Lazy Locker

- Experts

- Alexey Viktorov

- Versão: 1.20

- Atualizado: 7 junho 2020

- Ativações: 7

The Expert Advisor trades only Forex currencies on hedge accounts.

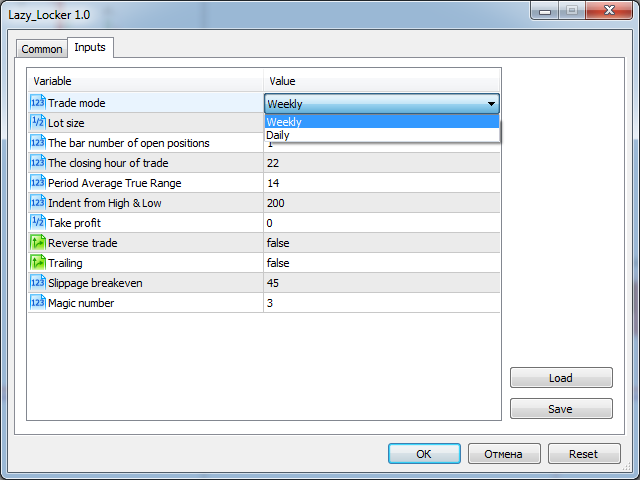

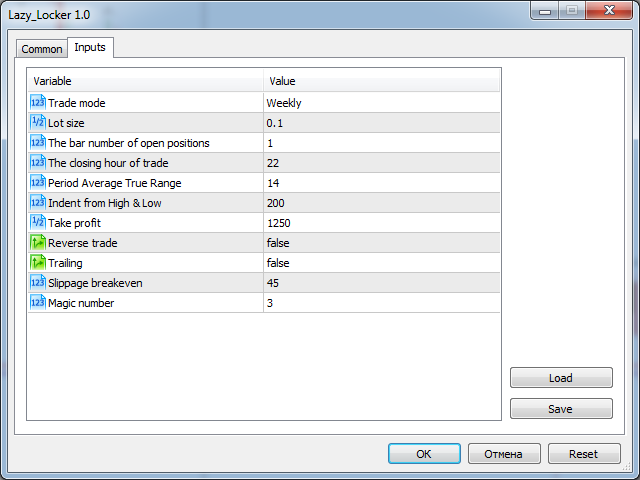

The strategy depends on the selected trading mode.

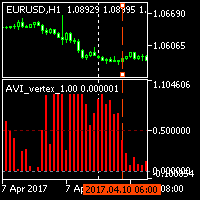

- Trade mode - Weekly/Daily. This means that the trading cycle is limited by a week or a day.

- Lot size - fixed lot size. Set manually.

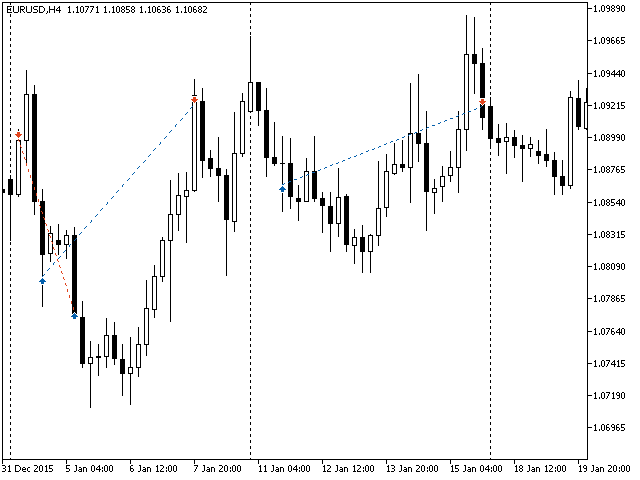

- The bar number of open positions - bar index from the start of the selected trading period for opening Limit or Stop orders. In case of Weekly mode, Н4 bars are considered. In case of Daily, Н1 bars are considered.

- The closing hour of trade - keep in mind that the EA closes all its pending orders 15 minutes before the set hour.

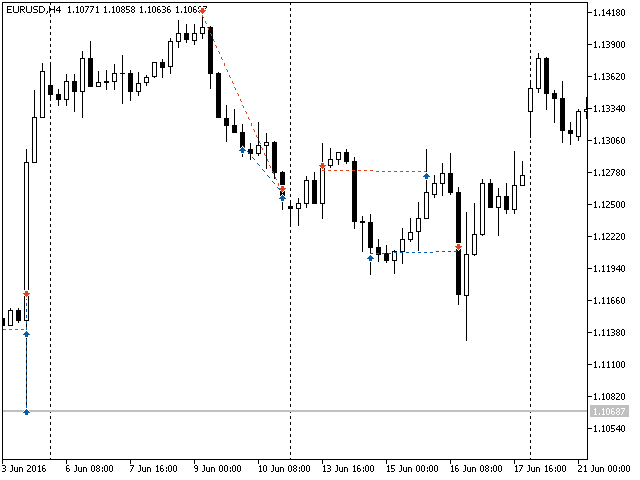

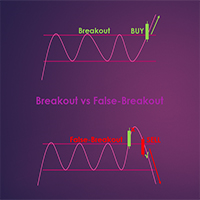

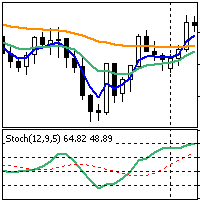

- Reverse trade - if false, Limit orders are to be used, if true, stop orders are applied.

- Period Average True Range - ATR period. The indicator value is considered only if Reverse trade is false.

- Indent from High & Low - indent from High and Low of the last closed bar. The value is considered only if Reverse trade is true.

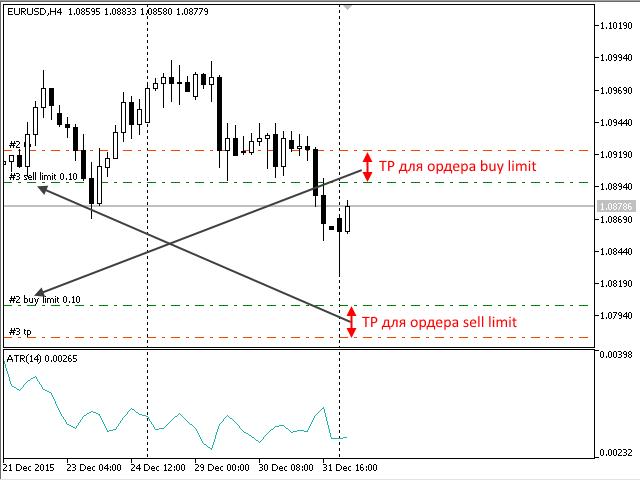

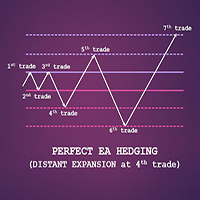

- Take profit - if 0, take profit is not set. Positions closed according to The closing hour of trade parameter. If Take profit is greater than zero, take profit is set at the specified distance from the opposite order (see explanation on Fig. 3). If during the selected trading period (week or day) the price did not reach take profit, the EA closes all positions and removes all orders at the specified time.

- Trailing - if false, only breakeven is set. If true, trailing is carried out in steps equal to the distance between BuyLimit and SellLimit orders. In the Reverse trade mode, only moving to breakeven is carried out.

- Slippage breakeven - slippage margin when closing a position by stop in breakeven.

- Magic number - self-explanatory.

The strategy with the default parameters:

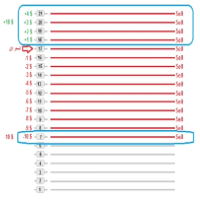

On Monday, two orders are placed when 4-8 hour bar opens:

- BuyLimit at a distance of the ATR indicator value is lower than the Low of the closed bar

- SellLimit at a distance of the ATR indicator value is higher than the High of the closed bar.

When one of them is activated, nothing happens. When the second one is activated, a stop loss of the first one is set to breakeven. If the price reverses and the first one closes at breakeven, the second one also receives a stop loss at breakeven.

You can intervene and close any of the opened positions manually or remove any of the pending orders only if you think that its further work decreases the profit or increases the loss.