Yashar Seyyedin / Profil

- Bilgiler

|

3 yıl

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

373

işler

|

0

sinyaller

|

0

aboneler

|

🚀 Expert MQL5/MQL4 Developer & Full-Stack Pro

Specializing in EAs, indicators, and custom web apps

📈 MQL Services on MQL5

Ready to build or debug your Forex trading robots and indicators?

Post your job: https://www.mql5.com/en/job/new?prefered=yashar.seyyedin

🌐 Full-Stack Web Development

Need robust web apps? Connect on Upwork or Fiverr for end-to-end solutions:

https://www.upwork.com/freelancers/~0169759d56a4a0dc91?mp_source=share

https://www.fiverr.com/s/ZmK18aj

💰 First time with The5ers? Claim your discount on all programs:

http://www.the5ers.com/?afmc=10mq

DM now! ⚡

Specializing in EAs, indicators, and custom web apps

📈 MQL Services on MQL5

Ready to build or debug your Forex trading robots and indicators?

Post your job: https://www.mql5.com/en/job/new?prefered=yashar.seyyedin

🌐 Full-Stack Web Development

Need robust web apps? Connect on Upwork or Fiverr for end-to-end solutions:

https://www.upwork.com/freelancers/~0169759d56a4a0dc91?mp_source=share

https://www.fiverr.com/s/ZmK18aj

💰 First time with The5ers? Claim your discount on all programs:

http://www.the5ers.com/?afmc=10mq

DM now! ⚡

Arkadaşlar

440

İstekler

Giden

Yashar Seyyedin

AGGIUNGERE ALTRE 2 CONDZIONI MA işi için müşteriye geri bildirim bıraktı

Thanks for the fair order.

| İş Gerekliliklerinin kalitesi | 5.0 | |

| Sonuç kontrol kalitesi | 5.0 | |

| Erişilebilirlik ve iletişim becerileri | 5.0 |

Yashar Seyyedin

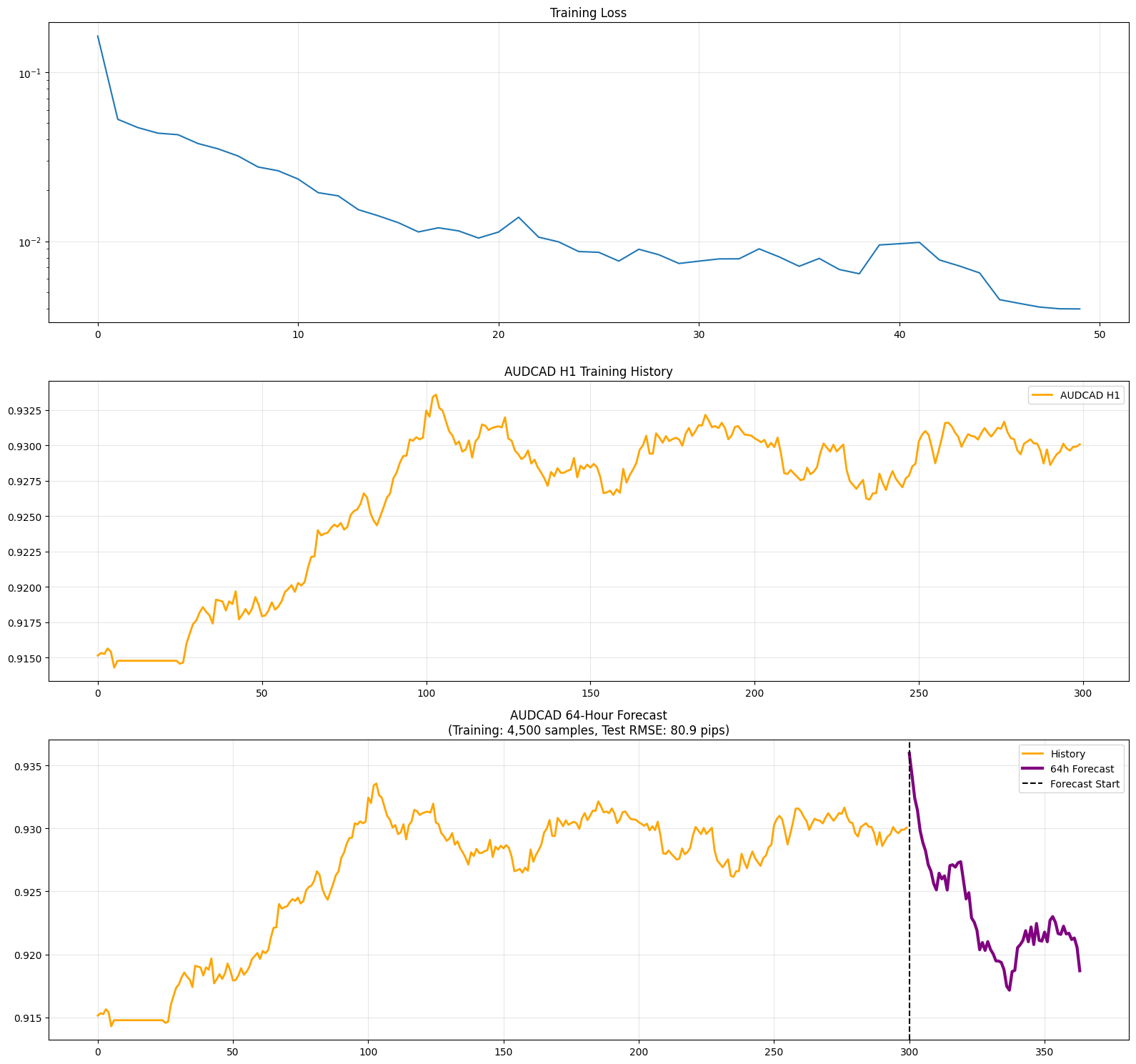

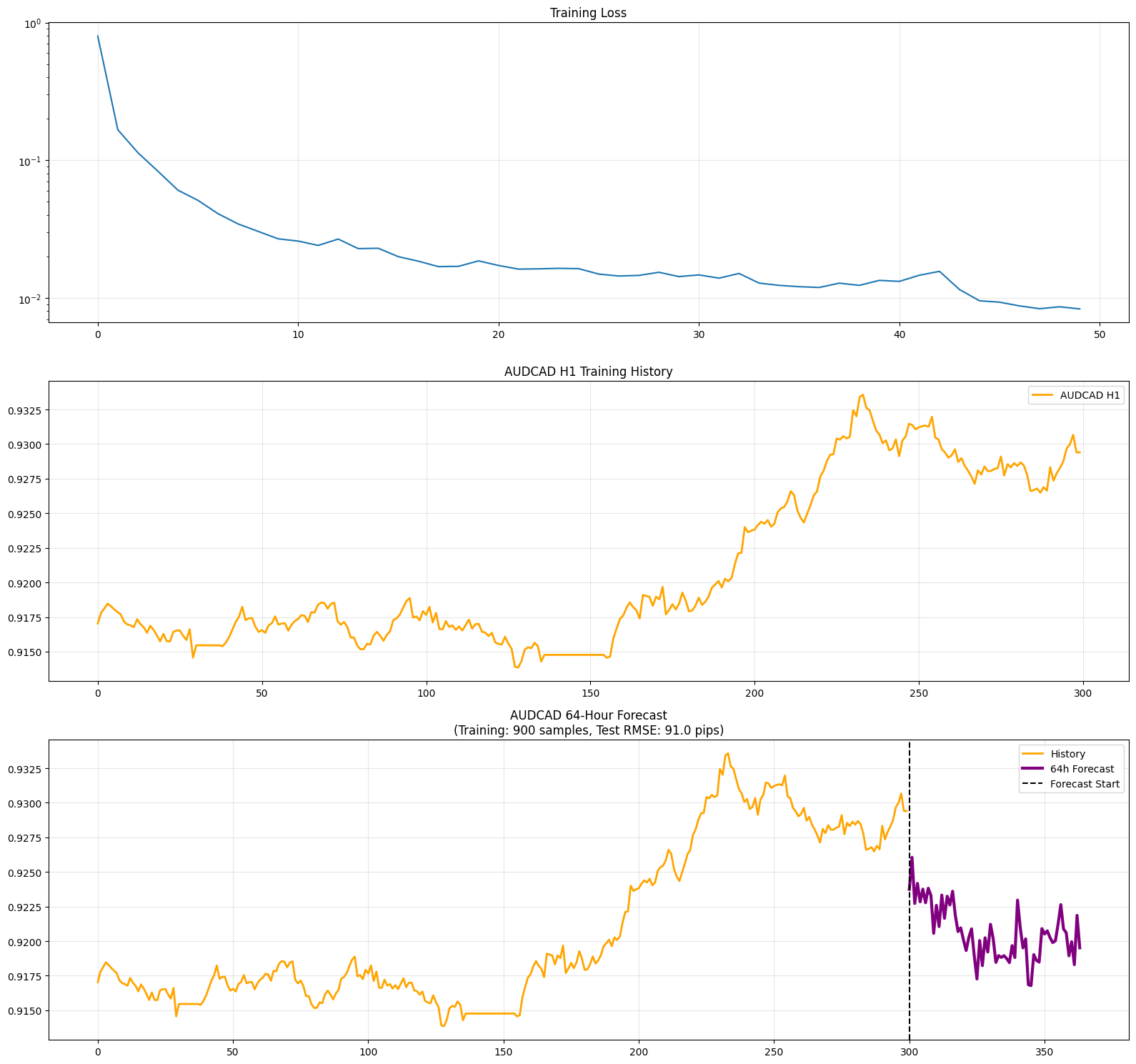

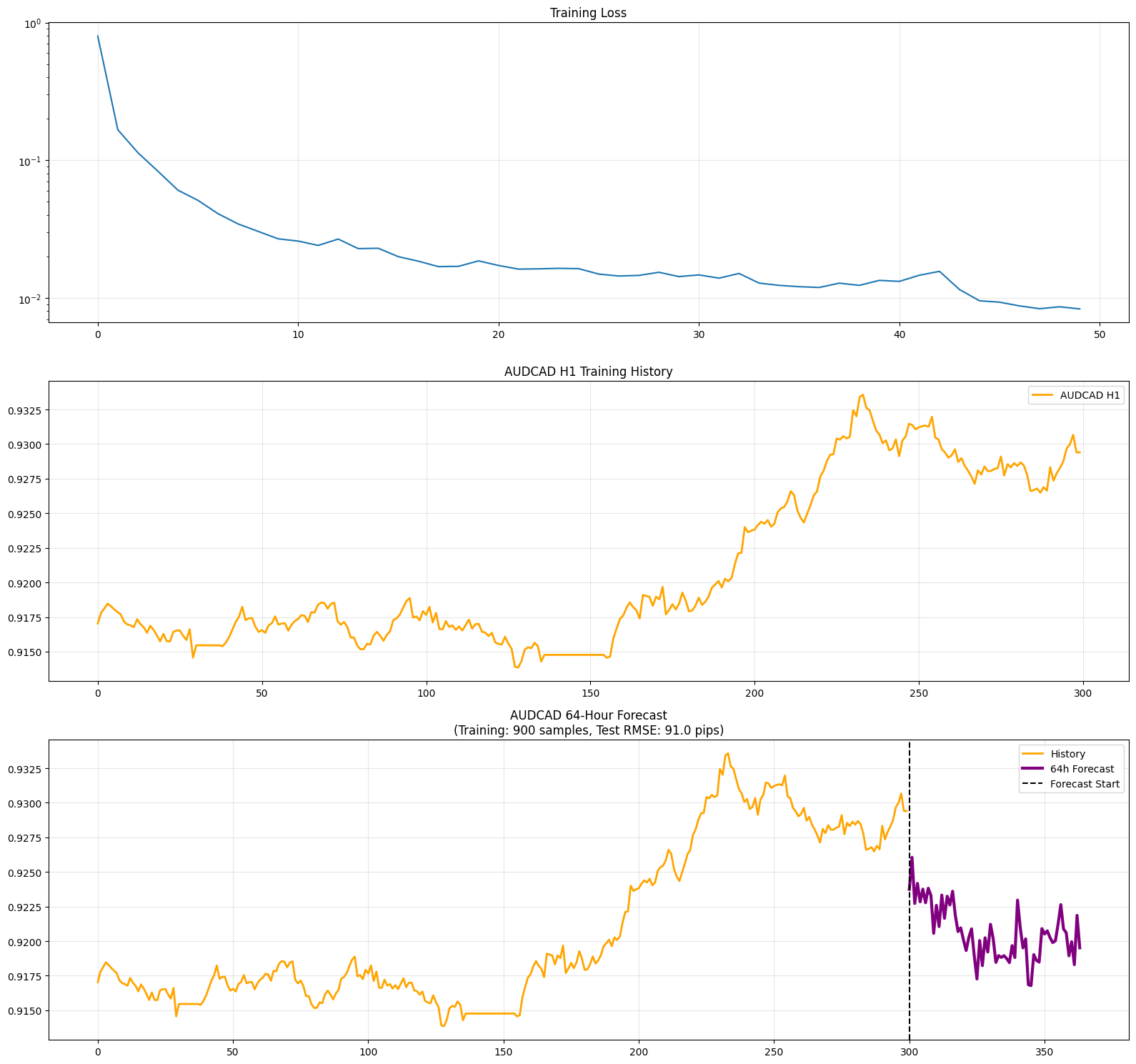

AI "chronos forecasting" new updates available today. https://forex-vision-tabs.lovable.app/

Yashar Seyyedin

Expert advisor based on a TMA indicator işi için müşteriye geri bildirim bıraktı

Thanks for the fair order.

| İş Gerekliliklerinin kalitesi | 5.0 | |

| Sonuç kontrol kalitesi | 5.0 | |

| Erişilebilirlik ve iletişim becerileri | 5.0 |

Yashar Seyyedin

In the face of an unfair distribution of computing power in training AI models, retail traders in financial markets will not have a chance to operate on low time frames in the not-so-distant future.

Yashar Seyyedin

AI "chronos forecasting" new updates available today. https://forex-vision-tabs.lovable.app/

Yashar Seyyedin

Updates on Existing Job işi için müşteriye geri bildirim bıraktı

Thanks for the fair order.

| İş Gerekliliklerinin kalitesi | 5.0 | |

| Sonuç kontrol kalitesi | 5.0 | |

| Erişilebilirlik ve iletişim becerileri | 5.0 |

Yashar Seyyedin

If I were as stupid as ten years ago I would have called this an end to gold rally as long as next decade.

Anyway if it's really the top, probably we are back to predictable FX regime.

Anyway if it's really the top, probably we are back to predictable FX regime.

Yashar Seyyedin

1. Do these freelance AI projects really have access to GPUs? Or they are too ignorant to even know the issue?

2. AI, rapidly and terribly, is increasing the level of class disparity.

3. If I'm really honest, I'd have to give up all tech-related activities right now.

2. AI, rapidly and terribly, is increasing the level of class disparity.

3. If I'm really honest, I'd have to give up all tech-related activities right now.

Yashar Seyyedin

Custom order for EA işi için müşteriye geri bildirim bıraktı

Thanks for the fair order.

| İş Gerekliliklerinin kalitesi | 5.0 | |

| Sonuç kontrol kalitesi | 5.0 | |

| Erişilebilirlik ve iletişim becerileri | 5.0 |

Yashar Seyyedin

Updates on Existing Job işi için müşteriye geri bildirim bıraktı

Thanks for the fair order.

| İş Gerekliliklerinin kalitesi | 5.0 | |

| Sonuç kontrol kalitesi | 5.0 | |

| Erişilebilirlik ve iletişim becerileri | 5.0 |

Yashar Seyyedin

MT5 EA Development Project işi için müşteriye geri bildirim bıraktı

Thanks for the fair order.

| İş Gerekliliklerinin kalitesi | 5.0 | |

| Sonuç kontrol kalitesi | 5.0 | |

| Erişilebilirlik ve iletişim becerileri | 5.0 |

Yashar Seyyedin

Social networks, including LinkedIn, either give people a sense of over-importance or under-importance.

Yashar Seyyedin

Sometimes AI prediction match well into traders' intuition and prediction. That should make things better.

Yashar Seyyedin

https://github.com/amazon-science/chronos-forecasting

Checkout this... easy to use pretrained forecast model for financial charts. I do not think you can create any better model with your available computational power and your knowledge.

Checkout this... easy to use pretrained forecast model for financial charts. I do not think you can create any better model with your available computational power and your knowledge.

Yashar Seyyedin

When you buy a car, you know that it is going to get you from one point to another. Although you may be a little satisfied or dissatisfied with its performance. When it comes to trading robots, 99% of buyers have a completely opposite perception of reality. Isn't this enough reason to give up selling EAs?

: