Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.23 05:24

USDJPY fundamentals: December 23 - 27

Monday, December 23

Markets in Japan will remain closed in observance of the Emperor's Birthday.

The

U.S. is to produce government data on personal spending and

expenditure, while the University of Michigan is to release revised data

on consumer sentiment and inflation expectations.

Tuesday, December 24

The U.S. is to release data on durable goods orders, a leading indicator of production, as well as a report on new home sales.

Wednesday, December 25

BoJ

Governor Haruhiko Kuroda is due to speak at the Japan Business

Federation, in Tokyo. His comments will be closely scrutinized for clues

regarding future monetary policy.

Markets in the U.S. will remain closed for the Christmas Day holiday.

Thursday, December 26

The

Bank of Japan is to publish the minutes of its latest policy meeting,

which contain valuable insights into economic conditions from the bank’s

perspective.

Later in the day, the Labor Department is to release the weekly report on initial jobless claims.

Friday, December 27

Japan

is to release a series of data, including reports on household

spending, inflation, retail sales and industrial production.

Meanwhile, the U.S. is to round up the week with a report on crude oil supplies.

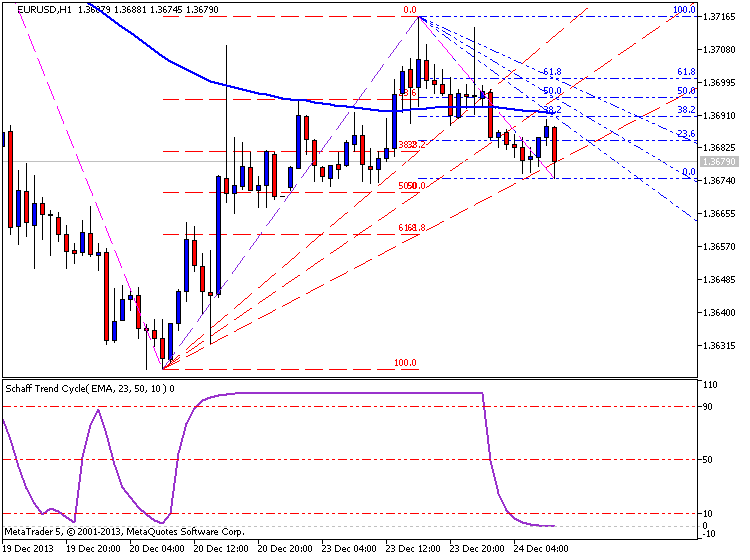

Intraday correction was started and finished (see image on this post), and all we can see on H4 timeframe is primary bullish to be continuing (good for trend following systems) :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_59980.png

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.24 09:38

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

Demands for U.S. Durable Goods are projected to increase 2.0% in November and a strong rebound may spark a bullish reaction in the greenback as the Fed moves away from its easing cycle.

What’s Expected:

- Time of release: 12/24/2013 13:30 GMT, 8:30 EST

- Primary Pair Impact: EURUSD

- Expected: 2.0%

-

Previous: -2.0%

- Forecast: 1.0% to 2.0%

How To Trade This Event Risk

Bullish USD Trade: Orders Rebound 2.0% or Greater

- Need red, five-minute candle following the report to consider a short EURUSD trade

- If the market reaction favors a bullish dollar trade, establish short EURUSD with two position

- Set stop at the near-by swing high/reasonable distance from entry with at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met; set reasonable limit

Bearish USD Trade: Demands Contract for Second Month

- Need green, five-minute candle following the release to look at a long EURUSD entry

- Implement same setup as the bullish USD trade, just in opposite direction

Forum on trading, automated trading systems and testing trading strategies

EURUSD Technical Analysis 22.12 - 29.12: Ranging Correction

newdigital, 2013.12.24 15:14

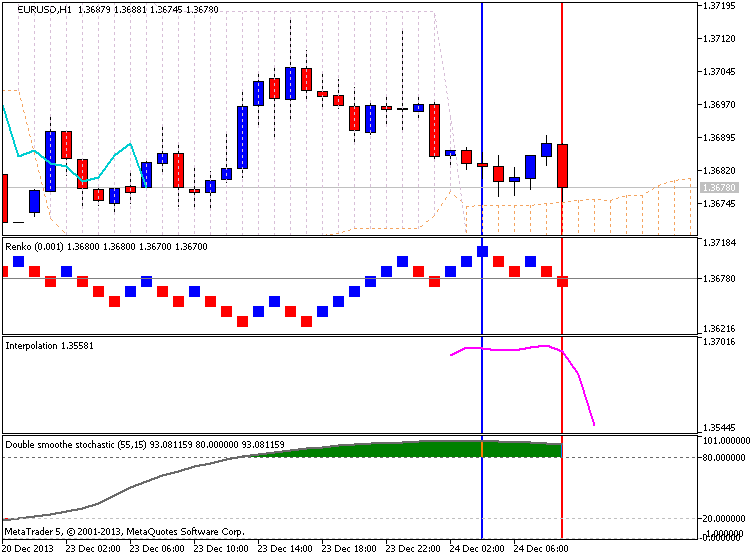

About U.S. Durable Goods Orders (see previous post) :

- Actual: 3.5% (according to official press release)

-

Previous: -1.6% (revised from -2.0%)

- Forecast: 1.7% (corrected from 2.0%)

if actual > forecast = good for currency (for USD in our case)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 10 pips price movement by USD Durable Goods Orders

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.25 08:03

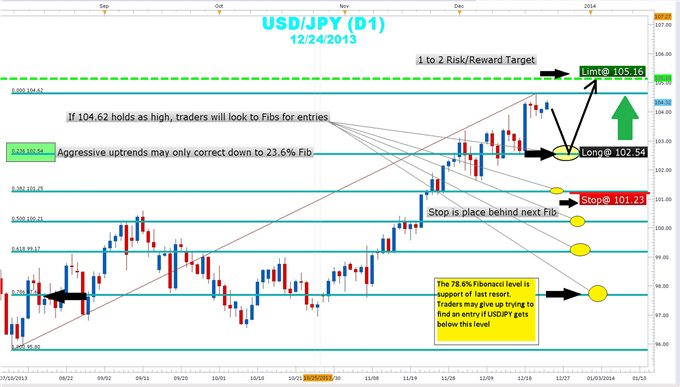

Trading a USDJPY Pullback Using Fibonacci (based on dailyfx.com article)

- USDJPY has been on an uptrend and, after a brief pullback, may continue to rally higher

- Typically, a profit-taking decline ends at one of four major Fibonacci support zones

- Multiple lots can be used to spread out the risk at different Fib levels

Fueled by an ultra-easy Bank of Japan monetary policy and a combination

of stronger U.S. economic data and rising interest rates, USDJPY has

trended up strongly. The surge in USDJPY in November from the 98.00 area

to the 104.00 handle was as textbook uptrend with shallow pullbacks

disappointing bargain hunters who were looking for a bigger correction.

However, Forex traders may get their chance as USDJPY has run into resistance just short of the 105.00 handle at 104.62 and with the Christmas holidays just around the corner, a profit taking present-buying decline may be in order as traders cash in. But where do Forex traders enter?

Trading Setup

The yen pair have been challenging because in order to draw a Fibonacci retracement, an established low is connected to an established high. If price fails to move lower and makes a new high, then the lines have to be redrawn. Using the October 8th low at 96.55 as our starting point for the Fibonacci tool and connecting it to the December 20th high at 104.62, we can establish five levels of potential Fibonacci support:

| Fibonacci Level | Price |

|---|---|

| 23.6% | 102.54 |

| 38.2% | 101.25 |

| 50% | 100.21 |

| 61.8% | 99.17 |

| 78.6% | 97.69 |

The Trading Plan

Once USDJPY rebounds from the 23.6 Fib level at 102.54 and starts moving

up, enter long with a protective stop-loss placed about 4-pips below

the next level of Fibonacci support under the entry around 101.23. A

limit can be set at 1.0516 which is slightly above the recent high made

on December 20th at 104.62. We are looking to risk 131 pips to make 262

pips in profit. In the event that USDJPY does not pullback but resumes

the move higher, we would need to redraw our Fibs after the high is

established and the profit-taking decline is confirmed.

Just a reminder that though Fibonacci can show great precision and

forecasting price targets and rebound zones, traders have to remain

flexible in their view of the charts and price action. USDJPY could

correct lower to the 38%, 50% or the 78.6% retracements before turning

around and heading higher. So if you are stopped out initially, don’t be

discouraged as it could take more than one attempt to catch a ride on

this trend. This is the reason that it is recommended that traders risk

no more than 2% of their account on any one trade. By only deploying a

small amount of your capital on any one trade, your account lives to

trade another day! Some traders may take their 2% position and divided

into three parts. In this way they can place a third at the 23.6% level,

and another third at the 38.2% Fibo, and the final third at the 61.8%

level. A stop on all the positions would be placed just below the 78.6%

“Fibo of last resort”. Using this method spreads out the risk over

smaller positions. Whether you choose an “the all in” approach or an

incremental method, Fibonacci gives you the road map to rejoin the

trend.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.26 06:37

2013-12-25 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

Yen Declines After BoJ Minutes

The Japanese yen lost ground against other major currencies in early Asian deals on Thursday as minutes of the Bank of Japan's latest monetary policy meeting showed that some board members expressed concern over the deceleration of real GDP growth rate during the July-September quarter.

Some members observed that there were unfavorable developments with respect to the results of the real GDP growth rate in the third quarter, taking into consideration of the degree of the contribution of inventories to real GDP growth and fall in compensation to employees from the prior quarter, it showed.

"One member said that the deceleration in the real GDP growth rate might not be a temporary development but rather could represent a downward shift in its trend, the minutes revealed.

Meanwhile, the members agreed to maintain the current guideline that the Bank would conduct money market operations to increase monetary base at an annual pace of about 60-70 trillion yen, the minutes of the BOJ's November 20-21 meeting said.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Strong bullish trend is still going on for D1 timeframe, and price just was stopped by 104.36 resistance level. But secondary correction was started within primary bullish on H4 timeframe with good sell signal on open bar, and the price is floating between 103.85 and 104.63 support/resistance levels. Anyway, we see that good breakout is going on fpr W1 timeframe for the second week and seems this general trend will be continuing for this week too.

If the price will break 104.36 resistance on D1 timeframe and 103.92 resistance on W1 close bar - bullish will be continuingIf the price will break 103.85 support level we may see good breakdown on H4

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2013-12-23 14:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

2013-12-24 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2013-12-24 15:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2013-12-24 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - CSPI]

2013-12-25 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Monetary Policy Meeting Minutes]

2013-12-26 05:00 GMT (or 06:30 MQ MT5 time) | [JPY - Housing Starts]

2013-12-26 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2013-12-26 23:30 GMT (or 00:30 MQ MT5 time) | [JPY - CPI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : bullish

TREND : correction

Intraday Chart