Hi,

If you need help, please contact me.

Paulo

> After days of testing...

Come back after 3 months of consistent & successful results & I'll code it

-BB-

These two pairs will be very highly negatively correlated for very long periods of time

If the relative value shifts and then resettles, it can be a very long time before a position comes back again...

Always open to new ideas, but this one needs a bit more time!

-BB-

I believe your logic is FLAWED.

TRUE hedging does not exist when you are dealing more than one currency pair.

Triangle arbitrage is also not risk-free. I've done my studied and found lots of flaws.

Take your EUR/USD and USD/CHF as example?

Here are scenarios that you need to take caution on.

EXAMPLE 1:

You LONG 1 LOT EUR/USD and SHORT 1 LOT USD/CHF.

EUR/USD instead is going down. And USD/CHF is going up.

Where is your hedge? Now what?

EXAMPLE2:

You LONG 1 LOT EUR/USD and LONG 1 LOT USD/CHF.

EUR/USD is going down. USD/CHF is going down too.

Where is your hedge? Now what?

The examples are endless. You should get the point.

If you need forex education: visit www.businessclubworldwide.com/ today.

Education is free.

Other than hedging the counter-currency pair that determines the tick value (and thus P/L) of a cross-currency position I have never figured out how/why people think of hedging as a strategy to make profits.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

hi all,

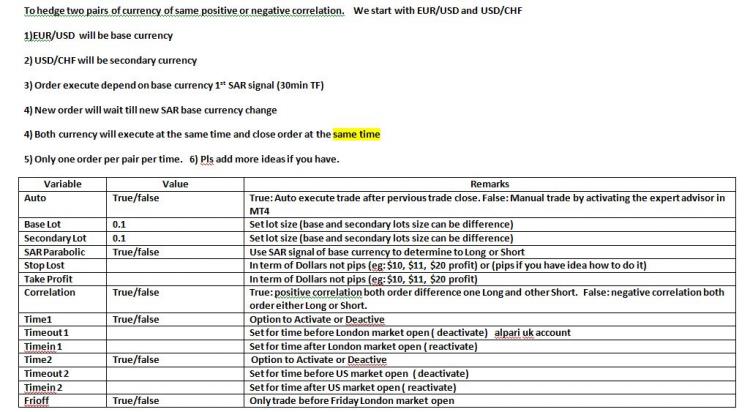

After days of testing i finally able to write a hedging EA strategy base on EUR/USD and USD/CHF. I manage to get very good result on my demo account using manual entry.

I need someone that can help me code it into EA. pls email me the EA. thanks

Regards

Hans