The Age of Turbulence by Alan Greenspan

An interesting narrative of the US economy in the last 50 years as experienced and seen from the eyes of the former chairman of the Federal Reserve, Alan Greenspan. The second half of the book contains some of Greenspan's own thoughts about the world economy and what the future may hold.

- reviews: 308

- 13.19 USD

- Alan Greenspan

- www.amazon.com

Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay

Tulipomania, the South Sea bubble and the Mississipi Land scheme are covered in this book, showing how herd mentality worked to create bubbles in past eras. It may serve as an interesting read as well as a guide for dealing with future bubbles.

- reviews: 17

- 35.96 USD

- Martin S. Fridson

- www.amazon.com

Common Stocks and Uncommon Profits by Philip Fisher

This unseeming book is written by Philip Fisher, who Buffett credits with most of his success. In the age of quantitative finance, this book is a must-read for those who want to understand how to inspect a company qualitatively.

- reviews: 4

- Philip A. Fisher

- www.amazon.com

Liar's Poker by Michael Lewis

The time was the 1980s. The place was Wall Street. The game was called Liar’s Poker.

Michael Lewis was fresh out of Princeton and the London School of Economics when he landed a job at Salomon Brothers, one of Wall Street’s premier investment firms. During the next three years, Lewis rose from callow trainee to bond salesman, raking in millions for the firm and cashing in on a modern-day gold rush.Liar’s Poker is the culmination of those heady, frenzied years—a behind-the-scenes look at a unique and turbulent time in American business. From the frat-boy camaraderie of the forty-first-floor trading room to the killer instinct that made ambitious young men gamble everything on a high-stakes game of bluffing and deception, here is Michael Lewis’s knowing and hilarious insider’s account of an unprecedented era of greed, gluttony, and outrageous fortune.

- reviews: 484

- 11.37 USD

- Michael Lewis

- www.amazon.com

When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein

A scintillating narrative of how one of the darlings of the hedge fund world rose and how it fell. A reminder for traders to keep their minds focused on risk and their circle of competence.

- reviews: 301

- 10.70 USD

- Roger Lowenstein

- www.amazon.com

With global markets and asset classes growing even more interconnected,

intermarket analysis—the analysis of related asset classes or financial

markets to determine their strengths and weaknesses—has become an

essential part of any trader's due diligence. In Trading with

Intermarket Analysis, John J. Murphy, former technical analyst for CNBC,

lays out the technical and intermarket tools needed to understand

global markets and illustrates how they help traders profit in volatile

climates using exchange-traded funds.

Armed with a knowledge of how economic forces impact various markets and

financial sectors, investors and traders can profit by exploiting

opportunities in markets about to rise and avoiding those poised to

fall. Trading with Intermarket Analysis provides advice on trend

following, chart patterns, moving averages, oscillators, spotting tops

and bottoms, using exchange-traded funds, tracking market sectors, and

the new world of intermarket relationships, all presented in a highly

visual way.

- reviews: 18

- 54.63 USD

- www.amazon.com

Harmonic Trading creator Scott Carney unveils the entire methodology to

turn patterns into profits. These strategies consistently identify the

price levels and market turning points that reveal the natural order

within the chaos of the financial markets. Analogous to the predictable

behavior of many of life’s natural processes, Harmonic Trading examines

similar relationships within the financial markets to define profitable

opportunities in an unprecedented manner. Carney introduces new

discoveries such as the Bat pattern, Alternate AB=CD structures, the

0.886 retracement, and more. These strategies are entirely new to the

trading community, and they represent a profound advancement beyond all

other Fibonacci methodologies!

After you’ve discovered how to identify harmonic patterns, Carney

presents a complete methodology for applying them in trade execution and

handling them throughout the entire trade management process. From

savage bear to rampaging bull, Harmonic Trading can be employed in all

markets--equities, currencies, commodities, and foreign markets--for

both short- and long-term timeframes.

- reviews: 35

- 49.75 USD

- Scott M. Carney

- www.amazon.com

by Scott M. Carney

Now, in Harmonic Trading: Volume 2, Carney takes a quantum leap forward, introducing new strategies, patterns, and methods that make Harmonic Trading an even more powerful tool for trading the financial markets. For the first time, he reveals how to utilize harmonic impulse waves and introduces measurement techniques that identify market turning points even more accurately. Finally, he demonstrates how to integrate the Relative Strength Indicator (RSI) with advanced Harmonic Trading techniques to separate minor “reactive” moves from major opportunities.

- reviews: 7

- 74.58 USD

- www.amazon.com

The Gartley Trading Method: New Techniques To Profit from the Markets Most Powerful Formation (Wiley Trading): Ross L. Beck

A detailed look at the technical pattern simply referred to today as the Gartley Pattern

Gartley patterns are based on the work of H.M. Gartley, a prominent

technical analyst best known for a particular retracement pattern that

bears his name. In recent years, Gartley patterns-which reflect the

underlying psychology of fear and greed in the markets-have received

renewed interest.

This definitive guide skillfully explains how to utilize the proven

methods of H.M. Gartley to capture consistent profits in the financial

markets. Page by page, you'll become familiar with Gartley's original

work, how his patterns can be adapted to today's fast moving markets,

and what it takes to make them work for you.

- Examines how to identify and profit from the most powerful formation in the financial markets

- Discusses the similarities, differences and the superiority of the Gartley Pattern compared to classical chart patterns including Elliott Wave

- Shows how to apply filters to Gartley patterns to improve the

probability of your trading opportunities, as well as specific rules

where to enter and exit positions

Gartley's pattern is based on a unique market position where most traders refuse to participate due to fear. This book reveals how you can overcome this fear, and how to profit from the most consistent and reliable pattern in the financial markets.

- reviews: 15

- 43.75 USD

- Ross L. Beck

- www.amazon.com

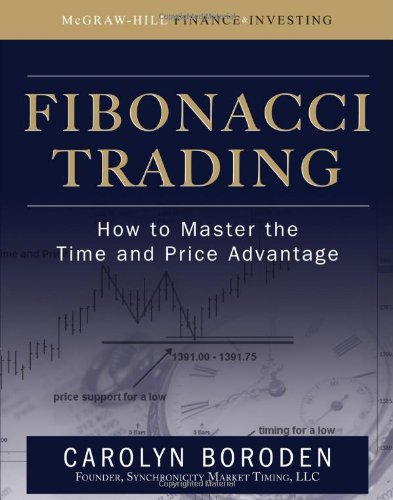

Fibonacci Trading: How to Master the Time and Price Advantage: Carolyn Boroden

Product Description :

Made famous by the Italian mathematician Leonardo De Pisa, the Fibonacci

number series holds a Golden Ratio that is universally found in nature

and used by architects, plastic surgeons, and many others to achieve

“perfect” aesthetic proportions. Now, in this groundbreaking guide,

noted technical trading advisor Carolyn Boroden shows you how Fibonacci

pattern studies can be used as an extremely effective method for

achieving greater profitability in stocks, futures, and Forex markets.

Fibonacci Trading provides a one-stop resource of reliable tools and

clear explanations for both identifying and taking advantage of the

trade setups naturally occurring in the markets that will enable you to

reach the highest rate of profitable trades. Inside, you'll find a

unique trading methodology based on Fibonacci ratios, and the author's

personal experience analyzing and setting up the markets in real time,

which makes this practical volume invaluable to the self-directed

investor.

Complete with detailed charts and insightful graphics in each chapter, Fibonacci Trading features:

- Dependable guidance for determining important support and resistance levels, along with expert advice for using them to maximize profits and limit losses

- Step-by-step processes for using Fibonacci analysis to predict turning points in the market far enough in advance to generate substantial profit

- Valuable tips for using Fibonacci analysis to establish optimal stop-loss placement

- Revealing coverage on how Fibonacci relationships can create a roadmap for the trader based on high percentage patterns

Fibonacci Trading also provides a four-step formula for applying the

covered techniques in a highly effective approach. Flexible enough for

all markets and trading styles, the formula helps you focus your newly

developed knowledge and skill sets into a solid trading methodology,

defined trading plan, successful trading mindset, and disciplined

trading approach that stacks the odds for profit in your favor.

This hands-on guide is packed with a wealth of actual trading

situations, setups, and scenarios that bring the four-step formula to

life so you can immediately use it in the real world.

- reviews: 46

- 51.27 USD

- Carolyn Boroden

- www.amazon.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and offocial link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted.

December thread 2013 is this one