All moving average type crossover with vol filter

- Experts

- Ricardo Dacosta

- Versão: 1.3

- Atualizado: 31 maio 2021

- Ativações: 5

Our Moving Average Crossover EA offers a unique and complete 100% automated trading solution with over 34 different types of Moving Average calculations to choose from! Yes, that right 34! See the list at the bottom of the description!

So many great features!

Position Sizing & Money Management

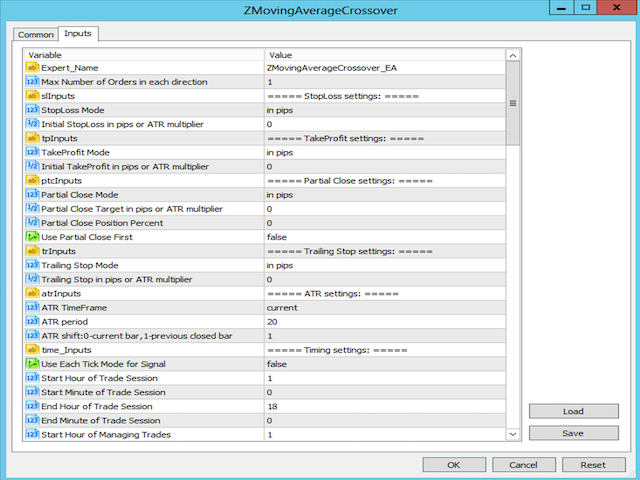

- Position sizes are either fixed or calculated dynamically based on percentage of Capital available divided by pip count or ATR multiplier.

Stop Loss, Target Profit, Trailing Stop & Partial Position Closing

- Stop Loss, Trailing Stop & Targets are based on either pip count or ATR multiplier

- Partial position closing available. Also based on pip count or ATR multiplier

Time Filter

- Ability to setup desire time of the day to Enter and also separately to Manage trades based on Hours & Minutes.

Trade management consist of monitoring partial closings, targets, moving trailing stops, etc

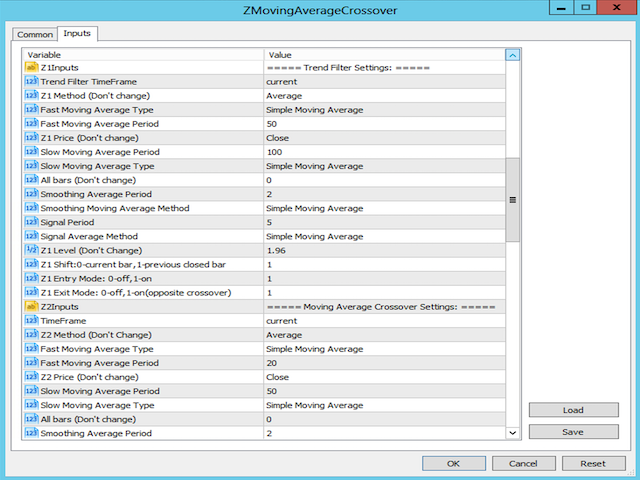

Entering Trades

- As mention above, traders have 34 different Moving Average calculations to choose from for main entry signal.

- It also features a Multi Frame Trend Filter. Ideally for traders who want to trade in lower timeframes but respecting the trend of higher Time Frames. The filter allows traders to specify Price above or below a certain period moving average in higher time frame as rule to enter Longs or Shorts in lower time frames

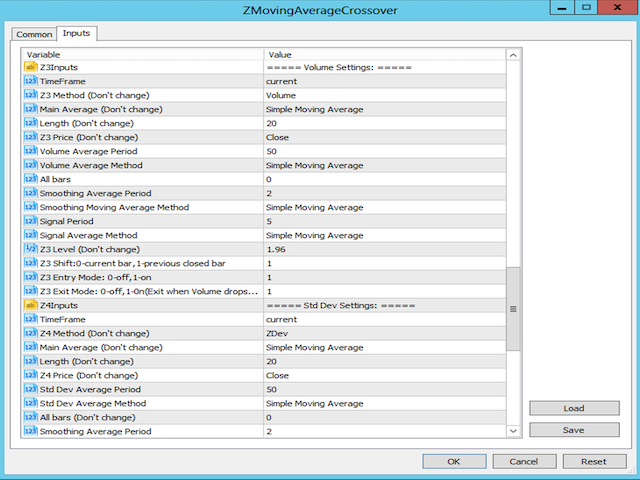

- It also offers a Volume filter to help eliminate false signals as it looks for Volume to be above a certain level of the average in order to ensure sufficient Fuel to enter trades.

- Lastly it also offers a unique and perhaps not well known filter based on Standard Deviation. It enters trades ONLY when the Standard Deviation is increasing, a sign of increased momentum.

Exiting Trades

- Trades can also be exited with indicator rules. Such as: Opposite Moving Average Crossover and/or Daily Trend Filter or a Decline in Volume

Optimization Recommendations

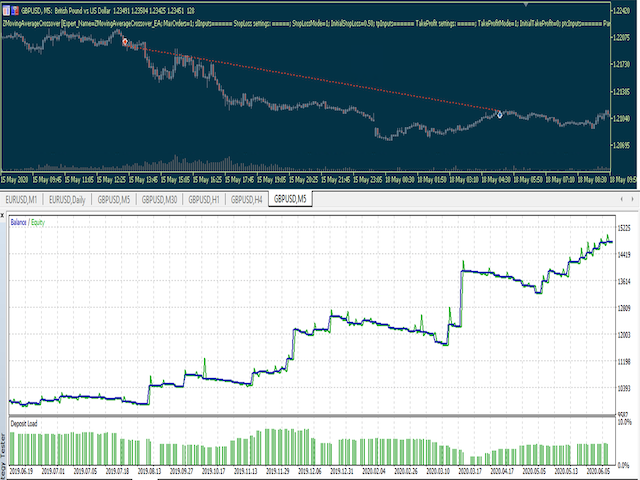

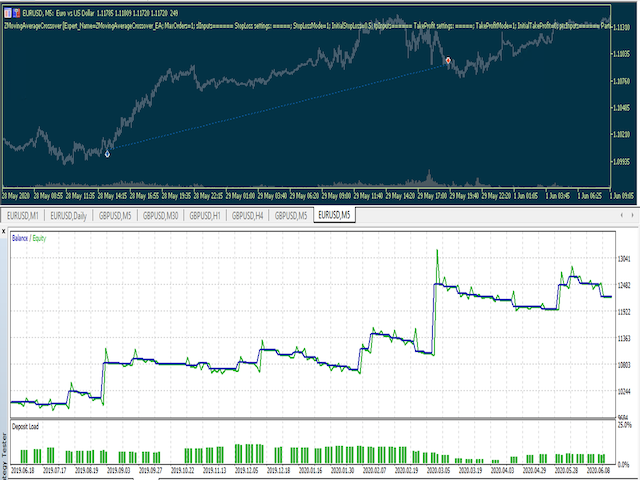

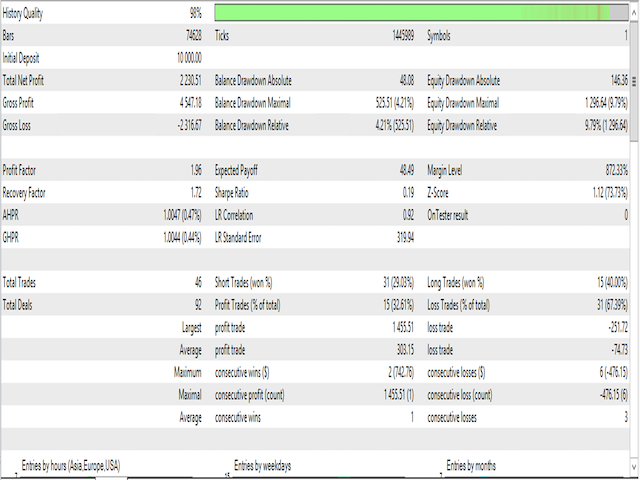

- We highly recommend using the Optimization feature from Strategy Tester on MT5 to fine tune the strategy to the particular instrument of your choice. We recommend testing both Fast and Slow Moving Average Periods as well as Type of Moving Average Used. Also testing in different Time Frames as the strategy can sometimes work better on lower time frames and other times in higher time frames, depending on the instrument chosen to trade.

Moving Average Types Available

Simple Moving Average

Exponential Moving Average

Wilder Exponential Moving Average

Linear Weighted Moving Average

Sine Weighted Moving Average

Triangular Moving Average

Least Square Moving Average (or EPMA, Linear Regression Line)

Smoothed Moving Average

Hull Moving Average by A.Hull

Zero-Lag Exponential Moving Average

Double Exponential Moving Average by P.Mulloy

T3 by T.Tillson (original version)

Instantaneous Trendline by J.Ehlers

Moving Median

Geometric Mean

Regularized EMA by C.Satchwell

Integral of Linear Regression Slope

Combination of LSMA and ILRS

Triangular Moving Average generalized by J.Ehlers

Volume Weighted Moving Average

M.Jurik's Smoothing

Simplified SMA

Arnaud Legoux Moving Average

Triple Exponential Moving Average by P.Mulloy

T3 by T.Tillson (correct version)

Laguerre filter by J.Ehlers

McGinley Dynamic

Two-pole modified Butterworth filter by J.Ehlers

Three-pole modified Butterworth filter by J.Ehlers

SuperSmoother by J.Ehlers

Simple Decycler by J.Ehlers

Modified eVWMA

Exponential Weighted Moving Average

Double Smoothed EMA

Triple Smoothed EMA

Volume-weighted Exponential Moving Average(V-EMA)