EURUSD Technical Analysis 2016, December: ranging market condition within the bearish area of the chart

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.26 12:30

Weekly Outlook for EUR/USD: 2016, November 27 - December 04 (based on the article)

EUR/USD dipped to new lows but did not experience the magnitude of the previous weeks. Fresh inflation figures stand out as we enter the final month of 2016.

- Monetary data: Monday, 9:00. According to the ECB, M3 Money Supply, or the amount of money in circulation, rose at an annual pace of 5%, and no change is expected. Private loans advanced at a rate of 1.8% and a rise to 1.9% is predicted. Both numbers have been stable of late.

- Mario Draghi talks: Monday, 14:00. The President of the ECB testifies once again in Brussels. His previous comments were relatively dovish, and there is a good chance he repeats them now. Tension is growing towards the ECB’s decision in December.

- German CPI: Tuesday: the German states release the data throughout the morning with the all-German figure at 13:00. Prices rose in Germany by 0.2% in October. We now get the preliminary numbers for November. The German numbers feed into the all-European figures and they will impact the ECB. A rise of 0.1% m/m is on the cards.

- French Consumer Spending: Tuesday, 7:45. Back in September, the volume of sales in Europe’s second largest economy disappointed with a drop of 0.2% against expectations for a rise. A rise of 0.2% is predicted.

- Spanish CPI: Tuesday, 8:00. Spain suffered from one of the deepest levels of deflation but managed to return to price rises. It saw an annual advance of 0.7% back in October. We now get the preliminary data for November. A rise of 0.5% is projected.

- German Retail Sales: Wednesday, 7:00. The volume of retail sales disappointed with a big drop of 1.4% in September. For the month of October, an increase of 1% is expected.

- French CPI: Wednesday, 7:45. Hours before the all-European release, we get figures from the second largest economy. Prices stalled back in October on a monthly basis. A slide of 0.1% is projected.

- German Unemployment Change: Wednesday, 8:55. Germany enjoys a rather consistent drop in the level of unemployment. The month of September saw a drop of 13K in the number of unemployed. A drop of 6K is estimated.

- CPI: Wednesday, 10:00. This is the first estimate of euro-zone inflation for November, data that will be closely watched by the ECB in Frankfurt. In October, headline inflation rose by 0.5%, an improvement led by the diminishing effect of the fall in oil prices. However, core inflation remained stuck at 0.8%. Another tick up is predicted in headline CPI, to 0.6%, while core inflation is projected to remain unchanged.

- Mario Draghi talks: Wednesday, 12:30. The President of the ECB will make a second apperance this week, this time in Madrid, where the future of Europe is on the agenda. While monetary policy is officially off the cards, anything related to future moves could still slip.

- Manufacturing PMIs: Thursday: Spain at 8:15, Italy at 8:45, final French figure at 8:50, final German data at 8:55 and the final euro-zone data at 9:00. Back in October, Spain had a score of 53.3 points, above the 50 point threshold separating expansion from contraction. A score of 53.7 is expected now.. Italy had a lower score of 50.9 points and 51.4 is forecast now. The initial number for France stood at 51.5 points in November. Germany had 54.4 and the whole euro-zone at 53.7 points. These numbers will probably be confirmed now.

- Unemployment Rate: Thursday, 10:00. The unemployment rate in the Euro-zone had a few great months, sliding from the highs, but afterward, it stalled. In September it reached 10%. A repeat is estimated now.

- Spanish Unemployment Change: Friday, 8:00. Spain still has a very high unemployment rate and the monthly release of the change in unemployment is eyed. Back in October, Spain saw a rise of 44.7K. A drop of 25.8K is predicted.

- PPI: Friday, 10:00. The Producer Price Index ticked up by 0.1% in September. These figures eventually reach consumers. A rise of 0.4% is on the cards.

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.11.28 08:54

Some people asked about indicators I am using for my market condition analysis (MT5) so please find indicators and template to download from the following post:

Market condition setup (indicators and template) is here

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.28 12:34

Weekly Review Fundamentals: Non-Farm Payrolls, GDP, CB Consumer Confidence and OPEC Meetings (based on the article)

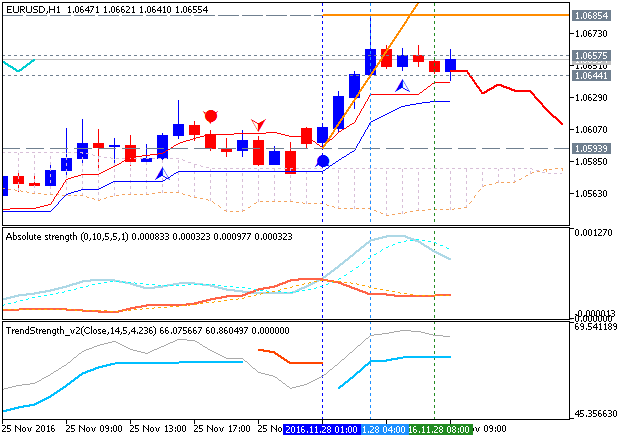

EURUSD daily price is located below Ichimoku cloud in the bearish area of the chart. The price is on ranging within very narrow s/r levels waiting for the primary bearish trend to be resumed or for the secondary rally to be started.

- "Some important economic reports are due out later in the week, including the monthly jobs report and new figures about economic growth. Meanwhile, the Federal Reserve will be in focus as well, with a number of speeches from Fed officials and the central bank's so-called Beige Book."

- "This might come as a surprise, considering the news flow of the last 11 months. In the U.S., uncertainty concerning the presidential election for much of the year added a headwind to the economy. There has been some risks from overseas as well: slowing growth in commodity-guzzling China, the Brexit vote, the health of the European financial system, an OPEC that seems to be constantly threatening a reduction in production and the ongoing Syrian refuge crisis."

- "On the Fed, the minutes of the November 2 FOMC meeting showed that members are still leaning towards a December rate hike. However, there were polarizing opinion concerning the amount of labor market slack and the risks plaguing the 2 percent inflation target. The December FOMC meeting is scheduled for December 13-14."

If the daily price breaks 1.0517 support level to below on close bar so the bearish trend will be resumed.

If the price breaks 1.0657 resistance level to above on close daily bar so the local uptrend as the secondary rally within the primary bearish market condition will be started.

If not so the price will be on bearish ranging withn the levels waiting for direction.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.28 15:30

Intra-Day Fundamentals - EUR/USD, USD/CNH and US Dollar Index: ECB President Draghi Speech

2016-11-28 14:00 GMT | [EUR - ECB President Draghi Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - ECB President Draghi Speaks] = Speech about the European Central Bank's perspective on economic and monetary developments and the consequences of the Brexit before the European Parliament's Economic Committee, in Brussels.

==========

From official release:

- "It is, in fact, essential to further strengthen and develop the Single Market. In the area of financial services we have made significant progress. The Single Market for financial services is now supported by the Single Rulebook for banks and by common supervisory institutions. Within the euro area we went further with the banking union. As I have said, we are not at the end of this process. For instance, financial integration through a fully fledged Capital Markets Union could diversify financing sources for European companies. By fostering private risk-sharing, it can also contribute to a more resilient European economy."

- "It is encouraging to see that recent opinion surveys show support for European integration increasing since the UK referendum, contrary to the expectations of many. At the same time, there are lessons to be learnt. The key lesson is that the European Union has to deliver on key objectives from the citizens’ perspective if it is to rekindle trust in the European project. And to address the widespread feelings of insecurity, including economic insecurity, the European project needs strong economic foundations. For the euro area economy, this means strengthening the recovery, preserving financial stability and addressing the remaining vulnerabilities of Economic and Monetary Union."

==========

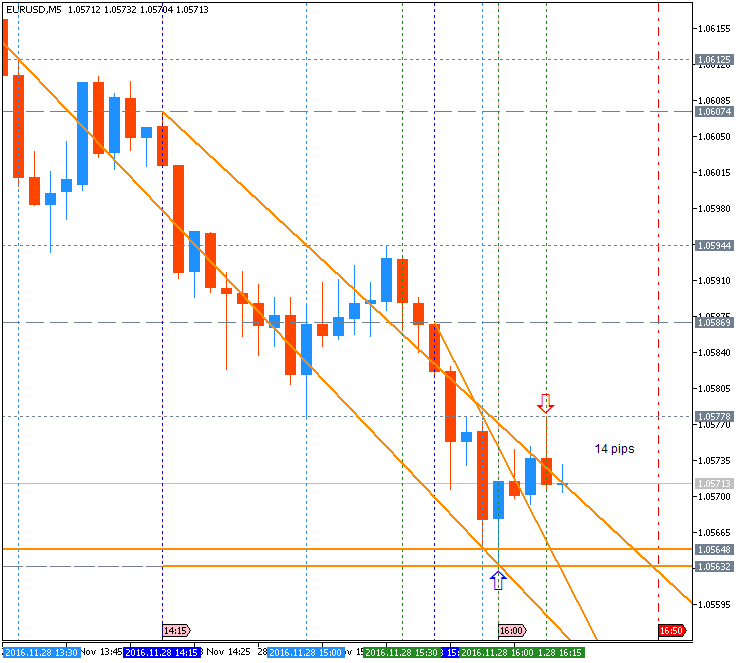

EUR/USD M5: 14 pips range price movement by ECB President Draghi Speech news events

==========

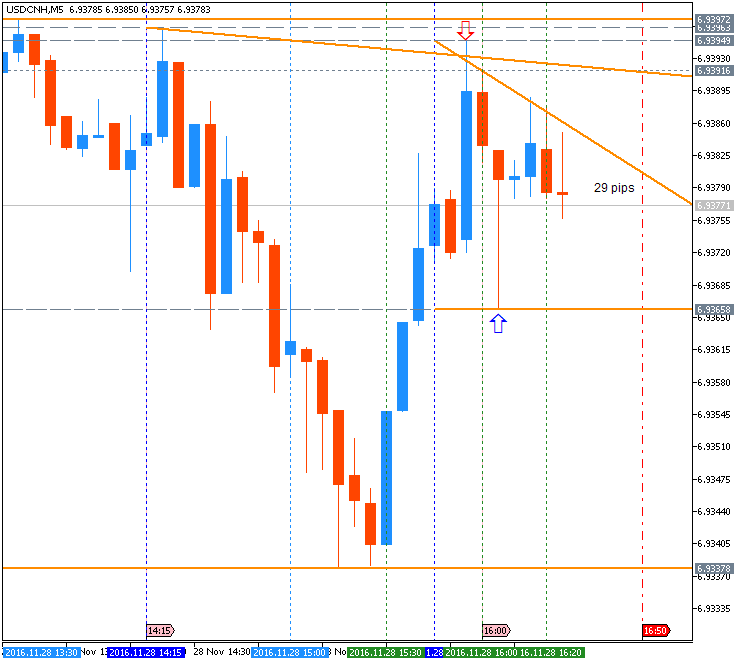

USD/CNH M5: 29 pips range price movement by ECB President Draghi Speech news events

==========

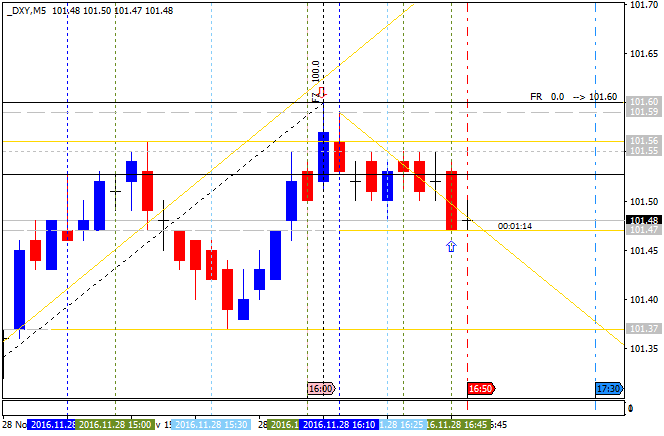

US Dollar Index M5: range price movement by ECB President Draghi Speech news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.29 11:21

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: ranging within 1.0518/1.0684 levels.

H4 price is located below 100 period SMA (100 SMA) and 200 period SMA (200 SMA) in the bearish area of the chart for the ranging within the following key support/resistance levels:

- 1.0684 resistance level located near and below 100 SMA in the secondary rally to be started, and

- 1.0518 support level located below 100/200 SMA in the primary ebarish trend to be resumed.

If

the price breaks 1.0684 level to above so the local uptrend as the secondary rally within the primary bearish trend will be started, , and if the price breaks 1.0518 suppoer level to below so the

bearish trend will be resumed.

Daily price is located below 100/200 SMA for the bearish market condition with the ranging within 1.0518/1.0684 levels waiting for the bearish trend to be continuing or for the rally to be started.

Anyway,

United Overseas Bank is considering the EUR/USD price to be

on ranging market condition within the primary bearish trend.

"We just turned neutral on EUR yesterday and there is no change to the

view. The current movement is viewed as part of a consolidation phase,

likely within a 1.0550/1.0750 range."

- If the price will break 1.0684

resistance level on close bar so the local uptrend as the secondary rally within the primary bearish market condition will be started.

- If price will break 1.0518

support on daily bar so the primary bearish trend will be resumed.

- If not so the price will be on bearish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.29 15:06

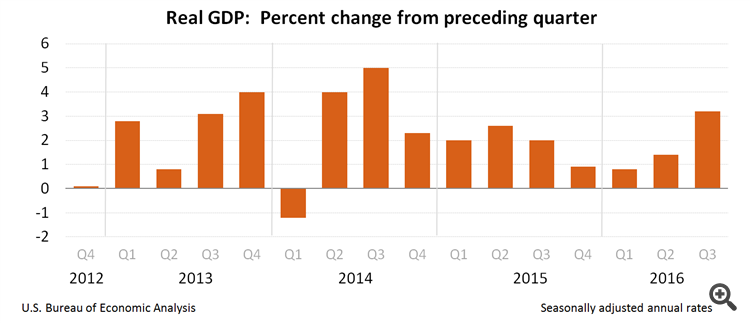

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. Gross Domestic Product

2016-11-29 13:30 GMT | [USD - GDP]

- past data is 2.9%

- forecast data is 3.0%

- actual data is 3.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the value of all goods and services produced by the economy.

==========

From official release:

==========

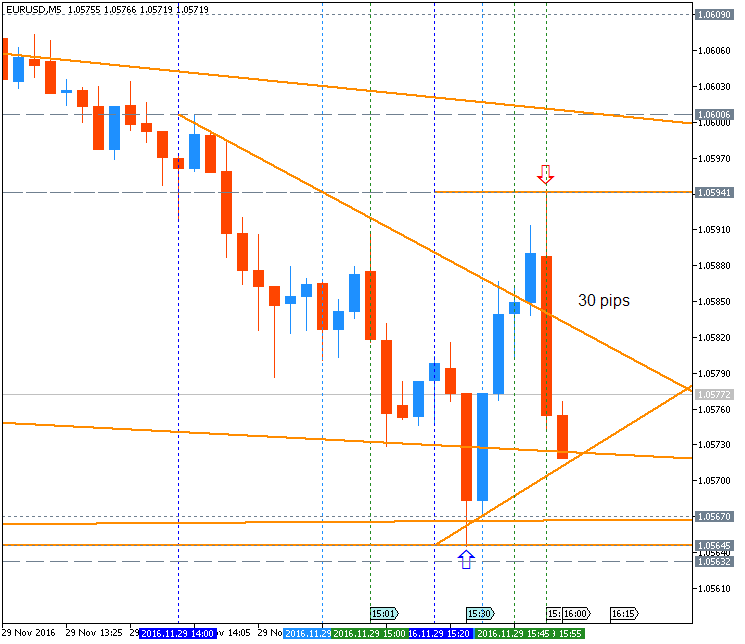

EUR/USD M5: 30 pips range price movement by U.S. Gross Domestic Product news events

==========

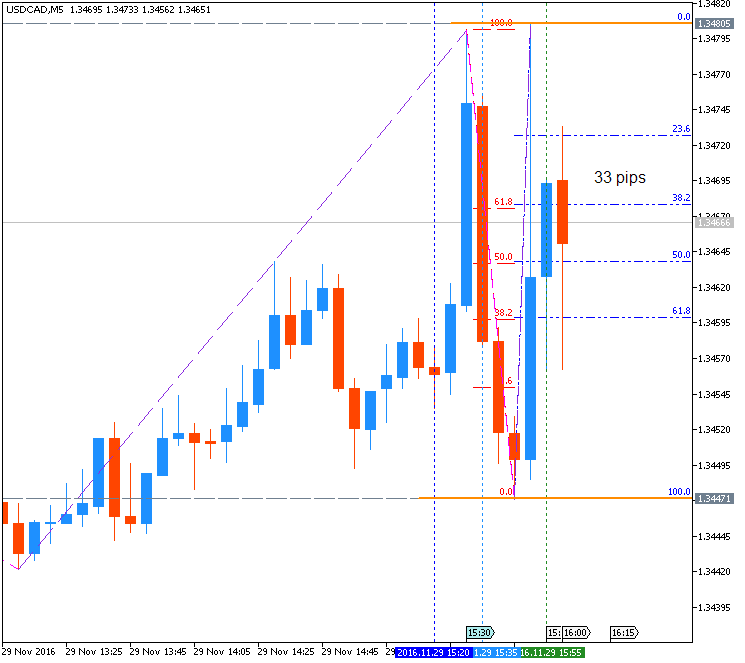

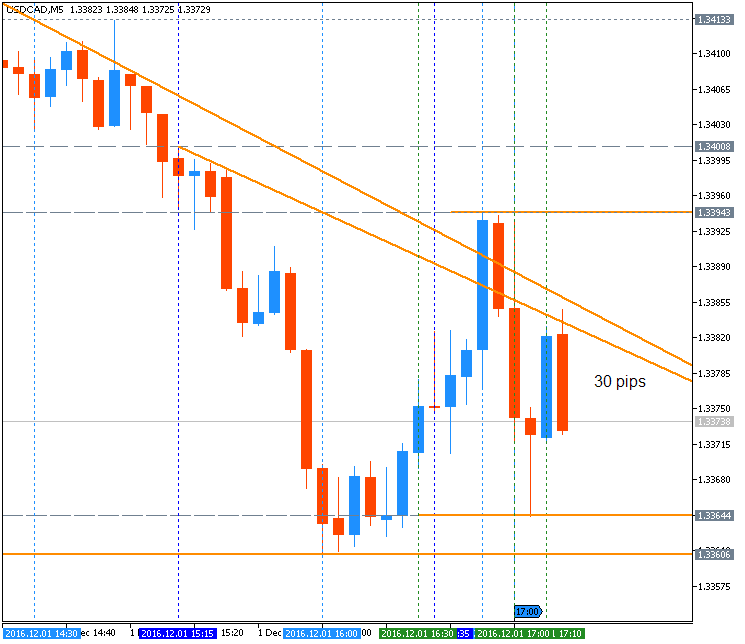

USD/CAD M5: 33 pips range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.29 18:23

Intra-Day Fundamentals - EUR/USD, GOLD (XAU/USD) and Dax Index: The Conference Board Consumer Confidence

2016-11-29 15:00 GMT | [USD - CB Consumer Confidence]

- past data is 100.8

- forecast data is 101.3

- actual data is 107.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report:

"The Conference Board Consumer Confidence Index®, which had declined in

October, increased significantly in November. The Index now stands at

107.1 (1985=100), up from 100.8 in October. The Present Situation Index

increased from 123.1 to 130.3, while the Expectations Index improved

from 86.0 last month to 91.7."

==========

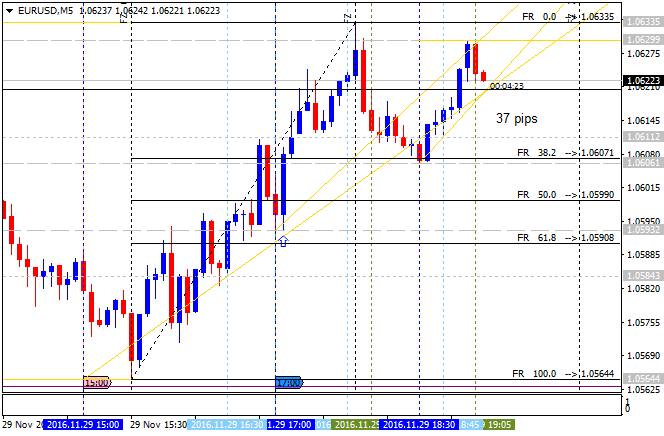

EUR/USD M5: 37 pips range price movement by CB Consumer Confidence news events

==========

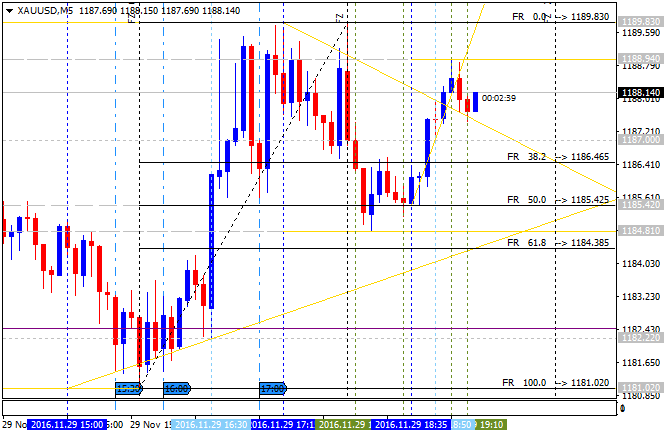

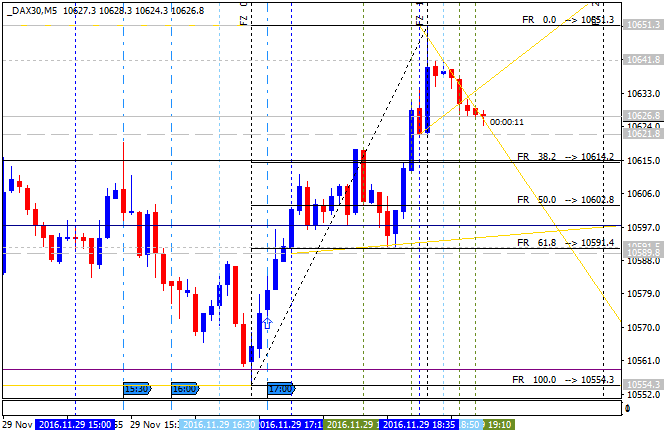

XAU/USD M5: range pips price movement by CB Consumer Confidence news events

==========

Dax Index M5: range pips price movement by CB Consumer Confidence news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.30 14:02

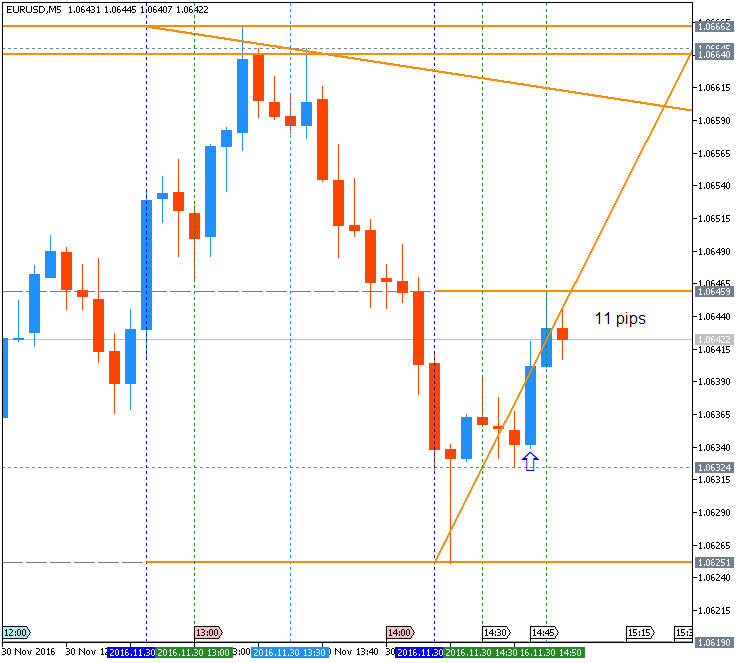

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speaks and 11 pips range price movement

2016-11-30 12:45 GMT | [EUR - ECB President Draghi Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - ECB President Draghi Speaks] = Speech about the future of Europe at the University of Deusto Business School, in Madrid.

==========

From official report:

- "The euro area faces a significant demographic challenge in the coming decades. Reversing the decline in productivity growth and improving labour market outcomes are both required to meet this challenge. Without concerted effort on structural reforms, per capita income growth in the euro area is likely to stagnate, and may even decline."

- "The ECB’s current monetary policy settings are designed to support

activity to bring inflation back to our objective of close to, but

below, 2% over the medium term. In doing so, we are lowering the risk

that the current low rates of growth become entrenched, but we alone

cannot eliminate that risk. Monetary policy is providing support and

space for governments to carry out necessary structural reforms. It is

up to euro area governments to act, individually at national level as

well as jointly at European level."

==========

EUR/USD M5: 11 pips range price movement by ECB President Draghi Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.01 16:25

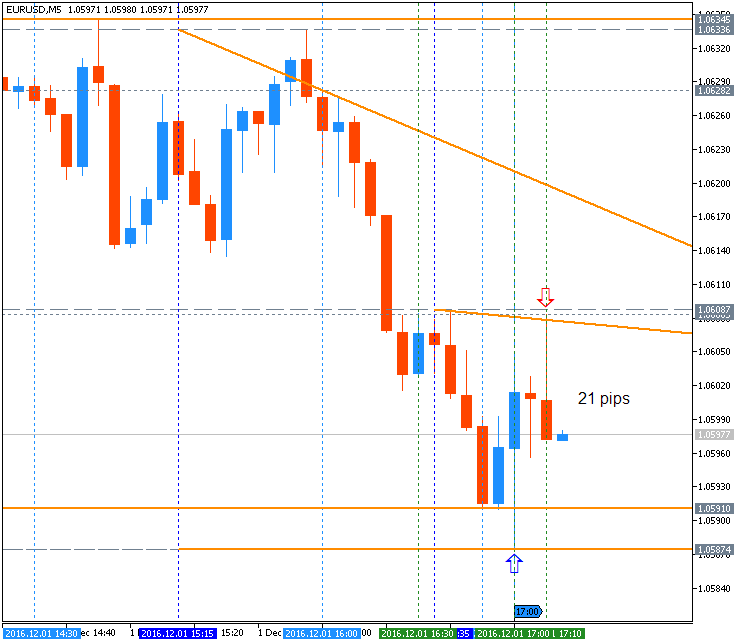

Intra-Day Fundamentals - EUR/USD, USD/CAD and USD/JPY: ISM Purchasing Managers' Index

2016-11-29 15:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 51.9

- forecast data is 52.4

- actual data is 53.2 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

"The November PMI® registered 53.2

percent, an increase of 1.3 percentage points from the October reading

of 51.9 percent. The New Orders Index registered 53 percent, an increase

of 0.9 percentage point from the October reading of 52.1 percent. The

Production Index registered 56 percent, 1.4 percentage points higher

than the October reading of 54.6 percent. The Employment Index

registered 52.3 percent, a decrease of 0.6 percentage point from the

October reading of 52.9 percent. Inventories of raw materials registered

49 percent, an increase of 1.5 percentage points from the October

reading of 47.5 percent. The Prices Index registered 54.5 percent in

November, the same reading as in October, indicating higher raw

materials prices for the ninth consecutive month. Comments from the

panel cite increasing demand, some tightness in the labor market and

plans to reduce inventory by the end of the year."

==========

EUR/USD M5: 21 pips range price movement by ISM Manufacturing PMI news events

==========

USD/CAD M5: 30 pips range price movement by ISM Manufacturing PMI news events

==========

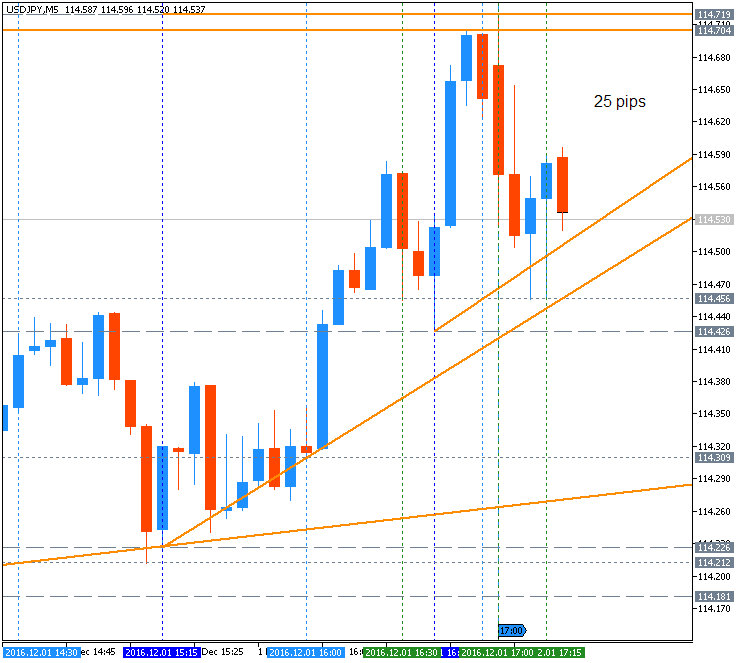

USD/JPY M5: 25 pips range price movement by ISM Manufacturing PMI news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

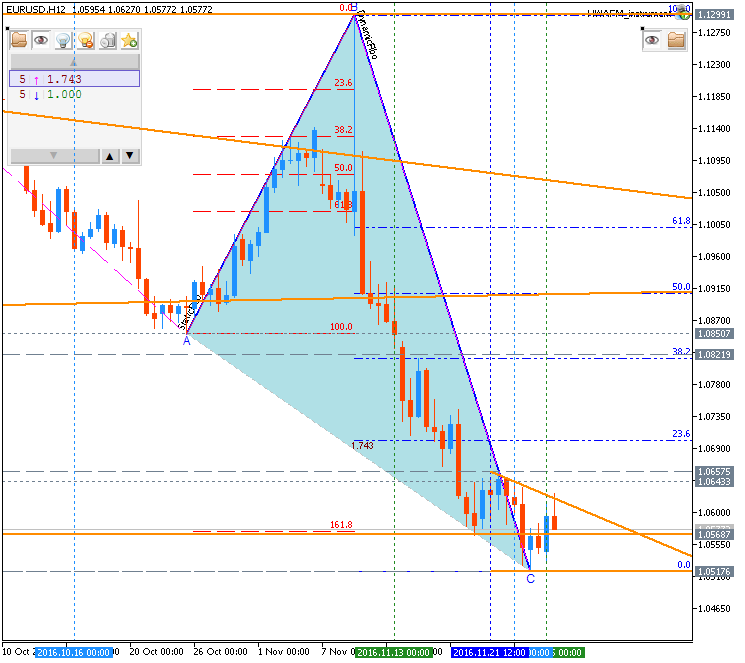

The weekly price is on bearish breakdown which was started in the beginning of october this year on the secondary ranging way: the price broke Ichimoku cloud to below to be reversed from the ranging bullish to the primary bearish market condition. For now, the price is on testing 1.0568 support level to below for the Fibo level at 1.0517 as a nearest daily/weekly bearish target.

The price is located within the following support/resistance levels:

Tenkan-sen line is below Kijun-sen line of Ichimoku indicator for the primary bearish condition to be continuing, and Chinkou Span line is below the price which is indicating the primary bearish trend in the future for this pair with the good volatility. By the way, Absolute Strength indicator is evaluating the future price movement as the ranging bearish so we can expect the ranging market condition in the bearish area of the chart for example.

If W1 price breaks 1.0517 support level to below on close bar so the primary bearish will be continuing.If weekly price breaks 1.0850 resistance level on close bar so the local uptrend as the secondary rally within the primary bearish market condition will be started.

If W1 price breaks 1.1066 resistance level on close weekly bar so we may see the reversal of the price movement to the primary bullish market condition.

If not so the price will be on bearish ranging within the levels.

SUMMARY: bearish

TREND: ranging breakdown