Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.23 05:27

EURUSD fundamentals: December 23 - 27

Monday, December 23

The U.S. is to produce government data

on personal spending and expenditure, while the University of Michigan

is to release revised data on consumer sentiment and inflation

expectations.

Tuesday, December 24

Markets in Germany will remain closed in observance of Christmas Eve, while France is to release data on consumer spending.

The U.S. is to release data on durable goods orders, a leading indicator of production, as well as a report on new home sales.

Wednesday, December 25

Markets in Europe and the U.S. will remain closed for the Christmas Day holiday.

Thursday, December 26

Markets in Europe will remain closed in observance of Boxing Day.

Meanwhile, the U.S. is to release weekly data on initial jobless claims.

Friday, December 27

The U.S. is to round up the week with a report on crude oil supplies.

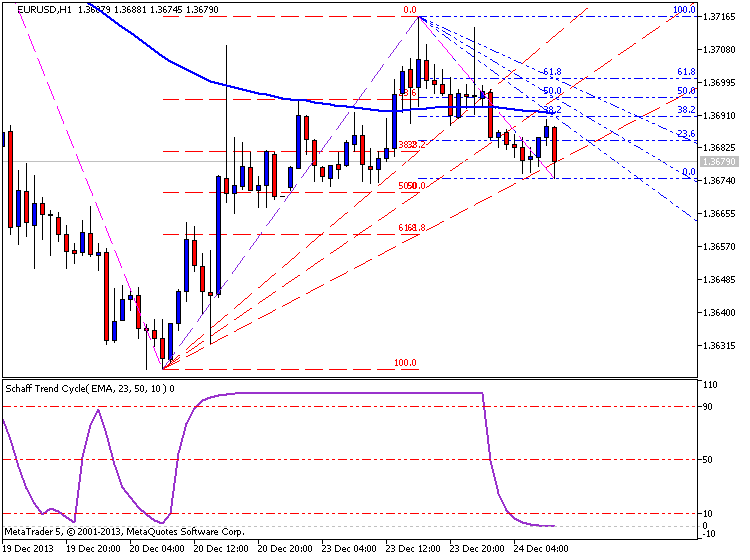

Just update of the situation

Correction is just started on open D1 and H4 bar - we can see it on the image :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_62026.png

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_5975.png

If some of you are using D1 timeframe - wait one day more for this bar to be closed, for H4 timeframe - wait 4 hours more.

H1 timeframe - breakdown is started but on open bar too. Wait for Chinkou Span to be crossed historical price on close bar, and the price to break Sinkou Span A line to open sell trade :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.24 09:38

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

Demands for U.S. Durable Goods are projected to increase 2.0% in November and a strong rebound may spark a bullish reaction in the greenback as the Fed moves away from its easing cycle.

What’s Expected:

- Time of release: 12/24/2013 13:30 GMT, 8:30 EST

- Primary Pair Impact: EURUSD

- Expected: 2.0%

-

Previous: -2.0%

- Forecast: 1.0% to 2.0%

How To Trade This Event Risk

Bullish USD Trade: Orders Rebound 2.0% or Greater

- Need red, five-minute candle following the report to consider a short EURUSD trade

- If the market reaction favors a bullish dollar trade, establish short EURUSD with two position

- Set stop at the near-by swing high/reasonable distance from entry with at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met; set reasonable limit

Bearish USD Trade: Demands Contract for Second Month

- Need green, five-minute candle following the release to look at a long EURUSD entry

- Implement same setup as the bullish USD trade, just in opposite direction

About U.S. Durable Goods Orders (see previous post) :

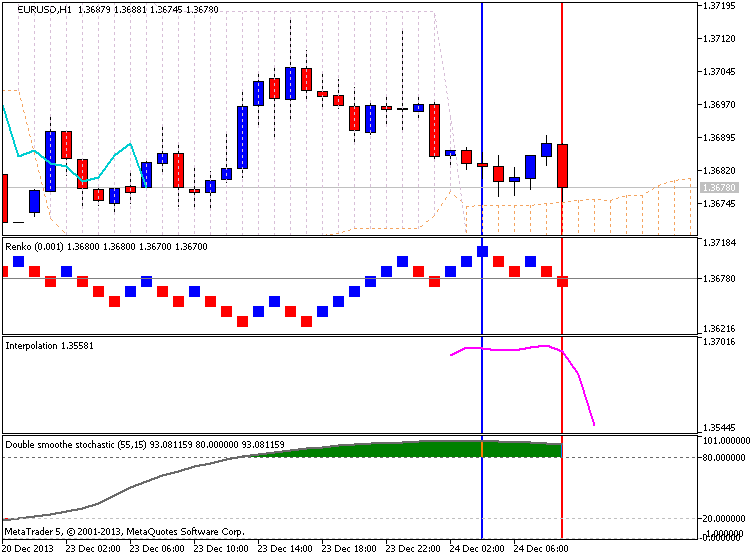

- Actual: 3.5% (according to official press release)

-

Previous: -1.6% (revised from -2.0%)

- Forecast: 1.7% (corrected from 2.0%)

if actual > forecast = good for currency (for USD in our case)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 21 pips price movement by USD Durable Goods Orders

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.26 14:53

2013-12-26 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

- past data is 380K

- forecast data is 345K

- actual data is 338K according to the latest press release

if actual < forecast = good for currency (for USD in our case)

==========

U.S. Weekly Jobless Claims Show Significant Decrease

Reflecting the volatility seen during the holiday season, the Labor Department released a report on Thursday showing a steep drop in weekly jobless claims in the week ended December 21st following the sharp jump seen earlier in the month.

The Labor Department said initial jobless claims tumbled to 338,000, a decrease of 42,000 from the previous week's revised figure of 380,000. Economists had expected claims to drop to 340,000 from the 379,000 originally reported for the previous week.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 14 pips price movement by USD - Unemployment Claims

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.12.27 19:50

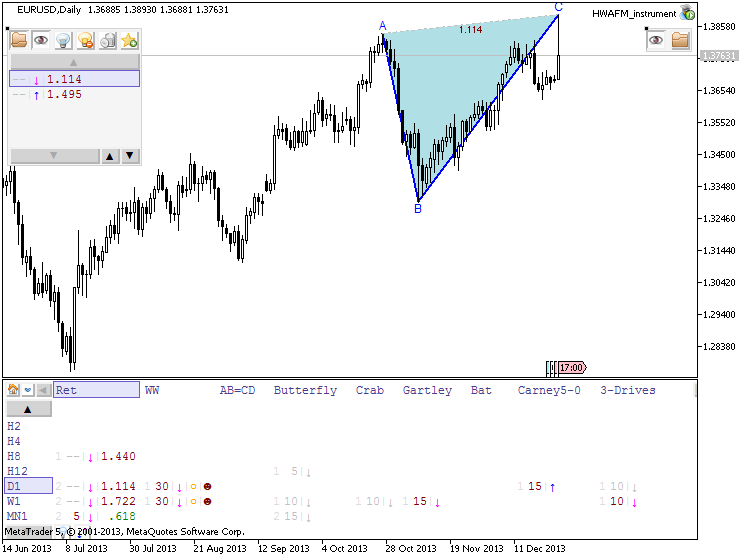

'Where the price will go to' in the beginning of January 2014

Just about EURUSD

Timeframes up to M30 timeframe - uptrend, starting from H1 till MN1 - downtrend.

=======

Why timeframes are important in our case? Well ... MN1 is monthly timeframe. One bar in MN1 timeframe = one month. Means : new bar is open in 1st of January 2014 and close in 1st of February ... so - if MN1 timeframe is showing uptrend - it is long story for at least 3 months or half a year (long term situation). M30 timeframe? One bar in M30 timeframe = 30 minutes. So, if we are having forming pattern on this timeframe - this pattern may be confirmed for half a day for example.

What is confirmation for forming pattern? Example with formed/developed pattern (for EURUSD) - Gartney 5-0 for uptrend :

Do you see pattern? right ... and do you see how the price went to uptrend after this pattern? it is confirmation - this pattern was formed (because it was confirmed) - we expected uptrend and we see - real uptrend. It is too late to open buy trade as everything was done here. This is formed/developed pattern.

next example with forming pattern :

We see that this pattern (Retracement) is showing downtrend. But it is forming pattern as we do not have confirmation for this downtrend. When we see this confirmation so it will be too late to open sell trade sorry ... that is why I am analysing forming patterns.

Thus, we may have uptrend in the very beginning of January 2014 and downtrend in general for this pair for at leats half a year.

=======

BUT!

It was technical analysis only. And technical analysis is providing on the way as "if the price/resistance/support/indicator will go to ... it will be upward ... otherwise - downtrend ...".

Why we are providing technical analysis in so approximate way? because technical analysis is not whole the story ... The whole analysis = technical analysis + fundamental analysis.

What is fundamental analysis? This is news events (economic calendar in MT5). Nut fundamental news events are very unpredictable by actual data ...

That is why we can not tell exactly with high probability about 'Where the price will go to' in the beginning of January 2014

That's all news

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The correction was started on D1 timeframe within primary bullish, and the price is ranging between 1.3811 resistance and 1.3649 support levels. On W1 timeframe - the flat is going for the second week with primary bullish, and if we look at H4 timeframe - the price crossed kumo (Ichimoku cloud) for reversal to bearish but the price is going along the border of the cloud trying to breal this resistance for secondary ranging.

If the price will break 1.0727 resistance level so the primary bullish will be continuing with good upward.If the price will break the bottom border of Ichimoku cloud on H4 timeframe and Chinkou Span will break H4 historical price from above to below on the same time, and if D1 price will break 1.0560 support from above to below - we will see good breakdown on H4 to trend reversal from bullish to bearish, and good correction on D1 timeframe.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-12-23 14:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

2013-12-24 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2013-12-24 15:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2013-12-26 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bullish

TREND : correction

Intraday Chart