ABC Order Block

- Experts

- BILLY ARANDUQUE ABCEDE

- Versão: 1.1

- Atualizado: 14 abril 2023

- Ativações: 20

Signal : https://www.mql5.com/en/signals/1925481

Signal : https://www.mql5.com/en/signals/1925156

What Are Order Blocks Forex?

Order blocks in trading refer to a situation where central banks or large financial institutions accumulate large quantities of a particular asset through one big order.

They are supply or demand zones in which big players can find the comfort of placing large buy and sell orders and completing a big, very big transaction. But, banks and financial institutions cannot place a huge order to buy or sell an asset as they might trigger unexpected moves and create high volatility.

So, as central banks and institutions typically aim to buy or sell valuable assets that are used by ordinary people and have day-to-day uses, they must create these special orders known as “blocks”.

Basically, they split their orders into blocks, enter the markets, make a purchase, and disappear. Then, they do the same repeatedly until they reach their target. For example, if a large bank has to buy 200M EUR/USD, they will make this purchase in three, four, or even more steps.

Additionally, in many cases, they use sophisticated orders not to disclose their involvement in the markets. For example, they use an order that shows 1 on the bid or sell side, although they have a block of 1000. Other traders cannot know that, and this is one method in which central banks and institutions achieve their goal without adding volatility to the markets and drastically changing prices.

Bullish Order Blocks

A bullish order book (BuOB) is a situation where a central bank or a big financial institution accumulates large quantities of a specific currency. For example, let’s say the Japanese central bank (BoJ) aims to weaken the value of the Japanese yen versus the US dollar to stimulate Japanese economic growth. In this situation, the BoJ will enter the foreign exchange market and buy lots of US dollars.

Bearish Order Blocks

Now, let’s assume a central bank involved in the reverse currency war is entering the market to sell the counter currency and strengthen its currency’s value. For this bearish order block (BeOB) demonstration, we’ll show an example of the US dollar versus the Swiss Franc (USD/CHF).

Parameters :

| Name | Value |

|---|---|

| Lotsize | 0.01 |

| Candle_Size | 20 |

| SL | 40 |

| TP | 50 |

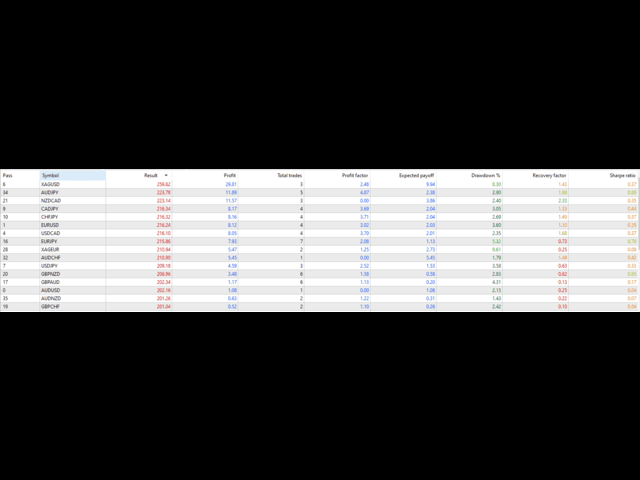

| Symbol | AUDJPY,NZDCAD,CADJPY,CHFJPY,EURUSD,USDCAD,EURJPY,AUDCHF,USDJPY,GBPNZD,GBPAUD,AUDUSD,AUDNZD,GBPCHF |

Recommended Pairs :

XM Micro Account :

PAIRS : GBPCHFmicro,AUDJPYmicro,CADJPYmicro,NZDCADmicro,USDCADmicro,EURUSDmicro,CFHJPYmicro,GBPAUDmicro,AUDUSDmicro,AUDCHFmicro,NZDUSDmicro,USDJPYmicro,EURJPYmicro,AUDNZDmicro,USDCHFmicro,NZDCHFmicro

FBS Cent Account :

METALS :XAGUSD,XAGEUR

PAIRS : AUDJPY,NZDCAD,CADJPY,CHFJPY,EURUSD,USDCAD,EURJPY,AUDCHF,USDJPY,GBPNZD,GBPAUD,AUDUSD,AUDNZD,GBPCHF

If you have some questions just inbox directly.