Dragon Lite

- エキスパート

- Dang Cong Duong

- バージョン: 2.0

- アップデート済み: 19 12月 2021

At first, I got my teeth into Dragon Ultra Expert Advisor.

Take your time to test demo. You should be always perfectly familiar with your Expert Advisor before a live trading.

Based on the statistics, you are more likely to succeed if you learn from experience to use this.

Dragon Lite is a free version for you to understand how the bot works.

Parameter Trading Mode: Change to UNLIMITED.

You should use the Dragon Training proficiently before using the Dragon Ultra.

The Forex Trader Vs The Forex Gambler

Today’s lesson is going to open your eyes and help you decide if you are trading or gambling, so I want you to read the

whole thing very closely, three times over if you have to. You should read today’s lesson even if you don’t think you have

a problem with gambling in the markets, because you will surely pick up some useful advice that will work to improve

your overall trading results.

Gamblers fund $500 accounts, blow them up and fund them again with another $500, they repeat this process over

and over again without changing their routine, mindset or their strategy; they do the same thing week in and week

out expecting to actually make money. I believe it was Einstein who said “doing the same thing over and over again

and expecting different results is the definition of insanity”… so we could even go so far as to say that continuously

gambling with your Forex trading account is not only financially problematic, but it’s insane.

The difference between pro trading and gambling…

In trading, we have the possibility to do almost unlimited financial damage to ourselves. There are basically no rules in

the trading arena, it’s just you versus you, and the winner or loser will be you. Sure, you can think you’re trading against

other market participants, but in reality you are trading against yourself.

Solutions for the gambling Forex trader…

• First thing is to stop trading with real money. You’re going to have to take a break from trading real money to

cut out the emotion and regroup effectively.

• Second, make sure you: A) Have a trading strategy that you know can be a high-probability trading edge,

and B) Fully understand how to use this strategy and you’ve demo traded it long enough to feel you have ‘mastered it’.

• Be confident in your trading strategy and rely on the long-term edge to recover any short-term losses, rather than

trying to get ‘revenge’ on the market and jump right back in after a loser.

The gambling traps that snare amateurs and that pros avoid…

A few winning trades often misleads amateur traders into thinking they are ‘onto something’. But what usually

happens is they hit a big winner and then they give it all right back, and usually more. This cycle of winning here

and there and then giving all your gains back, works to keep traders in a cycle of gambling in blind hope, and it

slowly depletes their accounts until their gone. Humans are wired to fall prey to this trap of randomly distributed

rewards. What happens is once we hit a few winners via luck, we sort of view that as some ‘special trading ability’

and then we just end up gambling our money away in a futile attempt to keep winning. There are scientific studies

that show that we condition ourselves to repeat self-destructive behavior like this for the allure of a large randomly

distributed reward…playing the lottery comes to mind here…or going to the casino and hitting one nice sized jackpot

and then spending countless hours and dollars trying to hit another.

You have to recognize this gambling behavior and try to break through it, because it really is a part of our wiring to

trade like a gambler. Luckily, we have large brains with highly-developed pre-frontal cortexes that can plan and think

long-term amongst other things. This is our primary tool to use in defending against our more primitive brain areas

that tend to naturally dominate most of our actions in the markets and cause us to gamble.

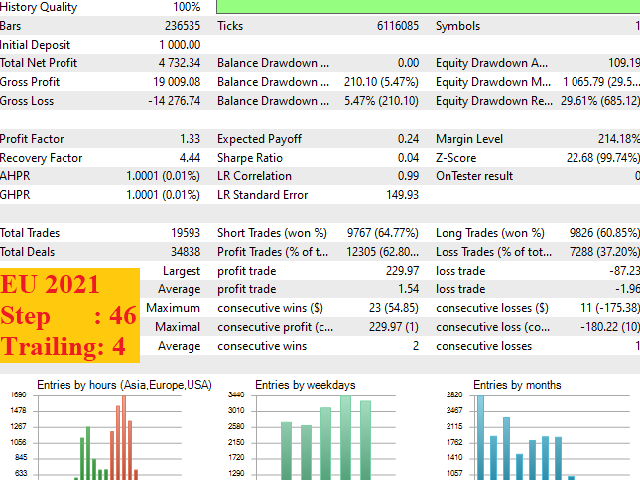

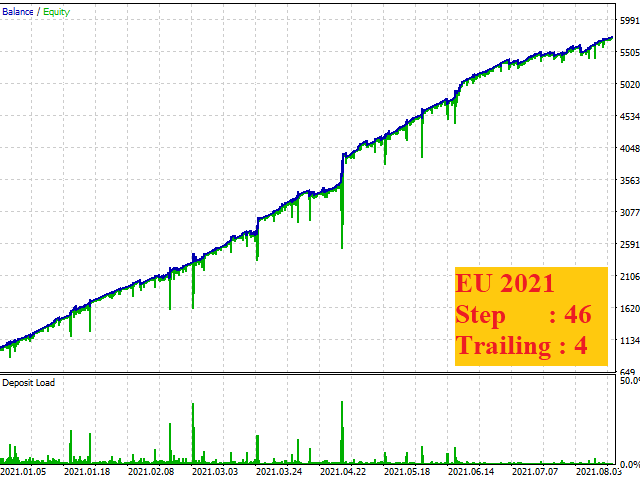

Consistent profits across multiple currencies! Very well made EA and easy to use.