You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.17 12:55

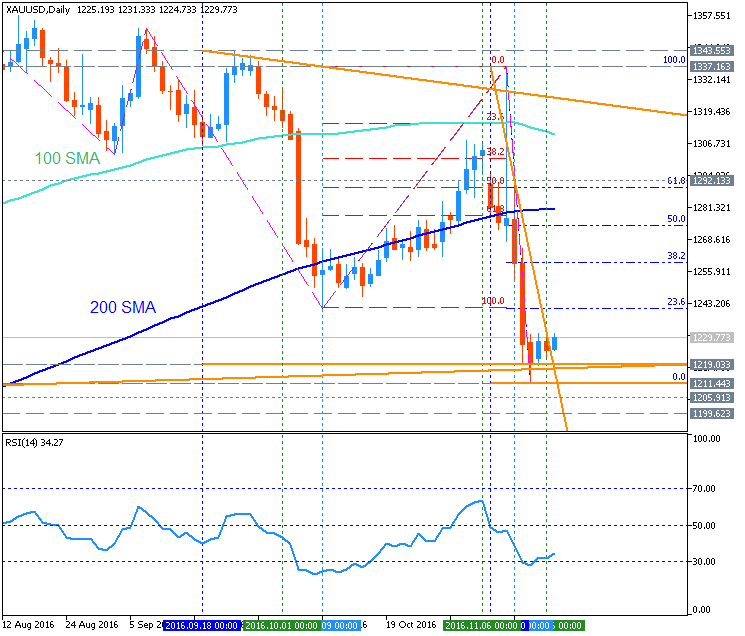

GOLD (XAU/USD) Daily Bearish Breakdown With 1.1219 Support To Continue (adapted from the article)

Daily price broke 100-day SMA/200-day SMA reversal levers to be reversed to the primary bearish area of the chart. For now, the price is on testing 1,1219 support level to below for the bearish breakdown to be continuing with 1,211 and 1,200 nearest daily bearish target to re-enter.

Most likely scenarios for the daily price movement are the following: the price will be continuing with the bearish breakdown by 1,200 psy level to be broken, or the ranging bearish condition will be started for the price to be waiting for the direction of the trend based on the future fundamental factors for example.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.23 15:35

Intra-Day Fundamentals - EUR/USD, GOLD (XAU/USD) and Dax Index: U.S. Durable Goods Orders

2016-11-23 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders see jet-fueled 4.8% gain in October

==========

EUR/USD M5: 49 pips range price movement by Durable Goods Orders news events

==========

GOLD (XAU/USD) M5: bearish price movement by Durable Goods Orders news events

==========

Dax Index M5: range price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.29 18:23

Intra-Day Fundamentals - EUR/USD, GOLD (XAU/USD) and Dax Index: The Conference Board Consumer Confidence

2016-11-29 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report:

"The Conference Board Consumer Confidence Index®, which had declined in October, increased significantly in November. The Index now stands at 107.1 (1985=100), up from 100.8 in October. The Present Situation Index increased from 123.1 to 130.3, while the Expectations Index improved from 86.0 last month to 91.7."

==========

EUR/USD M5: 37 pips range price movement by CB Consumer Confidence news events

==========

XAU/USD M5: range pips price movement by CB Consumer Confidence news events

==========

Dax Index M5: range pips price movement by CB Consumer Confidence news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.12.03 05:00

Quick Technical Overview - GOLD (XAU/USD): daily bearish to be continuing by 1170/1160 support levels to be broken (adapted from the article)

D1 price is located below 100-day SMA/200-day SMA in the bearish area of the chart by 1170/1160 support levels to be broken for the bearish trend to be continuing.

Trend:

D1 - bearishGOLD Is in a Down Trend with a Dead Cross Appeared and with Declining Momentum

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.12.18 12:32

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)GOLD (XAU/USD) - "Although the rate-hike was widely anticipated, slight upward revisions to the Fed’s growth & inflation forecasts were overshadowed by and uptick in the committee’s interest rate dot plot with officials now calling for 3 hikes next year. The release prompted a repricing off expectations, fueling a massive rally in the U.S. dollar as lower yielding ‘haven’ assets like gold came under pressure. That said, the first hike isn’t expected until the second half of the year and the recent rally in the greenback may be a bit overdone here. (Keep in mind we came into 2016 expecting three hikes and got just one). Although the implications for higher rates are likely to weigh on yellow metal, prices are responding to a key technical threshold which may offer a near-term reprieve to the most recent bout of selling."