Masayuki Sakamoto / Perfil

- Información

|

11+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Hola, somos ForexTopTeam.

Durante años hemos desarrollado y probado sistemas automáticos para el mercado del ORO (GOLD), mientras trabajamos y viajamos por diferentes países.

En este proceso descubrimos que muchos traders no fracasan por falta de disciplina, sino porque no cuentan con una estructura clara para entender:

• cómo se mueve realmente el mercado del ORO,

• cómo un EA (Expert Advisor) interpreta la volatilidad,

• y qué lógica debe tener un sistema automático para operar sin emociones.

Para ayudar a los traders de habla hispana, hemos creado un libro Kindle donde explicamos de forma sencilla y completa:

• la lógica completa de un GOLD EA,

• cómo interpretar el comportamiento del mercado,

• cómo funciona la toma de decisiones automática,

• y cómo preparar un entorno estable para utilizar un EA con seguridad.

El libro está disponible en las principales tiendas de Amazon:

🇪🇸 **España (Amazon ES)**

https://www.amazon.es/dp/B0G2CTV9RL

🌎 **Latinoamérica & Estados Unidos (Amazon COM)**

https://www.amazon.com/dp/B0G2CTV9RL

🇲🇽 **México (Amazon MX)**

https://www.amazon.com.mx/dp/B0G2CTV9RL

Además, los lectores del libro pueden acceder a una página especial donde pueden recibir el EA como **bono gratuito**, lo que permite estudiar la teoría y probar el sistema en la práctica.

🎁 **Bono para Lectores – EA Gratuito**

https://topforexea.net/how-to-get-free-ea-2/

Esperamos que este libro sea un recurso valioso para quienes desean comprender el trading automático del ORO de manera clara, profesional y realista.

Gracias por visitar nuestro perfil en MQL5.

– ForexTopTeam

Durante años hemos desarrollado y probado sistemas automáticos para el mercado del ORO (GOLD), mientras trabajamos y viajamos por diferentes países.

En este proceso descubrimos que muchos traders no fracasan por falta de disciplina, sino porque no cuentan con una estructura clara para entender:

• cómo se mueve realmente el mercado del ORO,

• cómo un EA (Expert Advisor) interpreta la volatilidad,

• y qué lógica debe tener un sistema automático para operar sin emociones.

Para ayudar a los traders de habla hispana, hemos creado un libro Kindle donde explicamos de forma sencilla y completa:

• la lógica completa de un GOLD EA,

• cómo interpretar el comportamiento del mercado,

• cómo funciona la toma de decisiones automática,

• y cómo preparar un entorno estable para utilizar un EA con seguridad.

El libro está disponible en las principales tiendas de Amazon:

🇪🇸 **España (Amazon ES)**

https://www.amazon.es/dp/B0G2CTV9RL

🌎 **Latinoamérica & Estados Unidos (Amazon COM)**

https://www.amazon.com/dp/B0G2CTV9RL

🇲🇽 **México (Amazon MX)**

https://www.amazon.com.mx/dp/B0G2CTV9RL

Además, los lectores del libro pueden acceder a una página especial donde pueden recibir el EA como **bono gratuito**, lo que permite estudiar la teoría y probar el sistema en la práctica.

🎁 **Bono para Lectores – EA Gratuito**

https://topforexea.net/how-to-get-free-ea-2/

Esperamos que este libro sea un recurso valioso para quienes desean comprender el trading automático del ORO de manera clara, profesional y realista.

Gracias por visitar nuestro perfil en MQL5.

– ForexTopTeam

Amigos

368

Solicitudes

Enviadas

Masayuki Sakamoto

📉 Cautious Mood Ahead of U.S. CPI Lack of fresh catalysts expected to keep movements limited; Dollar weakness trend continues...

Masayuki Sakamoto

💵 +73,293 USD – How the Market Moves After the FOMC! Weekly Outlook for August 11, 2025|Key Drivers & Market Recap...

Masayuki Sakamoto

💱 [Weekend Outlook] Dollar Market Remains Directionless After NFP Shock – Wait-and-See Mode Continues ✅ Dollar Weakness Pauses, Market Settles into Calm Equilibrium Ahead of Weekend The weaker-tha...

Masayuki Sakamoto

Post publicado 📊 August 6, 2025 – Options Overview by Currency Pair

📊 August 6, 2025 – Options Overview by Currency Pair...

Masayuki Sakamoto

📉 Dollar Stuck in a Range — Will Fed Commentary Be the Next Catalyst? 💱 Dollar Trades Sideways Near Lows, Awaiting a Trigger Following last week’s weak U.S...

Masayuki Sakamoto

Post publicado 📊 FX Options Summary by Currency Pair – August 5, 2025

FX Options Summary by Currency Pair – August 5, 2025 EUR/USD (Euro-Denominated) 1.1425: $1.8B 1.1500: $1.6B 1.1525: $1.1B 1.1550: $2.5B 1.1585: $1.2B 1.1600: $2.2B 1.1700: $1...

Masayuki Sakamoto

Post publicado 📊 Technical Analysis & Trade Strategy Summary – August 5, 2025

📊 Technical Analysis & Trade Strategy Summary – August 5, 2025...

Masayuki Sakamoto

Post publicado 📉 Dollar Selling Persists, But Lacks a Decisive Catalyst – All Eyes on ISM and Earnings

📉 Dollar Selling Persists, But Lacks a Decisive Catalyst – All Eyes on ISM and Earnings...

Masayuki Sakamoto

📉 U.S. Jobs Miss Stalls Dollar Rally – Markets Enter a Wait-and-See Mode?

4 agosto 2025, 12:18

📉 U.S. Jobs Miss Stalls Dollar Rally – Markets Enter a Wait-and-See Mode...

Masayuki Sakamoto

Position Report GOLD (XAUUSD) : New buy entry at 3369.46 with a stop at 3338.00...

Masayuki Sakamoto

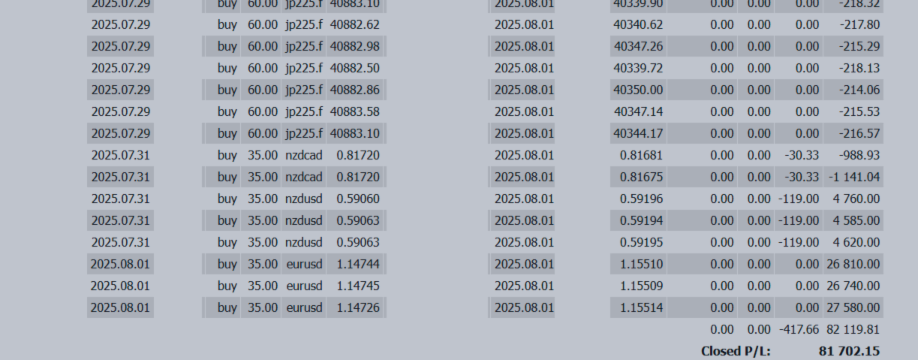

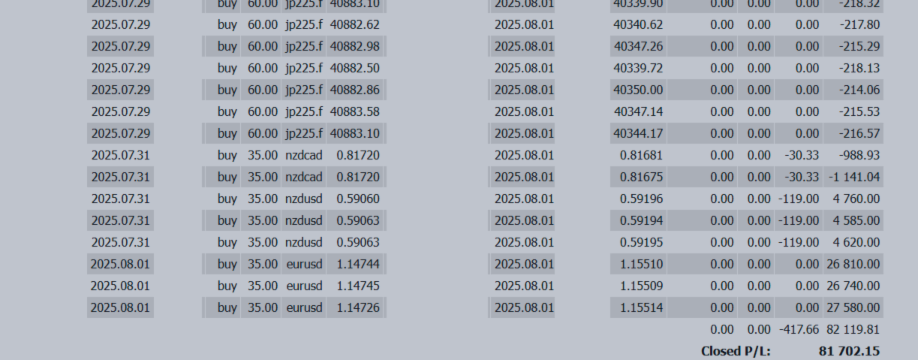

💹 +81,702 USD Profit Weekly FX Review (Aug 1st week) & Market Outlook Title: Will the Dollar Hold Up? U.S. Jobs Data & Nuclear Submarine Tensions Stir the Market...

Masayuki Sakamoto

📊 Technical Analysis & Trade Strategy Summary – August 1, 2025...

Compartir en las redes sociales · 1

236

Masayuki Sakamoto

🔍 [FX Strategy Report] Can the U.S. Jobs Report Shift the Trend? A Crucial Test for Dollar Strength 📌 U.S...

: