You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

A 0.6% rebound in orders for U.S. Durable Goods may heighten the appeal of the greenback and spur a bearish retraction in EUR/USD as it raises the fundamental outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Signs of a stronger recovery may encourage bets for a mid-2015 Fed rate hike, but the recent slew of weaker-than-expected data prints may encourage the central bank to further delay its normalization cycle in an effort to combat the ongoing slack in the real economy.

However, fading discounts along with the ongoing weakness in household spending may drag on orders for durable goods, and a dismal print may dampen the appeal of the greenback as it raises the Fed’s scope to retain its current policy beyond mid-2015.

How To Trade This Event Risk

Bullish USD Trade: Orders Rebound 0.6% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Demand for Durable Goods Falter- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

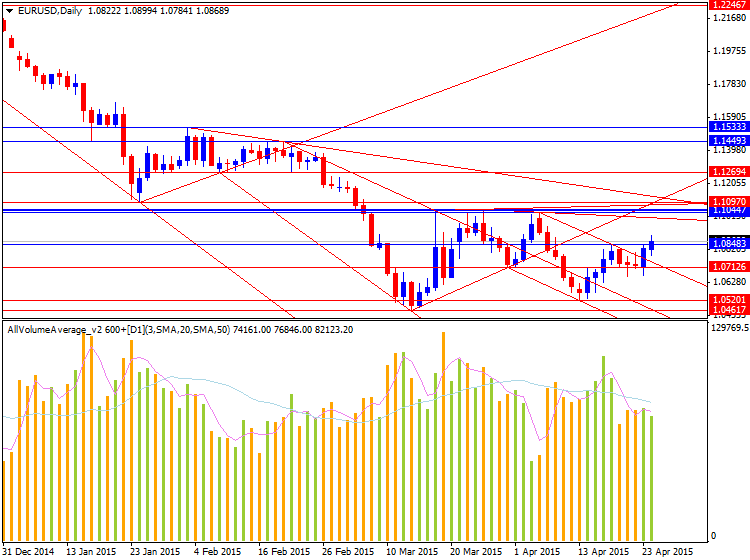

Potential Price Targets For The ReleaseEURUSD Daily Chart

Orders for U.S. Durable Goods unexpectedly shrank 1.4% in February following a revised 1.9% expansion the month prior. The contraction was largely drive by a drop in transportation, with demand for non-defense aircrafts slipping 8.9% from the previous month. The slowdown in private-sector consumption may become a growing concern for the Fed as lower energy costs fail to boost household spending, and the central bank may look to further delay its normalization cycle in an effort to encourage a stronger recovery. Despite the weaker-than-expected prints, the initial market reaction was rather limited as EUR/USD struggled to hold above the 1.1000 handle during the North American trade to end the day at 1.0973.

The Biggest EURUSD Resistance Test of the Year ( based on dailyfx article)

“EURUSD rolled over at slope resistance but several longer term technical observations are worthy of note; the rate found low at an important long term level (line off of 2008 and 2010 lows) and the ownership profile (as per COT) is at a record. The speculative crowd has never been more bearish…ever. Such conditions typically precede important reversals…although not necessarily right away. A break above the resistance lines (old support) would indicate that behavior has significantly changed and open up a run on 1.13.” It is decision time traders.

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Bearish

The stage is set and the curtain is rising. The Dollar has wobbled these past weeks, but it hasn’t managed to turn its nine-month long bull trend. That is difficult to do when the undercurrent of the FX market maintains solid support for the benchmark currency. Economic potential, monetary policy course and disaster insurance premium all bolster the Greenback’s case for a medium-to-long term climb. Yet, that doesn’t render the currency infallible. Speculative appetite – as it has in equities and other asset classes – has likely overreached on the Dollar. But, what would unnerve such a comfortable trade? Heavy event risk.

There is a lot going on in the financial markets over the coming week. Subsequently, there will be a lot of crosswinds working on the consensus view for the Dollar. That said, we will likely see the market discount the influence of many of these catalysts in deference for the concentrated event risk on Wednesday: 1Q US GDP and the FOMC rate decision. Over the past year, one theme has commanded the reins of the broader FX market – divergent monetary policy views. The Fed has shifted from the world’s most accommodative central bank to one of the first majors to contemplate a rate hike. What has resulted from this shift is one of the most impressive runs the currency market has seen in a while.

The trouble for the Dollar is that the premium afforded the currency is so-far unrealized. While there is general agreement that the Fed will lift rates over the coming year, there is considerable debate as to when the actual move will be realized. At the turn of the year, speculation for a ‘mid-2015’ move was robust with meaningful support for a June or July liftoff. However, in the past three months, the hawkish mood has soured. Data has softened and fallen increasingly short of forecasts (the Citigroup Economic Surprise Index dropped to a three-and-a-half year low). Rhetoric from central bank officials in turn has also backed off a campaign to acclimatize speculators to an earlier move. Maintaining a measure of skepticism throughout, the market has pushed back its timing of a first move through Fed Funds futures from September (at the start of the year) to January 2016 currently.

Whether or not the central bank will be forced to sit on its hands will be heavily dictated by the fundamental duo Wednesday. Chronologically, the growth report for the opening quarter of the year crosses the wires first. The forecast is already calling for a significant moderation of the economy’s pace from 2.2 percent in 4Q to a more reserved 1.0 percent clip. While many – including some Fed members – believe this could be a repeat of last year where the lull is temporary, it would likely kill any lingering hope for a June move.

As for the central bank decision, this is not one of the quarterly events where we receive updated forecasts and a press conference to work our speculative assessments off of. That said, the statement will be thoroughly processed and that is where the market derived most of its interest at the last meeting. If the group’s tone is materially more cautious or concerned on the state of the economy, inflation and global conditions, it could further dovish skepticism. Of course, the most potent outcome for the Dollar would be a combined economic slowdown and softer rhetoric.

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for the Japanese Yen: Neutral

The Bank of Japan seems unlikely to expand stimulus at its upcoming policy meeting. Recent comments from Governor Haruhiko Kuroda suggest he sees no urgency in fighting the pullback in headline inflation played out since mid-2014. The drop played out alongside a steep slide in oil prices, suggesting weakness will dissipate once rebasing takes effect in the second half of 2015. Indeed, core inflation has been remarkably stable near the target 2 percent level for the past 12 months and price-growth bets implied in bond yields have been rising since the beginning of the year.

The policy announcement may still prove market-moving if an updated set of economic forecasts proves especially ominous, foreshadowing a larger easing effort on the horizon. Follow-through on such a development may be limited however since leading economic activity surveys have pointed to decelerating growth since January. That means only a dramatically aggressive downgrade would deliver something material enough to force a rebalancing of already priced-in expectations.

Meanwhile on the external front, potent volatility catalysts abound. The outcome of negotiations between Greece and its EU/IMF creditors at a meeting of Eurozone finance ministers and central bankers in Riga over the weekend will set the tone initially. Athens is due to present the fourth revision of a reform package designed to unlock further bailout funding.

Both sides seem vested in a successful accord. EU and IMF officials want to avoid setting a precedent for a sovereign default within the Eurozone that potentially leads Greece out of the currency bloc. Meanwhile, Prime Minister Alexis Tsipras and company surely understand that disorderly redenomination will probably compound their country’s economic woes and may cost them their jobs. On balance, the announcement of an agreement that keeps Greece afloat – even if only in the near term – is likely to boost risk appetite and weigh on the Japanese Yen amid ebbing haven demand for the safety-linked currency.

The next major inflection point comes by way of the Federal Reserve policy meeting. A rate hike seems overwhelmingly unlikely just yet, putting the onus on the statement accompanying the announcement. The central bank seemed to switch to a month-to-month guidance regime at the March sit-down. If this continues, Chair Yellen and her colleagues on the rate-setting FOMC committee are unlikely to say much beyond hinting that tightening probably won’t arrive in May.

Such a result may embolden the recent dovish shift in investors’ perceived Fed rate hike timeline. This may lead the Yen higher, considering the average value of the Japanese unit against its top counterparts has displayed an increasingly significant inverse correlation with front-end US bond yields over recent weeks.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for British Pound: Bullish

An important jump in interest rate expectations helped push the British Pound to fresh two-month highs versus the US Dollar. Yet a great deal of uncertainty surrounding upcoming UK Elections could slow gains as traders prepare for potential volatility.

The coming week will be an important one for the UK and broader financial markets as national agencies release British and US Gross Domestic Product (GDP) growth figures for the first quarter, while a highly-anticipated US Federal Reserve policy meeting and Nonfarm Payrolls report will likewise drive market volatility.

Last week we argued that fundamental strength could fuel a sustained GBP reversal, and indeed recent developments suggest the British Pound could claw back further losses through upcoming trade. The key caveat is that any number of top-tier economic data releases and events in the coming two weeks could change outlook. Any large surprises out of upcoming UK GDP figures could have an especially significant impact for Sterling pairs. And the US Fed decision as well as NFPs results always threatens major moves in USD currency pairs.

The true test for the Sterling may ultimately come in the following week as there remains a great deal of uncertainty surrounding UK Elections. A sharp jump in GBPUSD volatility prices/expectations underlines the risk, and it remains especially difficult to predict the outcomes of the elections and much less implications for the GBP itself.

We remain cautiously bullish the British Pound as recent Bank of England rhetoric suggests that domestic interest rates may rise sooner than expected. Yield-seeking investors continue to favor currencies with higher rates of return, and interest rate differentials remain one of the most important drivers of exchange rate volatility. The key question is whether upcoming data and/or political uncertainty can derail what seems to be the start of a larger reversal for the UK currency.

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral

AUD/USD is likely to face increased volatility in the week ahead amid the key developments coming out of the U.S. economy, but fresh commentary coming out of the Reserve Bank of Australia (RBA) may continue to heighten the appeal of the higher-yielding currency as Governor Glenn Stevens appears to be in no rush to further embark on the easing cycle.

The advance U.S. Gross Domestic Product (GDP) report is expected to show the growth rate climbing an annualized 1.0% after expanding 2.2% during the last three-months of 2014, and fears of a slowing recovery may push the Federal Open Market Committee (FOMC) to further delay its easing cycle as a growing number of central bank officials adopt a more cautious tone for the region. With that said, the fresh developments coming out of the Fed’s April 29 interest rate decision may show little evidence for a June rate hike, and the near-term weakness in the greenback may turn into a larger correction should Janet Yellen and Co. show a greater willingness to carry its current policy into the second-half of the year.

Even though the RBA keeps the door open to further reduce the official cash rate, Governor Glenn Stevens may continue to endorse a wait-and-see approach next week at the Australian Financial Review Banking & Wealth Summit amid sticky price growth in the $1T economy. The unexpected uptick in the core rate of inflation may keep the RBA on the sidelines at the May 5 policy meeting and the central bank may soften its dovish tone for monetary policy as record-low borrowing costs raise the risk for housing market imbalance.

In turn, the rebound from earlier this month may spur a test of the March high (0.7987) on the back of dismal developments coming out of the U.S. economy, but the policy divergence should continue to foster a long-term bearish outlook for AUD/USD as the Fed remains on course to raise its benchmark interest rate. Moreover, the aussie remains at risk of facing additional headwinds over the near-term as the RBA retains the verbal intervention on the local currency.

GOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Neutral

Gold prices fell for a third consecutive week with the precious metal off more than 2.17% to trade at 1177 ahead of the New York close on Friday. The decline marks the largest weekly loss in seven as equity markets probed fresh record highs alongside a pullback in the dollar. Bullion looks to close the week just above key near-term support with major US data on tap next week.

Heading into next week, traders will be closely eyeing key US event risk with the release of 1Q Advanced Gross Domestic Product (GDP) & the FOMC policy decision on Wednesday. Consensus estimates are calling for an annualized read of 1.0% for the first quarter, down from 2.2% in 4Q. The GDP report may ultimately fall short of market expectations as seasonal factors are blamed for the recent batch of soft data and a set of weak prints may press the Fed to carry its highly accommodative policy stance through the second-half of 2015. As such, look for the release to impact interest rate expectations with a stronger print likely to weigh more heavily on gold.

From a technical standpoint, gold broke below slope support on Friday, opening up a decline targeting the 61.8% retracement of the advance off the yearly lows at 1173 (key support). Note that a median-line extending off the monthly high converges on this level into the start of next week and we’ll reserve this region as our bullish invalidation level with a break below risking a decline back into critical weekly support at 1150/51. Interim resistance is eyed at 1191 with a breach above 1200 needed to shift our attention back to the long-side of the trade. That said, we’ll take a neutral stance heading into next week while noting that the short bias remains at risk above keys support at 1173.

EURUSD forecast for the week of April 27, 2015, Technical Analysis (based on fxempire article)

The EURUSD pair initially fell during the course of the week but found enough support to turn things back around and form a hammer. However, we recognize that the 1.10 level above is still resistive, so therefore it’s difficult to take a longer-term trade. In fact, we are comfortable with longer-term trades until we are well above the 1.15 level, which is something that we are obviously not going to see anytime soon. With that, we remain on the sidelines as far as long-term trades are concerned, but will pay attention to the shorter-term daily chart.

Forex - Weekly outlook: April 27- May 1 (based on investing.com article)

The dollar ended the week lower against the other major currencies on Friday, the second consecutive weekly decline as fresh economic data underlined concerns that the recovery is losing momentum.

The Commerce Department reported Friday that orders for durable goods, excluding aircraft, fell 0.5% in March, after a downwardly revised 2.2% drop in February.

The headline figure rose 4.0%, beating expectations for a 0.6% gain, but investors focused on underlying weakness in the report.

The data came after recent weak reports on home sales, retail sales and industrial production, adding to signs of a slowdown in economic growth since the start of the year.

The weak data added to pressure on the dollar which has been hit as investors pushed back expectations on the timing of an initial rate hike by the Federal Reserve.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was last down to 97.07 late Friday. The index ended the week down 0.62%.

EUR/USD was up 0.48% to 1.0874 in late trade, to end the week with gains of 0.61%.

The single currency was held in check as concerns over Greece’s debt negotiations continued. Euro area finance ministers said Friday that Greece must present a full economic reform plan by early May in order to access any further funding.

The dollar was also lower against the yen, with USD/JPY down 0.51% to one-week lows of 118.98.

Sterling also pushed higher against the weaker dollar, with GBP/USD adding 0.88% to trade at 1.5188 late Friday. The pound shrugged off uncertainty over the outcome next month’s U.K. general elections.

In the week ahead investors will be looking to Wednesday’s Fed statement for clues on the possible timing of a rate increase. Investors will also be focusing on Wednesday’s preliminary reading on U.S. first quarter growth as well as reports on inflation, consumer confidence and manufacturing.

Central bank meetings in Japan and New Zealand will also be in focus, as will Thursday's preliminary data on euro zone inflation.

Monday, April 27

Tuesday, April 28

Wednesday, April 29

Thursday, April 30

Friday, May 1

EUR/USD Forecast Apr. 27 – May 1 (based on forexcrunch article)

EUR/USD had a choppy week, feeling some pressure but not falling too far. Inflation data stands out just before the May 1st holiday. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Greek headlines drifted between deteriorating conditions and Grexit talk to optimism or at least a deadline delay. This had a growing impact on the common currency. For a change, most euro-zone figures fell short of expectations and that also took its toll. In the US, data began looking better, with existing home sales beating expectations. But it’s far from looking rosy and as the week advanced, the dollar was hit by weak data. All in all, it’s a mixed picture with quite a lot of action.