Zhuo Kai Chen / Perfil

- Informações

|

1 ano

experiência

|

0

produtos

|

0

versão demo

|

|

1

trabalhos

|

0

sinais

|

0

assinantes

|

Quant Researcher with 3+ years of trading experience

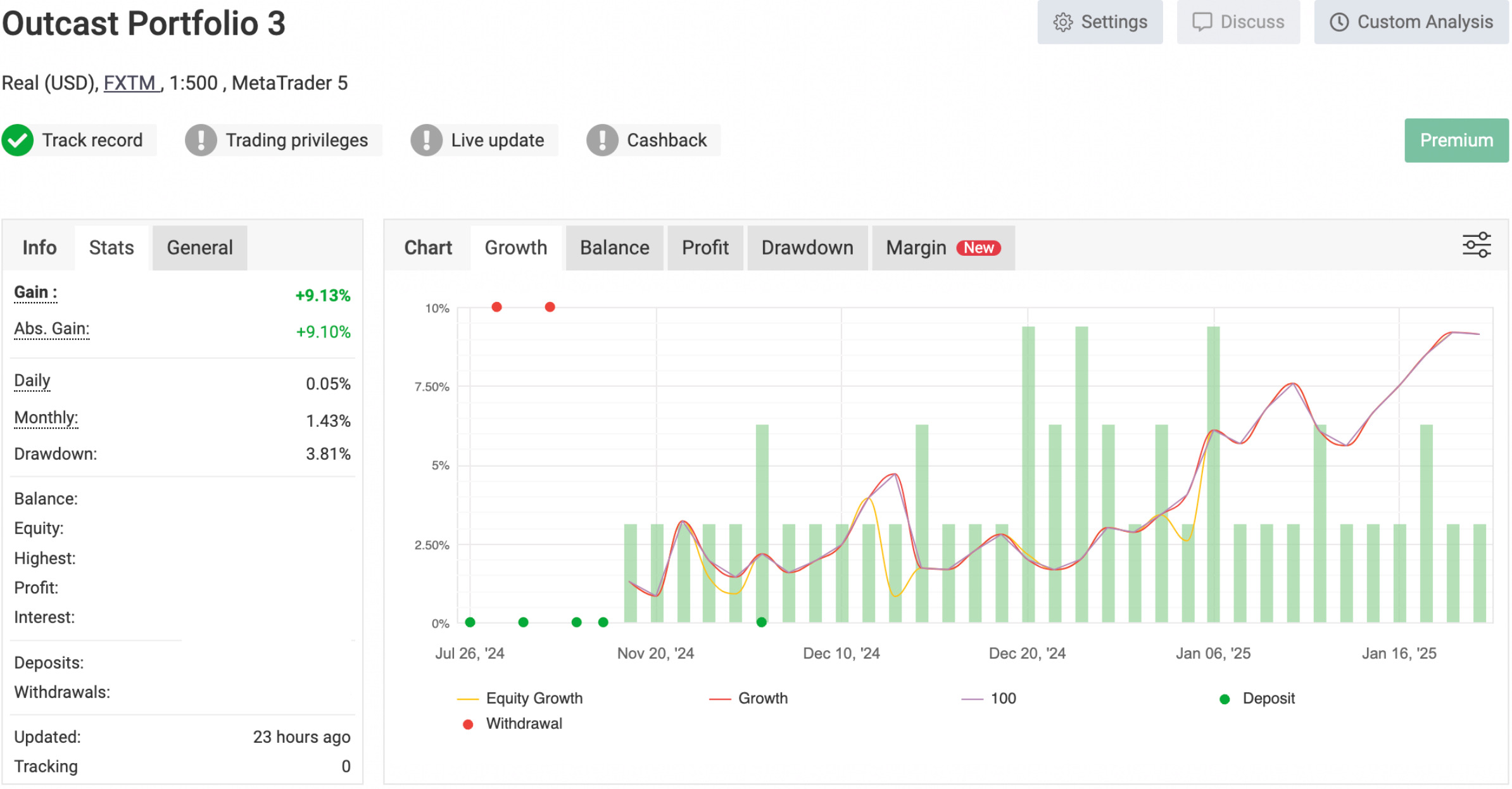

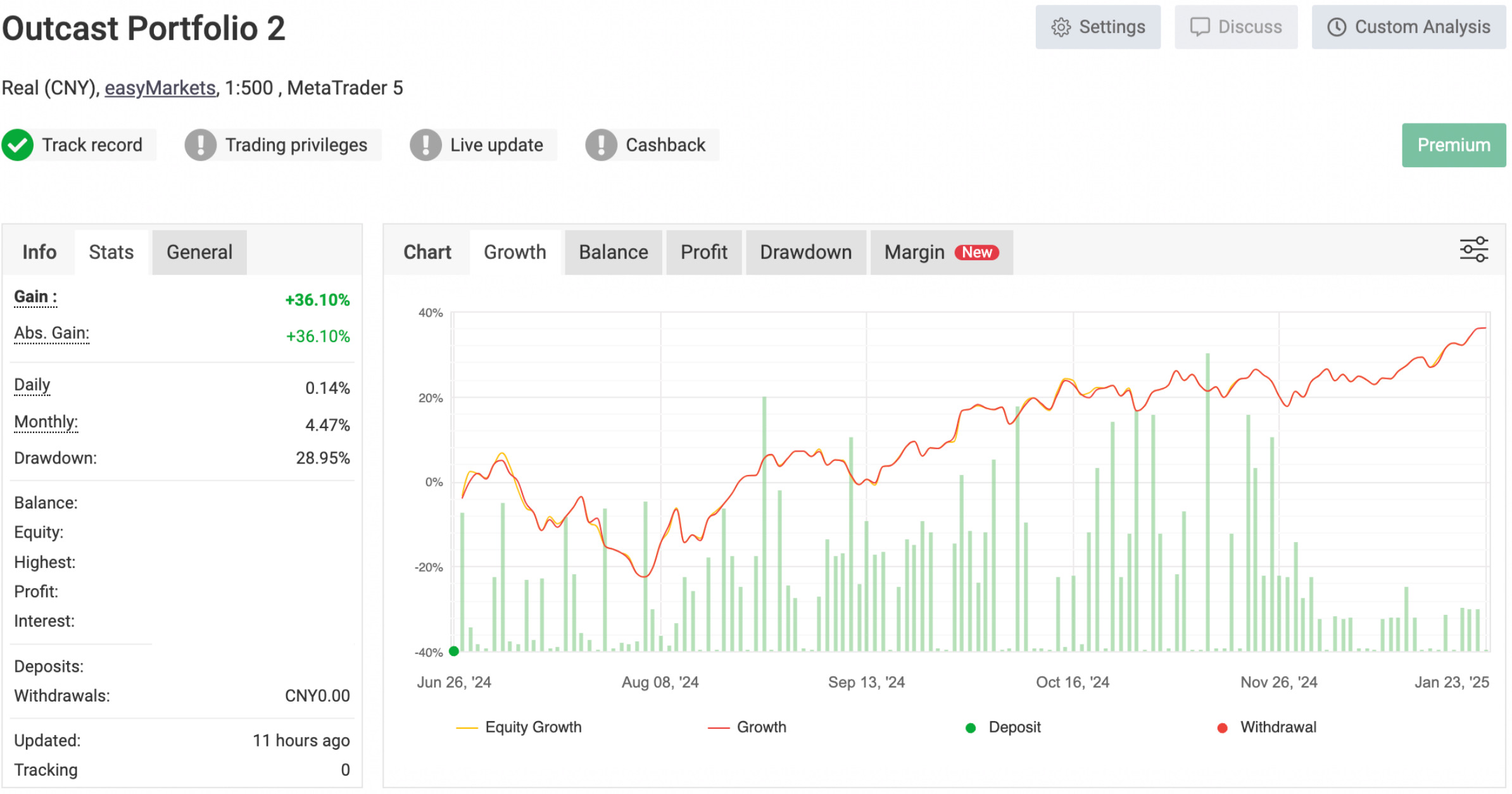

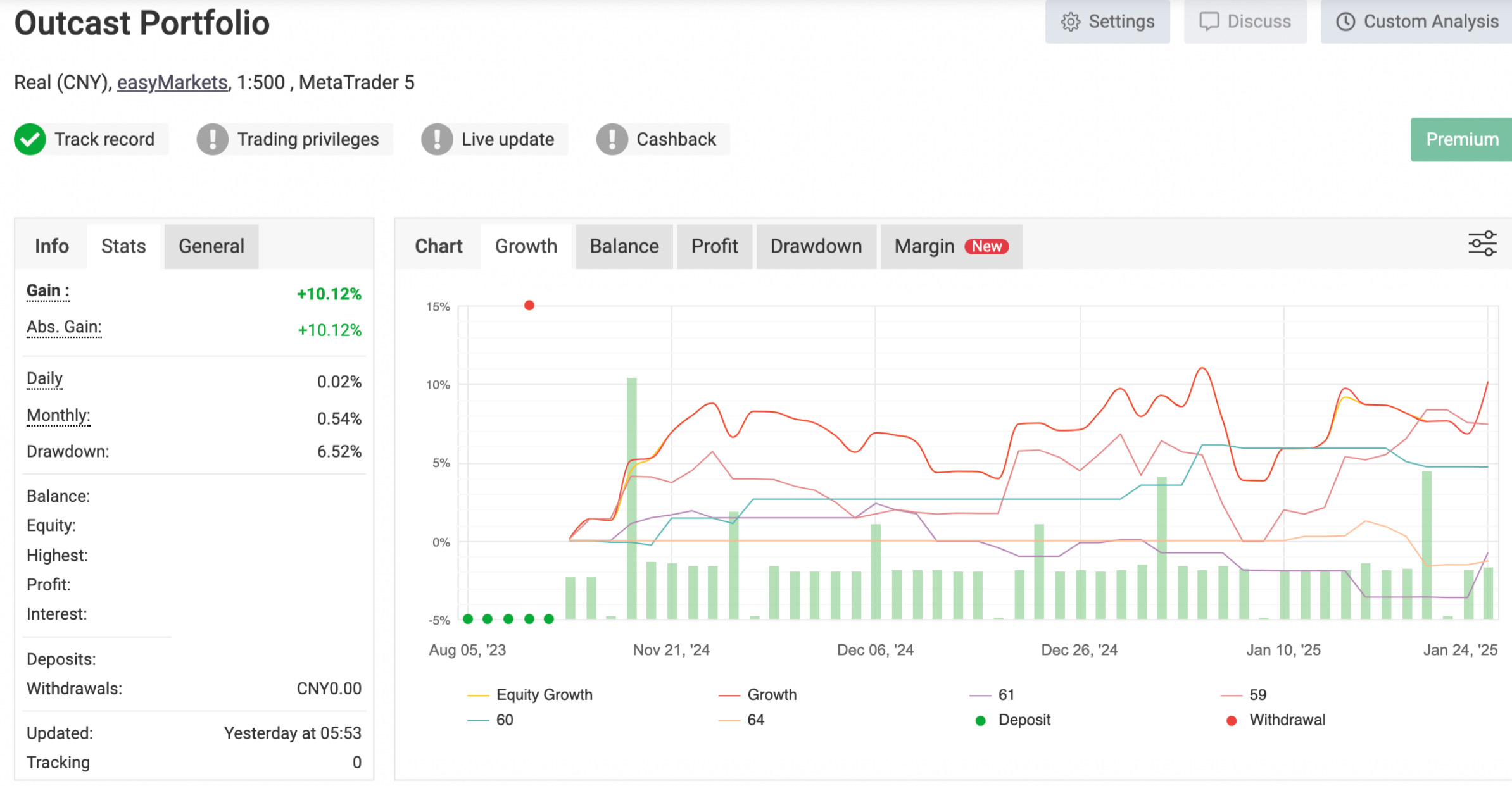

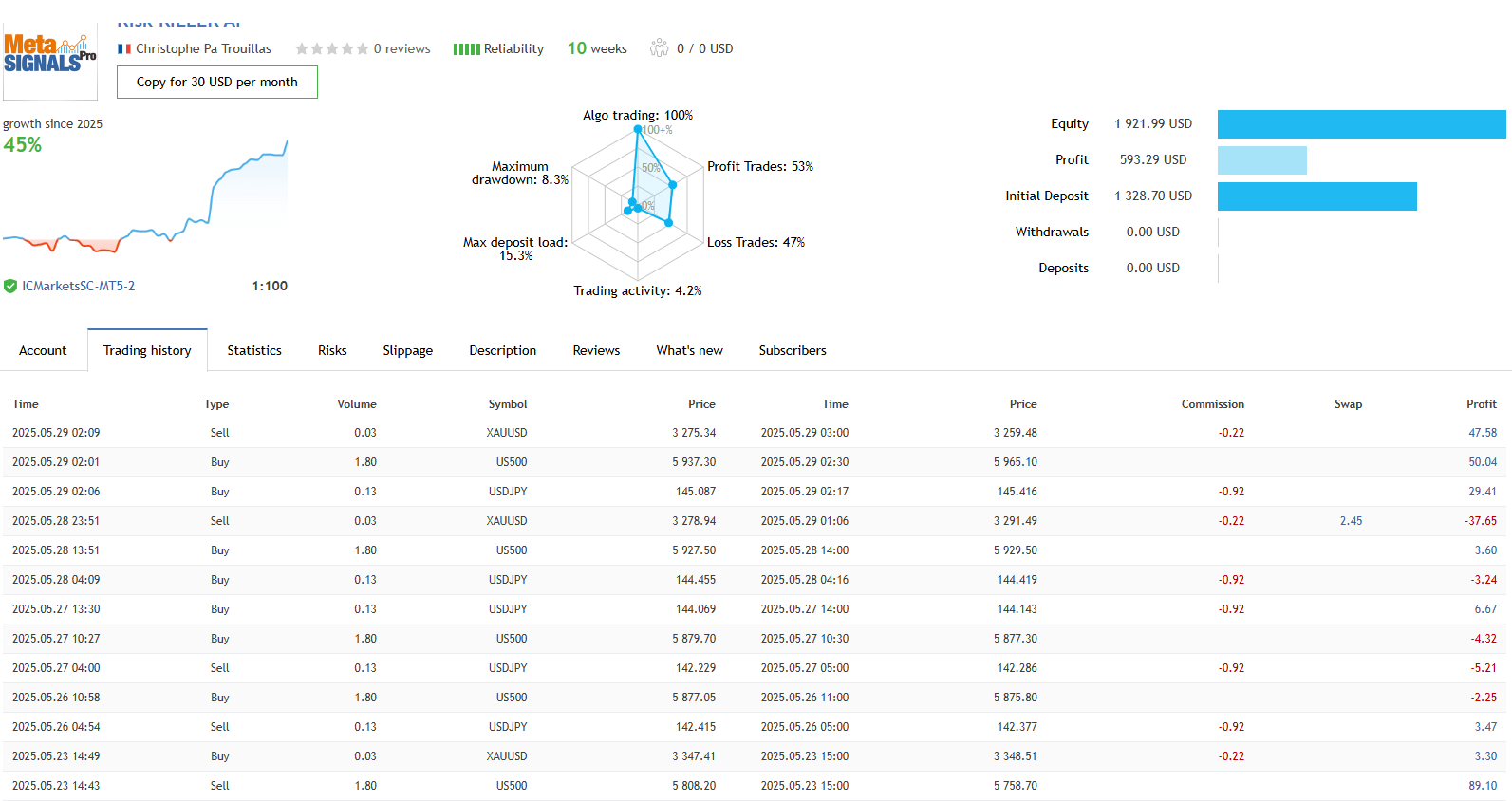

Currently managing 5+ trading systems

Specializes in CTA strategy development

Github: https://github.com/CodyOutcast

It's about LLM integration in intraday trading.

Keep in mind that I'm still a noob at research, but I would say this is a good first step.

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5246516

Download the demo and test it yourself: https://www.mql5.com/en/market/product/139184

| Qualidade dos termos de referência | 5.0 | |

| Qualidade da verificação dos resultados | 5.0 | |

| Disponibilidade e habilidades de comunicação | 5.0 |

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

The Darvas Box Breakout Strategy, created by Nicolas Darvas, is a technical trading approach that spots potential buy signals when a stock’s price rises above a set "box" range, suggesting strong upward momentum. In this article, we will apply this strategy concept as an example to explore three advanced machine learning techniques. These include using a machine learning model to generate signals rather than to filter trades, employing continuous signals rather than discrete ones, and using models trained on different timeframes to confirm trades.

The Kalman filter is a recursive algorithm used in algorithmic trading to estimate the true state of a financial time series by filtering out noise from price movements. It dynamically updates predictions based on new market data, making it valuable for adaptive strategies like mean reversion. This article first introduces the Kalman filter, covering its calculation and implementation. Next, we apply the filter to a classic mean-reversion forex strategy as an example. Finally, we conduct various statistical analyses by comparing the filter with a moving average across different forex pairs.

No desenvolvimento de estratégias, há muitos detalhes complexos a serem considerados, muitos dos quais não são destacados para traders iniciantes. Como resultado, muitos traders, eu incluído, tiveram de aprender essas lições da maneira mais difícil. Este artigo é baseado em minhas observações sobre armadilhas comuns que a maioria dos traders iniciantes encontra ao desenvolver estratégias em MQL5. Ele oferecerá uma variedade de dicas, truques e exemplos para ajudar a identificar a desqualificação de um EA e testar a robustez dos nossos próprios EAs de uma forma fácil de implementar. O objetivo é educar os leitores, ajudando-os a evitar futuros golpes ao comprar EAs, bem como a prevenir erros no desenvolvimento de suas próprias estratégias.

Memória de Curto e Longo Prazo (LSTM) é um tipo de rede neural recorrente (RNN) projetada para modelar dados sequenciais, capturando de forma eficaz dependências de longo prazo e resolvendo o problema do gradiente desvanecente. Neste artigo, exploraremos como utilizar LSTM para prever tendências futuras, aprimorando o desempenho de estratégias de seguimento de tendência. O artigo abordará a introdução de conceitos-chave e a motivação por trás do desenvolvimento, a obtenção de dados do MetaTrader 5, o uso desses dados para treinar o modelo em Python, a integração do modelo de aprendizado de máquina no MQL5 e a reflexão sobre os resultados e aspirações futuras com base em backtesting estatístico.

Um inverse fair value gap (IFVG) ocorre quando o preço retorna a um fair value gap previamente identificado e, em vez de apresentar a reação esperada de suporte ou resistência, falha em respeitá-lo. Essa falha pode sinalizar uma possível mudança na direção do mercado e oferecer uma vantagem contrária de negociação. Neste artigo, vou apresentar minha abordagem desenvolvida por mim para quantificar e utilizar o inverse fair value gap como uma estratégia para expert advisors do MetaTrader 5.

A volatilidade tende a atingir picos em torno de eventos de notícias de alto impacto, criando oportunidades significativas de breakout. Neste artigo, iremos delinear o processo de implementação de uma estratégia de breakout baseada em calendário. Abordaremos tudo, desde a criação de uma classe para interpretar e armazenar dados do calendário, o desenvolvimento de backtests realistas utilizando esses dados e, por fim, a implementação do código de execução para negociação ao vivo.

A estratégia de captura de liquidez é um componente-chave do Smart Money Concepts (SMC), que visa identificar e aproveitar as ações dos participantes institucionais no mercado. Ela envolve mirar áreas de alta liquidez, como zonas de suporte ou resistência, onde ordens de grande volume podem provocar um movimento de preço antes que o mercado retome sua tendência. Este artigo explica em detalhes o conceito de captura de liquidez e descreve o processo de desenvolvimento de um EA para a estratégia de captura de liquidez em MQL5.

Os modelos ocultos de Markov (HMM) são uma poderosa ferramenta estatística que permite identificar estados ocultos do mercado com base na análise de movimentos observáveis dos preços. No trading, os HMM permitem melhorar a previsão da volatilidade e são aplicados no desenvolvimento de estratégias de tendência, modelando as mudanças nos regimes de mercado. Neste artigo, apresentaremos um processo passo a passo para o desenvolvimento de uma estratégia de seguimento de tendência que utiliza HMM como filtro para previsão de volatilidade.

Por décadas, traders vêm utilizando a fórmula do Critério de Kelly para determinar a proporção ideal de capital a ser alocada em um investimento ou aposta, a fim de maximizar o crescimento de longo prazo enquanto minimiza o risco de ruína. No entanto, seguir cegamente o Critério de Kelly utilizando o resultado de um único backtest costuma ser perigoso para traders individuais, pois, na negociação ao vivo, a vantagem de trading diminui com o tempo, e o desempenho passado não é garantia de resultado futuro. Neste artigo, apresentarei uma abordagem realista para aplicar o Critério de Kelly para alocação de risco de um ou mais EAs no MetaTrader 5, incorporando resultados de simulação de Monte Carlo provenientes do Python.

Recently, a fund manager from Man Group gave a lecture about CTAs (Commodity Trading Advisors) at my university. He mentioned that they rarely use machine learning in their CTA bots, which baffled me. Literally, one of the most successful firms in the world prefers simple rules and intuitive algorithms over sophisticated methods. I asked him why, and he explained:

1. They tried using machine learning to mine alphas but failed miserably.

2. They attempted to use it as a filter, similar to what we discussed in this article, but it barely worked, achieving only 80% correlation. This means it provided almost no additional edge compared to the original strategy.

3. They found success in using machine learning to select the best strategy for a given market.

Regarding the third point, I wondered why they didn’t simply test each strategy for every market and compare the results. However, I assume they find it more efficient to cluster markets for certain strategies, especially since they trade over 6,000 assets. They believe the aforementioned theory explains their obstacles, as they primarily use trend-following strategies for their CTA bots.

CatBoost é um poderoso modelo de machine learning baseado em árvores que se especializa em tomada de decisão com base em features estacionárias. Outros modelos baseados em árvores como XGBoost e Random Forest compartilham características semelhantes em termos de robustez, capacidade de lidar com padrões complexos e interpretabilidade. Esses modelos têm uma ampla gama de usos, desde análise de features até gestão de risco. Neste artigo, vamos percorrer o procedimento de utilização de um modelo CatBoost treinado como filtro para uma estratégia clássica de seguimento de tendência com cruzamento de médias móveis.