Conor Mcnamara / Profil

- Bilgiler

|

2 yıl

deneyim

|

8

ürünler

|

4

demo sürümleri

|

|

0

işler

|

0

sinyaller

|

0

aboneler

|

I started learning C programming in 2010. From there I picked up many languages.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

Conor Mcnamara

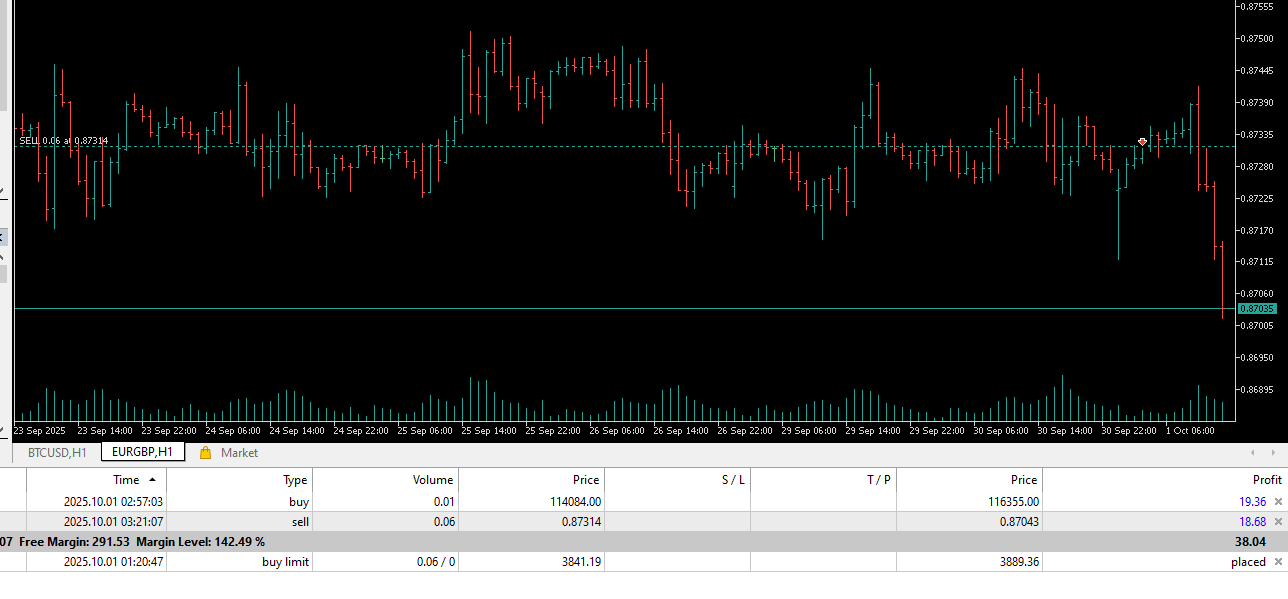

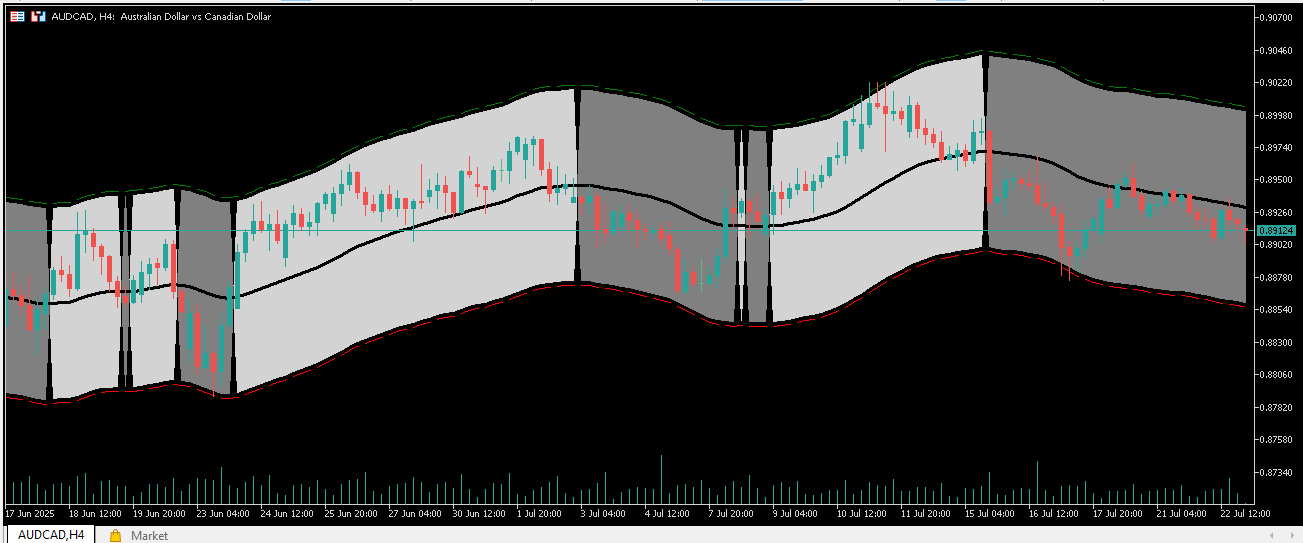

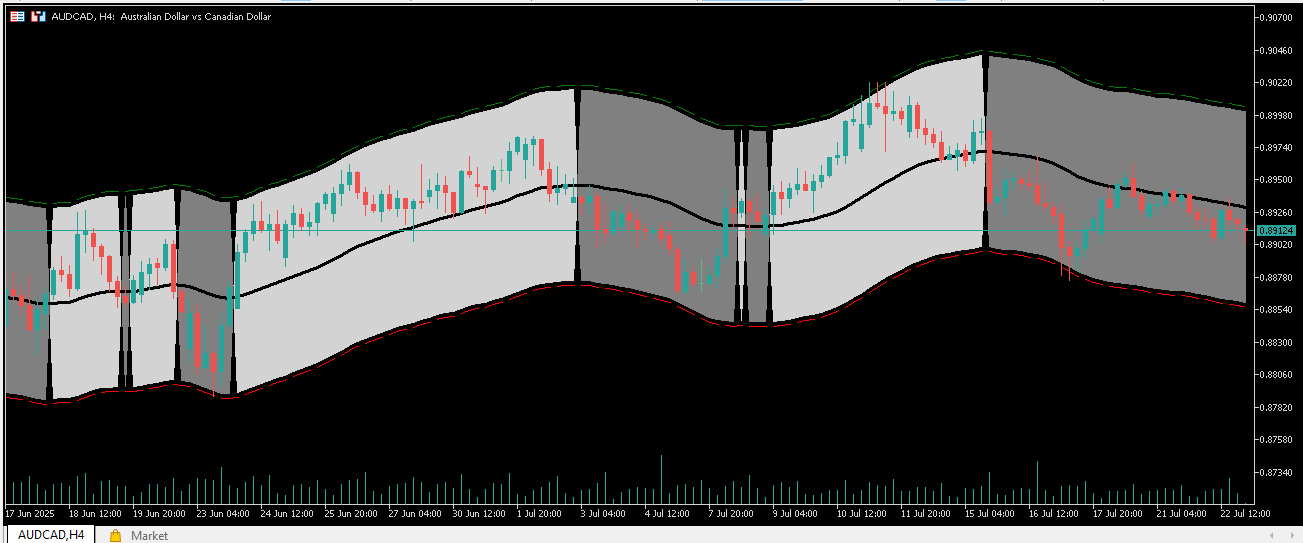

this was another entry on the VWAP price

the way I see it, whether you buy or sell at this price, there's some profit there eitherway

I am on a demo account performing these tests where I put indicators into live testing

the way I see it, whether you buy or sell at this price, there's some profit there eitherway

I am on a demo account performing these tests where I put indicators into live testing

Conor Mcnamara

this entry was the VWAP price at the time I placed the buy limit, it seems like a good indicator to me, and it's downloadable on the codebase

Conor Mcnamara

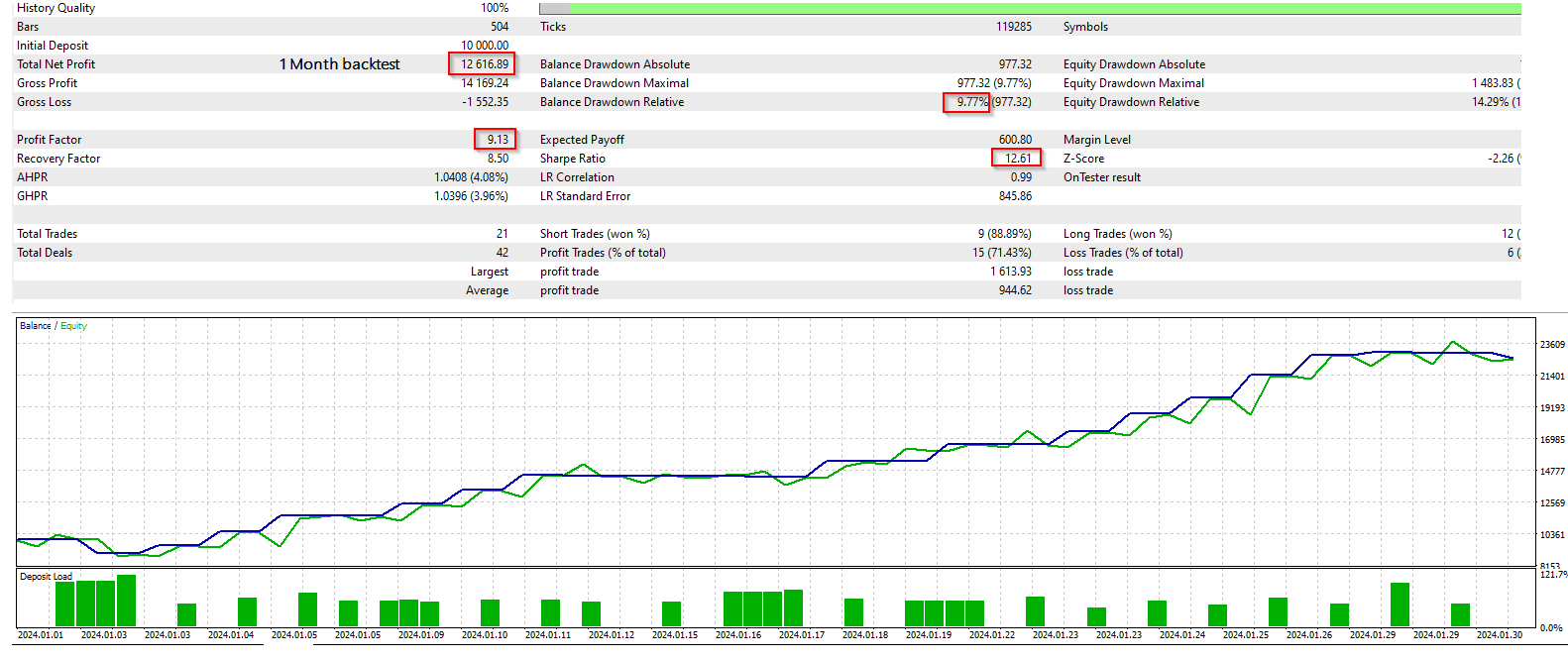

I used to think that from a 10K account and 1:33 leverage, a 1 month profit of 1 - 2K would be very good. But this current strategy is showing much greater alpha in one month.While I know that not every month can be the same, and that one month historical backtest means nothing for the future, it gives me an indication that this strategy has substance if it can show results like that. This is the power of ATR.

Conor Mcnamara

By not immediately executing a trade upon a signal...you can refine entries using states. It's just a bit more work.

Conor Mcnamara

It's crazy to think that technical analysis in financial markets borrowed from mechanical engineering, electrical engineering, statistics and probability theories, geospatial engineering, thermodynamics, neuroscience....the list goes on

Conor Mcnamara

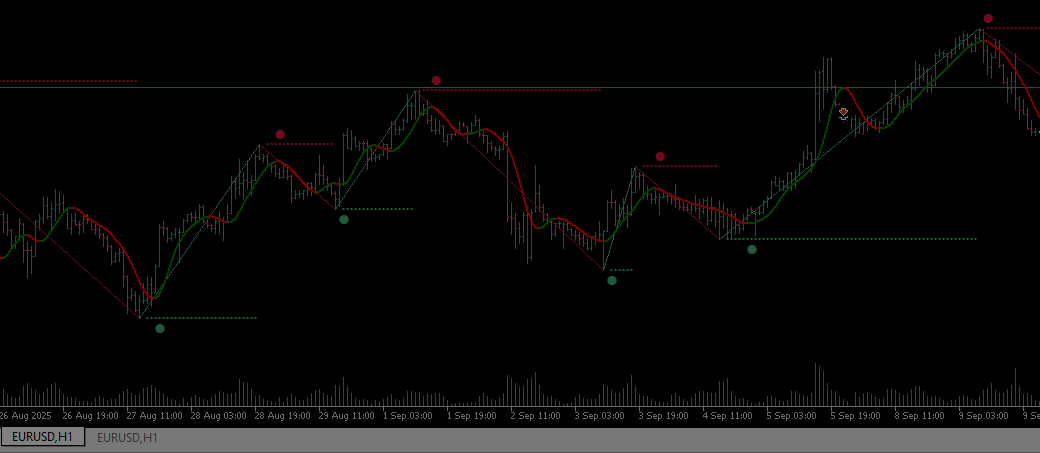

A promising work underway..

- Candles are colored based on IDWMA price cross, noise, momentum, and doji patterns

- Extreme channel to calculate extreme prices on the last 30 bars

- ATR bands from the IDWMA price

Buy:

Previous and current green candle

Bid price is below the midpoint of the extreme channel

Bid price is above the 50 period EMA

Position stop loss trails on ATR band

Sell:

Previous and current red candle

Bid price is above the midpoint of the extreme channel

Bid price is below the 50 period EMA

Position stop loss trails on ATR band

- Candles are colored based on IDWMA price cross, noise, momentum, and doji patterns

- Extreme channel to calculate extreme prices on the last 30 bars

- ATR bands from the IDWMA price

Buy:

Previous and current green candle

Bid price is below the midpoint of the extreme channel

Bid price is above the 50 period EMA

Position stop loss trails on ATR band

Sell:

Previous and current red candle

Bid price is above the midpoint of the extreme channel

Bid price is below the 50 period EMA

Position stop loss trails on ATR band

[Silindi]

2025.10.03

[Silindi]

Conor Mcnamara

There are some shortcomings in the Parabolic SAR.

It traditionally used a fixed acceleration factor and didn't account for volatility, and this made it give bad signals in choppy markets. It also didn't care about price momentum, so it always had a signal while disregarding the fact that sometimes it's not good to trade.

I'm building a Custom SAR which is accelerating based on volatility (fully dynamic acceleration factor), and looking for valid momentum. If there is no valid momentum, the signal is removed on these bars.

It traditionally used a fixed acceleration factor and didn't account for volatility, and this made it give bad signals in choppy markets. It also didn't care about price momentum, so it always had a signal while disregarding the fact that sometimes it's not good to trade.

I'm building a Custom SAR which is accelerating based on volatility (fully dynamic acceleration factor), and looking for valid momentum. If there is no valid momentum, the signal is removed on these bars.

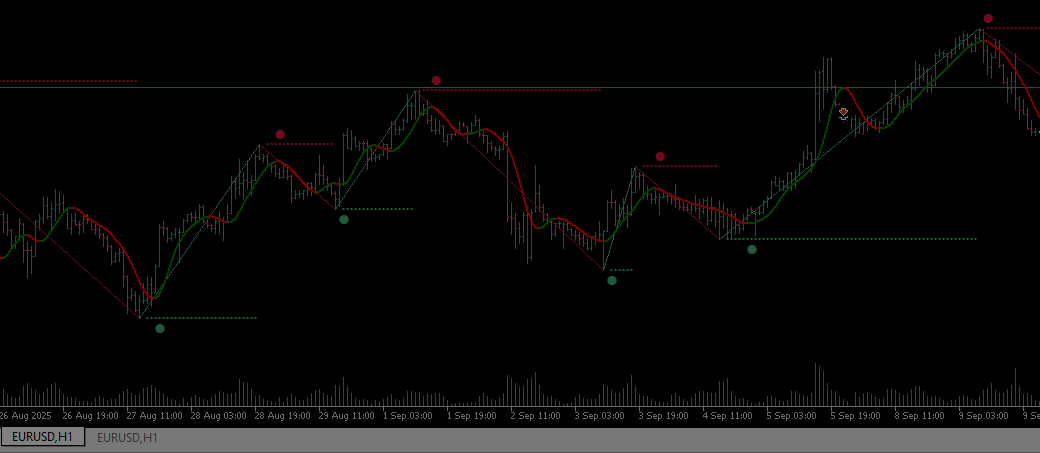

Conor Mcnamara

How can we calculate the trend change on time from extreme pivots?

- Zigzag algo extended to find when the leg stops moving

- When the leg stops moving, the trend change is analysed from a non lagging moving average

- Now it is calculating only the moving average trend changes relating to pivots

- All other fleeting moving average trends are ignored

- Zigzag algo extended to find when the leg stops moving

- When the leg stops moving, the trend change is analysed from a non lagging moving average

- Now it is calculating only the moving average trend changes relating to pivots

- All other fleeting moving average trends are ignored

Conor Mcnamara

Candle Pattern Recognition Unit kodunu yayınladı

Tüm popüler mum kalıplarını tespit etmek ve işaretlemek için bir gösterge

Sosyal ağlarda paylaş

128

1357

Conor Mcnamara

ürün yayınladı

This is a unique moving average that does not use timeframes. The indicator calculates a simple moving average (SMA) based on latest tick prices rather than timeframe bars, offering a direct way to track market trends. It processes a large number of tick prices up to the latest tick, using only live data for its calculations. Once active, the indicator updates and recalculates without relying on any historical timeframe bars. Real-Time Market Response The indicator updates as tick prices move

Conor Mcnamara

Price Percentage Zigzag (No timeframes) kodunu yayınladı

Varlık üzerindeki fiyat yüzdesi değişimine bağlı olarak dalga yönünü değiştiren zikzak

Sosyal ağlarda paylaş

160

613

Conor Mcnamara

Bull Bear Volume kodunu yayınladı

Piyasanın her iki tarafındaki hacim baskısının net bir şekilde görselleştirilmesini sağlayan bir gösterge

Sosyal ağlarda paylaş · 1

115

810

Conor Mcnamara

Someone made a good code for a zigzag based on ATR rules instead of the traditional depth and backstep rules, but it's still lagging because of the fact that it keeps moving to find the ultimate extremum. My approach to make it truly non lagging was to focus more on the live trend, and only consider the local extremes after a new trend change, and this is what makes a non lagging zigzag. It is not true zigzag as people know it, but still is visually a zigzag

Tüm yorumları göster (8)

Yashar Seyyedin

2025.07.28

Strong trends are pretty rare. Those who trade them have to wait quite long for an opportunity.

Conor Mcnamara

2025.07.28

that's true because the market is generally sideways a lot of the time, and thankfully the ATR reveals this. Many interesting indicators have recruited the average true range formula..but the original ATR indicator is visual garbage to me...never really bothered looking at that plot

Conor Mcnamara

the NW estimator (using kernel regression) is a hidden gem that nobody talks about. You don't need to make arrows or anything, I made a filled envelope, and I know where a market is moving

Conor Mcnamara

I would describe automated trading trading as something that does work. But when you understand what trading is about... it's not more ideal than manual trading.

It is like a car driving by itself. Do you trust that a car will automate driving perfectly? Are you happy to sit in a car that drives without your control? This is exactly how I would describe automated trading.

It is like a car driving by itself. Do you trust that a car will automate driving perfectly? Are you happy to sit in a car that drives without your control? This is exactly how I would describe automated trading.

Rajesh Kumar Nait

2025.07.09

Tesla drives automatically but i saw some instances of crash, It cant drive like human but there are ongonig advancement and continuous software updates (optimization ) which is making it more effective. Trading manually envolves emotion and no human is emotionless, Emotion causes errors.

Conor Mcnamara

2025.07.10

Emotional trading is trading without discipline, however even with discipline there is a huge amount of stress when someone is still in the stage of proving the strategy without trust in it.

Conor Mcnamara

There are many indicators on the codebase that are just proof of science or for data organization, but they're not suitable for trading signals. For "quant" trading, it's a layered combination of tools which makes something suitable for signals. Combine ADX, ATR, and an oscillator..and this gives a much more reliable trend

Conor Mcnamara

this wonder zigzag got a full optimization, but the code is not available

It can be provided for payment, and payment must be in the form of a briefcase of cash

The file will be provided to you on a floppy disk

It can be provided for payment, and payment must be in the form of a briefcase of cash

The file will be provided to you on a floppy disk

Conor Mcnamara

2025.07.05

there were some problems in the beta, they are fixed now It now has pivot modes "strict to pivots" and "strict to candle high/low" The pivot mode only concerns the trend change and instantly switches leg. The candle mode strictly connects legs to candle highest/lowest near the trend change

Conor Mcnamara

2025.07.05

both modes are identifying the new wave much faster than the old traditional zigzag

: