Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.19 08:09

Weekly EUR/USD Outlook: 2016, November 20 - November 27 (based on the article)

EUR/USD continued its deep dive and hit new lows as the dollar rally continued and euro-zone data was mixed. Another public appearance from Draghi and fresh PMIs stand out now. Here is an outlook for the highlights of this week.

- Draghi talks: Monday, 16:00. The President of the ECB may hint about the highly anticipated December meeting of the Bank.

- Consumer Confidence: Tuesday, 15:00.

- Flash PMIs: Wednesday: 8:00 for France, 8:30 for Germany and 9:00 for the euro-zone. For the whole euro-zone, manufacturing was ahead at 53.5 and services at 52.8 points, with 53.2 and 53.1 expected now.

- ECB Financial Stability Review: Wednesday, 9:00. Twice a year, the European Central Bank assesses the stability of the financial sector.

- Final German GDP: Thursday, 7:00.

- German Ifo Business Climate: Thursday, 9:00. A score of 110.6 is forecast.

- German GfK Consumer Climate: Thursday, 12:00. A small rise to 9.7 is on the cards.

- Belgian NBB Business Climate: Thursday, 14:00. A small improvement to -1.5 is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.21 17:47

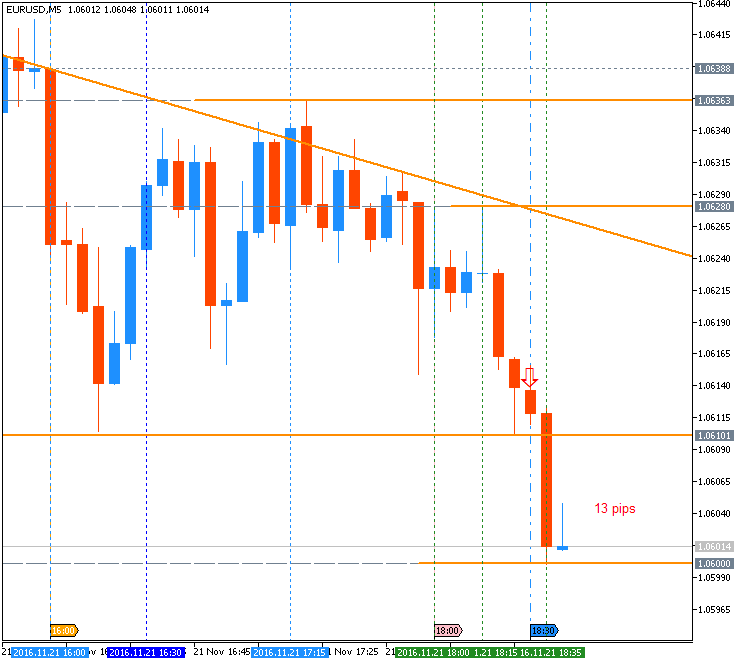

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speaks and 13 pips range price movement

2016-11-21 16:20 GMT | [EUR - ECB President Draghi Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - ECB President Draghi Speaks] = Speech about the European Central Bank's Annual Report before the European Parliament, in Strasbourg.

==========

From official report:

- "Beyond the relevance of the ECB’s monetary policy, an important contributing factor has been the more robust financial sector which has emerged from the financial crisis."

- "The decision to address the mistakes of the pre-crisis era through ambitious regulatory reforms is thus paying off. It has resulted in a European financial sector that is now stronger in terms of capital, leverage, funding and risk-taking. For example, Common Equity Tier 1 ratios in the euro area have improved substantially, rising from less than 7% for significant banking groups in 2008 to more than 14% today."

- "Supported by our monetary policy, the recovery is sustaining its

momentum. We also expect headline inflation to continue rising over the

coming months. At the same time, we are not seeing a consistent

strengthening of underlying price dynamics. Much of the expected

increase will be driven by statistical factors related to the

stabilisation of oil prices."

==========

EUR/USD M5: 13 pips price movement by ECB President Draghi Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.22 10:20

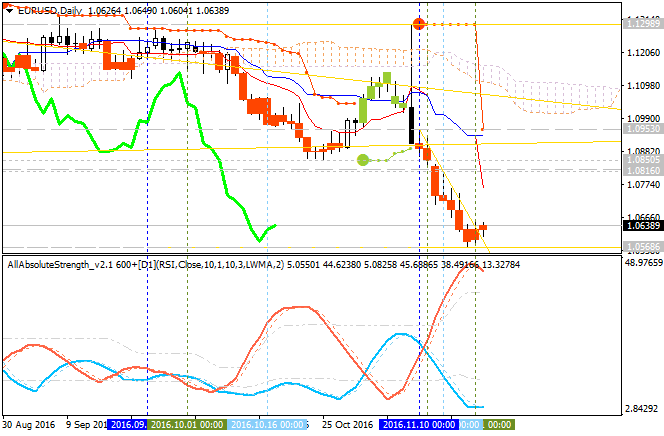

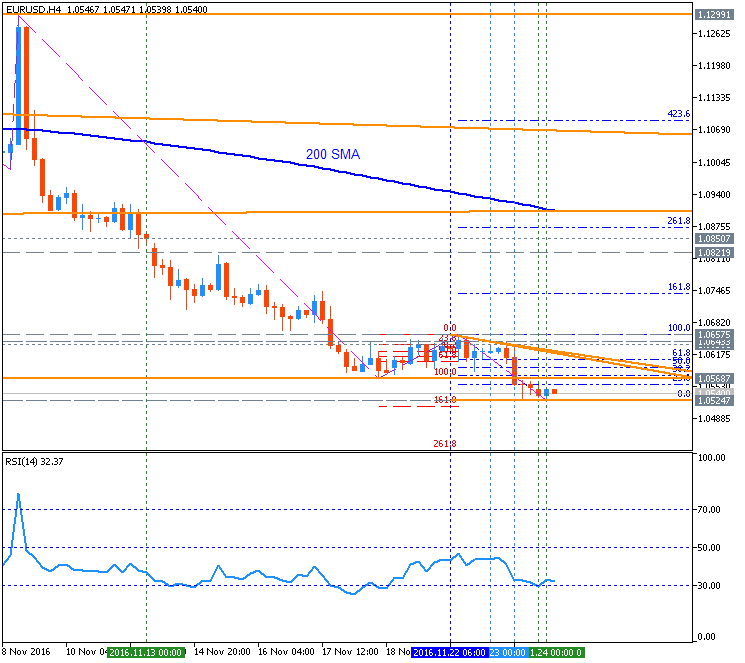

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

H4 price is located below 100 SMA/200 SMA on the bearish area of the chart. The price is on ranging within narrow support/resistance levels:

- 1.0649 resistance level located in the beginning of the secondary bear market rally to be started, and

- 1.0568 support level located far below 100 SMA/200 SMA in the bearish trend to be resumed.

Daily

price. United Overseas Bank is expecting for this pair to be bearish trend to be continuing:

"The lack of follow through despite the overall bearish indications coupled with the rather strong rebound yesterday suggests that the odds for further EUR weakness have diminished. A prolonged consolidation above 1.0540 would lead to a rapid loss in downward momentum and increase the risk of a short-term low."

- If daily price breaks 1.0953 resistance level

on close bar so the bullish reversal will be started.

- If daily price breaks 1.0568 support level on close bar so the primary bearish trend will be resumed.

- If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Eur/Usd downtrend.

Thomas Lawson, 2016.11.23 10:00

Eur/Usd forex pair still very bearish. FOMC minutes later today. Take Profit target 1.04770.Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.23 11:37

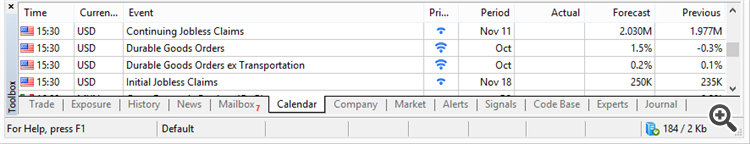

Trading News Events: U.S. Durable Goods Orders (adapted from dailyfx)

- "A 1.7% rebound in U.S. Durable Goods Orders may heighten the appeal of the greenback and spark a near-term decline in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to raise the benchmark interest rate at the last 2016-meeting on December 14."

- "Fed Funds Futures are pricing a greater than 90% probability for a December rate-hike as ‘the Committee judges that the case for an increase in the federal funds rate has continued to strengthen,’ and Chair Janet Yellen and Co. may continue to normalize monetary policy in the year ahead should the data print reinforce central bank expectations for a ‘moderate’ recovery. However, another unexpected decline in demand for large-ticket items may drag on interest-rate expectations as private-sector consumption remains one of the leading drivers of growth and inflation."

Bullish USD Trade: Demand for Large-Ticket Items Rebound 1.7% or Greater

- "Need red, five-minute candle following the report to consider a short EUR/USD trade."

- "If market reaction favors a bullish dollar trade, short EUR/USD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is met, set reasonable limit."

Bearish USD Trade: U.S. Durable Goods Orders Report Disappoints

- "Need green, five-minute candle to favor a long EUR/USD trade."

- "Implement same strategy as the bullish dollar trade, just in the opposite direction."

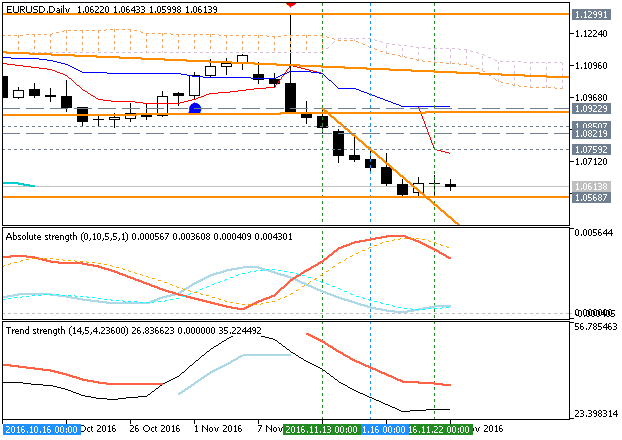

Daily price is on located below Ichimoku cloud in the primary bearish area of the chart. The price is trying to test 1.0568 support level to below for the bearish trend to be continuing.

- If the price will break 1.0759 resistance level on close daily bar so the local uptrend as the bear market rally will be started.

- If price will break 1.0568 support on close daily bar so the primary bearish trend will be resumed.

- If not so the price will be ranging within the levels.

------

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.23 15:35

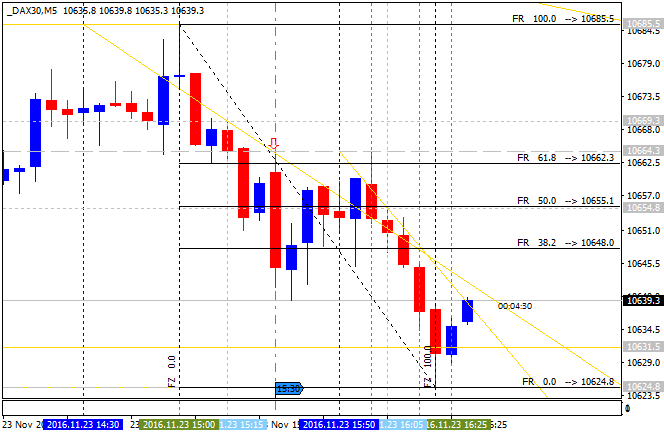

Intra-Day Fundamentals - EUR/USD, GOLD (XAU/USD) and Dax Index: U.S. Durable Goods Orders

2016-11-23 13:30 GMT | [USD - Durable Goods Orders]

- past data is -0.3%

- forecast data is 1.2%

- actual data is 4.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders see jet-fueled 4.8% gain in October

- "Orders for long-lasting goods made in the U.S. soared 4.8% in October largely because of stronger demand for commercial aircraft, but business investment is still not showing much spark."

- "Although these orders have picked up slightly in the fall, they are 4% lower compared to a year ago. Businesses have skimped on investment for years, undermining the ability of the U.S. economy to break out of a straitjacket that has limited it to 2% annual growth or less."

==========

EUR/USD M5: 49 pips range price movement by Durable Goods Orders news events

==========

GOLD (XAU/USD) M5: bearish price movement by Durable Goods Orders news events

==========

Dax Index M5: range price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.23 23:42

EUR/USD Intra-Day Fundamentals: FOMC Meeting Minutes and 19 pips range price movement

2016-11-23 19:00 GMT | [EUR - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

From rttnews article: The Fed is widely expected to raise rates at the next FOMC meeting, which is scheduled for December 13th and 14th.

- "Most Federal Reserve officials expect it to become appropriate to raise interest rates relatively soon, according to the minutes of the November meeting of the Federal Open Market Committee."

- "The minutes noted that the expectation for a near-term rate hike is contingent on incoming data providing some further evidence of continued progress toward the Fed's objectives."

==========

EUR/USD M5: 19 pips range price movement by FOMC Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.24 07:51

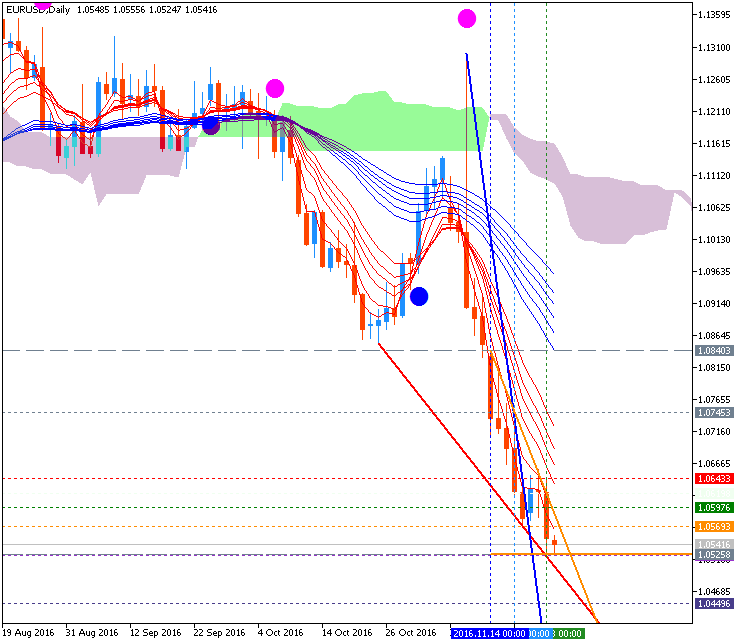

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

H4 price is below 100 SMA/200 SMA on the bearish area of the chart for the ranging within the narrow support/resistance levels:

- 1.0657 resistance level located in the beginning of the local uptrend as the secondary bear market rally within the primary ebarish condition to be started, and

- 1.0524 support level located far below 100 SMA/200 SMA in the bearish trend to be resumed.

Daily

price. United Overseas Bank is expecting for this pair to be bearish trend to be continuing with 1.0455/60 as the next nearest bearish target:

"After several days of lethargic trading, we noted in the Chart of the Day update yesterday that EUR has to see a ‘break lower soon’ or the risk of a short-term low would increase quickly. The timing of the breach of the December 2015 low of 1.0540 bodes well for our bearish view and from here, the next most obvious level to aim for is at the 2015 low of 1.0455/60 (seen in March). All in, the bearish view that started early last week is intact until 1.0650 is taken out (adjusted from 1.0700)."

- If daily price breaks 1.0745 resistance level

on close bar so the local uptrend as the secondary rally within the primary bearish market condition will be started.

- If daily price breaks 1.0524 support level on close bar so the primary bearish trend will be resumed with 1.0449 nearest bearish target.

- If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.24 16:40

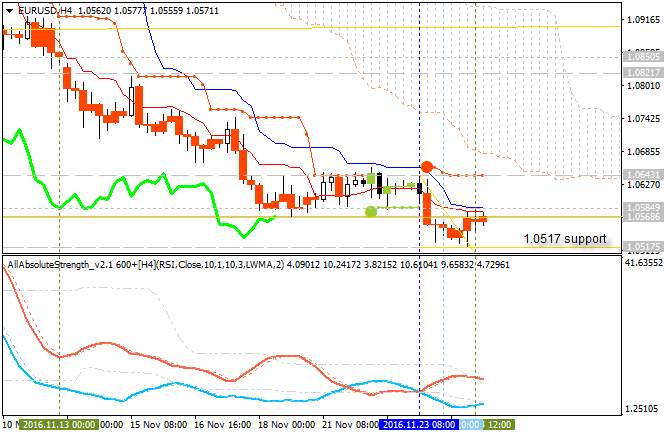

EUR/USD Establishes New Low At 1.0517 (based on the article)

- "EUR/USD dropped to new reaction lows in Wednesday’s trading as the dollar advanced to new rally highs following the release of a strong US Durable Goods report. In today’s trading, the pair established a new reaction low at 1.0517 and is currently rebounding from that low, holding near the 1.0568 level, up 0.16%."

- "The current low in EUR/USD represents a test of key support at the December 2015 corrective bottom at 1.05237. Not far below this level is the major corrective bottom established in March 2015 at the 1.04590 level. A drop below the key zone of support would confirm a breakdown from a multi-month trading range, calling for further losses in the months ahead."

- "Should EUR/USD advance beyond first resistance, the next level to watch

for potential resistance is the November 22nd high at 1.0660. Given the

strength exhibited by the dollar and ongoing expectations for a rate

increase at the December FOMC

meeting, a move above this level of resistance by EUR/USD is not

expected. At present, fed fund futures are pricing in a 93.5%

probability of an interest rate increase at the December FOMC meeting."

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video November 2016

Sergey Golubev, 2016.11.25 08:44

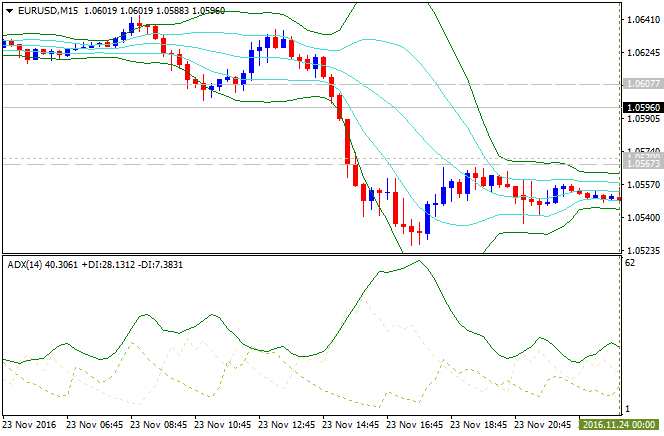

Euro Day Trading Strategy

1. A strategy designed for intraday trading

2. Rangebound strategy expecting the market to revert to a mean

3. Plot 2 pairs of bollinger bands, each using different standard deviations

4. When the market closes at or above the upper band of the higher standard deviation bollinger band, look to short

5. Confirm that ADX is low

6. Exit based on a fixed risk/reward, lower bollinger bands, and/or a spike in ADX

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bearish breakdown located below Ichimoku cloud in the bearish area of the chart. The price broke 1.0619 support level to below for the bearish breakdown to be continuing with 1.0567 target to re-enter.

If D1 price breaks 1.0567 support level on close bar so the bearish trend will be continuing.If D1 price breaks 61.8% Fibo resistance level at 1.1019 on close bar from below to above so the reversal of the price movement from the primary bearish to the primary bullish trend willbe started.

If not so the price will be on bearish ranging within the levels.

SUMMARY: bearish

TREND: breakdown