calculation, that is hard coded within the script. If you run it with showMessages = true, you get from the beginning the warning that there are not enough data for range, and it doesn't disappear even after much more than the equivalent of 20 x H4 bars have appeared on the historical simulation (H1).

2. The second part of your reply is something very valuable, and helps me (and probably any reader) very much.

I eagerly join the team of the holy grail searchers (LOL, how correct you are!  ). Although not skilled and probably experienced as you are, I consumed already several pairs of shoes on the path. And the increasing complexity of systems and indicators sometimes is discouraging, because after transforming, combining, modifying and tweaking indicators, at last you find yourself not far away from the starting point. One of the things I think to have learned (your feedback VERY appreciated) is that probably, in a trade system, it is not what I call the "directional device" (the tool telling you whether to go long or short) that makes the difference, rather, much more, the structure of the system, i.e. the interaction of this directional device with the "trade management" and the "risk management" devices. And so, probably, a 4 MA's + RSI (or another momentum indicator) might have a better effect of the last Fourier transform + TimeSeriesForecast + .... in a not so well structured system.

). Although not skilled and probably experienced as you are, I consumed already several pairs of shoes on the path. And the increasing complexity of systems and indicators sometimes is discouraging, because after transforming, combining, modifying and tweaking indicators, at last you find yourself not far away from the starting point. One of the things I think to have learned (your feedback VERY appreciated) is that probably, in a trade system, it is not what I call the "directional device" (the tool telling you whether to go long or short) that makes the difference, rather, much more, the structure of the system, i.e. the interaction of this directional device with the "trade management" and the "risk management" devices. And so, probably, a 4 MA's + RSI (or another momentum indicator) might have a better effect of the last Fourier transform + TimeSeriesForecast + .... in a not so well structured system.

Of course I have followed with deep interest your last work on Pee. Well, just a comment: sometimes (e.g. the Trend Trigger Factor) look to me like the good old Welles Wilder in a different flavour. The metrics of volatility and the elaboration thereafter are different, but the logic behind is quite similar to the "directional movement system": would you agree?

To conclude, just because I feel so "comfortable" and close to your viewpoit. My "quest" in the moment is focusing on an indicator or a system able to distinguish between ranging and trending markets (without a lot of lag). I know that this is the quest, LOL. But, as I trust you very much, among all the indi's presented in this forum, and of which you're surely a master, which one would be your preferred?

Bye and thanks again.

FVery interesting

Mmm,

...very interesting replies from both. Thank you very much.

Well, concerning the visual trading that's really strange. But today my terminal should have had some... "digestion problems". Never saw anything like that before: trying to save an html backtesting report, chaning EA several times, the generated html file was... ALWAYS THE SAME!!!????!!!!  . So, perhaps it's a general problem. Better to re-install it???

. So, perhaps it's a general problem. Better to re-install it???

The Garch seems something quite powerful! The stochastic is good for the ranges, and the non-stochastic gets the trend... IN ADVANCE!!!!!

...I suppose this is quite "secret" LOL, and you have 10.000% rights to keep it such... Congratulations!

Now, also after these disappointing fightings with my metatrader, today, I think I'll go back to my nice options for a little while. There the story is quite different than guessing direction.... (i.e. it is not just that, and it is not the most important success factor...)

Thanks again and see you soon again!

F

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Here is one more EA that might be useful (our forward testing showed that it is a moderate risk, "no nonsense" EA )

)

Basis of it are two MACD's (a "fast" one and a "slow" one) and Rsi used as confirmation for entering

___________________________

Some of the issues it solved (in advance