Aleksey Ivanov / Profil

- Information

|

8+ Jahre

Erfahrung

|

32

Produkte

|

146

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

------------------------------------------------------------------------------------------

💰 Präsentierte Produkte:

1) 🏆 Indikatoren mit optimaler Filterung von Marktgeräuschen (zur Auswahl von Öffnungs- und Schlusspositionen).

2) 🏆 Statistische Indikatoren (zur Bestimmung des globalen Trends).

3) 🏆 Marktforschungsindikatoren (um die Mikrostruktur der Preise zu klären, Kanäle aufzubauen, Unterschiede zwischen Trendumkehrungen und Pullbacks zu identifizieren).

------------------------------------------------------------------------------------------

☛ Weitere Informationen im Blog https://www.mql5.com/en/blogs/post/741637

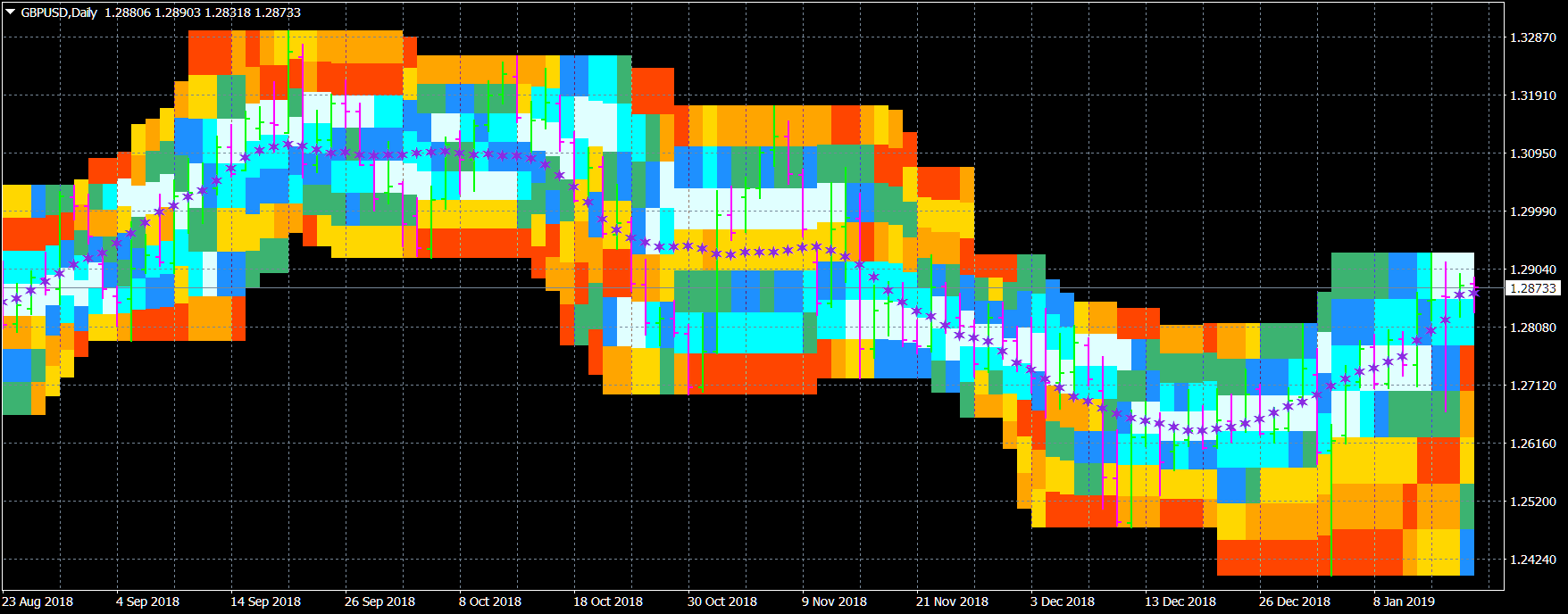

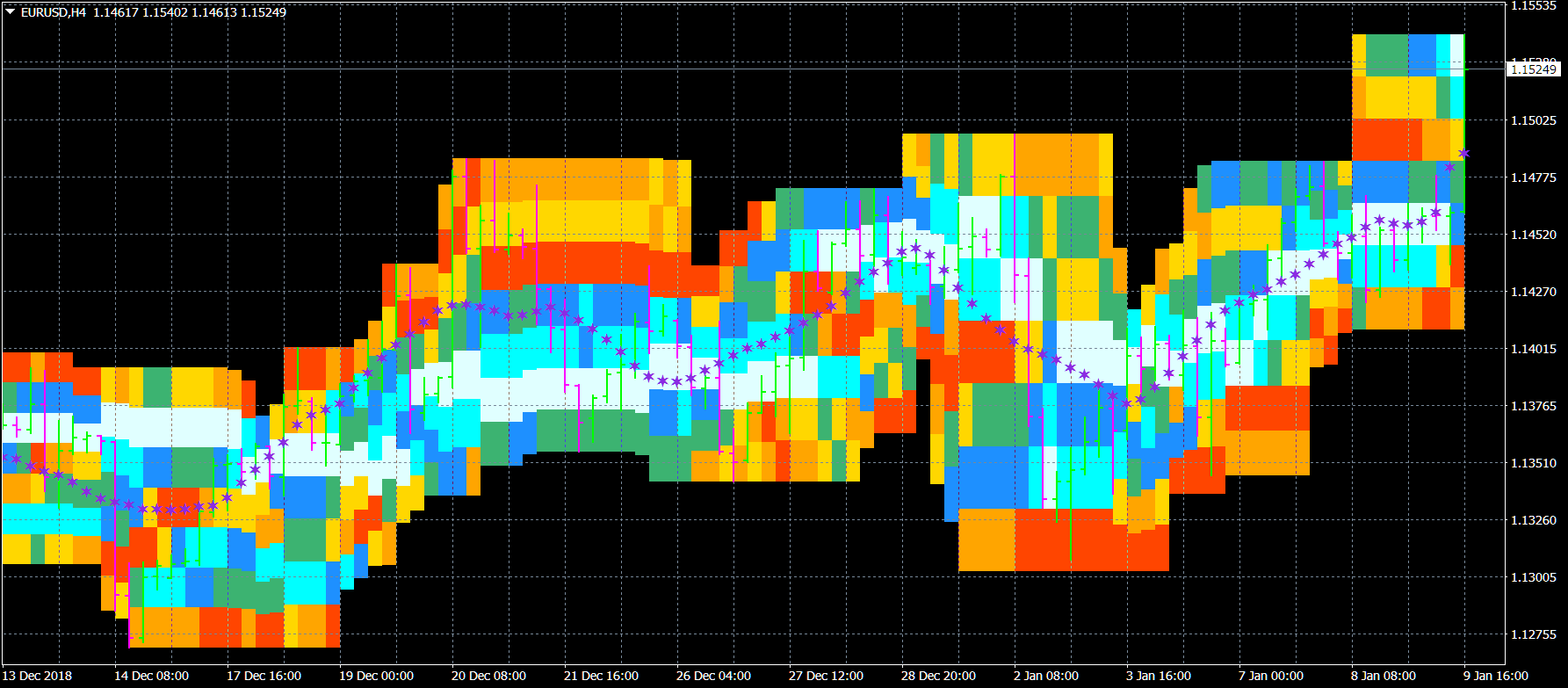

PDP indicator is used for:

1.defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2.defining the channel change moment.

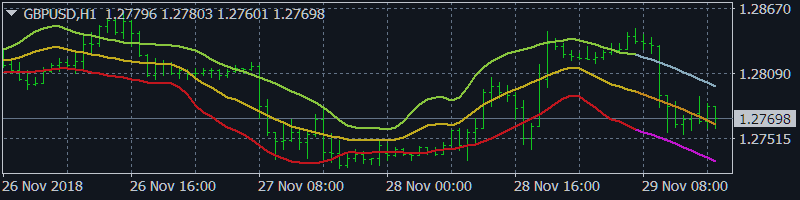

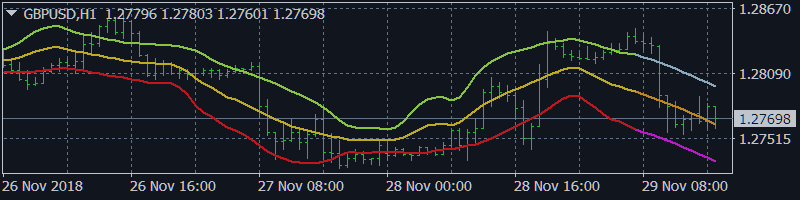

The Sensitive Signal (SS) indicator, using the filtering methods developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise.

PDP indicator is used for:

1.defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2.defining the channel change moment.

The Sensitive Signal (SS) indicator, using the filtering methods developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise.

The Sensitive Signal (SS) indicator, using the filtering methods developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise. The filtration developed by the author is carried out in several iterations and reveals the true trajectory of the regular price movement (more precisely, the most likely curve of such movement) and draws it.

Der Indikator für empfindliches Signal (SS) verwendet vom Autor entwickelte Filtermethoden. Mit SS können Sie den Beginn einer echten Trendbewegung mit hoher Wahrscheinlichkeit einstellen. SS filtert nach zufälligen Kursbewegungen, was für den Handel an der Börse sehr effektiv ist. Die vom Autor entwickelte Filtration wird in mehreren Iterationen durchgeführt und zeigt die wahre Flugbahn der regulären

Konstruktionsprinzipien des Indikators. Der Absolute-Bands-Indikator (AB-Indikator) erinnert in seinem Aussehen und seinen Funktionen an den Bollinger-Bands-Indikator , ist aber aufgrund der deutlich geringeren Anzahl von Fehlsignalen, die an ihn ausgegeben werden, für den Handel noch effektiver. Diese Effektivität des Absolute Bands Indikators ist auf seine Robustheit zurückzuführen. Beim Bollinger Bands Indikator befinden sich auf beiden Seiten des gleitenden Durchschnitts - Ma - Linien, die

https://www.mql5.com/en/users/60000382/seller#products

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.