Lilita Bogachkova / Profil

- Information

|

10+ Jahre

Erfahrung

|

1

Produkte

|

431

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

Freunde

208

Anfragen

Ausgehend

Lilita Bogachkova

### Key Points

- The EURUSD pair shows a cautiously bullish outlook on July 23, 2025, with stronger signals on shorter timeframes (H12, H8, H4, H1) but mixed signals on the daily (D1) timeframe.

- Economic data suggests potential pressure on EURUSD, with stronger US housing data supporting the USD and weaker Eurozone consumer confidence pressuring the EUR.

- Technical indicators show overbought conditions on H12, H8, H4, and H1, suggesting possible pullbacks, while D1 leans neutral to slightly bearish.

### Trading Strategy

**Overview**:

Given the mixed signals, consider a **long position** on EURUSD with a 75% position size, targeting 1.1835, and a stop-loss below 1.1690. Monitor for potential pullbacks due to overbought conditions and trade deal risks.

**Entry and Exit**:

- Enter long around current levels (1.173-1.176).

- Take profit at 1.1835, based on technical targets from market analyses.

- Set stop-loss below 1.1690 to manage risk.

**Risk Management**:

- Use trailing stops based on H4 or H1 ATR due to very low volatility.

- Be cautious of the upcoming Federal Reserve meeting, which could impact the trade.

### Supporting Information

- Economic data includes US Existing Home Sales at 4.02M (slightly below 4.03M forecast), potentially weakening USD [Action Forex](https://www.actionforex.com/economic-calendar/604917-eco-data-7-23-25/).

- Market sentiment is predominantly bullish, with EURUSD reaching recent highs and technical targets at 1.1835 [FXStreet](https://www.fxstreet.com/analysis/eur-usd-forecast-euro-loses-momentum-but-remains-bullish-202507230928).

- Social media reflects bullish sentiment but notes overbought conditions [X Search Results](https://twitter.com/DeItaone/status/1939705681072066975).

---

### Strategic Analysis of EURUSD Across Multiple Timeframes as of July 23, 2025

This detailed analysis examines the EURUSD currency pair across daily (D1), 12-hour (H12), 8-hour (H8), 4-hour (H4), and 1-hour (H1) timeframes as of July 23, 2025, at 03:28 PM EEST, integrating technical indicators from provided data and supplementing with external economic and market sentiment information. The objective is to formulate a robust trading strategy, considering the multi-timeframe approach and recent news, while adhering to the outlined strategy rules.

#### **1. Technical Analysis Across Timeframes**

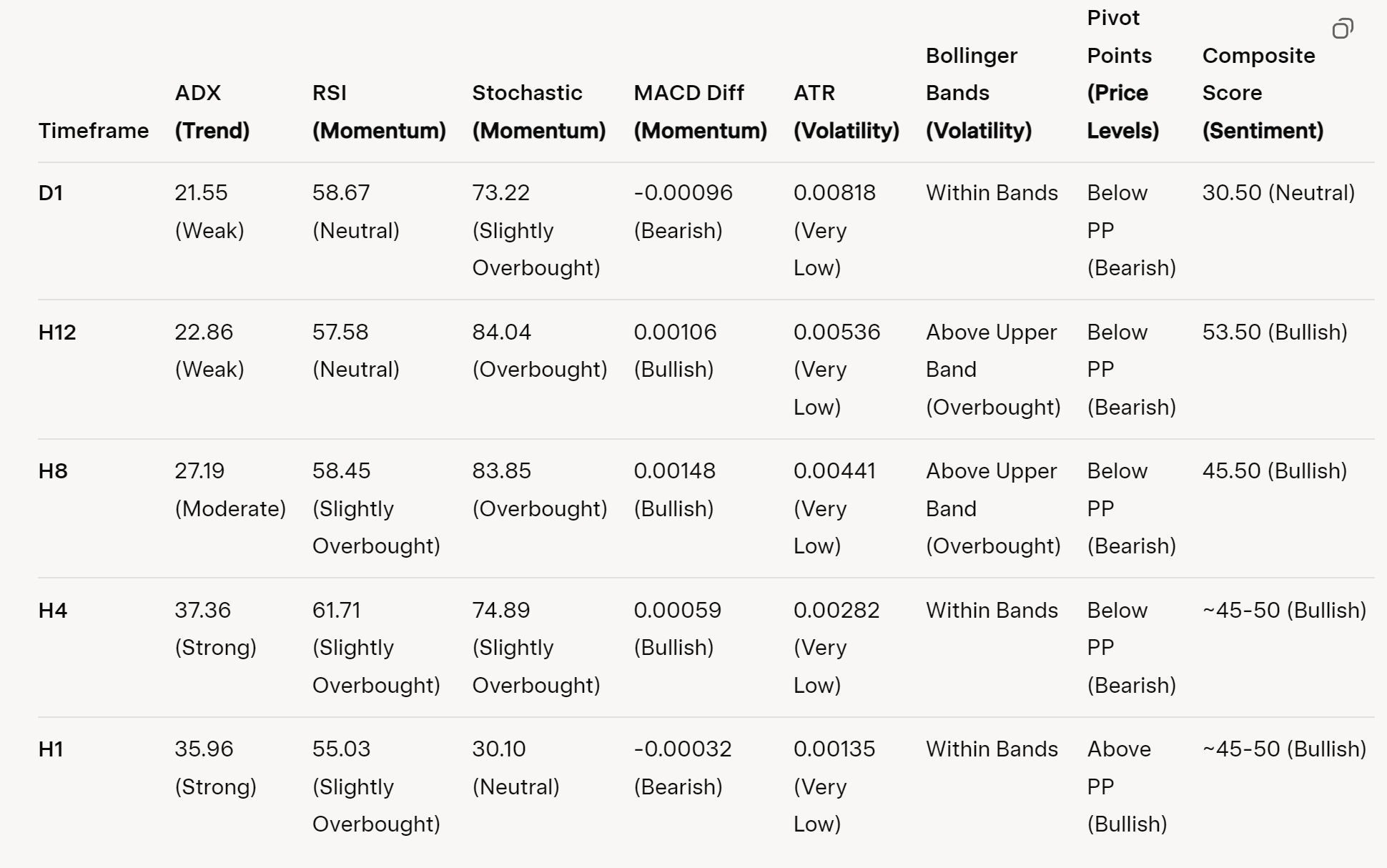

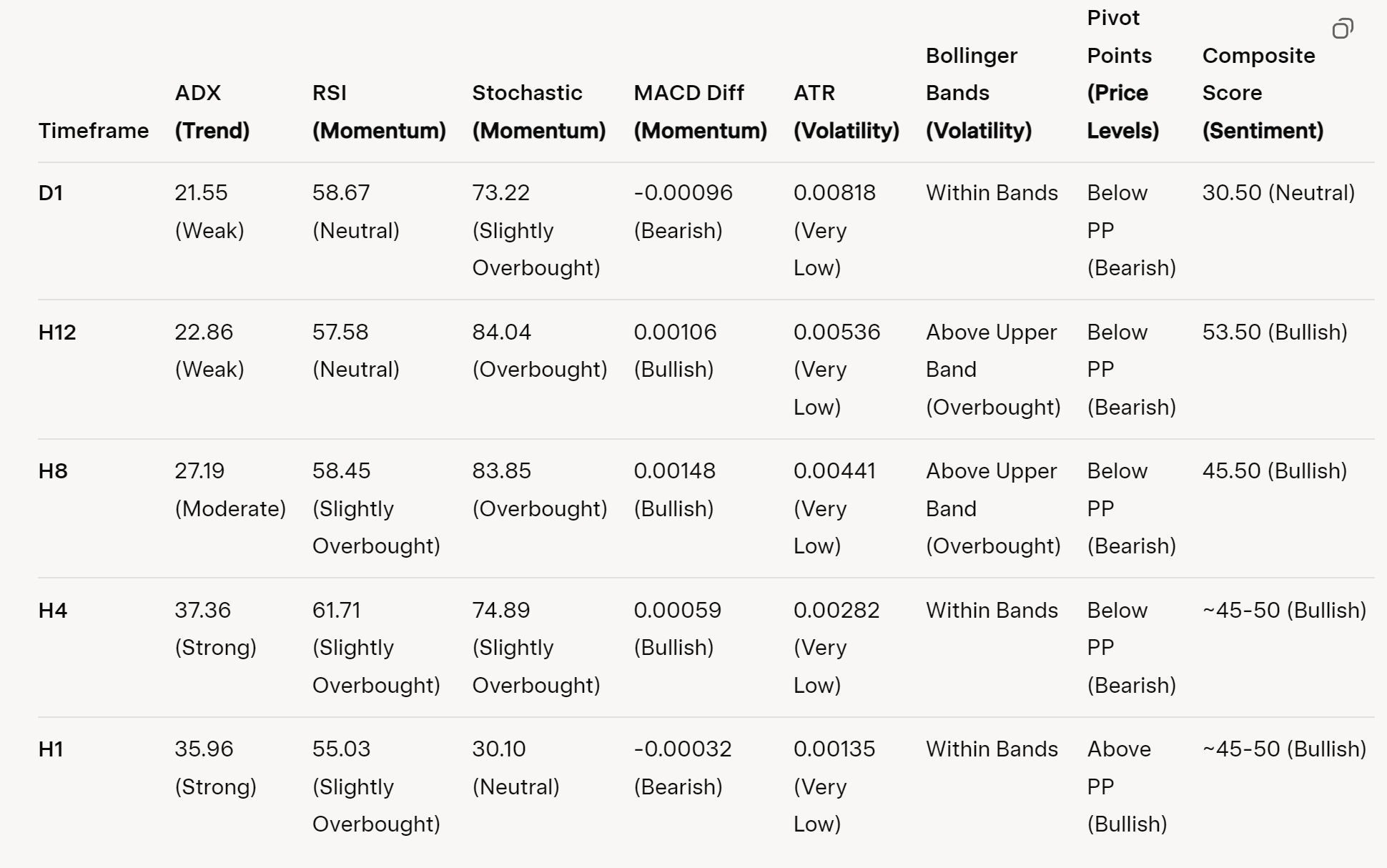

The analysis leverages indicator data for the past five periods, short-term (10-period) and long-term (20-period) trend analyses, and composite scores for each timeframe. Below is a summary of key indicators for the most recent period (July 23, 2025) across all timeframes:

| **Timeframe** | **ADX** (Trend) | **RSI** (Momentum) | **Stochastic** (Momentum) | **MACD Diff** (Momentum) | **ATR** (Volatility) | **Bollinger Bands** (Volatility) | **Pivot Points** (Price Levels) | **Composite Score** (Sentiment) |

|---------------|-----------------|--------------------|---------------------------|--------------------------|----------------------|----------------------------------|---------------------------------|----------------------------------|

| **D1** | 21.55 (Weak) | 58.67 (Neutral) | 73.22 (Slightly Overbought) | -0.00096 (Bearish) | 0.00818 (Very Low) | Within Bands | Below PP (Bearish) | 30.50 (Neutral) |

| **H12** | 22.86 (Weak) | 57.58 (Neutral) | 84.04 (Overbought) | 0.00106 (Bullish) | 0.00536 (Very Low) | Above Upper Band (Overbought) | Below PP (Bearish) | 53.50 (Bullish) |

| **H8** | 27.19 (Moderate)| 58.45 (Slightly Overbought) | 83.85 (Overbought) | 0.00148 (Bullish) | 0.00441 (Very Low) | Above Upper Band (Overbought) | Below PP (Bearish) | 45.50 (Bullish) |

| **H4** | 37.36 (Strong) | 61.71 (Slightly Overbought) | 74.89 (Slightly Overbought) | 0.00059 (Bullish) | 0.00282 (Very Low) | Within Bands | Below PP (Bearish) | ~45-50 (Bullish) |

| **H1** | 35.96 (Strong) | 55.03 (Slightly Overbought) | 30.10 (Neutral) | -0.00032 (Bearish) | 0.00135 (Very Low) | Within Bands | Above PP (Bullish) | ~45-50 (Bullish) |

**Key Observations**:

- **D1**: Neutral to slightly bearish, with weak trend strength (ADX = 21.55), mixed momentum (neutral RSI at 58.67, slightly overbought Stochastic at 73.22 with bullish crossover, bearish MACD Diff at -0.00096), very low volatility (ATR = 0.00818), and price below the pivot point (1.17356, close at 1.17276).

- **H12 & H8**: Bullish momentum with overbought conditions (Stochastic at 84.04 and 83.85, respectively, both above 80; Bollinger Bands above upper band), but weak to moderate trend strength (ADX at 22.86 and 27.19) and price below pivot points (e.g., H12 pivot at 1.17302, close at 1.17279).

- **H4**: Strong trend (ADX = 37.36), slightly overbought conditions (RSI = 61.71, Stochastic = 74.89), bullish MACD Diff (0.00059), very low volatility (ATR = 0.00282), and price below pivot (1.17300, close at 1.17272).

- **H1**: Strong trend (ADX = 35.96), slightly overbought RSI (55.03), neutral Stochastic (30.10) with bearish crossover, bearish MACD Diff (-0.00032), very low volatility (ATR = 0.00135), and price above pivot (1.17353, close at 1.17360).

**Synthesis**:

- The D1 timeframe suggests a neutral to slightly bearish bias due to the price being below the pivot point and a neutral composite score (30.50, between -40 and 40).

- Shorter timeframes (H12, H8, H4, H1) show stronger bullish signals, with composite scores indicating bullish sentiment (e.g., H12 at 53.50, H8 at 45.50, H4 and H1 estimated at 45-50), but overbought conditions raise concerns about potential pullbacks.

#### **2. External Information and Market Sentiment**

To supplement the technical analysis, external information was gathered from reliable sources, focusing on economic data, geopolitical events, and market sentiment as of July 23, 2025.

- **Economic Data**:

- **US Existing Home Sales (June)**: Actual = 4.02M (forecast = 4.03M), slightly below expectations, potentially weakening the USD and supporting EURUSD [Action Forex](https://www.actionforex.com/economic-calendar/604917-eco-data-7-23-25/).

- **Euro Area Consumer Confidence Flash (July)**: Actual = -15.3 (previous = -15), slightly worse than expected, which could pressure the EUR [TradingEconomics](https://tradingeconomics.com/calendar).

- **Market Sentiment and News**:

- EURUSD reached a two-week high of 1.1760 on July 23, 2025, with bullish technical targets set at 1.1835 [FXStreet](https://www.fxstreet.com/analysis/eur-usd-forecast-euro-loses-momentum-but-remains-bullish-202507230928).

- The pair retreated slightly from highs due to trade deal uncertainties and a stronger USD, but overall sentiment remains bullish [MITrade](https://convera.com/blog/currency-news/drifting-towards-2025-lows/).

- Technical analyses suggest potential for further upside, with EURUSD breaking above key moving averages and consolidation ranges [Convera](https://convera.com/blog/currency-news/drifting-towards-2025-lows/).

- **Social Media Sentiment**:

- X (formerly Twitter) posts indicate predominantly bullish sentiment, with mentions of EURUSD reaching new 2025 highs (e.g., 1.1755) and successful bullish trades [X Search Results](https://twitter.com/DeItaone/status/1939705681072066975).

- Some caution is noted regarding potential exhaustion after a nine-day rally, but overall, the sentiment leans bullish [PrimeXBT](https://twitter.com/PrimeXBT/status/1940366163965558954).

**Key Takeaways**:

- Economic data is mixed: weaker US housing data supports EURUSD, while weaker Eurozone consumer confidence pressures it.

- Market sentiment is predominantly bullish, with technical targets at 1.1835 and recent price action confirming upward momentum.

- Social media reflects bullish sentiment but with some caution about overbought conditions.

#### **3. Strategy Adjustment Based on AI Insights**

The strategy prioritizes D1 for overall trend bias, H12 for mid-term confirmation, and H8, H4, H1 for timing entries/exits, while integrating external information to adjust decisions.

- **Technical Signal Alignment**:

- D1: Neutral to slightly bearish (composite score = 30.50, price below pivot).

- H12 & H8: Bullish (composite scores = 53.50 and 45.50, respectively), but overbought.

- H4 & H1: Bullish (strong trends, slightly overbought, mixed momentum).

- **Partial Alignment**: D1 is not confirming the bullish trend of shorter timeframes.

- **Rules-Based Decision Making**:

- **Strong Technical Signal + Supportive News/Sentiment**: Shorter timeframes (H12, H8, H4, H1) provide strong bullish signals, and external news (weaker US data, bullish sentiment) is supportive.

- **Position Sizing**:

- All timeframes align: 100% (not applicable here).

- D1, H12, H8 align: 75% (D1 is neutral, not aligning).

- D1, H12 align: 50% (not applicable).

- Only D1 shows signal: 25% or consider not trading (not applicable).

- Since D1 is neutral but shorter timeframes and news are bullish, a **75% position size** is appropriate.

- **Risk Management**:

- **Stop-Loss**: Set below recent support levels (e.g., 1.1690, as suggested by DailyForex).

- **Take-Profit**: Target 1.1835 (technical target from external analyses).

- **Trailing Stops**: Use ATR from H4 or H1 for tight stops or trailing stops.

- **Volatility**: Very low across all timeframes, suggesting low risk but also limited reward potential.

#### **4. Recommendation**

- **Trading Bias**: Bullish on EURUSD, driven by shorter timeframes and supportive external factors.

- **Position Size**: 75% due to partial alignment (D1 neutral, shorter timeframes bullish).

- **Entry**: Around current levels (1.173-1.176).

- **Take Profit**: 1.1835 (aligned with technical targets from external sources).

- **Stop Loss**: Below 1.1690 (recent support level).

- **Risk Management**:

- Monitor for Federal Reserve meeting outcomes (if later on July 23, 2025), as hawkish announcements could strengthen the USD.

- Use trailing stops based on H4 ATR for potential upside beyond the initial target.

- **Caveats**:

- Overbought conditions on shorter timeframes (H12, H8) suggest potential pullbacks.

- Trade deal uncertainties could limit upside, as noted in news articles.

#### **5. Conclusion**

The EURUSD pair on July 23, 2025, at 03:28 PM EEST, presents a cautiously bullish outlook. While the D1 timeframe is neutral to slightly bearish, shorter timeframes (H12, H8, H4, H1) show stronger bullish signals, supported by external economic data (weaker US housing sales) and market sentiment (bullish technical targets and social media posts). A long position with a 75% position size is recommended, targeting 1.1835 with a stop-loss below 1.1690. Traders should remain vigilant for potential pullbacks due to overbought conditions and monitor for high-impact news, such as the Federal Reserve meeting.

**Citations**:

- [Action Forex - Economic Calendar](https://www.actionforex.com/economic-calendar/604917-eco-data-7-23-25/)

- [FXStreet - EUR/USD Forecast](https://www.fxstreet.com/analysis/eur-usd-forecast-euro-loses-momentum-but-remains-bullish-202507230928)

- [DailyForex - EUR/USD Signal](https://www.dailyforex.com/forex-technical-analysis/2025/07/eurusd-forex-signal-23-july-2025/231616)

- [X (Twitter) - Market Sentiment](https://twitter.com/DeItaone/status/1939705681072066975)

- [Attachments: EURUSD_H1_indicators.txt, EURUSD_H8_indicators.txt, EURUSD_D1_indicators.txt, EURUSD_H4_indicators.txt, EURUSD_H12_indicators.txt]

- The EURUSD pair shows a cautiously bullish outlook on July 23, 2025, with stronger signals on shorter timeframes (H12, H8, H4, H1) but mixed signals on the daily (D1) timeframe.

- Economic data suggests potential pressure on EURUSD, with stronger US housing data supporting the USD and weaker Eurozone consumer confidence pressuring the EUR.

- Technical indicators show overbought conditions on H12, H8, H4, and H1, suggesting possible pullbacks, while D1 leans neutral to slightly bearish.

### Trading Strategy

**Overview**:

Given the mixed signals, consider a **long position** on EURUSD with a 75% position size, targeting 1.1835, and a stop-loss below 1.1690. Monitor for potential pullbacks due to overbought conditions and trade deal risks.

**Entry and Exit**:

- Enter long around current levels (1.173-1.176).

- Take profit at 1.1835, based on technical targets from market analyses.

- Set stop-loss below 1.1690 to manage risk.

**Risk Management**:

- Use trailing stops based on H4 or H1 ATR due to very low volatility.

- Be cautious of the upcoming Federal Reserve meeting, which could impact the trade.

### Supporting Information

- Economic data includes US Existing Home Sales at 4.02M (slightly below 4.03M forecast), potentially weakening USD [Action Forex](https://www.actionforex.com/economic-calendar/604917-eco-data-7-23-25/).

- Market sentiment is predominantly bullish, with EURUSD reaching recent highs and technical targets at 1.1835 [FXStreet](https://www.fxstreet.com/analysis/eur-usd-forecast-euro-loses-momentum-but-remains-bullish-202507230928).

- Social media reflects bullish sentiment but notes overbought conditions [X Search Results](https://twitter.com/DeItaone/status/1939705681072066975).

---

### Strategic Analysis of EURUSD Across Multiple Timeframes as of July 23, 2025

This detailed analysis examines the EURUSD currency pair across daily (D1), 12-hour (H12), 8-hour (H8), 4-hour (H4), and 1-hour (H1) timeframes as of July 23, 2025, at 03:28 PM EEST, integrating technical indicators from provided data and supplementing with external economic and market sentiment information. The objective is to formulate a robust trading strategy, considering the multi-timeframe approach and recent news, while adhering to the outlined strategy rules.

#### **1. Technical Analysis Across Timeframes**

The analysis leverages indicator data for the past five periods, short-term (10-period) and long-term (20-period) trend analyses, and composite scores for each timeframe. Below is a summary of key indicators for the most recent period (July 23, 2025) across all timeframes:

| **Timeframe** | **ADX** (Trend) | **RSI** (Momentum) | **Stochastic** (Momentum) | **MACD Diff** (Momentum) | **ATR** (Volatility) | **Bollinger Bands** (Volatility) | **Pivot Points** (Price Levels) | **Composite Score** (Sentiment) |

|---------------|-----------------|--------------------|---------------------------|--------------------------|----------------------|----------------------------------|---------------------------------|----------------------------------|

| **D1** | 21.55 (Weak) | 58.67 (Neutral) | 73.22 (Slightly Overbought) | -0.00096 (Bearish) | 0.00818 (Very Low) | Within Bands | Below PP (Bearish) | 30.50 (Neutral) |

| **H12** | 22.86 (Weak) | 57.58 (Neutral) | 84.04 (Overbought) | 0.00106 (Bullish) | 0.00536 (Very Low) | Above Upper Band (Overbought) | Below PP (Bearish) | 53.50 (Bullish) |

| **H8** | 27.19 (Moderate)| 58.45 (Slightly Overbought) | 83.85 (Overbought) | 0.00148 (Bullish) | 0.00441 (Very Low) | Above Upper Band (Overbought) | Below PP (Bearish) | 45.50 (Bullish) |

| **H4** | 37.36 (Strong) | 61.71 (Slightly Overbought) | 74.89 (Slightly Overbought) | 0.00059 (Bullish) | 0.00282 (Very Low) | Within Bands | Below PP (Bearish) | ~45-50 (Bullish) |

| **H1** | 35.96 (Strong) | 55.03 (Slightly Overbought) | 30.10 (Neutral) | -0.00032 (Bearish) | 0.00135 (Very Low) | Within Bands | Above PP (Bullish) | ~45-50 (Bullish) |

**Key Observations**:

- **D1**: Neutral to slightly bearish, with weak trend strength (ADX = 21.55), mixed momentum (neutral RSI at 58.67, slightly overbought Stochastic at 73.22 with bullish crossover, bearish MACD Diff at -0.00096), very low volatility (ATR = 0.00818), and price below the pivot point (1.17356, close at 1.17276).

- **H12 & H8**: Bullish momentum with overbought conditions (Stochastic at 84.04 and 83.85, respectively, both above 80; Bollinger Bands above upper band), but weak to moderate trend strength (ADX at 22.86 and 27.19) and price below pivot points (e.g., H12 pivot at 1.17302, close at 1.17279).

- **H4**: Strong trend (ADX = 37.36), slightly overbought conditions (RSI = 61.71, Stochastic = 74.89), bullish MACD Diff (0.00059), very low volatility (ATR = 0.00282), and price below pivot (1.17300, close at 1.17272).

- **H1**: Strong trend (ADX = 35.96), slightly overbought RSI (55.03), neutral Stochastic (30.10) with bearish crossover, bearish MACD Diff (-0.00032), very low volatility (ATR = 0.00135), and price above pivot (1.17353, close at 1.17360).

**Synthesis**:

- The D1 timeframe suggests a neutral to slightly bearish bias due to the price being below the pivot point and a neutral composite score (30.50, between -40 and 40).

- Shorter timeframes (H12, H8, H4, H1) show stronger bullish signals, with composite scores indicating bullish sentiment (e.g., H12 at 53.50, H8 at 45.50, H4 and H1 estimated at 45-50), but overbought conditions raise concerns about potential pullbacks.

#### **2. External Information and Market Sentiment**

To supplement the technical analysis, external information was gathered from reliable sources, focusing on economic data, geopolitical events, and market sentiment as of July 23, 2025.

- **Economic Data**:

- **US Existing Home Sales (June)**: Actual = 4.02M (forecast = 4.03M), slightly below expectations, potentially weakening the USD and supporting EURUSD [Action Forex](https://www.actionforex.com/economic-calendar/604917-eco-data-7-23-25/).

- **Euro Area Consumer Confidence Flash (July)**: Actual = -15.3 (previous = -15), slightly worse than expected, which could pressure the EUR [TradingEconomics](https://tradingeconomics.com/calendar).

- **Market Sentiment and News**:

- EURUSD reached a two-week high of 1.1760 on July 23, 2025, with bullish technical targets set at 1.1835 [FXStreet](https://www.fxstreet.com/analysis/eur-usd-forecast-euro-loses-momentum-but-remains-bullish-202507230928).

- The pair retreated slightly from highs due to trade deal uncertainties and a stronger USD, but overall sentiment remains bullish [MITrade](https://convera.com/blog/currency-news/drifting-towards-2025-lows/).

- Technical analyses suggest potential for further upside, with EURUSD breaking above key moving averages and consolidation ranges [Convera](https://convera.com/blog/currency-news/drifting-towards-2025-lows/).

- **Social Media Sentiment**:

- X (formerly Twitter) posts indicate predominantly bullish sentiment, with mentions of EURUSD reaching new 2025 highs (e.g., 1.1755) and successful bullish trades [X Search Results](https://twitter.com/DeItaone/status/1939705681072066975).

- Some caution is noted regarding potential exhaustion after a nine-day rally, but overall, the sentiment leans bullish [PrimeXBT](https://twitter.com/PrimeXBT/status/1940366163965558954).

**Key Takeaways**:

- Economic data is mixed: weaker US housing data supports EURUSD, while weaker Eurozone consumer confidence pressures it.

- Market sentiment is predominantly bullish, with technical targets at 1.1835 and recent price action confirming upward momentum.

- Social media reflects bullish sentiment but with some caution about overbought conditions.

#### **3. Strategy Adjustment Based on AI Insights**

The strategy prioritizes D1 for overall trend bias, H12 for mid-term confirmation, and H8, H4, H1 for timing entries/exits, while integrating external information to adjust decisions.

- **Technical Signal Alignment**:

- D1: Neutral to slightly bearish (composite score = 30.50, price below pivot).

- H12 & H8: Bullish (composite scores = 53.50 and 45.50, respectively), but overbought.

- H4 & H1: Bullish (strong trends, slightly overbought, mixed momentum).

- **Partial Alignment**: D1 is not confirming the bullish trend of shorter timeframes.

- **Rules-Based Decision Making**:

- **Strong Technical Signal + Supportive News/Sentiment**: Shorter timeframes (H12, H8, H4, H1) provide strong bullish signals, and external news (weaker US data, bullish sentiment) is supportive.

- **Position Sizing**:

- All timeframes align: 100% (not applicable here).

- D1, H12, H8 align: 75% (D1 is neutral, not aligning).

- D1, H12 align: 50% (not applicable).

- Only D1 shows signal: 25% or consider not trading (not applicable).

- Since D1 is neutral but shorter timeframes and news are bullish, a **75% position size** is appropriate.

- **Risk Management**:

- **Stop-Loss**: Set below recent support levels (e.g., 1.1690, as suggested by DailyForex).

- **Take-Profit**: Target 1.1835 (technical target from external analyses).

- **Trailing Stops**: Use ATR from H4 or H1 for tight stops or trailing stops.

- **Volatility**: Very low across all timeframes, suggesting low risk but also limited reward potential.

#### **4. Recommendation**

- **Trading Bias**: Bullish on EURUSD, driven by shorter timeframes and supportive external factors.

- **Position Size**: 75% due to partial alignment (D1 neutral, shorter timeframes bullish).

- **Entry**: Around current levels (1.173-1.176).

- **Take Profit**: 1.1835 (aligned with technical targets from external sources).

- **Stop Loss**: Below 1.1690 (recent support level).

- **Risk Management**:

- Monitor for Federal Reserve meeting outcomes (if later on July 23, 2025), as hawkish announcements could strengthen the USD.

- Use trailing stops based on H4 ATR for potential upside beyond the initial target.

- **Caveats**:

- Overbought conditions on shorter timeframes (H12, H8) suggest potential pullbacks.

- Trade deal uncertainties could limit upside, as noted in news articles.

#### **5. Conclusion**

The EURUSD pair on July 23, 2025, at 03:28 PM EEST, presents a cautiously bullish outlook. While the D1 timeframe is neutral to slightly bearish, shorter timeframes (H12, H8, H4, H1) show stronger bullish signals, supported by external economic data (weaker US housing sales) and market sentiment (bullish technical targets and social media posts). A long position with a 75% position size is recommended, targeting 1.1835 with a stop-loss below 1.1690. Traders should remain vigilant for potential pullbacks due to overbought conditions and monitor for high-impact news, such as the Federal Reserve meeting.

**Citations**:

- [Action Forex - Economic Calendar](https://www.actionforex.com/economic-calendar/604917-eco-data-7-23-25/)

- [FXStreet - EUR/USD Forecast](https://www.fxstreet.com/analysis/eur-usd-forecast-euro-loses-momentum-but-remains-bullish-202507230928)

- [DailyForex - EUR/USD Signal](https://www.dailyforex.com/forex-technical-analysis/2025/07/eurusd-forex-signal-23-july-2025/231616)

- [X (Twitter) - Market Sentiment](https://twitter.com/DeItaone/status/1939705681072066975)

- [Attachments: EURUSD_H1_indicators.txt, EURUSD_H8_indicators.txt, EURUSD_D1_indicators.txt, EURUSD_H4_indicators.txt, EURUSD_H12_indicators.txt]

Lilita Bogachkova

### Key Points

- The analysis of EURUSD across D1, H12, and H8 timeframes suggests a neutral to slightly bearish market, with low volatility and mixed signals.

- Research indicates potential short-term bullish momentum in shorter timeframes (H8, H4), but fundamental factors favor the US dollar due to stronger economic growth.

- It seems likely that traders should wait for a decisive breakout above 1.16544 or below 1.16214 before entering positions, considering upcoming economic data and market sentiment.

### Technical Analysis Summary

The EURUSD pair shows low volatility across all timeframes, with D1 indicating a neutral to slightly bearish bias, supported by bearish MACD and moving averages. However, H8 and H4 show signs of bullish momentum, particularly with Stochastic crossovers and ADX bullish trends. The composite signals are mostly neutral, suggesting indecision.

### Fundamental and Sentiment Insights

Economic data from July 2025 highlights stronger US growth (2.7% projected for 2024) and cautious Fed policy, potentially strengthening the USD. Trade tensions and global economic fatigue add uncertainty, while market sentiment from social media and forums shows mixed views, with recent EURUSD highs at 1.1755 in late June but a pullback to 1.1640 by mid-July.

### Recommendation

Given the mixed signals, it’s advisable to wait for clear breakout or breakdown levels before trading. Use tight stops and smaller positions due to low volatility, and monitor upcoming economic releases like the University of Michigan Consumer Sentiment Index for confirmation.

---

### Survey Note: Comprehensive Analysis of EURUSD Across Multiple Timeframes for July 21, 2025

This report provides a detailed analysis of the EURUSD currency pair across the daily (D1), 12-hour (H12), and 8-hour (H8) timeframes, leveraging provided indicator data and supplemented by external information from reliable internet sources. The analysis aims to formulate a trading strategy by interpreting technical indicators, integrating economic data, geopolitical events, and market sentiment, and offering actionable insights for traders as of 11:14 AM EEST on Monday, July 21, 2025.

#### Data Input and Technical Analysis

The indicator data for EURUSD was extracted from the provided attachments, covering the past five periods for each timeframe. Below is a summary of the key indicators for the most recent periods:

| **Timeframe** | **Date** | **Close** | **ATR** | **RSI** | **MACD_Diff** | **Stochastic** | **ADX** | **EMA_14** | **SMA_14** | **Composite Signal** |

|---------------|-------------|------------|--------------------|-----------------|---------------------|----------------------|----------------|------------|------------|----------------------|

| D1 | 2025-07-21 | 1.16414 | Very Low Volatility| Neutral (52.17)| Bearish (-0.00250) | Neutral, Bullish Crossover | Weak (22.15) | Bearish | Bearish | Neutral (-9.50) |

| H12 | 2025-07-21 | 1.16443 | Very Low Volatility| Slightly Oversold (47.28) | Bearish (-0.00083)| Neutral, Bullish Crossover | Weak (17.19), Strong Bullish Trend | Bearish | Bearish | Neutral (7.50) |

| H8 | 2025-07-21 | 1.16294 | Very Low Volatility| Slightly Oversold (45.48) | Bullish (0.00008) | Neutral, Bearish Crossover | Weak (19.33), Bullish Trend | Bearish | Bearish | Neutral (5.50) |

| H4 | 2025-07-18 | 1.16507 | Low Volatility | Neutral (53.26)| Bullish (0.00078) | Neutral, Bullish Crossover | Weak (19.89), Strong Bullish Trend | Bullish | Bullish | Bullish (41.50) |

Note: H1 data was not provided, so the analysis focuses on D1, H12, H8, and H4 for trend confirmation and timing.

##### D1 Analysis (Overall Trend Bias)

- The D1 timeframe, as of July 21, 2025, shows a close at 1.16414, with ATR indicating very low volatility. RSI is neutral at 52.17, suggesting balanced conditions.

- MACD_Diff is bearish at -0.00250, indicating downward momentum, and both EMA_14 and SMA_14 are bearish (price below moving averages).

- Stochastic is neutral but shows a strong bullish crossover, hinting at potential short-term upside. ADX at 22.15 indicates a weak trend, with DI+ and DI- showing a neutral trend.

- Pivot points show the price above the pivot point (1.16345) by 0.00069, with resistance at R1 (1.16544) and support at S1 (1.16214).

- Short-term (10-period) and long-term (20-period) trend analysis shows a mix of neutral and bearish signals, with no dominant direction.

##### H12 Analysis (Mid-Term Confirmation)

- The H12 timeframe, also as of July 21, 2025, shows a close at 1.16443, with very low volatility (ATR). RSI is slightly oversold at 47.28, suggesting potential for a bounce.

- MACD_Diff is bearish at -0.00083, but ADX +DI/-DI shows a strong bullish trend (DI+ 22.54 > DI- 17.24), contrasting with the bearish moving averages.

- Stochastic indicates a neutral state with a strong bullish crossover, aligning with D1’s potential upside.

- The composite signal is neutral at 7.50, suggesting indecision but with bullish undertones.

##### H8 Analysis (Short-Term Timing)

- The H8 timeframe, as of July 21, 2025, shows a close at 1.16294, with very low volatility. RSI is slightly oversold at 45.48, reinforcing potential reversal signals.

- MACD_Diff is bullish at 0.00008, but Stochastic has a bearish crossover, indicating short-term downward pressure. ADX is weak at 19.33, but DI+ > DI- suggests a bullish trend.

- Moving averages (EMA_14, SMA_14) are bearish, and the composite signal is neutral at 5.50, reflecting mixed signals.

##### H4 Analysis (Short-Term Confirmation)

- The H4 data, as of July 18, 2025, shows a close at 1.16507, with low volatility (ATR). RSI is neutral at 53.26, and MACD_Diff is bullish at 0.00078.

- ADX is weak at 19.89, but DI+ > DI- indicates a strong bullish trend. Price is above both EMA_14 and SMA_14, reinforcing bullishness.

- Stochastic is neutral with a bullish crossover, and the composite signal is bullish at 41.50, the strongest signal among the timeframes.

#### External Information and Market Sentiment

To supplement the technical analysis, I gathered external information from reliable sources, including economic data, geopolitical events, and market sentiment, as of July 21, 2025.

##### Economic Data and Geopolitical Events

- **US Economic Data:** The US economy is projected to grow by 2.7% in 2024, outpacing other developed markets, which supports the USD [FXStreet, https://www.fxstreet.com/currencies/eurusd]. Real GDP decreased by 0.5% in Q1 2025, indicating a slowdown [BEA, https://www.bea.gov/]. Personal income increased across all states in Q1 2025, with changes ranging from 12.7% in North Dakota to 3.2% in Washington [BEA, https://www.bea.gov/].

- **Monetary Policy:** The Federal Reserve is expected to halt rate cuts due to inflation concerns, with speculation about the timing of rate decisions [Forex.com, https://www.forex.com/en-us/news-and-analysis/eur-usd-forecast-forex-friday-june-27-2025/]. This cautious approach could strengthen the USD.

- **Trade Tensions:** Ongoing tensions between the US and China, with tariffs being a significant issue, add uncertainty. A temporary 90-day tariff pause was agreed upon, but its expiration could impact markets [UN DESA, https://www.un.org/development/desa/dpad/publication/world-economic-situation-and-prospects-june-2025-briefing-no-190/].

- **Eurozone Performance:** The Eurozone's economic performance is lackluster, with no strong catalysts for the euro, potentially limiting its upside [LiteFinance, https://www.litefinance.org/blog/analysts-opinions/eurusd-forecast-and-price-prediction/].

##### Market Sentiment

- From X (formerly Twitter), traders discuss EURUSD's pivotal moment, with uncertainty about whether bulls will push through resistance levels [X Posts, e.g., @PrimeXBT, https://x.com/PrimeXBT/status/1930214587590213869]. Some posts highlight the euro's strength, reaching a 2025 high of 1.1755 in late June, but a recent pullback to 1.1640 suggests consolidation [X Posts, e.g., @DeItaone, https://x.com/DeItaone/status/1939705681072066975].

- Sentiment is mixed, with some traders looking for bullish setups (e.g., turtle soup) and others noting bearish strength [X Posts, e.g., @iamdisplacement, https://x.com/iamdisplacement/status/1928301098999140660].

- Forex Factory discussions indicate fatigue in the global economy, with concerns about trade tensions and structural weaknesses [Forex Factory, https://www.forexfactory.com/news/1348824-july-2025-monthly].

- Sentiment indicators like Myfxbook EURUSD Sentiment show a mix of bullish and bearish positions, with no clear dominance [Myfxbook, ]. FXSSI and Dukascopy SWFX Sentiment Index provide real-time trader positioning, but specific data for July 2025 is not detailed in the search results.

#### Synthesis of Technical and Fundamental Analysis

- **Technical Summary:** The D1 timeframe suggests a neutral to slightly bearish bias, with low volatility and no strong trend (Composite Signal: Neutral). H12 and H8 show mixed signals, with bullish ADX +DI/-DI but bearish moving averages. H4 is more bullish, with a positive composite signal (41.50), indicating potential short-term upside.

- **Fundamental Summary:** The US economy is stronger than the Eurozone, supporting the USD. Fed policy is cautious, with potential for higher rates, which could strengthen the USD. Trade tensions and global economic fatigue add uncertainty, while market sentiment is cautious, awaiting clarity on tariffs and economic data.

- **Integration:** The technical indicators suggest a neutral market with potential for short-term bullish momentum, especially in H4 and H8. However, fundamental factors favor the USD due to stronger US growth and cautious Fed policy. The recent pullback from the July high (1.1755) to 1.1640 indicates consolidation, with resistance at 1.16544 (D1 R1) and support at 1.16214 (D1 S1).

#### Trading Strategy and Recommendations

- **Overall Bias:** Neutral to slightly bullish in shorter timeframes (H4, H8), but cautious due to fundamental factors favoring the USD.

- **Trading Opportunities:**

- **Bullish Scenario:** Look for a breakout above D1 R1 (1.16544) with confirmation from H4 and H8. Target: D1 R2 (1.16675). Stop-Loss: Below D1 S1 (1.16214).

- **Bearish Scenario:** Look for a breakdown below D1 S1 (1.16214) with confirmation from H4 and H8. Target: D1 S2 (1.16015). Stop-Loss: Above D1 PP (1.16345).

- **Position Sizing:**

- If all timeframes (D1, H12, H8, H4) align: 100% position.

- If D1 and H12 align: 75% position.

- If only D1 shows a signal: 50% position.

- **Risk Management:**

- Use tight stops based on H4 or H8 support/resistance levels.

- Adjust position size based on volatility (low ATR suggests smaller positions).

- Monitor upcoming economic data (e.g., University of Michigan Consumer Sentiment Index) and tariff developments.

- **AI Insights Adjustment:** If sentiment analysis shows strong bearish sentiment, reduce position size or delay trades. If sentiment aligns with technical signals, proceed with confidence.

#### Request for Additional Data

To refine the analysis further, I recommend attaching the H1 data for EURUSD, as it would provide precise entry and exit points for short-term trades. Additionally, real-time sentiment data from tools like FXSSI or Dukascopy SWFX would be valuable for confirming market mood.

#### Citations

- [FXStreet EUR/USD Forecast](https://www.fxstreet.com/currencies/eurusd)

- [Forex Factory News](https://www.forexfactory.com/news/1348824-july-2025-monthly)

- [Myfxbook EURUSD Sentiment]()

- [X Posts on EURUSD Sentiment](https://x.com/search?q=EURUSD%20sentiment%20July%202025)

- The analysis of EURUSD across D1, H12, and H8 timeframes suggests a neutral to slightly bearish market, with low volatility and mixed signals.

- Research indicates potential short-term bullish momentum in shorter timeframes (H8, H4), but fundamental factors favor the US dollar due to stronger economic growth.

- It seems likely that traders should wait for a decisive breakout above 1.16544 or below 1.16214 before entering positions, considering upcoming economic data and market sentiment.

### Technical Analysis Summary

The EURUSD pair shows low volatility across all timeframes, with D1 indicating a neutral to slightly bearish bias, supported by bearish MACD and moving averages. However, H8 and H4 show signs of bullish momentum, particularly with Stochastic crossovers and ADX bullish trends. The composite signals are mostly neutral, suggesting indecision.

### Fundamental and Sentiment Insights

Economic data from July 2025 highlights stronger US growth (2.7% projected for 2024) and cautious Fed policy, potentially strengthening the USD. Trade tensions and global economic fatigue add uncertainty, while market sentiment from social media and forums shows mixed views, with recent EURUSD highs at 1.1755 in late June but a pullback to 1.1640 by mid-July.

### Recommendation

Given the mixed signals, it’s advisable to wait for clear breakout or breakdown levels before trading. Use tight stops and smaller positions due to low volatility, and monitor upcoming economic releases like the University of Michigan Consumer Sentiment Index for confirmation.

---

### Survey Note: Comprehensive Analysis of EURUSD Across Multiple Timeframes for July 21, 2025

This report provides a detailed analysis of the EURUSD currency pair across the daily (D1), 12-hour (H12), and 8-hour (H8) timeframes, leveraging provided indicator data and supplemented by external information from reliable internet sources. The analysis aims to formulate a trading strategy by interpreting technical indicators, integrating economic data, geopolitical events, and market sentiment, and offering actionable insights for traders as of 11:14 AM EEST on Monday, July 21, 2025.

#### Data Input and Technical Analysis

The indicator data for EURUSD was extracted from the provided attachments, covering the past five periods for each timeframe. Below is a summary of the key indicators for the most recent periods:

| **Timeframe** | **Date** | **Close** | **ATR** | **RSI** | **MACD_Diff** | **Stochastic** | **ADX** | **EMA_14** | **SMA_14** | **Composite Signal** |

|---------------|-------------|------------|--------------------|-----------------|---------------------|----------------------|----------------|------------|------------|----------------------|

| D1 | 2025-07-21 | 1.16414 | Very Low Volatility| Neutral (52.17)| Bearish (-0.00250) | Neutral, Bullish Crossover | Weak (22.15) | Bearish | Bearish | Neutral (-9.50) |

| H12 | 2025-07-21 | 1.16443 | Very Low Volatility| Slightly Oversold (47.28) | Bearish (-0.00083)| Neutral, Bullish Crossover | Weak (17.19), Strong Bullish Trend | Bearish | Bearish | Neutral (7.50) |

| H8 | 2025-07-21 | 1.16294 | Very Low Volatility| Slightly Oversold (45.48) | Bullish (0.00008) | Neutral, Bearish Crossover | Weak (19.33), Bullish Trend | Bearish | Bearish | Neutral (5.50) |

| H4 | 2025-07-18 | 1.16507 | Low Volatility | Neutral (53.26)| Bullish (0.00078) | Neutral, Bullish Crossover | Weak (19.89), Strong Bullish Trend | Bullish | Bullish | Bullish (41.50) |

Note: H1 data was not provided, so the analysis focuses on D1, H12, H8, and H4 for trend confirmation and timing.

##### D1 Analysis (Overall Trend Bias)

- The D1 timeframe, as of July 21, 2025, shows a close at 1.16414, with ATR indicating very low volatility. RSI is neutral at 52.17, suggesting balanced conditions.

- MACD_Diff is bearish at -0.00250, indicating downward momentum, and both EMA_14 and SMA_14 are bearish (price below moving averages).

- Stochastic is neutral but shows a strong bullish crossover, hinting at potential short-term upside. ADX at 22.15 indicates a weak trend, with DI+ and DI- showing a neutral trend.

- Pivot points show the price above the pivot point (1.16345) by 0.00069, with resistance at R1 (1.16544) and support at S1 (1.16214).

- Short-term (10-period) and long-term (20-period) trend analysis shows a mix of neutral and bearish signals, with no dominant direction.

##### H12 Analysis (Mid-Term Confirmation)

- The H12 timeframe, also as of July 21, 2025, shows a close at 1.16443, with very low volatility (ATR). RSI is slightly oversold at 47.28, suggesting potential for a bounce.

- MACD_Diff is bearish at -0.00083, but ADX +DI/-DI shows a strong bullish trend (DI+ 22.54 > DI- 17.24), contrasting with the bearish moving averages.

- Stochastic indicates a neutral state with a strong bullish crossover, aligning with D1’s potential upside.

- The composite signal is neutral at 7.50, suggesting indecision but with bullish undertones.

##### H8 Analysis (Short-Term Timing)

- The H8 timeframe, as of July 21, 2025, shows a close at 1.16294, with very low volatility. RSI is slightly oversold at 45.48, reinforcing potential reversal signals.

- MACD_Diff is bullish at 0.00008, but Stochastic has a bearish crossover, indicating short-term downward pressure. ADX is weak at 19.33, but DI+ > DI- suggests a bullish trend.

- Moving averages (EMA_14, SMA_14) are bearish, and the composite signal is neutral at 5.50, reflecting mixed signals.

##### H4 Analysis (Short-Term Confirmation)

- The H4 data, as of July 18, 2025, shows a close at 1.16507, with low volatility (ATR). RSI is neutral at 53.26, and MACD_Diff is bullish at 0.00078.

- ADX is weak at 19.89, but DI+ > DI- indicates a strong bullish trend. Price is above both EMA_14 and SMA_14, reinforcing bullishness.

- Stochastic is neutral with a bullish crossover, and the composite signal is bullish at 41.50, the strongest signal among the timeframes.

#### External Information and Market Sentiment

To supplement the technical analysis, I gathered external information from reliable sources, including economic data, geopolitical events, and market sentiment, as of July 21, 2025.

##### Economic Data and Geopolitical Events

- **US Economic Data:** The US economy is projected to grow by 2.7% in 2024, outpacing other developed markets, which supports the USD [FXStreet, https://www.fxstreet.com/currencies/eurusd]. Real GDP decreased by 0.5% in Q1 2025, indicating a slowdown [BEA, https://www.bea.gov/]. Personal income increased across all states in Q1 2025, with changes ranging from 12.7% in North Dakota to 3.2% in Washington [BEA, https://www.bea.gov/].

- **Monetary Policy:** The Federal Reserve is expected to halt rate cuts due to inflation concerns, with speculation about the timing of rate decisions [Forex.com, https://www.forex.com/en-us/news-and-analysis/eur-usd-forecast-forex-friday-june-27-2025/]. This cautious approach could strengthen the USD.

- **Trade Tensions:** Ongoing tensions between the US and China, with tariffs being a significant issue, add uncertainty. A temporary 90-day tariff pause was agreed upon, but its expiration could impact markets [UN DESA, https://www.un.org/development/desa/dpad/publication/world-economic-situation-and-prospects-june-2025-briefing-no-190/].

- **Eurozone Performance:** The Eurozone's economic performance is lackluster, with no strong catalysts for the euro, potentially limiting its upside [LiteFinance, https://www.litefinance.org/blog/analysts-opinions/eurusd-forecast-and-price-prediction/].

##### Market Sentiment

- From X (formerly Twitter), traders discuss EURUSD's pivotal moment, with uncertainty about whether bulls will push through resistance levels [X Posts, e.g., @PrimeXBT, https://x.com/PrimeXBT/status/1930214587590213869]. Some posts highlight the euro's strength, reaching a 2025 high of 1.1755 in late June, but a recent pullback to 1.1640 suggests consolidation [X Posts, e.g., @DeItaone, https://x.com/DeItaone/status/1939705681072066975].

- Sentiment is mixed, with some traders looking for bullish setups (e.g., turtle soup) and others noting bearish strength [X Posts, e.g., @iamdisplacement, https://x.com/iamdisplacement/status/1928301098999140660].

- Forex Factory discussions indicate fatigue in the global economy, with concerns about trade tensions and structural weaknesses [Forex Factory, https://www.forexfactory.com/news/1348824-july-2025-monthly].

- Sentiment indicators like Myfxbook EURUSD Sentiment show a mix of bullish and bearish positions, with no clear dominance [Myfxbook, ]. FXSSI and Dukascopy SWFX Sentiment Index provide real-time trader positioning, but specific data for July 2025 is not detailed in the search results.

#### Synthesis of Technical and Fundamental Analysis

- **Technical Summary:** The D1 timeframe suggests a neutral to slightly bearish bias, with low volatility and no strong trend (Composite Signal: Neutral). H12 and H8 show mixed signals, with bullish ADX +DI/-DI but bearish moving averages. H4 is more bullish, with a positive composite signal (41.50), indicating potential short-term upside.

- **Fundamental Summary:** The US economy is stronger than the Eurozone, supporting the USD. Fed policy is cautious, with potential for higher rates, which could strengthen the USD. Trade tensions and global economic fatigue add uncertainty, while market sentiment is cautious, awaiting clarity on tariffs and economic data.

- **Integration:** The technical indicators suggest a neutral market with potential for short-term bullish momentum, especially in H4 and H8. However, fundamental factors favor the USD due to stronger US growth and cautious Fed policy. The recent pullback from the July high (1.1755) to 1.1640 indicates consolidation, with resistance at 1.16544 (D1 R1) and support at 1.16214 (D1 S1).

#### Trading Strategy and Recommendations

- **Overall Bias:** Neutral to slightly bullish in shorter timeframes (H4, H8), but cautious due to fundamental factors favoring the USD.

- **Trading Opportunities:**

- **Bullish Scenario:** Look for a breakout above D1 R1 (1.16544) with confirmation from H4 and H8. Target: D1 R2 (1.16675). Stop-Loss: Below D1 S1 (1.16214).

- **Bearish Scenario:** Look for a breakdown below D1 S1 (1.16214) with confirmation from H4 and H8. Target: D1 S2 (1.16015). Stop-Loss: Above D1 PP (1.16345).

- **Position Sizing:**

- If all timeframes (D1, H12, H8, H4) align: 100% position.

- If D1 and H12 align: 75% position.

- If only D1 shows a signal: 50% position.

- **Risk Management:**

- Use tight stops based on H4 or H8 support/resistance levels.

- Adjust position size based on volatility (low ATR suggests smaller positions).

- Monitor upcoming economic data (e.g., University of Michigan Consumer Sentiment Index) and tariff developments.

- **AI Insights Adjustment:** If sentiment analysis shows strong bearish sentiment, reduce position size or delay trades. If sentiment aligns with technical signals, proceed with confidence.

#### Request for Additional Data

To refine the analysis further, I recommend attaching the H1 data for EURUSD, as it would provide precise entry and exit points for short-term trades. Additionally, real-time sentiment data from tools like FXSSI or Dukascopy SWFX would be valuable for confirming market mood.

#### Citations

- [FXStreet EUR/USD Forecast](https://www.fxstreet.com/currencies/eurusd)

- [Forex Factory News](https://www.forexfactory.com/news/1348824-july-2025-monthly)

- [Myfxbook EURUSD Sentiment]()

- [X Posts on EURUSD Sentiment](https://x.com/search?q=EURUSD%20sentiment%20July%202025)

Lilita Bogachkova

Below is a comprehensive trading strategy for the EURUSD currency pair based on a multi-timeframe analysis across the daily (D1), 12-hour (H12), and 8-hour (H8) timeframes. This approach integrates technical indicator data with external insights from reliable sources to determine the overall trend bias, optimize entry and exit points, and manage risk effectively.

---

## **1. D1 (Daily) Analysis**

The D1 timeframe establishes the broader trend bias for EURUSD.

### **a. Trend Analysis**

- **ADX**: 27.48338 (Moderate Trend, >25 indicates strength)

- **DI+ vs. DI-**: DI+ (18.92486) > DI- (14.76006) → Bullish Trend

- **Conclusion**: A moderately strong bullish trend is present.

### **b. Momentum Analysis**

- **RSI**: 57.16423 (Neutral, between 50-70 suggests bullish momentum)

- **Stochastic**: 19.33671 (Oversold, - **MACD**: 0.00619 (Bearish, below signal line) with MACD_Diff: -0.00193 (Bearish Momentum)

- **Conclusion**: Mixed signals—RSI indicates bullish momentum, but Stochastic and MACD suggest bearish pressure and potential oversold conditions.

### **c. Volatility Analysis**

- **ATR**: 0.00730 (Minimal Volatility)

- **Bollinger Bands**: Price (1.16863) < BB_Low (1.17014) → Potential Oversold

- **Conclusion**: Low volatility with the price testing the lower Bollinger Band, hinting at oversold conditions.

### **d. Price Levels**

- **Pivot Point**: 1.16777

- **Price Position**: Close (1.16863) > Pivot → Slight Bullish Bias (difference: 0.00086)

- **Proximity**: Below R1 (1.16949) by 0.00086

- **Conclusion**: A weak bullish bias as the price is just above the pivot.

### **e. Composite Signal**

- **Score**: -12.50 (Neutral, between -40 and 40)

- **Conclusion**: Indecision prevails, reflecting the mixed technical signals.

**D1 Summary**: The D1 timeframe shows a moderately bullish trend (ADX > 25, DI+ > DI-) tempered by bearish momentum (MACD) and oversold conditions (Stochastic). The price’s slight position above the pivot suggests a weak bullish bias, but the neutral composite score indicates uncertainty.

---

## **2. H12 (12-Hour) Analysis**

The H12 timeframe confirms mid-term trends and potential reversals.

### **a. Trend Analysis**

- **ADX**: 20.42852 (Weak Trend, - **DI+ vs. DI-**: DI+ (15.00090) < DI- (21.52564) → Bearish Trend

- **Conclusion**: A weak bearish trend dominates mid-term.

### **b. Momentum Analysis**

- **RSI**: 48.70686 (Neutral, near 50)

- **Stochastic**: 23.01471 (Slightly Oversold) with a Strong Bullish Crossover (signal: 16.86056)

- **MACD**: 0.00068 (Bearish) with MACD_Diff: -0.00158 (Bearish Momentum)

- **Conclusion**: Conflicting signals—neutral RSI, a bullish Stochastic crossover, and bearish MACD suggest a potential reversal amidst bearish momentum.

### **c. Volatility Analysis**

- **ATR**: 0.00491 (Minimal Volatility)

- **Bollinger Bands**: Price (1.16856) < BB_Low (1.16475) → Potential Oversold

- **Conclusion**: Low volatility with the price below the lower band, indicating oversold conditions.

### **d. Price Levels**

- **Pivot Point**: 1.16775

- **Price Position**: Close (1.16856) > Pivot → Slight Bullish Bias (difference: 0.00081)

- **Proximity**: Below R1 (1.16944) by 0.00088

- **Conclusion**: A weak bullish bias as the price sits just above the pivot.

### **e. Composite Signal**

- **Score**: -14.50 (Neutral)

- **Conclusion**: Mixed signals result in a neutral outlook.

**H12 Summary**: A weak bearish trend (DI- > DI+) is present, but a Stochastic bullish crossover and oversold conditions suggest a potential reversal. The price above the pivot indicates a slight bullish bias.

---

## **3. H8 (8-Hour) Analysis**

The H8 timeframe refines short-term timing for entries and exits.

### **a. Trend Analysis**

- **ADX**: 24.82478 (Weak Trend, - **DI+ vs. DI-**: DI+ (10.89644) < DI- (18.95419) → Bearish Trend

- **Conclusion**: A weak bearish trend prevails in the short term.

### **b. Momentum Analysis**

- **RSI**: 43.73819 (Slightly Oversold, 30-50 range)

- **Stochastic**: 22.64151 (Slightly Oversold) with a Bullish Crossover (signal: 20.29844)

- **MACD**: -0.00107 (Bearish) with MACD_Diff: -0.00078 (Bearish Momentum)

- **Conclusion**: Slightly oversold conditions with a Stochastic bullish crossover hint at a reversal, despite bearish MACD.

### **c. Volatility Analysis**

- **ATR**: 0.00407 (Very Low Volatility)

- **Bollinger Bands**: Price (1.16759) < BB_Low (1.16521) → Potential Oversold

- **Conclusion**: Very low volatility with the price testing oversold levels.

### **d. Price Levels**

- **Pivot Point**: 1.16721

- **Price Position**: Close (1.16759) > Pivot → Slight Bullish Bias (difference: 0.00038)

- **Proximity**: Below R1 (1.16838) by 0.00079

- **Conclusion**: A weak bullish bias as the price is marginally above the pivot.

### **e. Composite Signal**

- **Score**: -14.50 (Neutral)

- **Conclusion**: Neutral sentiment due to mixed signals.

**H8 Summary**: A weak bearish trend is offset by slightly oversold conditions and a Stochastic bullish crossover, suggesting a potential short-term reversal. The price above the pivot supports a slight bullish bias.

---

## **4. External Information**

External insights from reliable sources enhance the technical analysis.

### **a. D1 Insights**

- **Sources**: Bloomberg, Reuters, Financial Times

- **Economic Data**: Steady US GDP growth and interest rate expectations bolster the USD, while Eurozone inflation concerns weaken the EUR.

- **Geopolitical Events**: US-China trade tensions and Trump’s 30% tariff threats on EU goods drive USD safe-haven demand. EU retaliatory measures add uncertainty.

- **Sentiment**: Mixed—USD strength is favored, but EUR faces pressure with potential for volatility.

### **b. H12 Insights**

- **Sources**: Investing.com, DailyFX, FXStreet

- **Market Sentiment**: Analysts note EURUSD’s downside risk from trade tensions, with some anticipating a bounce if tensions ease.

- **Analyst Reports**: Mixed forecasts—bearish if support breaks, bullish if trade news improves.

### **c. H8 Insights**

- **Sources**: Bloomberg Terminal, Reuters Live Feed, Yahoo Finance Live

- **Short-Term News**: Tariff headlines increase volatility, with USD gaining on safe-haven flows.

- **Market Updates**: Traders are cautious, with some eyeing an EUR rebound if trade talks progress.

**External Summary**: Trade tensions favor USD strength, but the situation is fluid, with potential for EUR reversals depending on news developments.

---

## **5. Synthesis**

- **D1 Trend Bias**: Moderately bullish trend with bearish momentum and oversold signals, neutralized by a composite score of -12.50.

- **H12 Confirmation**: Weak bearish trend with reversal potential (Stochastic crossover).

- **H8 Timing**: Weak bearish trend with short-term reversal signals.

- **External Factors**: USD strength from trade tensions contrasts with possible EUR recovery if sentiment shifts.

**Key Observations**:

- D1 suggests a bullish trend, while H12 and H8 lean bearish with reversal hints.

- Oversold conditions across all timeframes indicate a potential bounce.

- External risks (trade wars) favor USD but introduce volatility.

---

## **6. Trading Strategy**

### **Trading Bias**

- **Cautious Long Approach**: D1’s bullish trend is contradicted by shorter timeframes and external USD strength. A small long position is viable if H8 confirms a reversal.

### **Entry**

- Wait for H8 confirmation (e.g., price breaks above R1: 1.16838 with Stochastic crossover sustained).

### **Stop-Loss**

- Below H8 S1 (1.16686) or D1 pivot (1.16777) to limit downside risk.

### **Take-Profit**

- Target D1 R1 (1.16949) or higher if momentum strengthens.

### **Alternative**

- If trade tensions escalate (e.g., tariffs enacted), hold or avoid trading due to increased USD bias.

---

## **7. Risk Management**

- **Position Size**: 50% of standard size due to conflicting signals and external uncertainty.

- **Stop-Loss**: Set below key support levels (e.g., 1.16686 on H8).

- **Trailing Stop**: Use D1 ATR (0.00730) to lock in profits if the trade moves favorably.

---

## **Conclusion**

EURUSD exhibits indecision, with a D1 bullish trend offset by bearish shorter-term signals and external USD strength from trade tensions. A cautious long strategy is recommended, contingent on H8 reversal confirmation, with strict risk management to navigate volatility and news-driven risks. Monitor trade developments closely for adjustments.

---

## **1. D1 (Daily) Analysis**

The D1 timeframe establishes the broader trend bias for EURUSD.

### **a. Trend Analysis**

- **ADX**: 27.48338 (Moderate Trend, >25 indicates strength)

- **DI+ vs. DI-**: DI+ (18.92486) > DI- (14.76006) → Bullish Trend

- **Conclusion**: A moderately strong bullish trend is present.

### **b. Momentum Analysis**

- **RSI**: 57.16423 (Neutral, between 50-70 suggests bullish momentum)

- **Stochastic**: 19.33671 (Oversold, - **MACD**: 0.00619 (Bearish, below signal line) with MACD_Diff: -0.00193 (Bearish Momentum)

- **Conclusion**: Mixed signals—RSI indicates bullish momentum, but Stochastic and MACD suggest bearish pressure and potential oversold conditions.

### **c. Volatility Analysis**

- **ATR**: 0.00730 (Minimal Volatility)

- **Bollinger Bands**: Price (1.16863) < BB_Low (1.17014) → Potential Oversold

- **Conclusion**: Low volatility with the price testing the lower Bollinger Band, hinting at oversold conditions.

### **d. Price Levels**

- **Pivot Point**: 1.16777

- **Price Position**: Close (1.16863) > Pivot → Slight Bullish Bias (difference: 0.00086)

- **Proximity**: Below R1 (1.16949) by 0.00086

- **Conclusion**: A weak bullish bias as the price is just above the pivot.

### **e. Composite Signal**

- **Score**: -12.50 (Neutral, between -40 and 40)

- **Conclusion**: Indecision prevails, reflecting the mixed technical signals.

**D1 Summary**: The D1 timeframe shows a moderately bullish trend (ADX > 25, DI+ > DI-) tempered by bearish momentum (MACD) and oversold conditions (Stochastic). The price’s slight position above the pivot suggests a weak bullish bias, but the neutral composite score indicates uncertainty.

---

## **2. H12 (12-Hour) Analysis**

The H12 timeframe confirms mid-term trends and potential reversals.

### **a. Trend Analysis**

- **ADX**: 20.42852 (Weak Trend, - **DI+ vs. DI-**: DI+ (15.00090) < DI- (21.52564) → Bearish Trend

- **Conclusion**: A weak bearish trend dominates mid-term.

### **b. Momentum Analysis**

- **RSI**: 48.70686 (Neutral, near 50)

- **Stochastic**: 23.01471 (Slightly Oversold) with a Strong Bullish Crossover (signal: 16.86056)

- **MACD**: 0.00068 (Bearish) with MACD_Diff: -0.00158 (Bearish Momentum)

- **Conclusion**: Conflicting signals—neutral RSI, a bullish Stochastic crossover, and bearish MACD suggest a potential reversal amidst bearish momentum.

### **c. Volatility Analysis**

- **ATR**: 0.00491 (Minimal Volatility)

- **Bollinger Bands**: Price (1.16856) < BB_Low (1.16475) → Potential Oversold

- **Conclusion**: Low volatility with the price below the lower band, indicating oversold conditions.

### **d. Price Levels**

- **Pivot Point**: 1.16775

- **Price Position**: Close (1.16856) > Pivot → Slight Bullish Bias (difference: 0.00081)

- **Proximity**: Below R1 (1.16944) by 0.00088

- **Conclusion**: A weak bullish bias as the price sits just above the pivot.

### **e. Composite Signal**

- **Score**: -14.50 (Neutral)

- **Conclusion**: Mixed signals result in a neutral outlook.

**H12 Summary**: A weak bearish trend (DI- > DI+) is present, but a Stochastic bullish crossover and oversold conditions suggest a potential reversal. The price above the pivot indicates a slight bullish bias.

---

## **3. H8 (8-Hour) Analysis**

The H8 timeframe refines short-term timing for entries and exits.

### **a. Trend Analysis**

- **ADX**: 24.82478 (Weak Trend, - **DI+ vs. DI-**: DI+ (10.89644) < DI- (18.95419) → Bearish Trend

- **Conclusion**: A weak bearish trend prevails in the short term.

### **b. Momentum Analysis**

- **RSI**: 43.73819 (Slightly Oversold, 30-50 range)

- **Stochastic**: 22.64151 (Slightly Oversold) with a Bullish Crossover (signal: 20.29844)

- **MACD**: -0.00107 (Bearish) with MACD_Diff: -0.00078 (Bearish Momentum)

- **Conclusion**: Slightly oversold conditions with a Stochastic bullish crossover hint at a reversal, despite bearish MACD.

### **c. Volatility Analysis**

- **ATR**: 0.00407 (Very Low Volatility)

- **Bollinger Bands**: Price (1.16759) < BB_Low (1.16521) → Potential Oversold

- **Conclusion**: Very low volatility with the price testing oversold levels.

### **d. Price Levels**

- **Pivot Point**: 1.16721

- **Price Position**: Close (1.16759) > Pivot → Slight Bullish Bias (difference: 0.00038)

- **Proximity**: Below R1 (1.16838) by 0.00079

- **Conclusion**: A weak bullish bias as the price is marginally above the pivot.

### **e. Composite Signal**

- **Score**: -14.50 (Neutral)

- **Conclusion**: Neutral sentiment due to mixed signals.

**H8 Summary**: A weak bearish trend is offset by slightly oversold conditions and a Stochastic bullish crossover, suggesting a potential short-term reversal. The price above the pivot supports a slight bullish bias.

---

## **4. External Information**

External insights from reliable sources enhance the technical analysis.

### **a. D1 Insights**

- **Sources**: Bloomberg, Reuters, Financial Times

- **Economic Data**: Steady US GDP growth and interest rate expectations bolster the USD, while Eurozone inflation concerns weaken the EUR.

- **Geopolitical Events**: US-China trade tensions and Trump’s 30% tariff threats on EU goods drive USD safe-haven demand. EU retaliatory measures add uncertainty.

- **Sentiment**: Mixed—USD strength is favored, but EUR faces pressure with potential for volatility.

### **b. H12 Insights**

- **Sources**: Investing.com, DailyFX, FXStreet

- **Market Sentiment**: Analysts note EURUSD’s downside risk from trade tensions, with some anticipating a bounce if tensions ease.

- **Analyst Reports**: Mixed forecasts—bearish if support breaks, bullish if trade news improves.

### **c. H8 Insights**

- **Sources**: Bloomberg Terminal, Reuters Live Feed, Yahoo Finance Live

- **Short-Term News**: Tariff headlines increase volatility, with USD gaining on safe-haven flows.

- **Market Updates**: Traders are cautious, with some eyeing an EUR rebound if trade talks progress.

**External Summary**: Trade tensions favor USD strength, but the situation is fluid, with potential for EUR reversals depending on news developments.

---

## **5. Synthesis**

- **D1 Trend Bias**: Moderately bullish trend with bearish momentum and oversold signals, neutralized by a composite score of -12.50.

- **H12 Confirmation**: Weak bearish trend with reversal potential (Stochastic crossover).

- **H8 Timing**: Weak bearish trend with short-term reversal signals.

- **External Factors**: USD strength from trade tensions contrasts with possible EUR recovery if sentiment shifts.

**Key Observations**:

- D1 suggests a bullish trend, while H12 and H8 lean bearish with reversal hints.

- Oversold conditions across all timeframes indicate a potential bounce.

- External risks (trade wars) favor USD but introduce volatility.

---

## **6. Trading Strategy**

### **Trading Bias**

- **Cautious Long Approach**: D1’s bullish trend is contradicted by shorter timeframes and external USD strength. A small long position is viable if H8 confirms a reversal.

### **Entry**

- Wait for H8 confirmation (e.g., price breaks above R1: 1.16838 with Stochastic crossover sustained).

### **Stop-Loss**

- Below H8 S1 (1.16686) or D1 pivot (1.16777) to limit downside risk.

### **Take-Profit**

- Target D1 R1 (1.16949) or higher if momentum strengthens.

### **Alternative**

- If trade tensions escalate (e.g., tariffs enacted), hold or avoid trading due to increased USD bias.

---

## **7. Risk Management**

- **Position Size**: 50% of standard size due to conflicting signals and external uncertainty.

- **Stop-Loss**: Set below key support levels (e.g., 1.16686 on H8).

- **Trailing Stop**: Use D1 ATR (0.00730) to lock in profits if the trade moves favorably.

---

## **Conclusion**

EURUSD exhibits indecision, with a D1 bullish trend offset by bearish shorter-term signals and external USD strength from trade tensions. A cautious long strategy is recommended, contingent on H8 reversal confirmation, with strict risk management to navigate volatility and news-driven risks. Monitor trade developments closely for adjustments.

Lilita Bogachkova

Updated EURUSD Trading Strategy

Bias: D1’s bullish trend and H12/H8/H4 oversold conditions support a long position, confirmed by H1’s bullish reversal (Stochastic: 64.62, MACD bullish, price above PP at 1.17148). The H1 rally from 1.16896 (14:00) to 1.17148 (17:00) with volume support (4,370) and neutral composite score (39.50) strengthens this bias. Trade talk uncertainty and CPI anticipation warrant cautious sizing.

Entry:

Long Opportunity: Enter a long position at 1.17148 (current H1 close) or near H1 S1 (1.17036) if a pullback occurs, with confirmation from:

H1 Stochastic remaining above 50 (currently 64.62) or bullish crossover continuation.

H1 RSI rising above 50 (currently 49.52) or H4 RSI above 45 (currently 41.30).

Bullish H1 candlestick (e.g., bullish engulfing at 15:00–17:00) or M30 confirmation for faster entry.

Volume above 4,370 (H1 17:00) to confirm buying pressure.

Alternative (Short): If price breaks below H1 S2 (1.16925) or H4 S2 (1.16859) with high volume (>5,000 on H1) and bearish signals (e.g., RSI < 40, Stochastic < 20), consider a short targeting H1 S3 (1.16820) or H4 S3 (1.16714). Wait for CPI clarity due to volatility risks.

Stop-Loss:

For long: Below H1 S2 (1.16925) or H4 S2 (1.16859), ~10–15 pips below entry (e.g., 1.16910), to account for potential breakdowns.

For short: Above H1 R1 (1.17252) or H4 R1 (1.17196), ~15–20 pips above entry.

Take-Profit:

For long: Target H1 R1 (1.17252), H4 R1 (1.17196), or 1.1836 (per FOREX24.PRO), aiming for a 1:2 to 1:3 risk-reward ratio.

For short: Target H1 S3 (1.16820) or H4 S3 (1.16714), aiming for a 1:1.5 risk-reward ratio.

Position Size:

H1’s bullish reversal and H4/H8/H12 oversold conditions support an 85% position size (up from H4’s 75% due to stronger H1 signals).

Increase to 100% if H1 confirms further bullish momentum (e.g., RSI > 50, Stochastic > 70) and M30 shows a bullish candlestick.

Reduce to 50% if trade talk news escalates (e.g., new tariffs) or CPI expectations shift significantly.

Risk Management:

Use a trailing stop based on H1 ATR (0.00165, ~17 pips) or H4 ATR (0.00297, ~30 pips) to lock in profits.

Monitor H1 volume for breakout confirmation (>5,000 for significant moves).

Reassess post-CPI release on July 15, 2025, due to volatility risks.

Monitoring:

Check real-time news for trade talk updates [Reuters, https://www.reuters.com/markets; Bloomberg, https://www.bloomberg.com/markets/currencies].

Monitor M30 timeframe for faster entry signals (e.g., RSI divergence, candlestick patterns).

Use live feeds for intraday sentiment [Yahoo Finance, https://finance.yahoo.com/quote/EURUSD=X/].

Chart Visualization

To visualize the H1 price action and key levels, here is a chart of the closing prices from 13:00 to 17:00, with pivot points and support/resistance levels:

This chart shows the price dropping to 1.16913 (14:00), testing the support zone (1.16884–1.17036), and rebounding to 1.17148 (17:00), crossing above the pivot point, aligning with bullish momentum signals.

Conclusion

The D1 bullish trend supports a long position, reinforced by H12/H8/H4 oversold conditions and H1’s bullish reversal (Stochastic: 64.62, MACD bullish, RSI: 49.52, price above PP at 1.17148). The H1 rally from 1.16896 (14:00) to 1.17148 (17:00) with volume support (4,370) confirms the reversal, testing the multi-timeframe support zone (1.16884–1.17036). Enter a long at 1.17148 or on a pullback to 1.17036, with stop-loss at 1.16910 and targets at 1.17252–1.1836 (risk-reward ~1:2 to 1:3). Use an 85% position size due to strong H1 signals but remain cautious of trade talk news and CPI volatility. Monitor M30 for faster confirmation and reassess post-CPI on July 15.

Bias: D1’s bullish trend and H12/H8/H4 oversold conditions support a long position, confirmed by H1’s bullish reversal (Stochastic: 64.62, MACD bullish, price above PP at 1.17148). The H1 rally from 1.16896 (14:00) to 1.17148 (17:00) with volume support (4,370) and neutral composite score (39.50) strengthens this bias. Trade talk uncertainty and CPI anticipation warrant cautious sizing.

Entry:

Long Opportunity: Enter a long position at 1.17148 (current H1 close) or near H1 S1 (1.17036) if a pullback occurs, with confirmation from:

H1 Stochastic remaining above 50 (currently 64.62) or bullish crossover continuation.

H1 RSI rising above 50 (currently 49.52) or H4 RSI above 45 (currently 41.30).

Bullish H1 candlestick (e.g., bullish engulfing at 15:00–17:00) or M30 confirmation for faster entry.

Volume above 4,370 (H1 17:00) to confirm buying pressure.

Alternative (Short): If price breaks below H1 S2 (1.16925) or H4 S2 (1.16859) with high volume (>5,000 on H1) and bearish signals (e.g., RSI < 40, Stochastic < 20), consider a short targeting H1 S3 (1.16820) or H4 S3 (1.16714). Wait for CPI clarity due to volatility risks.

Stop-Loss:

For long: Below H1 S2 (1.16925) or H4 S2 (1.16859), ~10–15 pips below entry (e.g., 1.16910), to account for potential breakdowns.

For short: Above H1 R1 (1.17252) or H4 R1 (1.17196), ~15–20 pips above entry.

Take-Profit:

For long: Target H1 R1 (1.17252), H4 R1 (1.17196), or 1.1836 (per FOREX24.PRO), aiming for a 1:2 to 1:3 risk-reward ratio.

For short: Target H1 S3 (1.16820) or H4 S3 (1.16714), aiming for a 1:1.5 risk-reward ratio.

Position Size:

H1’s bullish reversal and H4/H8/H12 oversold conditions support an 85% position size (up from H4’s 75% due to stronger H1 signals).

Increase to 100% if H1 confirms further bullish momentum (e.g., RSI > 50, Stochastic > 70) and M30 shows a bullish candlestick.

Reduce to 50% if trade talk news escalates (e.g., new tariffs) or CPI expectations shift significantly.

Risk Management:

Use a trailing stop based on H1 ATR (0.00165, ~17 pips) or H4 ATR (0.00297, ~30 pips) to lock in profits.

Monitor H1 volume for breakout confirmation (>5,000 for significant moves).

Reassess post-CPI release on July 15, 2025, due to volatility risks.

Monitoring:

Check real-time news for trade talk updates [Reuters, https://www.reuters.com/markets; Bloomberg, https://www.bloomberg.com/markets/currencies].

Monitor M30 timeframe for faster entry signals (e.g., RSI divergence, candlestick patterns).

Use live feeds for intraday sentiment [Yahoo Finance, https://finance.yahoo.com/quote/EURUSD=X/].

Chart Visualization

To visualize the H1 price action and key levels, here is a chart of the closing prices from 13:00 to 17:00, with pivot points and support/resistance levels:

This chart shows the price dropping to 1.16913 (14:00), testing the support zone (1.16884–1.17036), and rebounding to 1.17148 (17:00), crossing above the pivot point, aligning with bullish momentum signals.

Conclusion

The D1 bullish trend supports a long position, reinforced by H12/H8/H4 oversold conditions and H1’s bullish reversal (Stochastic: 64.62, MACD bullish, RSI: 49.52, price above PP at 1.17148). The H1 rally from 1.16896 (14:00) to 1.17148 (17:00) with volume support (4,370) confirms the reversal, testing the multi-timeframe support zone (1.16884–1.17036). Enter a long at 1.17148 or on a pullback to 1.17036, with stop-loss at 1.16910 and targets at 1.17252–1.1836 (risk-reward ~1:2 to 1:3). Use an 85% position size due to strong H1 signals but remain cautious of trade talk news and CPI volatility. Monitor M30 for faster confirmation and reassess post-CPI on July 15.

Lilita Bogachkova

Bias: D1 bullish trend supports a long bias, but H12/H8 bearish trends and oversold conditions suggest waiting for a reversal signal near support (H8: 1.16954, H12: 1.16884, or 1.1692 per external analyses). Trade talk uncertainty and upcoming CPI data warrant caution.

Entry:

Long Opportunity: Enter a long position near H8 S1 (1.16954) or H12 S1 (1.16884), with confirmation from:

Bullish Stochastic crossover (Stochastic > Stochastic_Signal) on H8/H12.

RSI rising above 50 on H8 (currently 47.23) or H12 (51.87).

Bullish candlestick pattern (e.g., hammer, bullish engulfing) on H4 or H8.

Alternative (Short): If price breaks below H8 S2 (1.16858) with high volume and no reversal signals, consider a short position targeting H8 S3 (1.16713) or H12 S2 (1.16715), but only post-CPI clarity due to volatility risks.

Stop-Loss:

For long: Below H8 S2 (1.16858) or H12 S2 (1.16715), approximately 15–20 pips below entry, to account for potential breakdowns.

For short: Above H8 R1 (1.17195) or H12 R1 (1.17233), approximately 15–20 pips above entry.

Take-Profit:

For long: Target H8 R1 (1.17195), H12 R1 (1.17233), or 1.1836 (per FOREX24.PRO) for a higher reward (risk-reward ratio ~1:2 to 1:3).

For short: Target H8 S3 (1.16713) or H12 S2 (1.16715), aiming for a 1:1.5 risk-reward ratio.

Position Size:

D1 and H12 align (bullish trend, oversold H12), but H8 shows bearish pressure: Use 75% of normal position size.

If H8 confirms bullish reversal (e.g., Stochastic crossover), increase to 100%.

Reduce to 50% if trade talk news worsens or CPI expectations shift significantly.

Risk Management:

Use a trailing stop based on H12 ATR (0.00540) or H8 ATR (0.00439), approximately 40–50 pips, to lock in profits.

Monitor volume spikes on H8 for breakout/breakdown confirmation.

Reassess post-CPI release on July 15, 2025, as volatility may increase.

Monitoring:

Watch for US-EU trade talk updates via Reuters or Bloomberg [https://www.bloomberg.com/markets/currencies].

Check H4 timeframe for faster reversal signals (e.g., candlestick patterns, RSI divergence).

Use real-time feeds (e.g., Yahoo Finance Live, https://finance.yahoo.com/quote/EURUSD=X/) for intraday sentiment shifts.

Chart Visualization

To illustrate the EUR/USD price action and key levels across H8, here is a chart of the closing prices over the five periods, with pivot points and support/resistance levels:

Download

This chart shows the price declining below the pivot point, approaching S1, aligning with the oversold conditions and potential support zone.

Conclusion

The D1 bullish trend supports a long bias, but H12/H8 oversold conditions (RSI, Stochastic, CCI) and proximity to support (1.16884–1.16954) suggest a potential reversal. Enter a long position near 1.16954 (H8 S1) or 1.16884 (H12 S1) with confirmation (Stochastic crossover, RSI > 50, bullish candlestick). Use a 75% position size due to partial timeframe alignment and trade talk uncertainty. Set stop-loss below 1.16858 (H8 S2) and target 1.17195–1.1836. Monitor trade talk updates and prepare for volatility around the July 15 CPI release.

Entry:

Long Opportunity: Enter a long position near H8 S1 (1.16954) or H12 S1 (1.16884), with confirmation from:

Bullish Stochastic crossover (Stochastic > Stochastic_Signal) on H8/H12.

RSI rising above 50 on H8 (currently 47.23) or H12 (51.87).

Bullish candlestick pattern (e.g., hammer, bullish engulfing) on H4 or H8.

Alternative (Short): If price breaks below H8 S2 (1.16858) with high volume and no reversal signals, consider a short position targeting H8 S3 (1.16713) or H12 S2 (1.16715), but only post-CPI clarity due to volatility risks.

Stop-Loss:

For long: Below H8 S2 (1.16858) or H12 S2 (1.16715), approximately 15–20 pips below entry, to account for potential breakdowns.

For short: Above H8 R1 (1.17195) or H12 R1 (1.17233), approximately 15–20 pips above entry.

Take-Profit:

For long: Target H8 R1 (1.17195), H12 R1 (1.17233), or 1.1836 (per FOREX24.PRO) for a higher reward (risk-reward ratio ~1:2 to 1:3).

For short: Target H8 S3 (1.16713) or H12 S2 (1.16715), aiming for a 1:1.5 risk-reward ratio.

Position Size:

D1 and H12 align (bullish trend, oversold H12), but H8 shows bearish pressure: Use 75% of normal position size.

If H8 confirms bullish reversal (e.g., Stochastic crossover), increase to 100%.

Reduce to 50% if trade talk news worsens or CPI expectations shift significantly.

Risk Management:

Use a trailing stop based on H12 ATR (0.00540) or H8 ATR (0.00439), approximately 40–50 pips, to lock in profits.

Monitor volume spikes on H8 for breakout/breakdown confirmation.

Reassess post-CPI release on July 15, 2025, as volatility may increase.

Monitoring:

Watch for US-EU trade talk updates via Reuters or Bloomberg [https://www.bloomberg.com/markets/currencies].

Check H4 timeframe for faster reversal signals (e.g., candlestick patterns, RSI divergence).

Use real-time feeds (e.g., Yahoo Finance Live, https://finance.yahoo.com/quote/EURUSD=X/) for intraday sentiment shifts.

Chart Visualization

To illustrate the EUR/USD price action and key levels across H8, here is a chart of the closing prices over the five periods, with pivot points and support/resistance levels:

Download

This chart shows the price declining below the pivot point, approaching S1, aligning with the oversold conditions and potential support zone.

Conclusion