You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

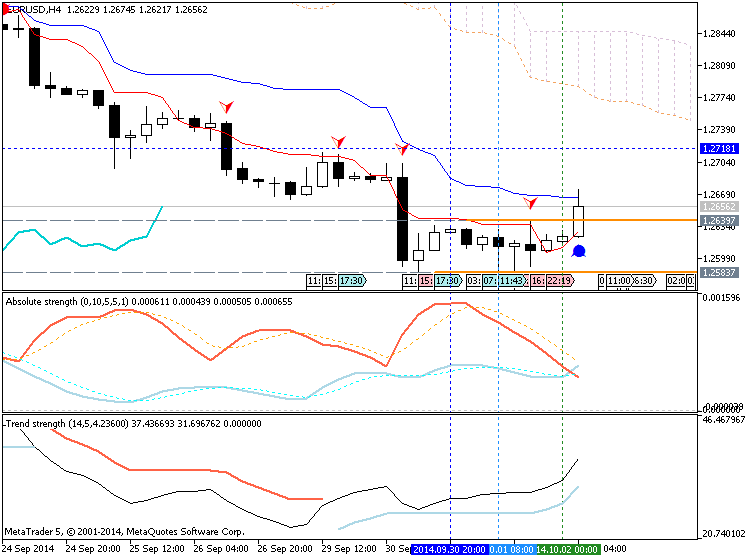

The Plan - EURUSD downtrend going according to the plan (based on efxnews article)

EUR/USD: Removed our target support zone at 1.2787/55.

EURUSD has broken below our core target zone at 1.2787/55 – the 61.8% retracement of the entire 2012/14 bull trend and July 2013 low. We are wary that prices are becoming exhausted near term, and resistance at 1.2785 needs to cap to keep the immediate risk lower to see a direct extension to 1.2662 next, the November 2012 low. Beneath here would aim at the 78.6% retracement of the 2012/2014 uptrend at 1.2460. Bigger picture we would see scope for 1.2215/10, and potentially as far as the 1.2042 low of 2012.

Resistance shows at 1.2762/70, then 1.2785, above which can see a move back to 1.2801/16. Beyond here is needed to ease the immediate downside bias for strength back to 1.2839, then 1.2865.

EUR/USD May Extend Declines Amid Void Of Reversal Candles (based on dailyfx article)

EUR/USD may be set to continue its slide amid an absence of candlestick reversal signals for the pair. Some buying interest appears evident near the November 2012 low at 1.2660. If broken the stage would be set for an extended decline to the late August 2012 low at 1.2250.

Weekend Edition with Dr. Richard Ebeling

John O’Donnell and Merlin Rothfeld are Joined by Dr. Richard Ebeling who takes a look at the current economic situation and its bubble like appearance. The trio take a look at several factors contributing to the problem, as well as several solutions.

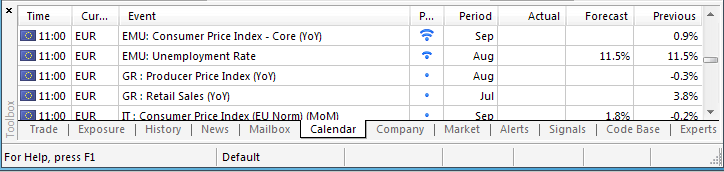

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

A further slowdown in the Euro-Zone’s Consumer Price Index (CPI) may prompt fresh monthly lows in the EUR/USD as it puts increased pressure on the European Central Bank (ECB) to implement more non-standard measures.

What’s Expected:

Why Is This Event Important:

The ECB may continue to push monetary policy into uncharted territory as the Governing Council struggles to achieve its one and only mandate to deliver price stability, and the bearish sentiment surrounding the Euro may gather pace throughout the remainder of the year amid the weakening outlook for growth and inflation.

The persistent slack in the real economy may paint a weakened outlook for price growth, and a dismal CPI print may generate a bearish reaction in the EUR/USD should the report highlight a greater threat for deflation.

However, the unprecedented steps taken by the ECB may help to mitigate the downside risk for inflation, and a better-than-expected release may generate a more meaningful rebound in the Euro as it curbs bets of seeing a new wave of monetary support.

How To Trade This Event Risk

Bearish EUR Trade: Headline & Core CPI Highlight Greater Threat for Deflation

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish EUR Trade: Euro-Zone Inflation Tops Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Downside targets remain favored as RSI retains bearish momentum & pushes deeper into oversold territory

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2590 (100% expansion) to 1.2600 pivot

Impact that the Euro-Zone CPI report has had on EUR during the last release(1 Hour post event )

(End of Day post event)

August 2014 Euro-Zone Consumer Price Index (CPI)

EURUSD M5 : 17 pips price movement by EUR - CPI news event:

The Euro-Zone’s annualized Consumer Price Index (CPI) continued the downward trend and slipped to a 5-year low of 0.3% from 0.4% the month prior, while the core inflation rate unexpectedly rose 0.9% during the same period amid forecasts for a 0.8% print. The ongoing weakness in price growth may put increased pressure on the European Central Bank (ECB) to implement its own quantitative easing program amid the growing threat for deflation. Nevertheless, the initial reaction in the EUR/USD was short-lived as the pair consolidated around 1.3182 following the release, but the euro-dollar came under increased pressure during the North American trade as it ended the day at 1.3133.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.09.30

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 68 pips price movement by EUR - CPI news event

Next EUR/USD Leg Lower Begins; Trade Opportunities in EUR/AUD, EUR/GBP

Euro-Zone economic data came out roundly weaker than expected today, and the aftershocks have been felt throughout EUR-complex. The depth of impact stemming from the disappointing preliminary September Euro-Zone CPI may have to do with expectations for the core: +0.9% y/y was expected when +0.7% y/y was delivered. The scope of disinflation widens.

Over the next few months, Euro-Zone CPI may start to bottom. For starters, if it takes three to nine months for changes in interest rates and exchange rates to impact an economy, then the EURUSD peak in early-May is a good watermark to look back at; the window for peak drag on CPI by FX is just about now.

EUR/USD Downside Targets in Focus- Gold Eyes Key $1,179 Support

Trading the News: U.S. ISM Manufacturing (based on dailyfx article)

A downtick in the ISM Manufacturing survey may generate a bearish dollar reaction (bullish EUR/USD) should the data print dampen the outlook for growth and inflation.

What’s Expected:

Why Is This Event Important:

At the same time, we will need to keep a close eye on the employment component as the highly anticipated Non-Farm Payrolls (NFP) report is expected to show the U.S. economy adding another 217K jobs in September, and a material downward revision in the key metrics may undermine the bullish sentiment surrounding the greenback as it drags on interest rate expectations.

The dollar may face a near-term correction should the ongoing slack in the real economy spur a marked slowdown in manufacturing, and a dismal ISM print may prompt the Fed to further delay its normalization cycle as Chair Janet Yellen remains reluctant to move away from the zero-interest rate policy (ZIRP).

Nevertheless, the resilience in private sector consumption may foster another unexpected uptick in the manufacturing survey, and a better-than-expected release may heighten the bullish sentiment surrounding the dollar as it raises the Fed’s scope to implement a rate hike sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: ISM Survey Narrows to 58.5 or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Manufacturing Unexpectedly Tops Market Forecast for Second Month- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Remains vulnerable to a further decline as near-term bearish RSI momentum remains in play

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

Impact that the U.S. ISM Manufacturing report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

August 2014 U.S. ISM Manufacturing

EURUSD M5 : 10 pips price movement by USD - ISM Manufacturing PMI news event:

Manufacturing activity in the U.S. unexpectedly picked up in August as the ISM survey rose to 59.0 from July’s 57.1 print; reaching the highest level since March 2011. The expansion was fueled by a surge in orders for plastics and metals, and highlights the scope for a stronger U.S. recovery in the second half of the year. The market reaction to the positive ISM print was limited and short-lived as the EUR/USD chopped around 1.3128, with the pair closing the day at 1.3122.

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activityю

==========

U.S. Private Sector Job Growth Exceeds Economist Estimates In September

Employment in the U.S. private sector increased by more than expected in the month of September, according to a report released by payroll processor ADP on Wednesday, with employment rising by more than 200,000 jobs for the sixth straight month.

ADP said private sector employment jumped by 213,000 jobs in September following a downwardly revised increase of 202,000 jobs in August.

Economists had been expecting an increase of about 205,000 jobs compared to the addition of 204,000 jobs originally reported for the previous month.

The stronger than expected job growth was partly due to a notable increase in goods-producing employment, which rose by 58,000 jobs in September following an increase of 42,000 jobs in August.

The construction industry added 20,000 jobs, while employment in the manufacturing industry climbed by 35,000 jobs, the biggest increase in that sector since May of 2010.

Meanwhile, ADP said service-providing employment rose by 155,000 jobs in September, reflecting a modest slowdown compared to the addition of 160,000 jobs in August.

EUR/USD Technical Analysis: Euro Ready to Move Higher? (based on dailyfx article)

The Euro put in a Hammer candlestick, hinting a bounce against the US Dollar may be around the corner. Near-term resistance is in the 1.2659-73 area marked by the November 2012 low and the 38.2% Fibonacci expansion, with a break above that exposing the 1.2754-60 zone bracketed by the July 2013 bottom and the 23.6% level. Alternatively, a drop below the 50% Fib at 1.2602 opens the door for a test of the 61.8% expansion at 1.2532.

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

Further details surrounding the European Central Bank’s (ECB) asset-back securities (ABS) and covered-bond purchase program may heighten the bearish sentiment surrounding the Euro, but we may see a relief rally in the EUR/USD should the Governing Council use the interest rate decision as an attempt to buy more time.

What’s Expected:

Why Is This Event Important:

The ECB may refrain from addressing the unanswered questions surrounding the non-standard measures as President Mario Draghi waits for the results of the second targeted long-term refinancing operation (T-LTRO), and the EUR/USD may face a near-term correction should the fresh developments dampen bets for more easing.

The ECB may sound increasingly dovish amid the growth threat for deflation, and the EUR/USD may face a further decline should the council keep the door open for more non-standard measures, which may quantitative easing (QE).

Nevertheless, the ECB may scale back its dovish outlook amid the improvements in the monetary union, and the Euro may face a near-term bounce should the central bank adopt a wait-and-see approach.

How To Trade This Event Risk

Bearish EUR Trade: ECB Keeps Door Open for More Non-Standard Measures

- Need red, five-minute candle following the updated foreward-guidance to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Tries to Buy More Time- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

Impact that the ECB rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)