Gamuchirai Zororo Ndawana / Profilo

- Informazioni

|

2 anni

esperienza

|

6

prodotti

|

24

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Se vuoi scoprire come ottenere risultati migliori più velocemente, sei nel posto giusto.

Puoi iniziare con uno qualsiasi dei miei consulenti esperti gratuiti, o puoi leggere alcune delle mie pubblicazioni se hai sete di conoscenza.

Cosa stai aspettando? Una partnership di lunga durata verso il tuo successo inizia qui.

Email: patriolbw@gmail.com

In this series of articles, we explore popular trading strategies and try to improve them using AI. In today's article, we revisit the classical trading strategy built on the relationship between the stock market and the bond market.

In this series of articles, we revisit well-known trading strategies to see if we can improve them using AI. In today's discussion, join us as we test whether there is a reliable relationship between precious metals and currencies.

In today's article, we will analyze the relationship between future exchange rates and government bonds. Bonds are among the most popular forms of fixed income securities and will be the focus of our discussion.Join us as we explore whether we can improve a classic strategy using AI.

In the world of big data, there are millions of alternative datasets that hold the potential to enhance our trading strategies. In this series of articles, we will help you identify the most informative public datasets.

In this series of articles, we revisit classic strategies to see if we can improve them using AI. In today's article, we will examine the popular strategy of multiple time-frame analysis to judge if the strategy would be enhanced with AI.

In this series of articles, we revisit classical strategies to see if we can improve the strategy using AI. In today's article, we will examine a popular strategy of multiple symbol analysis using a basket of correlated securities, we will focus on the exotic USDZAR currency pair.

In this series of articles, we analyze classical trading strategies using modern algorithms to determine whether we can improve the strategy using AI. In today's article, we revisit a classical approach for trading the SP500 using the relationship it has with US Treasury Notes.

Machine learning models come with various adjustable parameters. In this series of articles, we will explore how to customize your AI models to fit your specific market using the SciPy library.

In this series article, we will empirically analyze classic trading strategies to see if we can improve them using AI. In today's discussion, we tried to predict higher highs and lower lows using the Linear Discriminant Analysis model.

In this article, we will discuss how we can build Expert Advisors capable of autonomously selecting and changing trading strategies based on prevailing market conditions. We will learn about Markov Chains and how they can be helpful to us as algorithmic traders.

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

In this article, we will discuss how to integrate trend following and fundamental principles seamlessly into one Expert Advisors to build a strategy that is more robust. This article will demonstrate how easy it is for anyone to get up and running building customized trading algorithms using MQL5.

Discover how to leverage MQL5 to forecast the S&P 500 with precision, blending in classical technical analysis for added stability and combining algorithms with time-tested principles for robust market insights.

In this article, we revisit the classic moving average crossover strategy to assess its current effectiveness. Given the amount of time since its inception, we explore the potential enhancements that AI can bring to this traditional trading strategy. By incorporating AI techniques, we aim to leverage advanced predictive capabilities to potentially optimize trade entry and exit points, adapt to varying market conditions, and enhance overall performance compared to conventional approaches.

Did you know that we can gain more accuracy forecasting certain technical indicators than predicting the underlying price of a traded symbol? Join us to explore how to leverage this insight for better trading strategies.

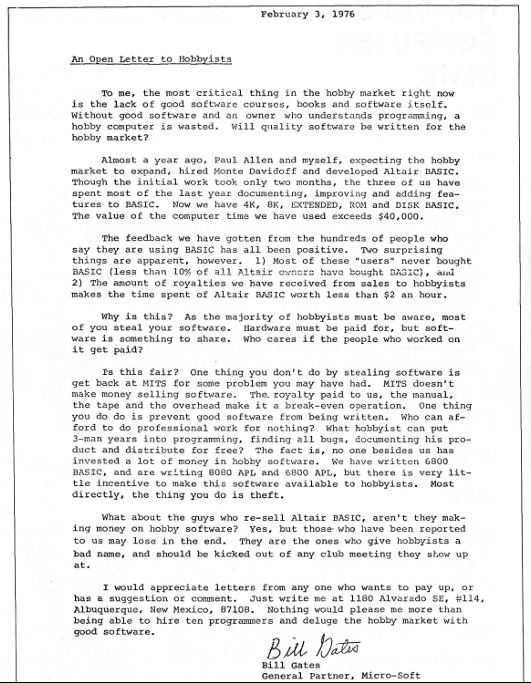

" As the majority of hobbyists must be aware, most of you steal your software. Hardware must be paid for, but software is something to share. Who cares if the people who worked on it get paid? Is this fair?... One thing you do is prevent good software from being written. Who can afford to do professional work for nothing? What hobbyist can put 3-man years into programming, finding all bugs, documenting his product and distribute for free? "

In this article, we revisit a classic crude oil trading strategy with the aim of enhancing it by leveraging supervised machine learning algorithms. We will construct a least-squares model to predict future Brent crude oil prices based on the spread between Brent and WTI crude oil prices. Our goal is to identify a leading indicator of future changes in Brent prices.

Spurious regressions occur when two time series exhibit a high degree of correlation purely by chance, leading to misleading results in regression analysis. In such cases, even though variables may appear to be related, the correlation is coincidental and the model may be unreliable.

Ecco la traduzione in italiano: Presentiamo il Volatility Doctor RSI, un innovativo strumento basato sull'affidabile indicatore RSI, progettato per elevare la tua esperienza di trading come mai prima d'ora. Il nostro indicatore non solo fornisce letture in tempo reale dell'RSI, ma offre anche una previsione precisa di dove si troverà la lettura dell'RSI tra 10 passaggi nel futuro, su qualsiasi intervallo di tempo scelto e su qualsiasi simbolo di trading preferito. Intelligenza Adattativa: Questo

Build expert advisors that look forward and adjust themselves to any market.