Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

shared author's Serhii Ivanenko code

Breakout Bars Trend v2

The second (edited and added) version of the alternative indicator for trend definition based on the breakthrough bars and distance from extremums. The breakthrough levels and size of the previous trends are added.

Sergey Golubev

MQL5 向导:无需编程即可创建 EA 交易程序

Sergey Golubev

Comment to topic 如何开始学习MQL5

MQL5 向导:无需编程即可创建 EA 交易程序 当您创建自动化交易系统时,有必要编写分析市场状况、生成交易信号的算法,以及追踪您的敞口仓位、资金管理与风险管理系统的算法。

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

生长型神经气:MQL5 中的实施 上世纪 90 年代, 人工神经网络 研究人员得出了一个结论:有必要为那些缺少网络层固定拓扑特征的运算机制,开发一个新的类。也就是说,人工神经在特征空间内的数量和布置并不会事先指定,而是在学习此类模型的过程中、根据输入数据的特性来计算,独立调节也与其适应。

Sergey Golubev

Renat Fatkhullin - MetaQuotes

Запустили испанский сайт https://www.mql5.com/es

Впереди еще месяцев 6 плотной работы переводчиков по переводу статей и библиотеки.

Впереди еще месяцев 6 плотной работы переводчиков по переводу статей и библиотеки.

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

中金:2014年中国央行流动性或将趋紧 星期四, 十二月 12 2013, 05:14 GMT 12月11日中国央行公布最新金融统计后,中金公司首席经济学家彭文生称,今年M2同比与环比增速均有小幅回落,但实际增速仍高于13%的预期值,使得货 币条件有收紧的压力,去杠杆的压力仍在。加上社会融资总量扩张的速度仍然较快,有可能使2014年中国央行流动性或将趋紧。

Sergey Golubev

MetaQuotes

Bienvenido a MQL5.com!

Hemos lanzado la versión en español del portal para la comunidad MQL5, el cual está dedicado al lenguaje MQL5 desarrollado por MetaQuotes Software Corp. Siempre hacemos lo posible por tener en cuenta todas las sugerencias y comentarios de los

Sergey Golubev

“Diversification is a protection against ignorance.

It makes very little sense to those who know what they are doing”.

Warren Buffet

It makes very little sense to those who know what they are doing”.

Warren Buffet

Sergey Golubev

MetaQuotes

Bem-Vindo ao site MQL5.com

Nós lançamos a versão em Português do site MQL5.community dedicado a linguagem de programação MQL5 da MetaQuotes Software Corp. Nós sempre levamos em conta todas as sugestões e comentários de nossos membros do fórum, onde a maioria das sugestões são

Sergey Golubev

Rogerio Figurelli

Zen e a arte da otimização de trading systems

Um pouco sobre os objetivos desse tópico Resolvi abrir esse tópico para trocar ideias na área de otimização de trading systems, que confesso é uma das minhas preferidas em termos de estudos e pesquisas com robôs traders. Minha visão é que até

Sergey Golubev

The Evaluation and Optimization of Trading Strategies (Wiley Trading)

Rogerio Figurelli

Comment to topic Zen e a arte da otimização de trading systems

Um pouco de arte no processo de otimização Continuando as reflexões e ideias sobre o assunto do tópico, gostaria de entrar em um assunto mais delicado relacionado à palavra arte presente no nosso

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

一个用于通过 Google Chart API 构建图表的库 Google Chart 允许创建 11 类不同的图表。包括: 线条图, 柱形图, 散点图, 雷达图, 烛形图, 维恩图, QR 码, 地图, 公式, 图形图, 饼图

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

一个使用命名管道在 MetaTrader 5 客户端之间进行通信的无 DLL 解决方案 有时,我想知道在 MetaTrader 5 客户端之间进行通信的几种可能方式。我的目标是使用价格变动指标并且在其中一个客户端上显示来自不同报价者的价格变动。

Sergey Golubev

Sergey Golubev

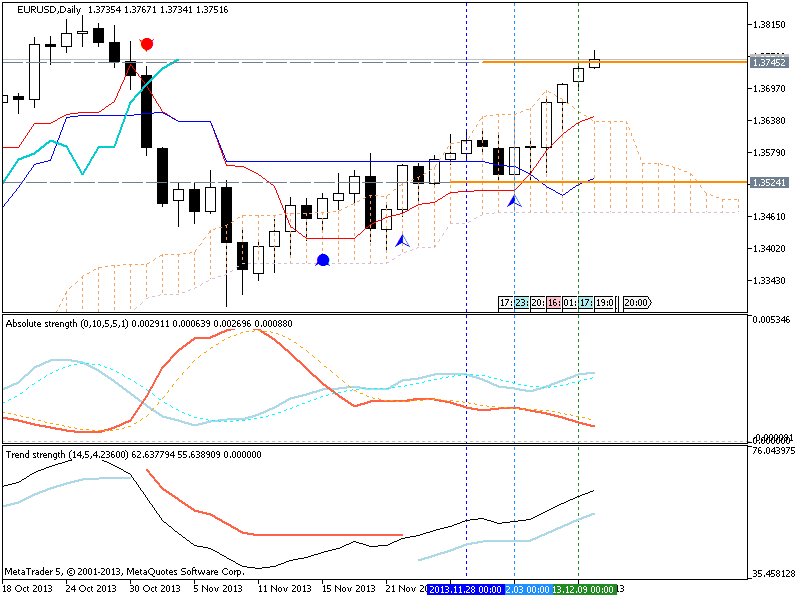

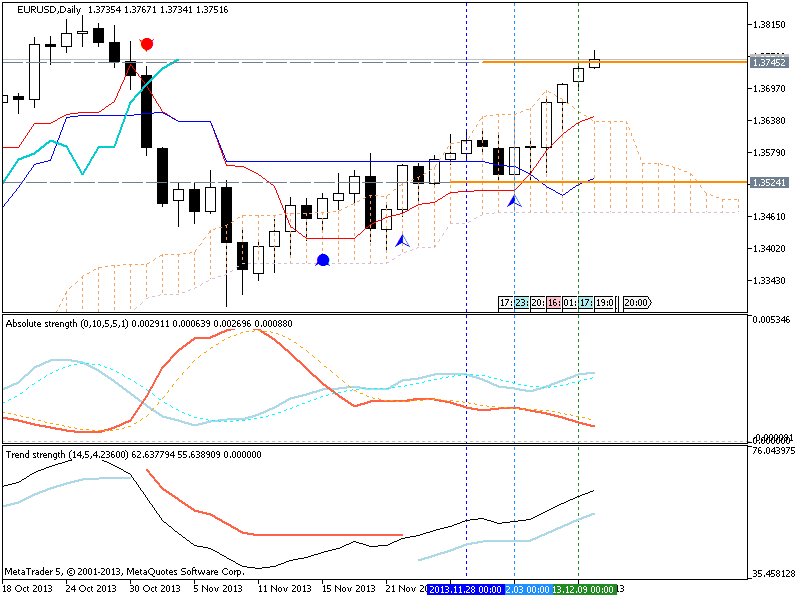

Comment to topic EURUSD Technical Analysis 08.12 - 15.12: Bullish Breakout?

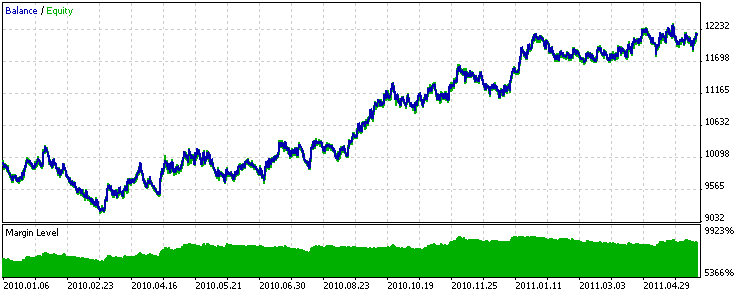

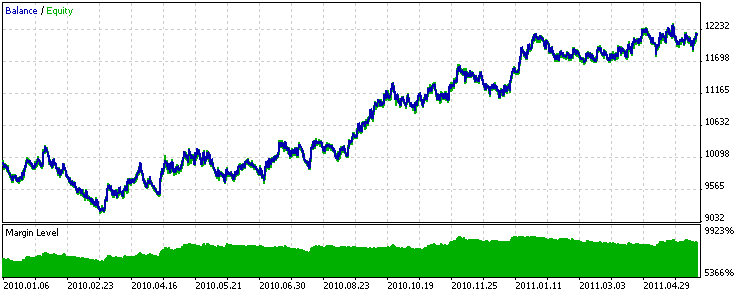

Breakout is going on for D1 timeframe : about W1 - if the price will cross 1.3832 on close bar so we may see good breakout on weekly chart which may be going on up to New Year for example. MetaTrader

Sergey Golubev

Sergey Golubev

Comment to topic algo interessante

Livro | Caetano Veloso (Álbum Completo) Good night

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

用 MQL5 创建交易活动控制板 效率在一个工作环境中至关重要,尤其是在交易者的工作中,其中速度和准确性扮演着重要的 角色。在准备工作客户端的同时,每个人都会让他的工作空间尽可能舒适,从而尽可能快地进行分析并进入市场。但是事实的真相是开发人员无法总是让每个人都高 兴,并且也不可能与某人希望的某些功能完全合调。

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

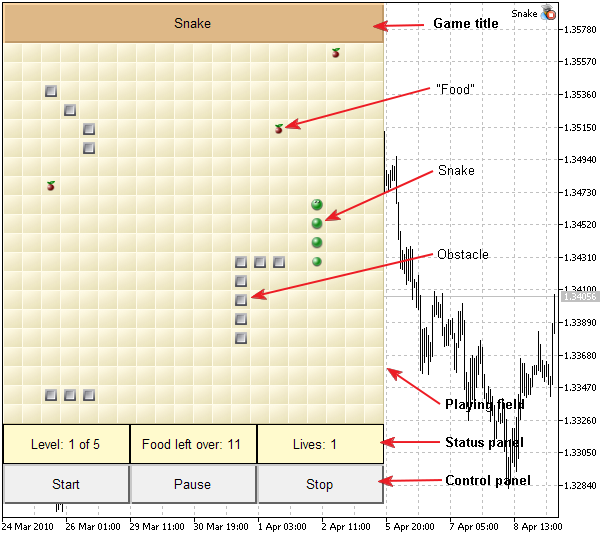

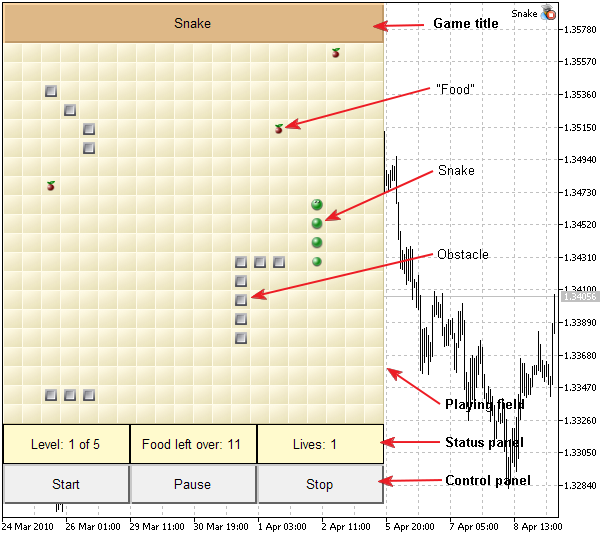

用 MQL5 创建“贪吃蛇”游戏 在本文中,我们将考虑一个用 MQL5 编写“贪吃蛇”游戏的例子。 从 MQL 5 起,游戏编程变为可能,主要是因为 事件处理 功能,包括 自定义事件 。面向对象编程简化此类程序的设计,使代码更加清晰,并且减少错误的数量。 在阅读本文之后,您将了解 OnChart 事件处理 、 MQL5 标准库 类的使用例子和在一定时间之后循环调用函数来进行任何计算的方法。

Sergey Golubev

Week Ahead: Let's Avoid A Friday 13th Fright For Markets (source -forbes)

Let’s hope politicians don't spoil the party, because it could dampen what has been a fantastic year for stocks, with the S&P 500 up more than 25% and some equity analysts speculating the S&P could climb another 11 per cent next year to hit the symbolic number of 2,014 in 2014.

_________

Good morning

Let’s hope politicians don't spoil the party, because it could dampen what has been a fantastic year for stocks, with the S&P 500 up more than 25% and some equity analysts speculating the S&P could climb another 11 per cent next year to hit the symbolic number of 2,014 in 2014.

_________

Good morning

: