Zhuo Kai Chen / Profil

- Information

|

1 Jahr

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

1

Jobs

|

0

Signale

|

0

Abonnenten

|

Quant Researcher with 3+ years of trading experience

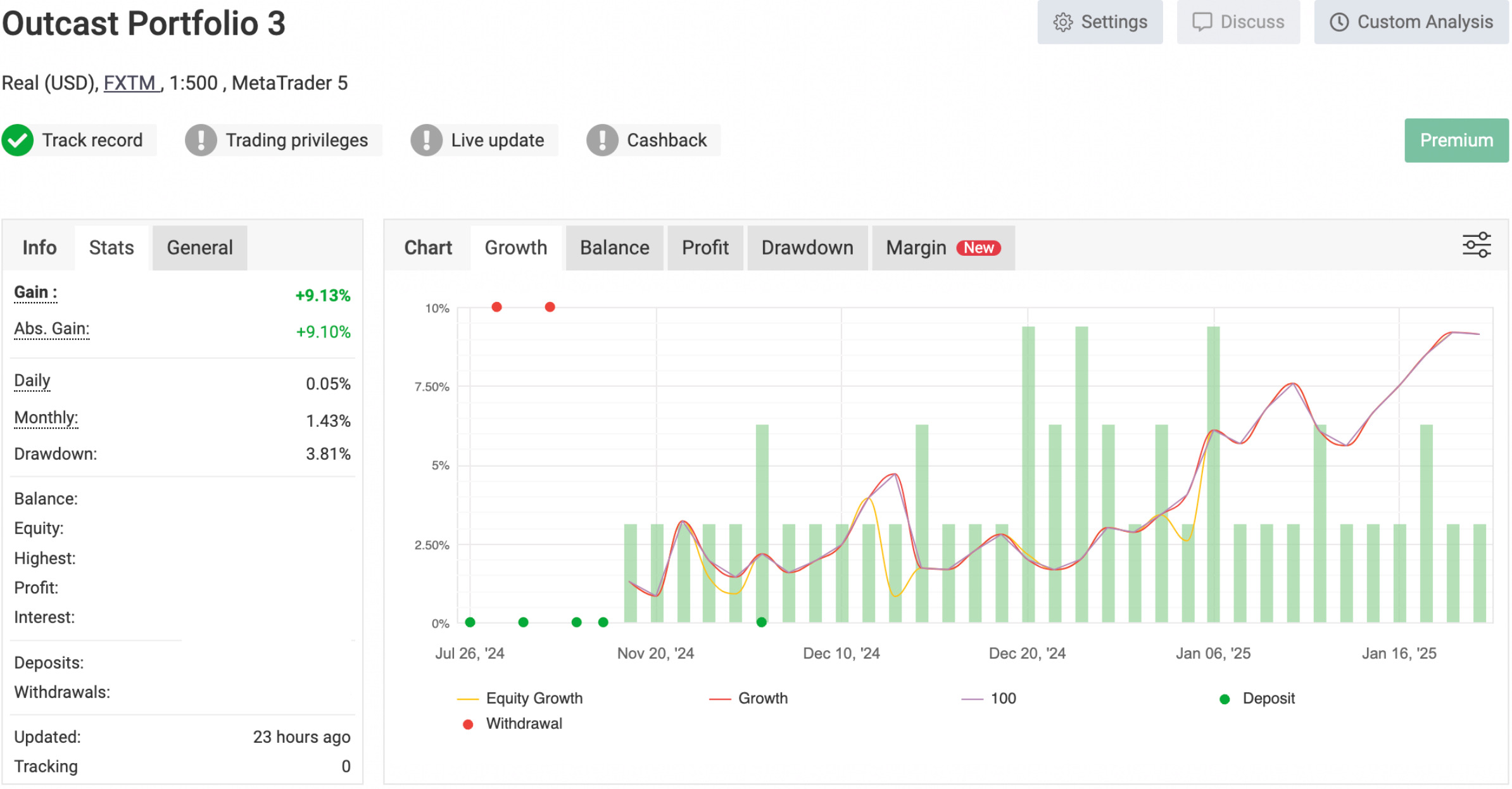

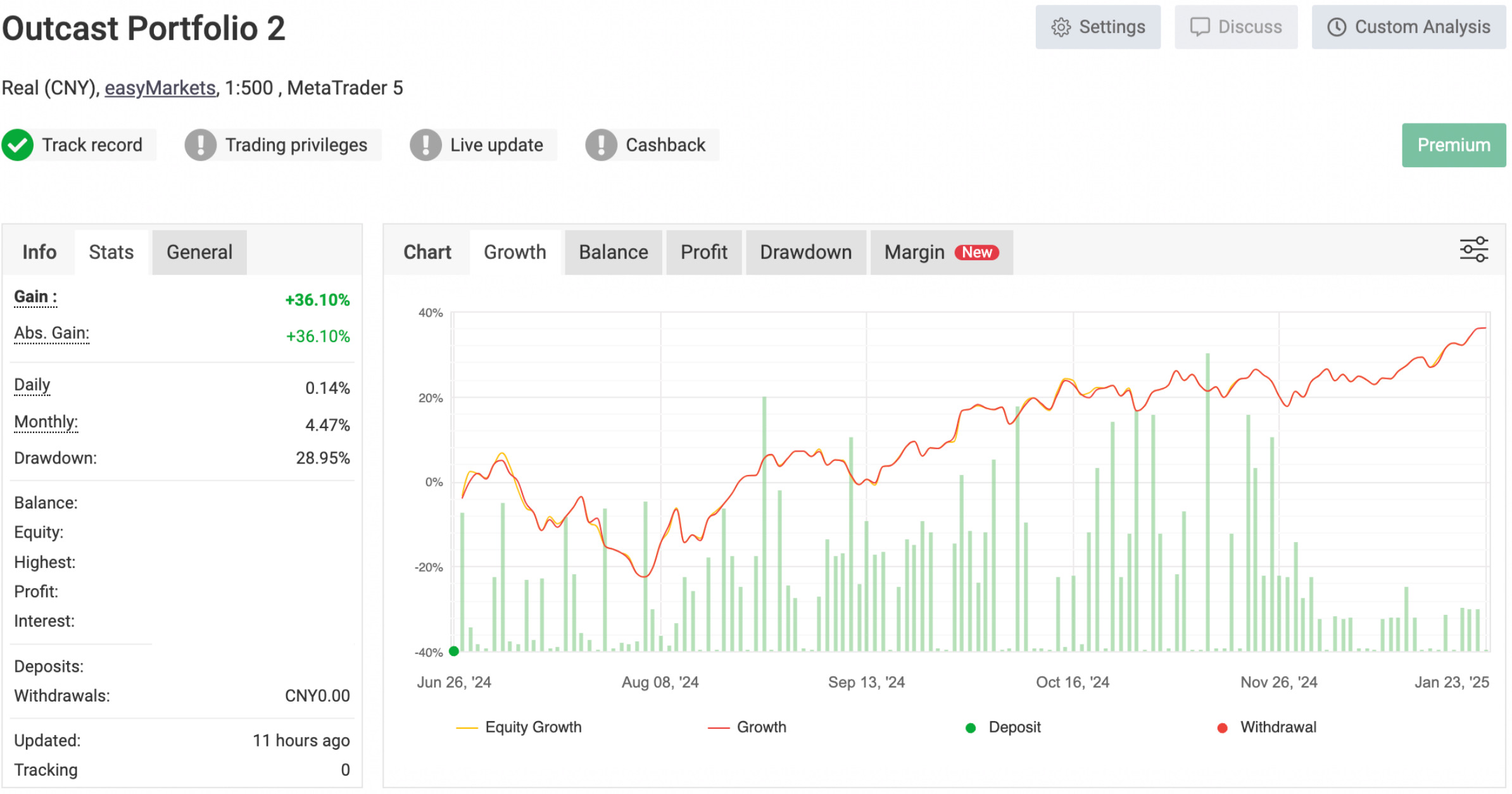

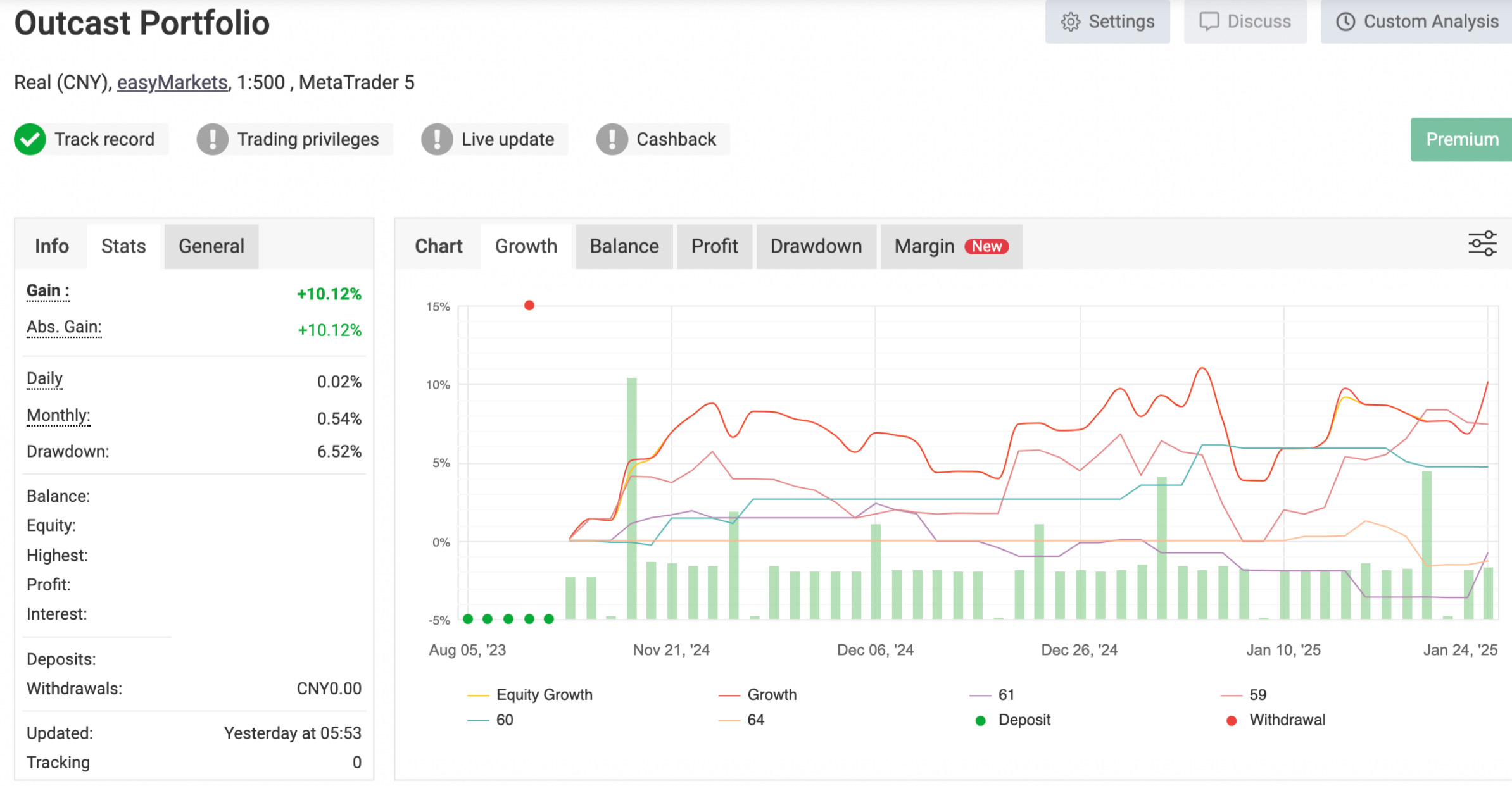

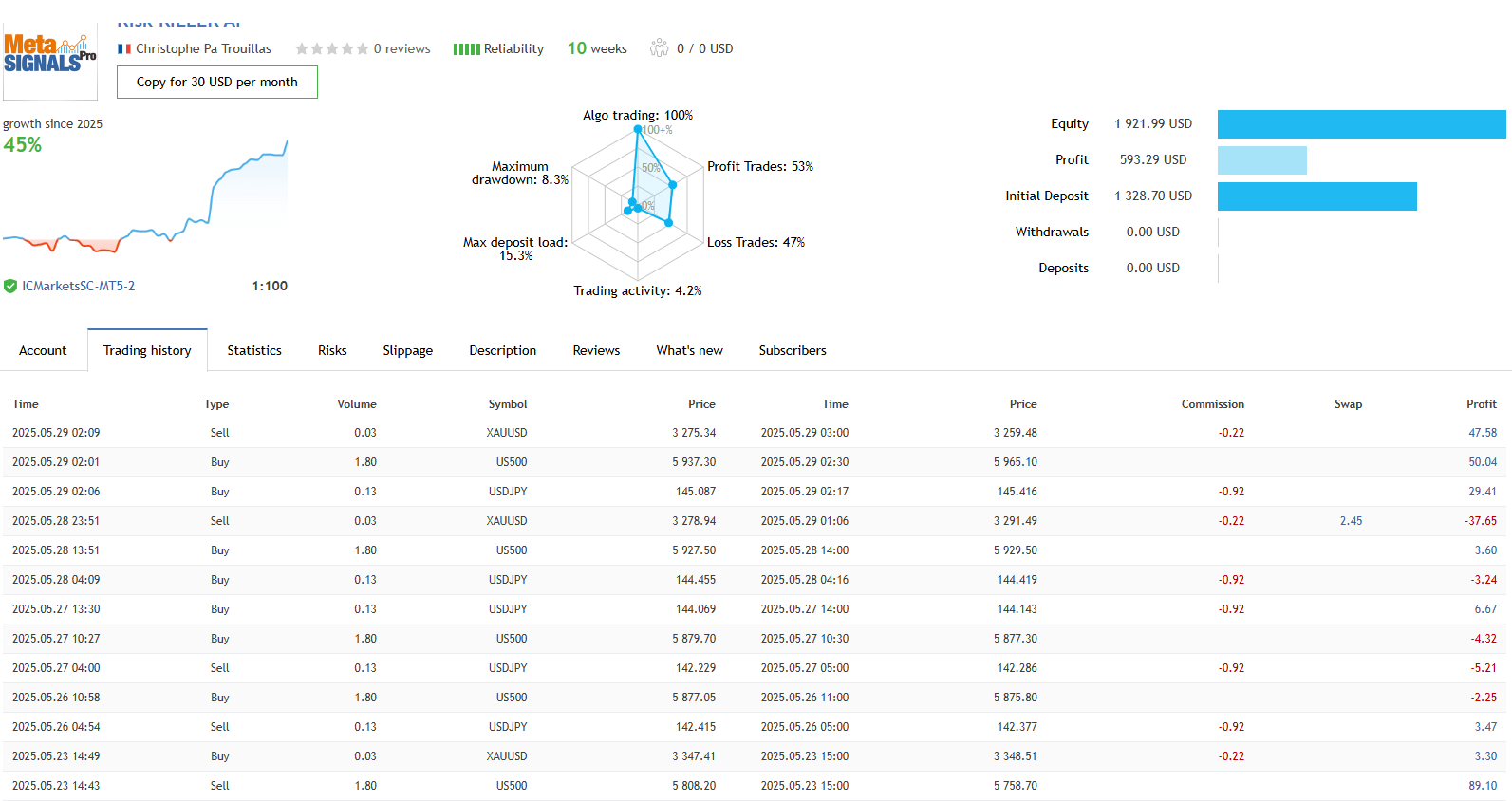

Currently managing 5+ trading systems

Specializes in CTA strategy development

Github: https://github.com/CodyOutcast

It's about LLM integration in intraday trading.

Keep in mind that I'm still a noob at research, but I would say this is a good first step.

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5246516

Download the demo and test it yourself: https://www.mql5.com/en/market/product/139184

| Qualität der Leistungsbeschreibung | 5.0 | |

| Ergebnis der Qualitätsprüfung | 5.0 | |

| Erreichbarkeit und Kommunikation | 5.0 |

Die Strategien des Opening Range Breakout (ORB) basieren auf der Idee, dass die erste Handelsspanne, die sich kurz nach der Markteröffnung bildet, wichtige Preisniveaus widerspiegelt, bei denen sich Käufer und Verkäufer auf einen Wert einigen. Durch die Identifizierung von Ausbrüchen über oder unter einer bestimmten Spanne können Händler von der Dynamik profitieren, die oft folgt, wenn die Marktrichtung klarer wird. In diesem Artikel werden wir drei ORB-Strategien untersuchen, die von der Concretum Group übernommen wurden.

Larry Connors ist ein renommierter Händler und Autor, der vor allem für seine Arbeit im Bereich des quantitativen Handels und für Strategien wie den 2-Perioden-RSI (RSI2) bekannt ist, der dabei hilft, kurzfristig überkaufte und überverkaufte Marktbedingungen zu erkennen. In diesem Artikel werden wir zunächst die Motivation für unsere Forschung erläutern, dann drei von Connors' berühmtesten Strategien in MQL5 nachbilden und sie auf den Intraday-Handel mit dem S&P 500 Index CFD anwenden.

Die von Nicolas Darvas entwickelte Darvas-Box-Breakout-Strategie ist ein technischer Handelsansatz, der potenzielle Kaufsignale erkennt, wenn der Kurs einer Aktie über einen festgelegten Bereich der „Box“ ansteigt, was auf eine starke Aufwärtsdynamik hindeutet. In diesem Artikel werden wir dieses Strategiekonzept als Beispiel anwenden, um drei fortgeschrittene Techniken des maschinellen Lernens zu untersuchen. Dazu gehören die Verwendung eines maschinellen Lernmodells zur Generierung von Signalen anstelle von Handelsfiltern, die Verwendung von kontinuierlichen Signalen anstelle von diskreten Signalen und die Verwendung von Modellen, die auf verschiedenen Zeitrahmen trainiert wurden, um Handelsgeschäfte zu bestätigen.

Der Kalman-Filter ist ein rekursiver Algorithmus, der im algorithmischen Handel verwendet wird, um den wahren Zustand einer Finanzzeitreihe durch Herausfiltern von Rauschen aus den Preisbewegungen zu schätzen. Er aktualisiert die Vorhersagen dynamisch auf der Grundlage neuer Marktdaten, was ihn für adaptive Strategien wie Mean Reversion wertvoll macht. In diesem Artikel wird zunächst der Kalman-Filter vorgestellt und seine Berechnung und Anwendung erläutert. Als nächstes wenden wir den Filter auf eine klassische Devisenstrategie, der Rückkehr zur Mitte, als Beispiel an. Schließlich führen wir verschiedene statistische Analysen durch, indem wir den Filter mit einem gleitenden Durchschnitt für verschiedene Devisenpaare vergleichen.

Bei der Entwicklung von Strategien sind viele komplizierte Details zu berücksichtigen, von denen viele für Anfänger nicht besonders interessant sind. Infolgedessen mussten viele Händler, mich eingeschlossen, diese Lektionen auf die harte Tour lernen. Dieser Artikel basiert auf meinen Beobachtungen von häufigen Fallstricken, die den meisten Anfängern bei der Entwicklung von Strategien auf MQL5 begegnen. Es wird eine Reihe von Tipps, Tricks und Beispielen bieten, die dabei helfen, die Untauglichkeit eines EA zu erkennen und die Robustheit unserer eigenen EAs auf einfache Weise zu testen. Ziel ist es, die Leser aufzuklären und ihnen zu helfen, zukünftige Betrügereien beim Kauf von EAs zu vermeiden und Fehler bei der eigenen Strategieentwicklung zu verhindern.

Long Short-Term Memory (LSTM) ist eine Art rekurrentes neuronales Netz (RNN), das für die Modellierung sequenzieller Daten entwickelt wurde, indem es langfristige Abhängigkeiten effektiv erfasst und das Problem des verschwindenden Gradienten löst. In diesem Artikel werden wir untersuchen, wie LSTM zur Vorhersage zukünftiger Trends eingesetzt werden kann, um die Leistung von Trendfolgestrategien zu verbessern. Der Artikel behandelt die Einführung von Schlüsselkonzepten und die Motivation hinter der Entwicklung, das Abrufen von Daten aus dem MetaTrader 5, die Verwendung dieser Daten zum Trainieren des Modells in Python, die Integration des maschinellen Lernmodells in MQL5 und die Reflexion der Ergebnisse und zukünftigen Bestrebungen auf der Grundlage von statistischem Backtesting.

Eine Inverse Fair Value Gap (IFVG) liegt vor, wenn der Kurs in eine zuvor ermittelte „Fair Value Gap“ abprallt und statt der erwarteten unterstützenden oder Widerstandsreaktion diese nicht einhält. Dieses Scheitern kann eine potenzielle Veränderung der Marktrichtung signalisieren und einen konträren Handelsvorteil bieten. In diesem Artikel werde ich meinen selbst entwickelten Ansatz zur Quantifizierung und Nutzung der inversen Fair Value Gap als Strategie für MetaTrader 5 Expert Advisors vorstellen.

Die Volatilität erreicht ihren Höhepunkt in der Regel in der Nähe von Ereignissen mit hohem Nachrichtenwert, wodurch sich erhebliche Ausbruchschancen ergeben. In diesem Artikel werden wir den Umsetzungsprozess einer kalenderbasierten Ausbruch-Strategie skizzieren. Wir werden alles von der Erstellung einer Klasse zur Interpretation und Speicherung von Kalenderdaten über die Entwicklung realistischer Backtests mit diesen Daten bis hin zur Implementierung von Ausführungscode für den Live-Handel behandeln.

Die Strategie des Handel eines Liquiditätshungers (liquidity grab) ist eine Schlüsselkomponente von Smart Money Concepts (SMC), die darauf abzielt, die Aktionen institutioneller Marktteilnehmer zu identifizieren und auszunutzen. Dabei werden Bereiche mit hoher Liquidität, wie z. B. Unterstützungs- oder Widerstandszonen, ins Visier genommen, in denen große Aufträge Kursbewegungen auslösen können, bevor der Markt seinen Trend wieder aufnimmt. In diesem Artikel wird das Konzept des Liquiditätshungers im Detail erklärt und der Entwicklungsprozess des Expert Advisor der Liquiditätshunger-Handelsstrategie in MQL5 skizziert.

Hidden Markov Modelle (HMM) sind leistungsstarke statistische Instrumente, die durch die Analyse beobachtbarer Kursbewegungen die zugrunde liegenden Marktzustände identifizieren. Im Handel verbessern HMM die Volatilitätsprognose und liefern Informationen für Trendfolgestrategien, indem sie Marktverschiebungen modellieren und antizipieren. In diesem Artikel stellen wir das vollständige Verfahren zur Entwicklung einer Trendfolgestrategie vor, die HMM zur Prognose der Volatilität als Filter einsetzt.

Seit Jahrzehnten verwenden Händler die Formel des Kelly-Kriteriums, um den optimalen Anteil des Kapitals für eine Investition oder eine Wette zu bestimmen, um das langfristige Wachstum zu maximieren und gleichzeitig das Risiko des Ruins zu minimieren. Das blinde Befolgen des Kelly-Kriteriums auf der Grundlage der Ergebnisse eines einzigen Backtests ist jedoch für einzelne Händler oft gefährlich, da beim Live-Handel der Handelsvorsprung im Laufe der Zeit abnimmt und die vergangene Leistung keine Vorhersage für das zukünftige Ergebnis ist. In diesem Artikel werde ich einen realistischen Ansatz für die Anwendung des Kelly-Kriteriums für die Risikoallokation eines oder mehrerer EAs in MetaTrader 5 vorstellen und dabei die Ergebnisse der Monte-Carlo-Simulation von Python einbeziehen.

Recently, a fund manager from Man Group gave a lecture about CTAs (Commodity Trading Advisors) at my university. He mentioned that they rarely use machine learning in their CTA bots, which baffled me. Literally, one of the most successful firms in the world prefers simple rules and intuitive algorithms over sophisticated methods. I asked him why, and he explained:

1. They tried using machine learning to mine alphas but failed miserably.

2. They attempted to use it as a filter, similar to what we discussed in this article, but it barely worked, achieving only 80% correlation. This means it provided almost no additional edge compared to the original strategy.

3. They found success in using machine learning to select the best strategy for a given market.

Regarding the third point, I wondered why they didn’t simply test each strategy for every market and compare the results. However, I assume they find it more efficient to cluster markets for certain strategies, especially since they trade over 6,000 assets. They believe the aforementioned theory explains their obstacles, as they primarily use trend-following strategies for their CTA bots.

CatBoost ist ein leistungsfähiges, baumbasiertes, maschinelles Lernmodell, das auf die Entscheidungsfindung auf der Grundlage stationärer Merkmale spezialisiert ist. Andere baumbasierte Modelle wie XGBoost und Random Forest haben ähnliche Eigenschaften in Bezug auf ihre Robustheit, ihre Fähigkeit, komplexe Muster zu verarbeiten, und ihre Interpretierbarkeit. Diese Modelle haben ein breites Anwendungsspektrum, das von der Merkmalsanalyse bis zum Risikomanagement reicht.